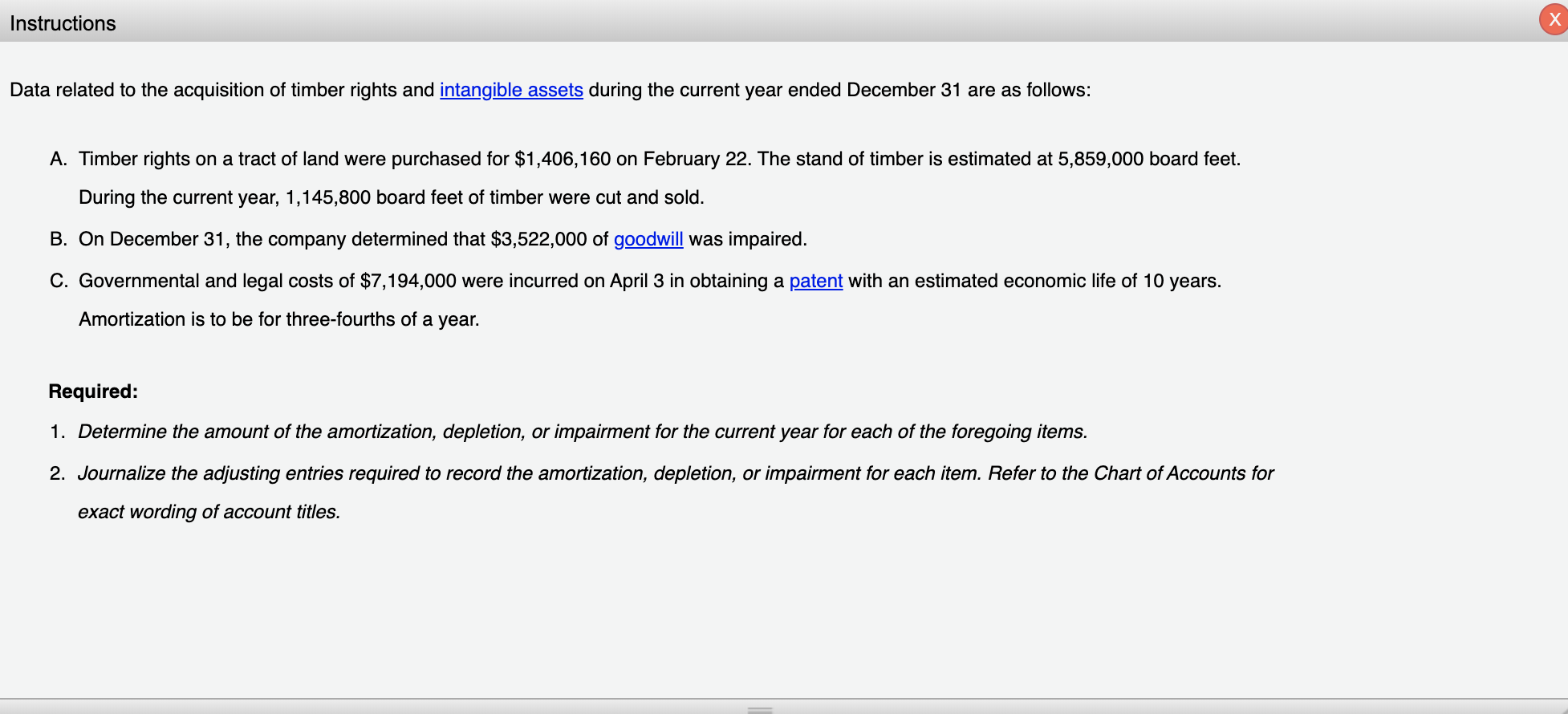

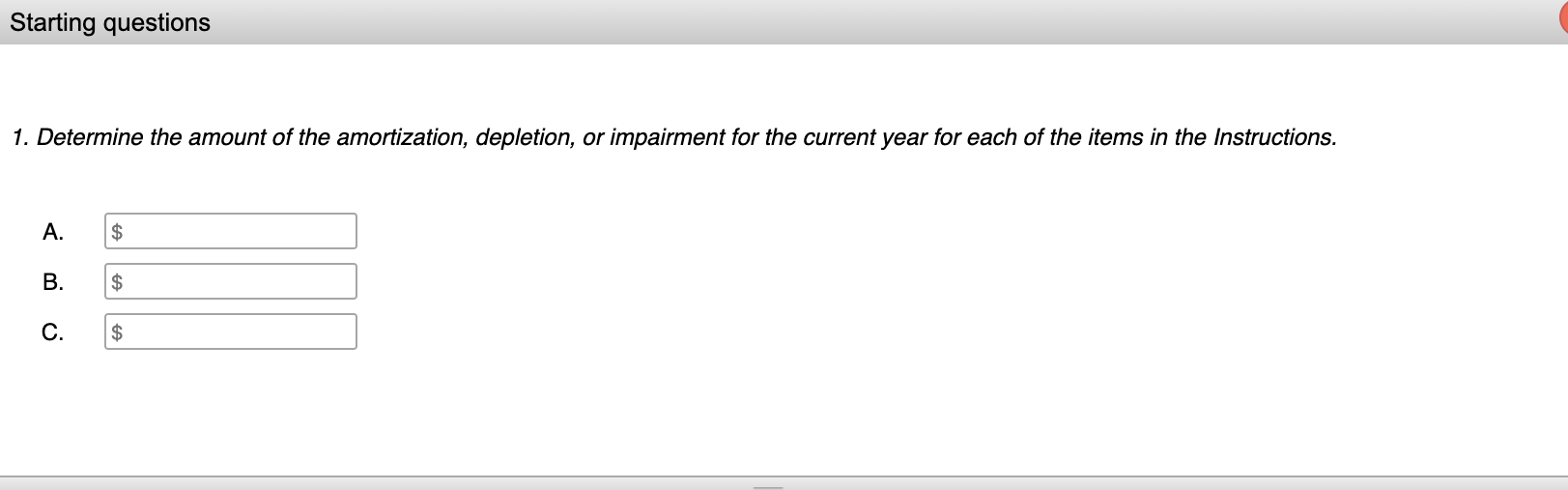

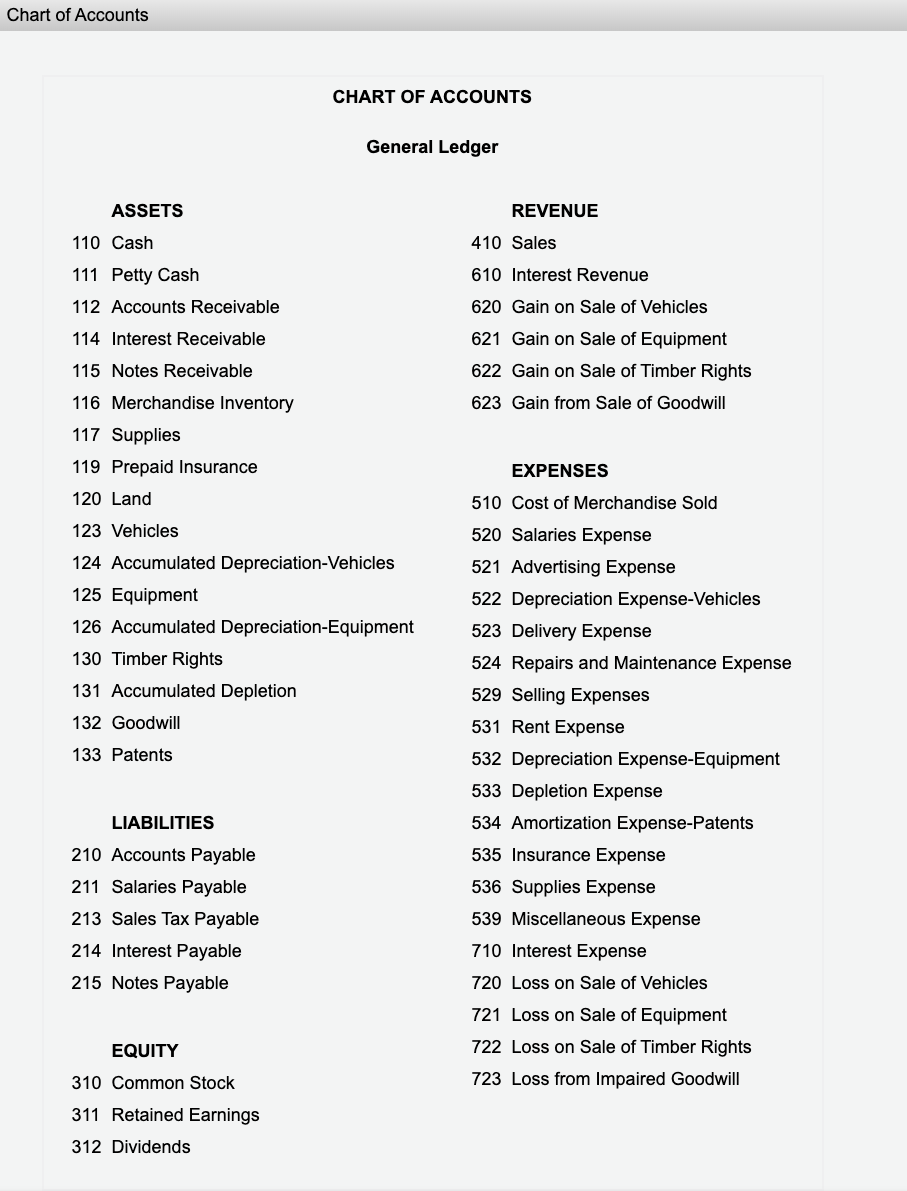

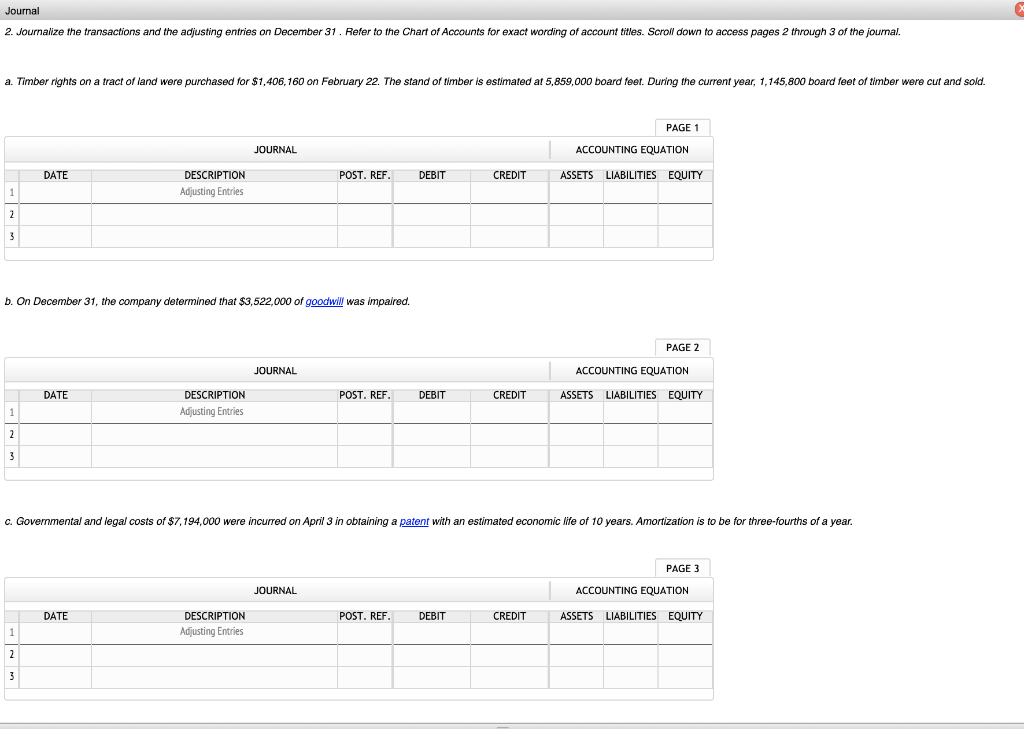

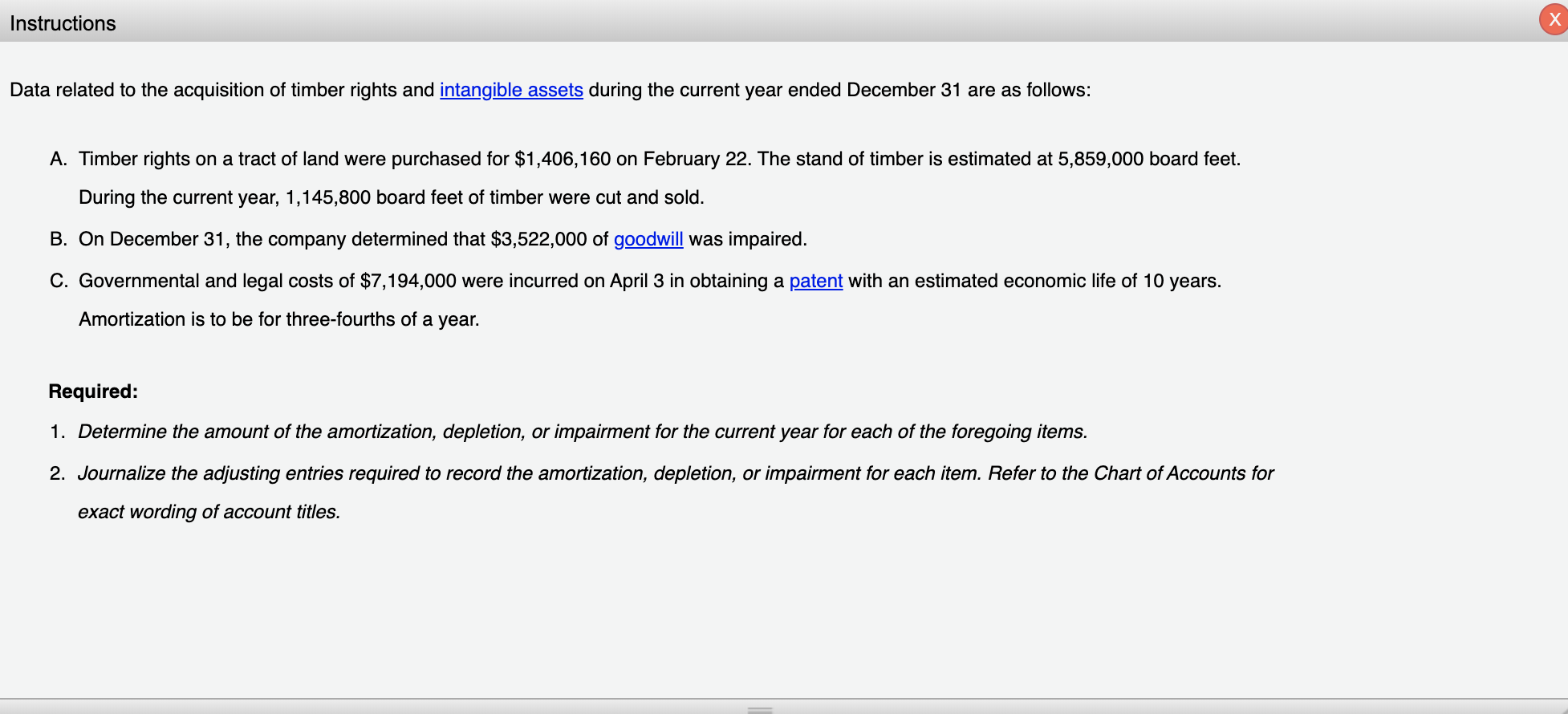

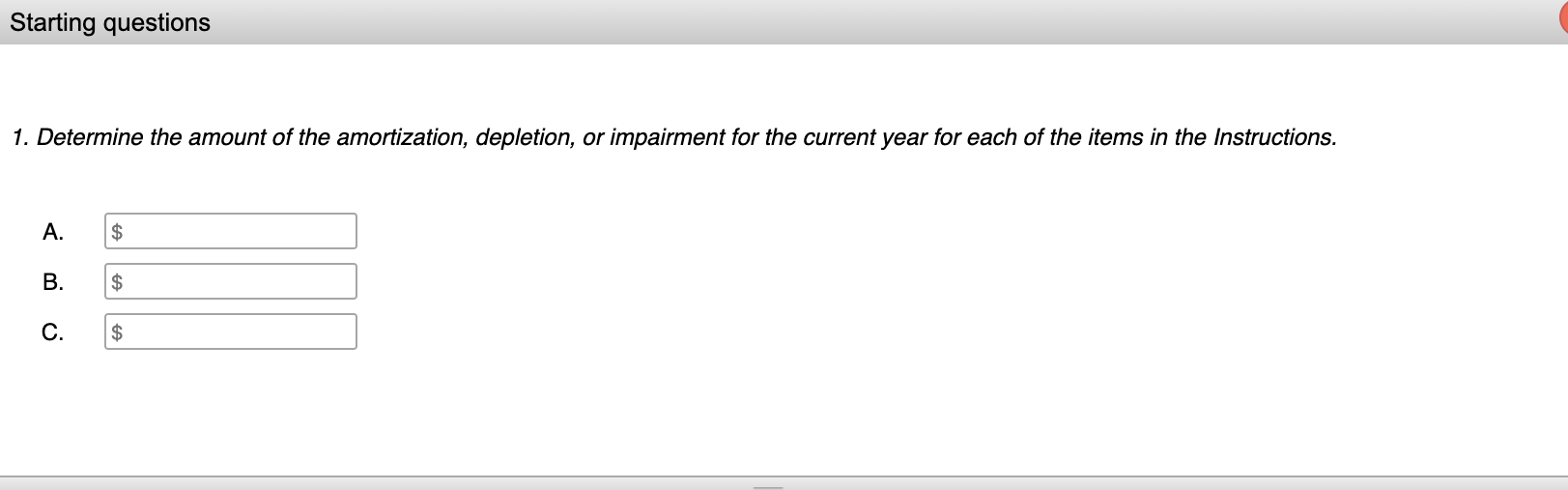

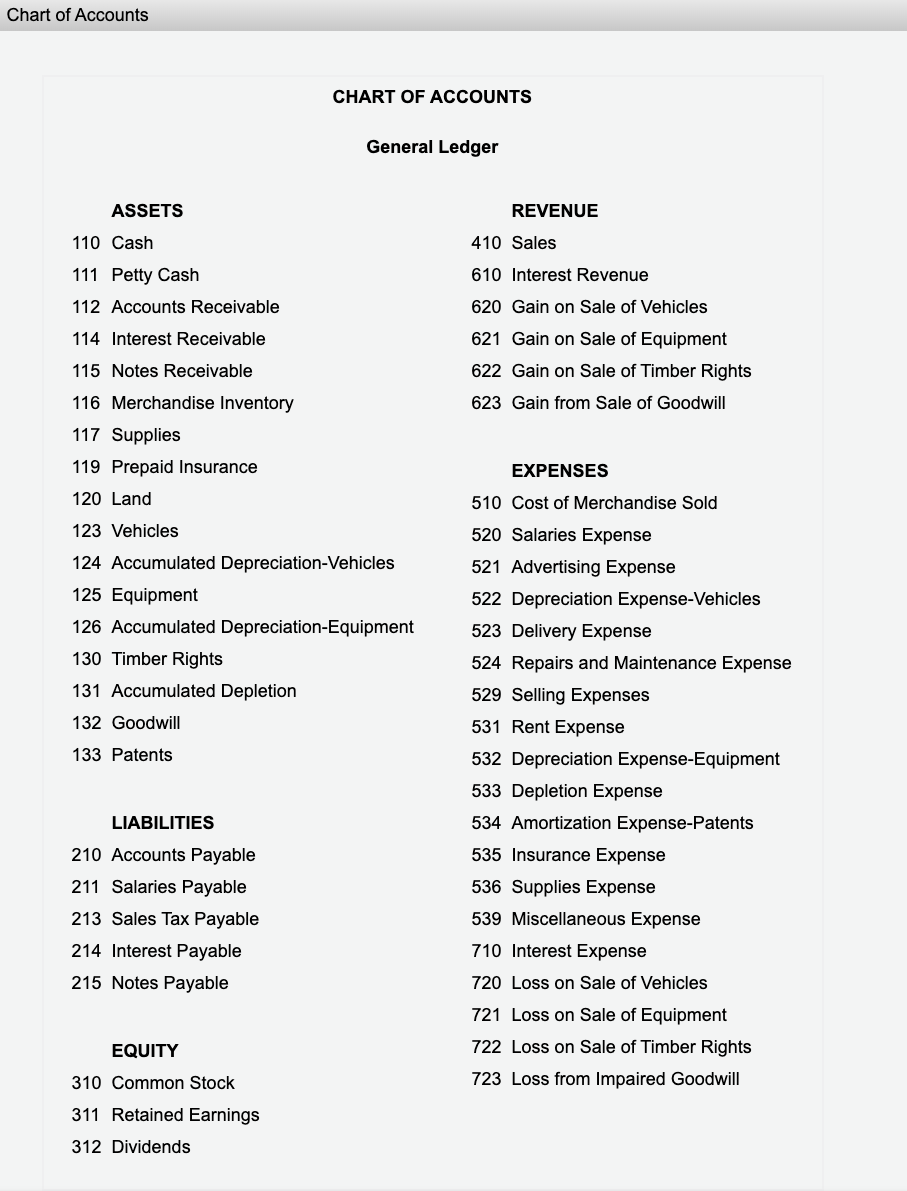

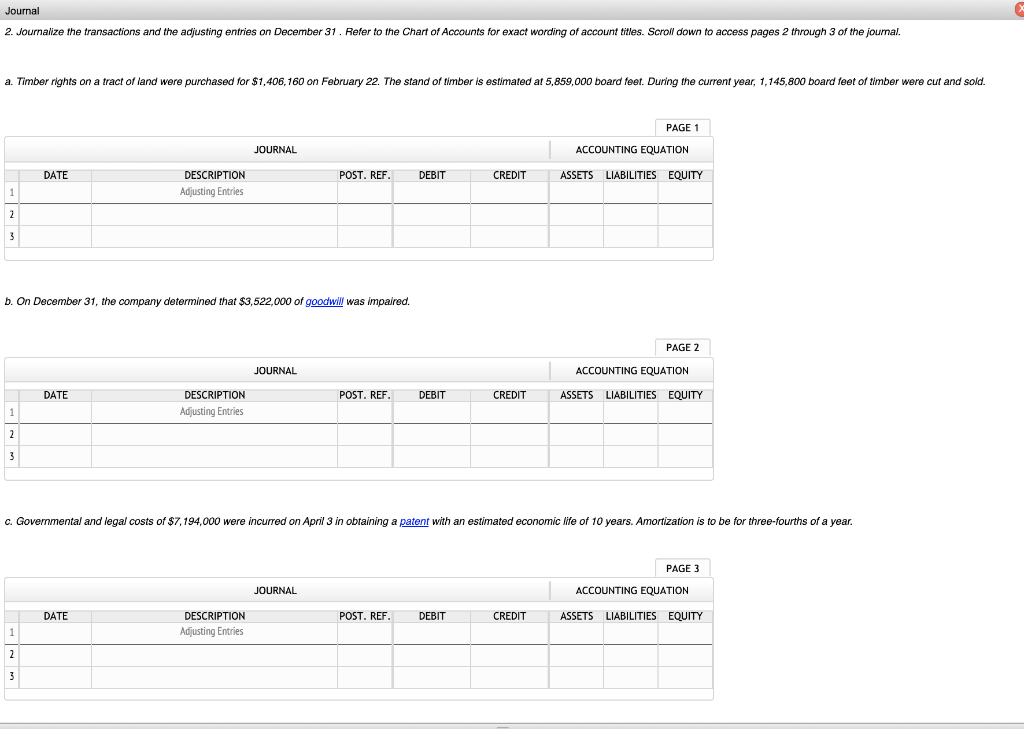

Instructions Data related to the acquisition of timber rights and intangible assets during the current year ended December 31 are as follows: A. Timber rights on a tract of land were