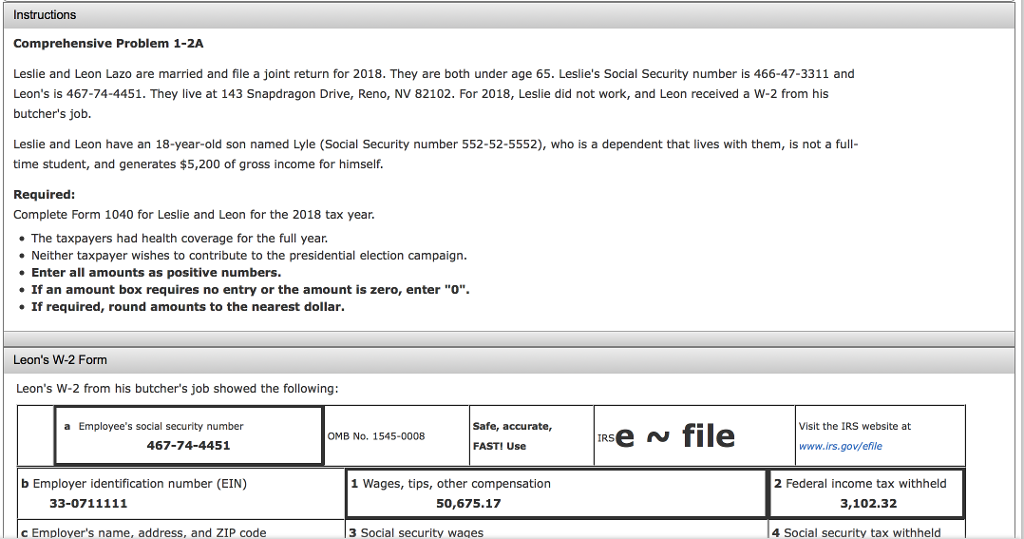

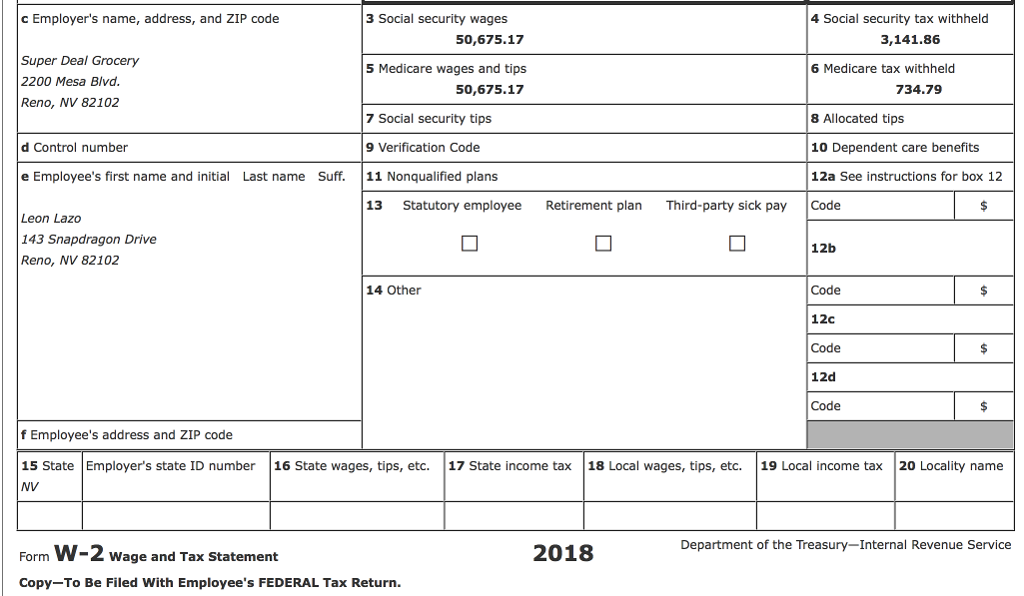

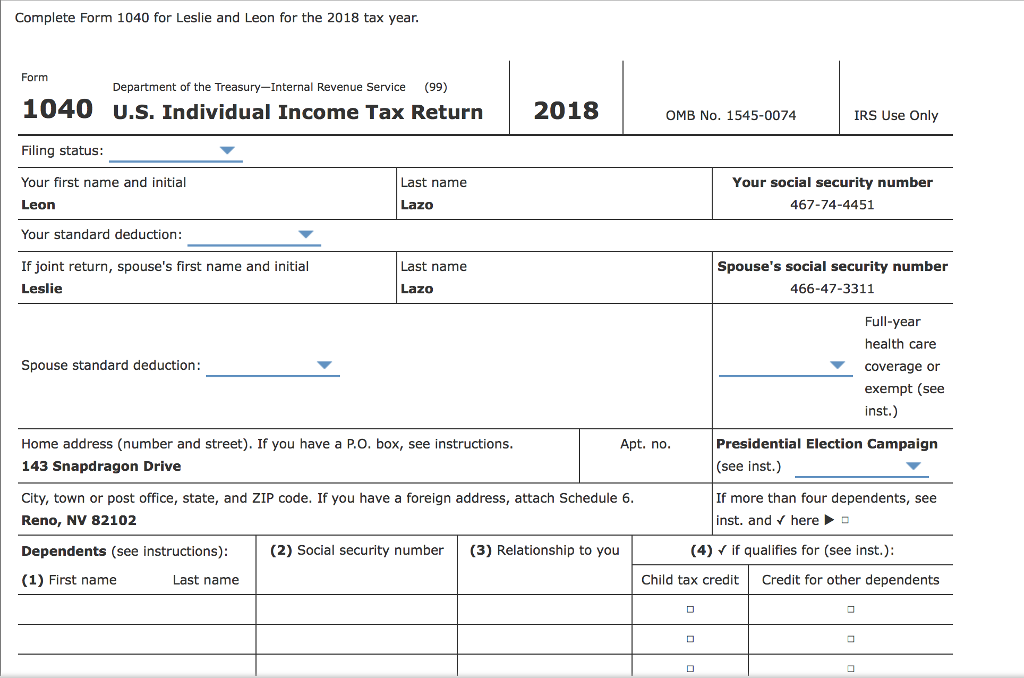

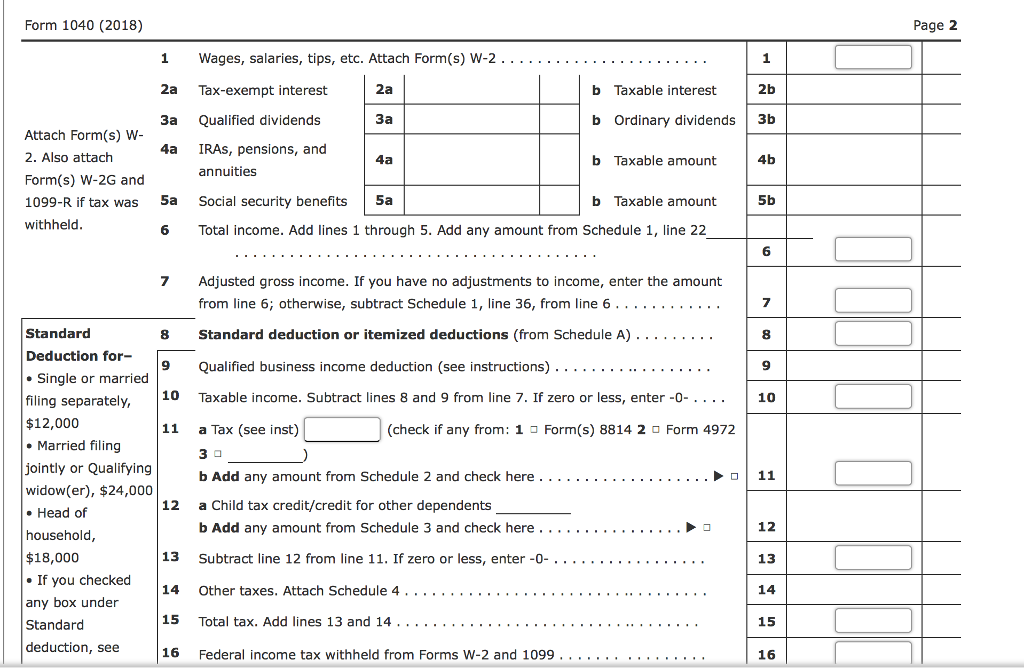

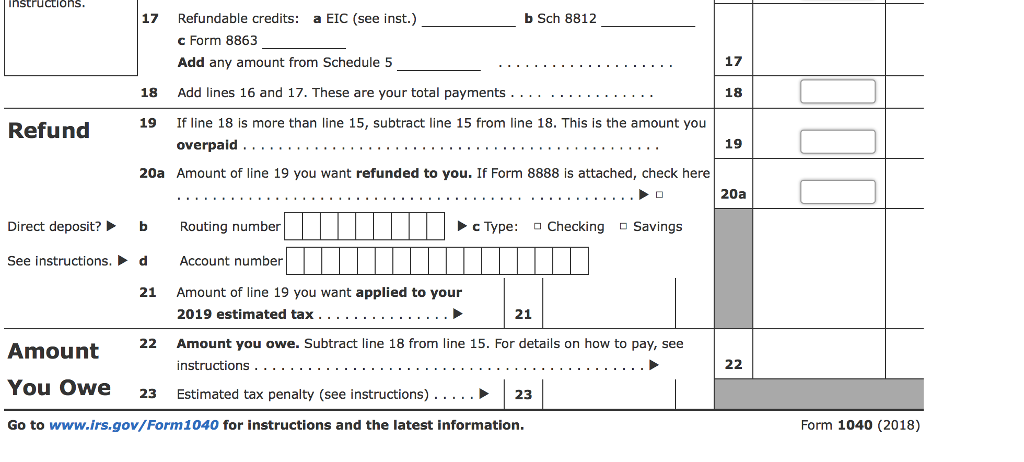

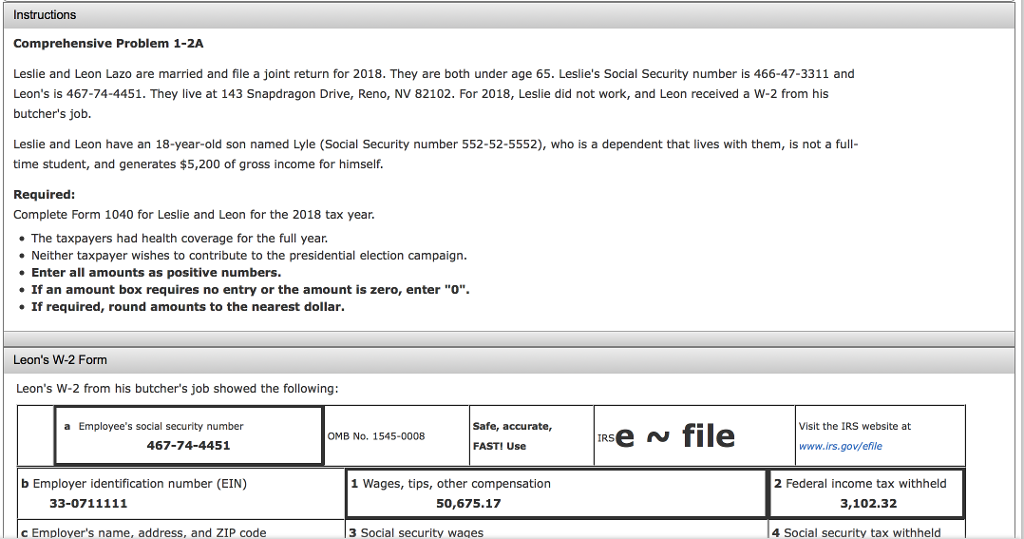

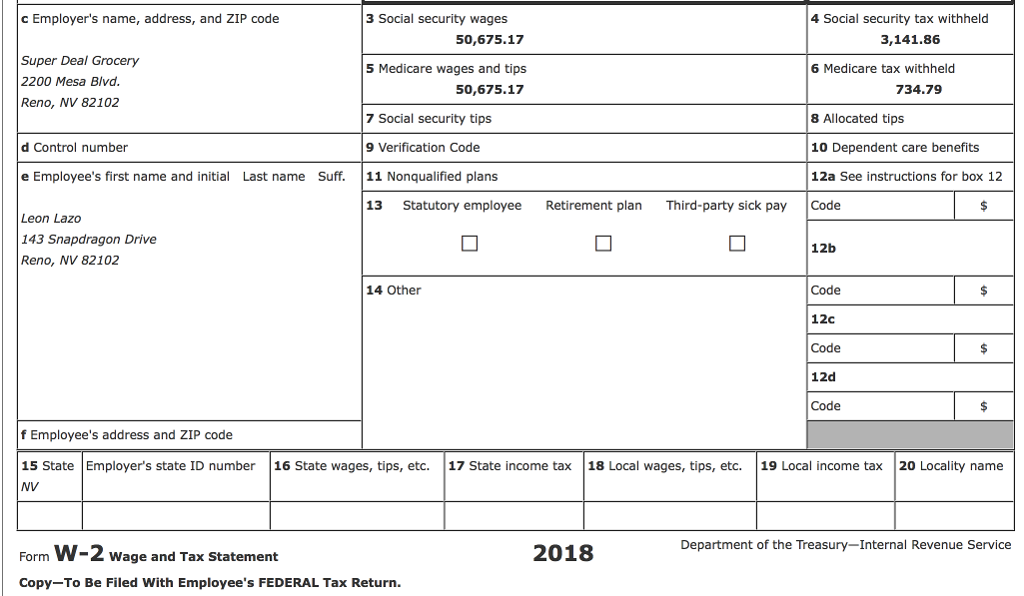

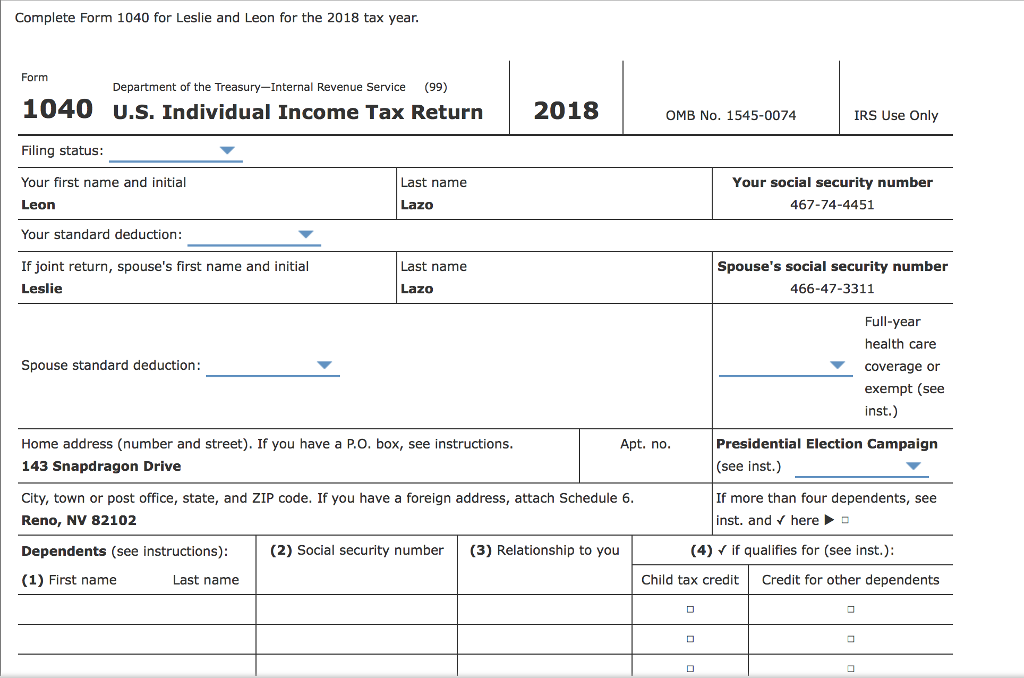

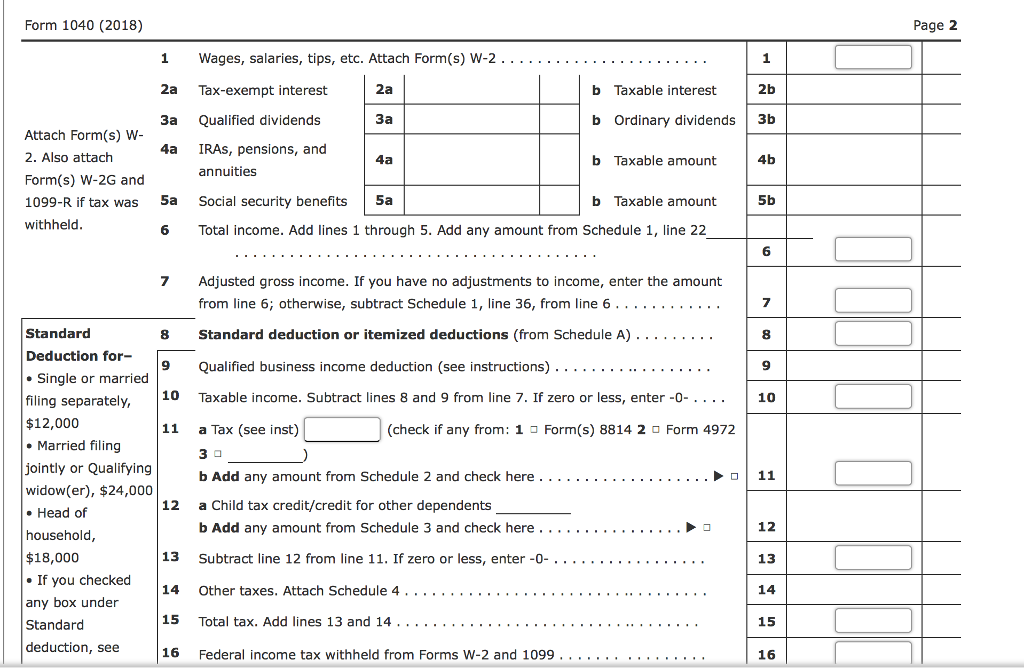

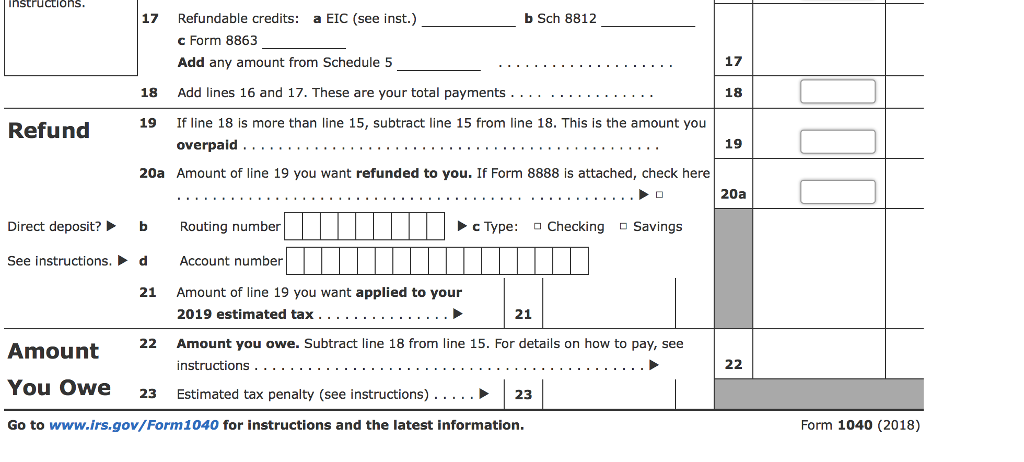

Instructions Comprehensive Problem 1-2A Leslie and Leon Lazo are married and file a joint return for 2018. They are both under age 65. Leslie's Social Security number is 466-47-3311 and Leon's is 467-74-4451. They live at 143 Snapdragon Drive, Reno, NV 82102. For 2018, Leslie did not work, and Leon received a W-2 from his butcher's job. Leslie and Leon have an 18-year-old son named Lyle (Social Security number 552-52-5552), who is a dependent that lives with them, is not a full- time student, and generates $5,200 of gross income for himself Required Complete Form 1040 for Leslie and Leon for the 2018 tax year The taxpayers had health coverage for the full year . Neither taxpayer wishes to contribute to the presidential election campaign. Enter all amounts as positive numbers If an amount box requires no entry or the amount is zero, enter "o". If required, round amounts to the nearest dollar. Leon's W-2 Form Leon's W-2 from his butcher's job showed the following: a Employee's social security number Safe, accurate, Visit the IRS website at OMB No. 1545-0008 IRS 467-74-4451 FASTI Use www.irs.gov/efile