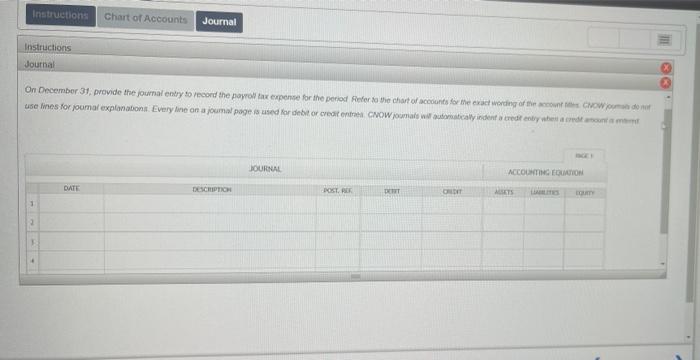

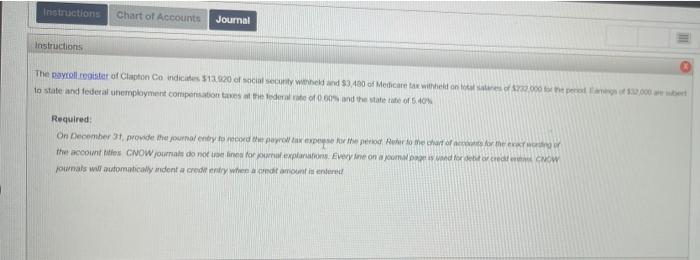

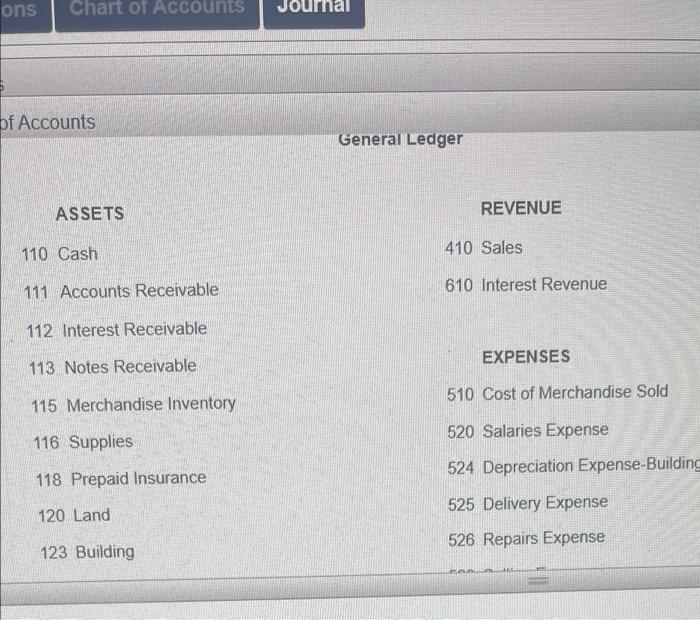

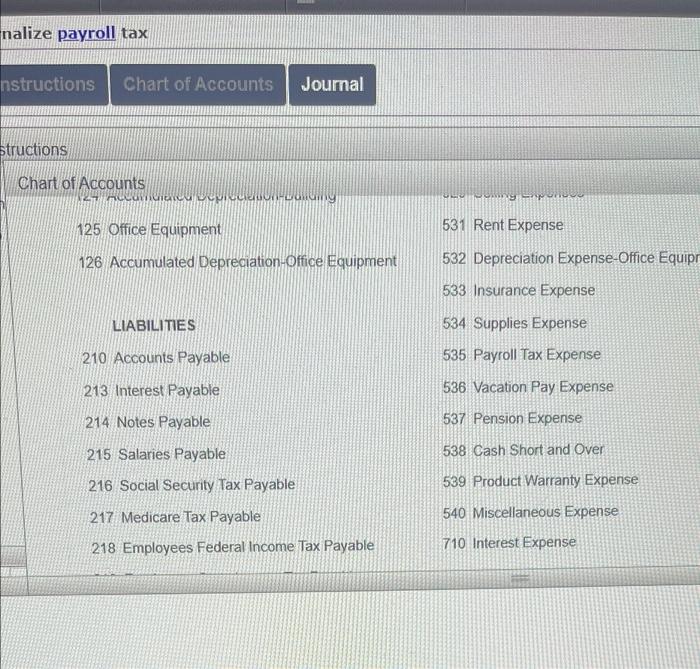

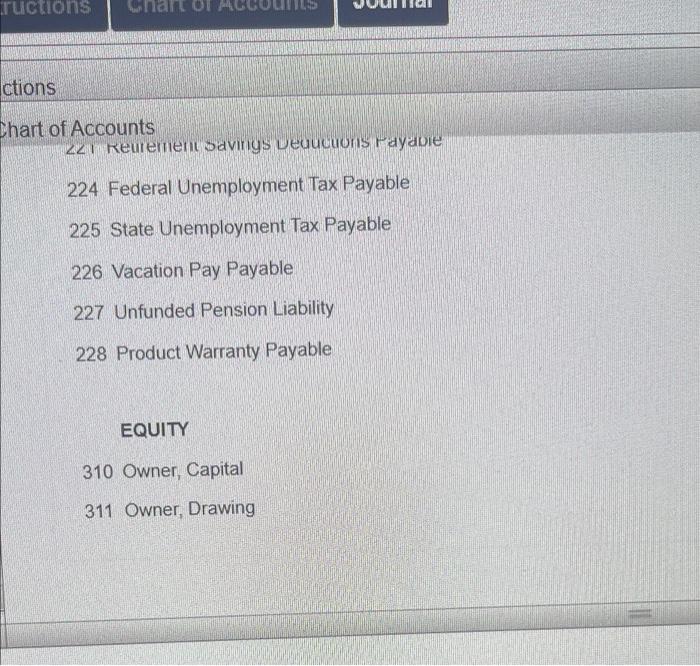

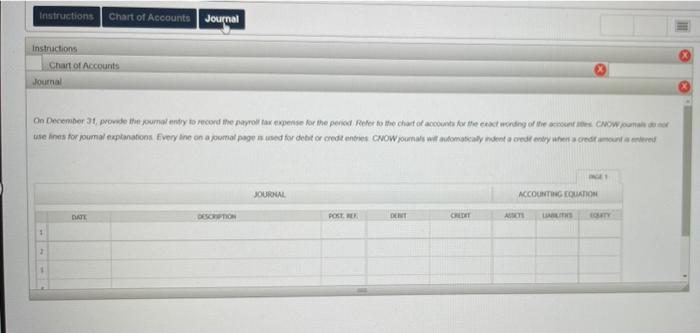

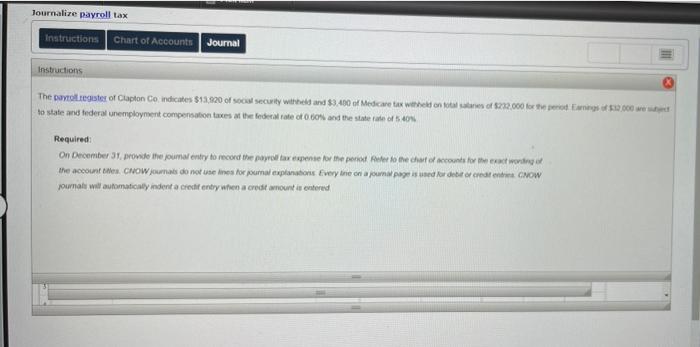

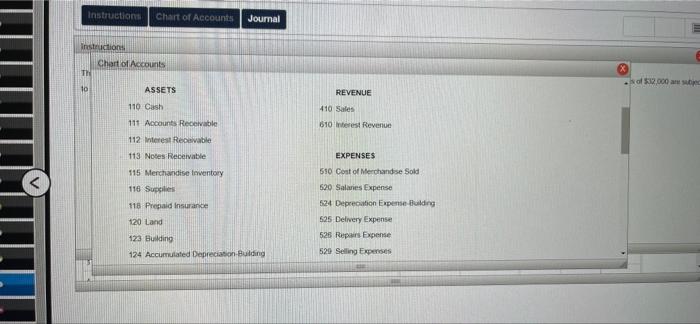

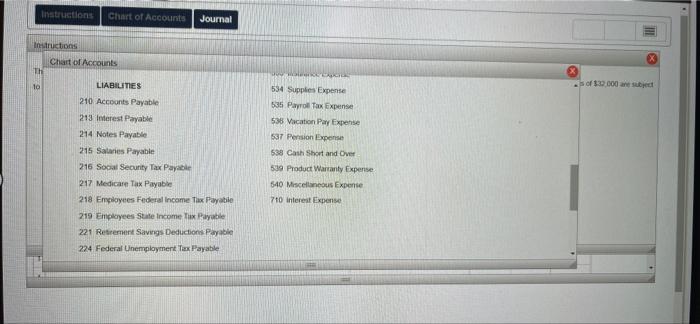

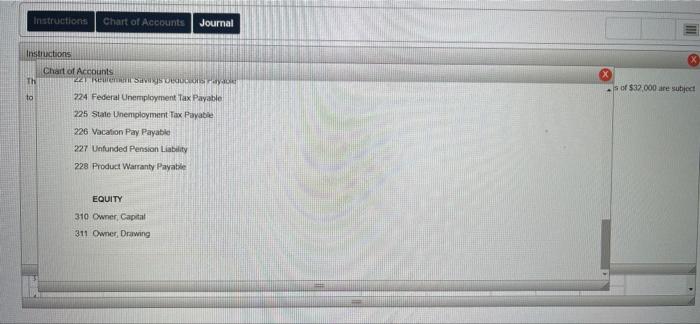

Instructions Chart of Accounts Journal Instructions Journal On December 31, provide the journal entry to record the payroll tax expense for the period Refer to the chart of accounts for the exact wording of the NOW use lines for ouma explanations. Every line on a journal page is used for debitor credite NOW w cayindenred by the con JOURNAL ACCOUNTING EQUION DATE DESCRIPTION DOSTALE ORDIT SETS 1 2 Instructions Chart of Accounts Journal Instructions The Daytoll register of Clapton Co indicates $13.920 of social security held and 33.480 of Medicare tax withheld on 2000 per 12.000 to state and federal unemployment compensations at the federale of 0.00 and the statue of 10 Required On December 31, provide the journal entry to record the pay experie period where the chart for the account is CNOWjournal do nelines for explain. Every Ane on med for det at NOW journals ww outomatically andent a credenty a ondt amount in ener ons Chart of Accounts Journal of Accounts General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Accounts Receivable 610 Interest Revenue 112 Interest Receivable EXPENSES 113 Notes Receivable 510 Cost of Merchandise Sold 115 Merchandise Inventory 520 Salaries Expense 116 Supplies 524 Depreciation Expense-Buildin 118 Prepaid Insurance 525 Delivery Expense 120 Land 