purchased for $1,406,160 on February 22. The stand of timber is estimated at 5,859,000 board feet. During the current year, 1,145,800 board feet of timber were cut and sold. B. On December 31, the company determined that $3,522,000 of goodwill was impaired. C. Governmental and legal costs of $7,194,000 were incurred on April 3 in obtaining a patent with an estimated economic life of 10 years. Amortization is to be for three-fourths of a year. Required: 1. Determine the amount of the amortization, depletion, or impairment for the current year for each of the foregoing items. 2. Journalize the adjusting entries required to record the amortization, depletion, or impairment for each item. Refer to the Chart of Accounts for exact wording of account titles. Starting questions 1. Determine the amount of the amortization, depletion, or impairment for the current year for each of the items in the Instructions. A. B. $ $ o Chart of Accounts CHART OF ACCOUNTS General Ledger REVENUE 410 Sales 610 Interest Revenue 620 Gain on Sale of Vehicles 621 Gain on Sale of Equipment 622 Gain on Sale of Timber Rights 623 Gain from Sale of Goodwill ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 114 Interest Receivable 115 Notes Receivable 116 Merchandise Inventory 117 Supplies 119 Prepaid Insurance 120 Land 123 Vehicles 124 Accumulated Depreciation-Vehicles 125 Equipment 126 Accumulated Depreciation-Equipment 130 Timber Rights 131 Accumulated Depletion 132 Goodwill 133 Patents EXPENSES 510 Cost of Merchandise Sold 520 Salaries Expense 521 Advertising Expense 522 