b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld 50,675.17 3,102.32 c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld 50,675.17 5 Medicare wages and tips 50,675.17 3,141.86 Super Deal Grocery 2200 Mesa Blvd Reno, NV 82102 6 Medicare tax withheld 734.79 8 Allocated tips 10 Dependent care benefits 12a See instructions for box 12 7 Social security tips d Control number 9 Verification Code e Employee's first name and initial Last name Suff. 11 Nonqualified plans 13 Statutory employee Retirement plan Third-party sick pay Code Leon Lazo 143 Snapdragon Drive Reno, NV 82102 12b 14 Other Code 12c Code 12d Code f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name NV Department of the Treasury-Internal Revenue Service Form W-2 Wage and Tax Statement 2018 Copy-To Be Filed With Employee's FEDERAL Tax Return. Complete Form 1040 for Leslie and Leon for the 2018 tax year Form Department of the Treasury-Internal Revenue Service (99) 1040 U.S. Individual Income Tax Retun2018 OMB No. 1545-0074 IRS Use Only Filing status: Your first name and initial Leon Your standard deduction: If joint return, spouse's first name and initial Leslie Your social security number 467-74-4451 Last name Lazo Last name Spouse's social security number 466-47-3311 Lazo Full-year health care COverage or exempt (see inst.) Spouse standard deduction: Home address (number and street). If you have a P.O. box, see instructions 143 Snapdragon Drive City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6 Reno, NV 82102 Dependents (see instructions) (1) First name Apt. no Presidential Election Campaign (see inst.) If more than four dependents, see inst. and Y here- (2) Social security number(3) Relationship to you (4) V if qualifies for (see inst.) Last name Child tax credit Credit for other dependents Form 1040 (2018) Page 2 2a 3a 4a 1 2b b Ordinary dividends 3b 2a Tax-exempt interest Qualified dividends IRAs, pensions, and annuities b Taxable interest Attach Form(s) W- 2. Also attach Form(s) W-2G and 4a b Taxable amount 4b 1099-R if tax was 5 Social security benefits Sa b Taxable amount 5b withheld 6 Total income. Add lines 1 through 5. Add any amount from Schedule 1, line 22 6 7 Adjusted gross income. If you have no adjustments to income, enter the amount from line 6; otherwise, subtract Schedule 1, line 36, from line 6.. . . . . . . . . . Standard 8 Standard deduction or itemized deductions (from Schedule A) . . . . . . 9 Qualified business income deduction (see instructions) . . . . . . . . .. . . . . . . . . 10 Taxable income. Subtract lines 8 and 9 from line 7. If zero or less, enter-0- . . . 11 a Tax (see inst) 8 Deduction for9 9 Single or married filing separately, $12,000 (check if any from: 1Form(s) 8814 2 Form 4972 Married filing jointly or Qualifying widow(er), $24,000 b Add any amount from Schedule 2 and check here.. . . . . . . . . . . . .. . . . .11 a Child tax credit/credit for other dependents b Add any amount from Schedule 3 and check here. Subtract line 12 from line 11. If zero or less, enter -0-.. . . .. . . . . . . . . . . . 12 Head of household, $18,000 If you checked any box under Standard deduction, see 12 13 14 15 16 . . . . .. 13 15 Total tax. Add lines 13 and 14. . . . . . . .. . . . . . . . . . . . . . . . . .. . . . . . . . 16 Federal income tax withheld from Forms W-2 and 1099... .. . . nstructions b Sch 8812 a EIC (see inst.) Refundable credits: c Form 8863 Add any amount from Schedule 5 Add lines 16 and 17. These are your total payments . . . . If line 18 is more than line 15, subtract line 15 from line 18. This is the amount you 17 17 18 . . . . 18 . . 19 Refund 19 20a Amount of line 19 you want refunded to you. If Form 8888 is attached, check here 20a c Type: Checking Savings Direct deposit?b Routing number See instructions.dAccount number 21 Amount of line 19 you want applied to your 21 22 Amount you owe. Subtract line 18 from line 15. For details on how to pay, see Amount You Owe 23 Estimated Go to www.irs.gov/Form1040 for instructions and the latest information Form 1040 (2018) Instructions Comprehensive Problem 1-2A Leslie and Leon Lazo are married and file a joint return for 2018. They are both under age 65. Leslie's Social Security number is 466-47-3311 and Leon's is 467-74-4451. They live at 143 Snapdragon Drive, Reno, NV 82102. For 2018, Leslie did not work, and Leon received a W-2 from his butcher's job. Leslie and Leon have an 18-year-old son named Lyle (Social Security number 552-52-5552), who is a dependent that lives with them, is not a full- time student, and generates $5,200 of gross income for himself Required Complete Form 1040 for Leslie and Leon for the 2018 tax year The taxpayers had health coverage for the full year . Neither taxpayer wishes to contribute to the presidential election campaign. Enter all amounts as positive numbers If an amount box requires no entry or the amount is zero, enter "o". If required, round amounts to the nearest dollar. Leon's W-2 Form Leon's W-2 from his butcher's job showed the following: a Employee's social security number Safe, accurate, Visit the IRS website at OMB No. 1545-0008 IRS 467-74-4451 FASTI Use www.irs.gov/efile b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld 50,675.17 3,102.32 c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld 50,675.17 5 Medicare wages and tips 50,675.17 3,141.86 Super Deal Grocery 2200 Mesa Blvd Reno, NV 82102 6 Medicare tax withheld 734.79 8 Allocated tips 10 Dependent care benefits 12a See instructions for box 12 7 Social security tips d Control number 9 Verification Code e Employee's first name and initial Last name Suff. 11 Nonqualified plans 13 Statutory employee Retirement plan Third-party sick pay Code Leon Lazo 143 Snapdragon Drive Reno, NV 82102 12b 14 Other Code 12c Code 12d Code f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name NV Department of the Treasury-Internal Revenue Service Form W-2 Wage and Tax Statement 2018 Copy-To Be Filed With Employee's FEDERAL Tax Return. Complete Form 1040 for Leslie and Leon for the 2018 tax year Form Department of the Treasury-Internal Revenue Service (99) 1040 U.S. Individual Income Tax Retun2018 OMB No. 1545-0074 IRS Use Only Filing status: Your first name and initial Leon Your standard deduction: If joint return, spouse's first name and initial Leslie Your social security number 467-74-4451 Last name Lazo Last name Spouse's social security number 466-47-3311 Lazo Full-year health care COverage or exempt (see inst.) Spouse standard deduction: Home address (number and street). If you have a P.O. box, see instructions 143 Snapdragon Drive City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6 Reno, NV 82102 Dependents (see instructions) (1) First name Apt. no Presidential Election Campaign (see inst.) If more than four dependents, see inst. and Y here- (2) Social security number(3) Relationship to you (4) V if qualifies for (see inst.) Last name Child tax credit Credit for other dependents Form 1040 (2018) Page 2 2a 3a 4a 1 2b b Ordinary dividends 3b 2a Tax-exempt interest Qualified dividends IRAs, pensions, and annuities b Taxable interest Attach Form(s) W- 2. Also attach Form(s) W-2G and 4a b Taxable amount 4b 1099-R if tax was 5 Social security benefits Sa b Taxable amount 5b withheld 6 Total income. Add lines 1 through 5. Add any amount from Schedule 1, line 22 6 7 Adjusted gross income. If you have no adjustments to income, enter the amount from line 6; otherwise, subtract Schedule 1, line 36, from line 6.. . . . . . . . . . Standard 8 Standard deduction or itemized deductions (from Schedule A) . . . . . . 9 Qualified business income deduction (see instructions) . . . . . . . . .. . . . . . . . . 10 Taxable income. Subtract lines 8 and 9 from line 7. If zero or less, enter-0- . . . 11 a Tax (see inst) 8 Deduction for9 9 Single or married filing separately, $12,000 (check if any from: 1Form(s) 8814 2 Form 4972 Married filing jointly or Qualifying widow(er), $24,000 b Add any amount from Schedule 2 and check here.. . . . . . . . . . . . .. . . . .11 a Child tax credit/credit for other dependents b Add any amount from Schedule 3 and check here. Subtract line 12 from line 11. If zero or less, enter -0-.. . . .. . . . . . . . . . . . 12 Head of household, $18,000 If you checked any box under Standard deduction, see 12 13 14 15 16 . . . . .. 13 15 Total tax. Add lines 13 and 14. . . . . . . .. . . . . . . . . . . . . . . . . .. . . . . . . . 16 Federal income tax withheld from Forms W-2 and 1099... .. . . nstructions b Sch 8812 a EIC (see inst.) Refundable credits: c Form 8863 Add any amount from Schedule 5 Add lines 16 and 17. These are your total payments . . . . If line 18 is more than line 15, subtract line 15 from line 18. This is the amount you 17 17 18 . . . . 18 . . 19 Refund 19 20a Amount of line 19 you want refunded to you. If Form 8888 is attached, check here 20a c Type: Checking Savings Direct deposit?b Routing number See instructions.dAccount number 21 Amount of line 19 you want applied to your 21 22 Amount you owe. Subtract line 18 from line 15. For details on how to pay, see Amount You Owe 23 Estimated Go to www.irs.gov/Form1040 for instructions and the latest information Form 1040 (2018)