526 Repairs Expense 123 Building nalize payroll tax nstructions Chart of Accounts Journal structions Chart of Accounts MLOUILA wy 125 Office Equipment 531 Rent Expense 126 Accumulated Depreciation Office Equipment 532 Depreciation Expense-Office Equip 533 Insurance Expense LIABILITIES 534 Supplies Expense 210 Accounts Payable 535 Payroll Tax Expense 213 Interest Payable 536 Vacation Pay Expense 537 Pension Expense 214 Notes Payable 538 Cash Short and Over 215 Salaries Payable 216 Social Security Tax Payable 539 Product Warranty Expense 217 Medicare Tax Payable 540 Miscellaneous Expense 218 Employees Federal Income Tax Payable 710 Interest Expense ctions ctions Chart of Accounts 22 Reurement savings Deducuns Payable 224 Federal Unemployment Tax Payable 225 State Unemployment Tax Payable 226 Vacation Pay Payable 227 Unfunded Pension Liability 228 Product Warranty Payable EQUITY 310 Owner, Capital 311 Owner, Drawing Instructions Chart of Accounts Journal Instructions Chart of Accounts Journal On December 31, provide the poornanay to record the payroll tax expense for the period refer to the chart of accounts for the end wording of the contes CHOW use Ines for journal explanations Every ine on a joumal pages used for debitor credt under CNOWomas wir macalyne a cred enery went credt amounts need JOURNAL ACCOUNTING EQUATION DATE DESOTO POSER DENT GRID LITE + 2 Journalize payroll tax Instructions Chart of Accounts Journal Instructions The payroll.register or Clapton Co. indicates $13.920 of social security withheld and $3,400 of Medicare tax witheld on to tre of $223,000 for a period lags 12.000 to state and federal unemployment compensation tes of the federal rate of cow and the state cate of on Required On December 31, provide the ouma entry to record the payroll tax expense for the periode to the chalet counts for me and worse the accounts. CNOW oumas do not use dnes for pura exploration Evey the oni a une page is used for debut or create NOW Journals will automaticwyindent a credit entry when a credit mount is entered Instruction Chart of Accounts Journal instructions Chart of Accounts TH of $12.000 abc 10 ASSETS REVENUE 110 Cash 410 Sales 111 Accounts Receivable 610 Interest Revenue 112 Interest Receivable 113 Notes Receivable 115 Merchandise Inventory 116 Supplies 118 Prepaid Insurance 120 Land EXPENSES 550 Cost of Merchandise Sold 520 Salaries Expense 524 Deprecation Expense Building 525 Delivery Expense 526 Repairs Expense 529 Selling Expenses 123 Building 124 Accumulated Depreciation Bulding Instructions Chart of Accounts Journal Instructions of 2000 are subject Chart of Accounts Th 10 LIABILITIES 210 Accounts Payable 213 Interest Payable 214 Notes Payable 215 Satanes Payable 216 Social Security Tax Payable 217 Medicare Tax Payable 218 Employees Federal Income Tax Payable 219 Employees State Income Tax Payable 221 Retirement Savings Deductions Payable 224 Federal Unemployment Tax Payable 534 Supplies Expense 535 Payroll Tax Expense 535 Vacation Pay Expense 537 Pension Expense 538 Cash Short and Over 539 Product Warranty Expense 540 Miscellaneous Expense 710 interest Expense Instructions Chart of Accounts Journal Instructions s of $32.000 are subject Chart of Accounts TH 22 RSS to 224 Federal Unemployment Tax Payable 225 State Unemployment Tax Payable 226 Vacation Pay Payable 227 Unfunded Pension Liability 228 Product Warranty Payable EQUITY 310 Owner Capital 311 Owner, Drawing