Depreciation Expense-Vehicles 523 Delivery Expense 524 Repairs and Maintenance Expense 529 Selling Expenses 531 Rent Expense 532 Depreciation Expense-Equipment 533 Depletion Expense 534 Amortization Expense-Patents 535 Insurance Expense 536 Supplies Expense 539 Miscellaneous Expense 710 Interest Expense 720 Loss on Sale of Vehicles 721 Loss on Sale of Equipment 722 Loss on Sale of Timber Rights 723 Loss from Impaired Goodwill LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends Journal 2. Journalize the transactions and the adjusting entries on December 31. Refer to the Chart of Accounts for exact wording of account titles. Scroll down to access pages 2 through 3 of the journal. a. Timber rights on a tract of land were purchased for $1,406,160 on February 22. The stand of timber is estimated at 5,859,000 board feet. During the current year, 1,145,800 board feet of timber were cut and sold. PAGE 1 ACCOUNTING EQUATION JOURNAL DATE POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY DESCRIPTION Adjusting Entries b. On December 31, the company determined that $3,522,000 of goodwill was impaired. PAGE 2 JOURNAL ACCOUNTING EQUATION ASSETS LIABILITIES EQUITY DATE POST. REF. DEBIT CREDIT DESCRIPTION Adjusting Entries c. Governmental and legal costs of $7,194,000 were incurred on April 3 in obtaining a patent with an estimated economic life of 10 years. Amortization is to be for three-fourths of a year. PAGE 3 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION Adjusting Entries POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY