Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions: Do not begin this assignment until you have watched all of the instructor tax research videos. Use RIA Checkpoint to answer the following questions.

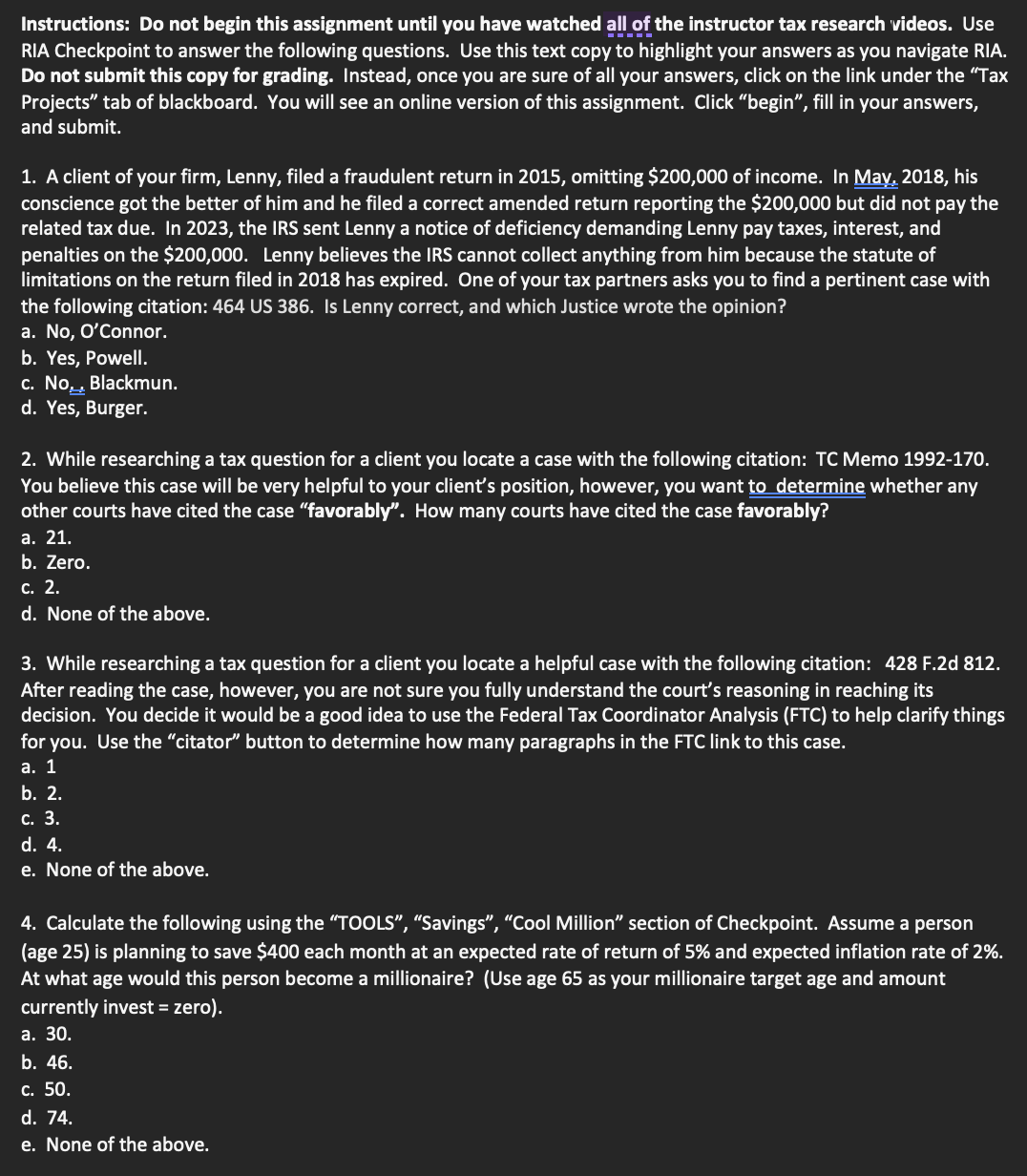

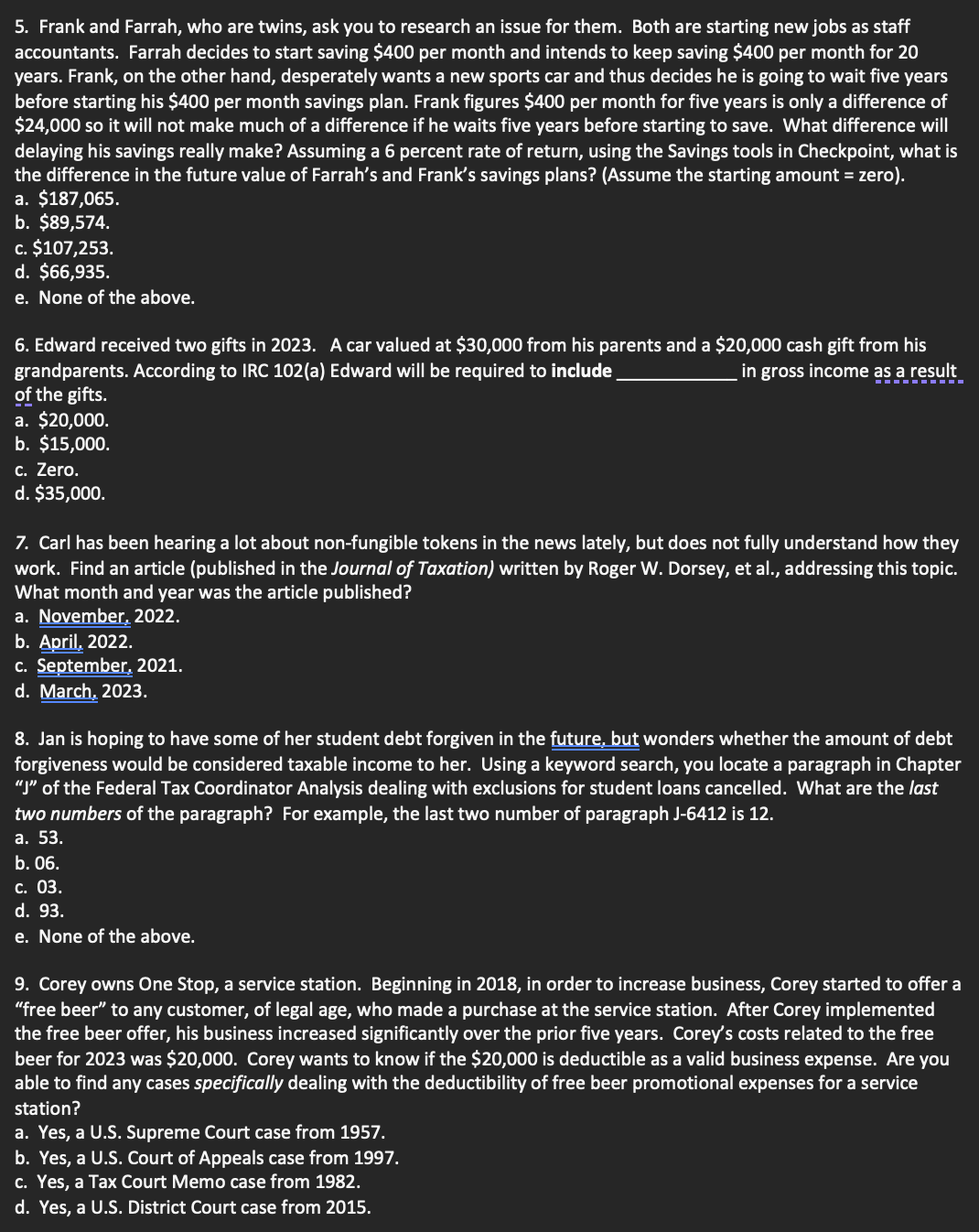

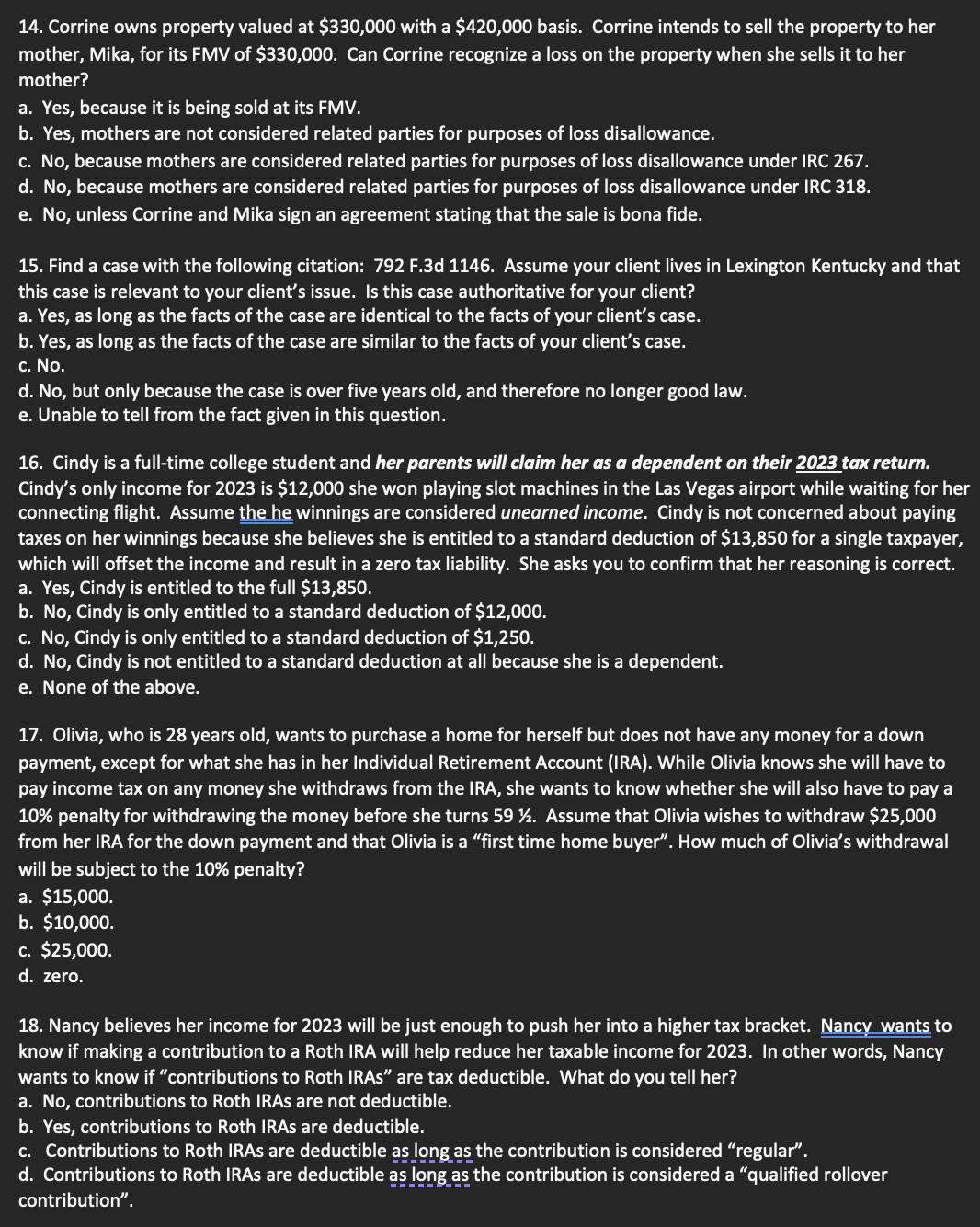

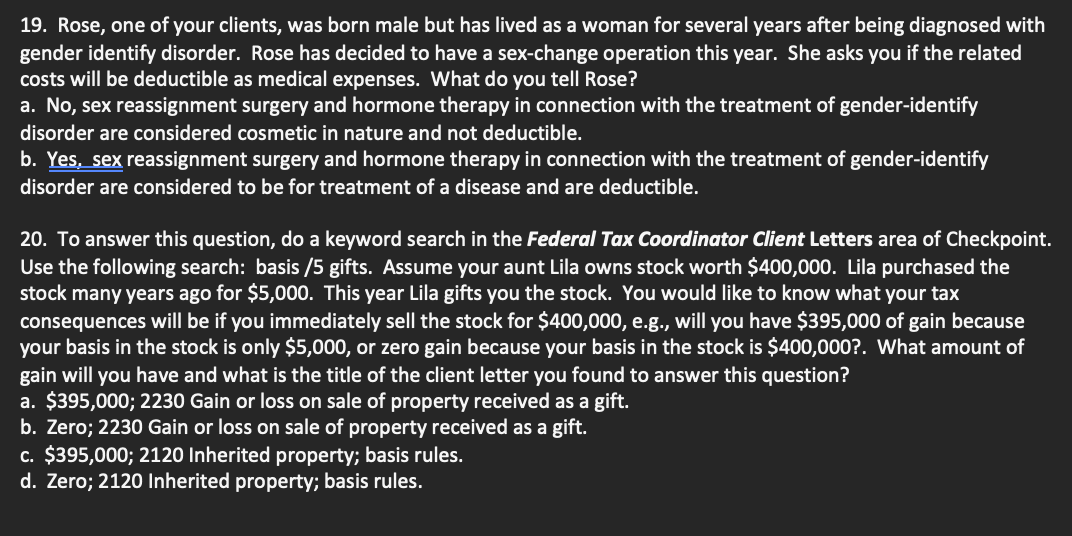

Instructions: Do not begin this assignment until you have watched all of the instructor tax research videos. Use RIA Checkpoint to answer the following questions. Use this text copy to highlight your answers as you navigate RIA. Do not submit this copy for grading. Instead, once you are sure of all your answers, click on the link under the "Tax Projects" tab of blackboard. You will see an online version of this assignment. Click "begin", fill in your answers, and submit. 1. A client of your firm, Lenny, filed a fraudulent return in 2015 , omitting $200,000 of income. In Mav, 2018, his conscience got the better of him and he filed a correct amended return reporting the $200,000 but did not pay the related tax due. In 2023, the IRS sent Lenny a notice of deficiency demanding Lenny pay taxes, interest, and penalties on the $200,000. Lenny believes the IRS cannot collect anything from him because the statute of limitations on the return filed in 2018 has expired. One of your tax partners asks you to find a pertinent case with the following citation: 464 US 386. Is Lenny correct, and which Justice wrote the opinion? a. No, O'Connor. b. Yes, Powell. c. No, Blackmun. d. Yes, Burger. 2. While researching a tax question for a client you locate a case with the following citation: TC Memo 1992-170. You believe this case will be very helpful to your client's position, however, you want to determine whether any other courts have cited the case "favorably". How many courts have cited the case favorably? a. 21. b. Zero. c. 2. d. None of the above. 3. While researching a tax question for a client you locate a helpful case with the following citation: 428 F.2d 812 . After reading the case, however, you are not sure you fully understand the court's reasoning in reaching its decision. You decide it would be a good idea to use the Federal Tax Coordinator Analysis (FTC) to help clarify things for you. Use the "citator" button to determine how many paragraphs in the FTC link to this case. a. 1 b. 2 . c. 3. d. 4 . e. None of the above. 4. Calculate the following using the "TOOLS", "Savings", "Cool Million" section of Checkpoint. Assume a person (age 25 ) is planning to save $400 each month at an expected rate of return of 5% and expected inflation rate of 2%. At what age would this person become a millionaire? (Use age 65 as your millionaire target age and amount currently invest = zero). a. 30 . b. 46 . c. 50 . d. 74 . e. None of the above. 10. Craig wants to buy a car and his parents would like to give him an interest-free loan of $15,000 to help him out. However, Craig's parent have heard that even though they are not actually receiving any interest on the loan, according to the internal revenue code, they may still have to pay tax because of the "imputed interest" rules on loans with "below-market interest" Craig finds this hard to believe but asks you to check it out for him. You learn that this is true. However, you also notice that loans under a certain amount are not subject to these rules because they are considered "de minimis" in nature. To avoid the rules, Craig's parents should limit the loan amount to: a. $12,000 according to IRC 7872(c)(2). b. $10,000 according to IRC 7872(c)(2). c. $20,000 according to IRC 7872(c)(2). d. $100,000 according to IRC 7872(c)(2). 11. Calculate the following using the "TOOLS", "Loan", Amortizing Loan" section of Checkpoint. You recently graduated and obtained a great job at a large public accounting firm. You would like to buy a house. After assessing your financial situation, you determine your maximum monthly payment of the loan is $1,800. Assume the market rate of interest is 6%, the amount of the loan is $200,000, and the term of the loan is 15 years. Based on these facts, will you be able to stay within your $1,800 budget? a. No, the monthly payment is $2,024.90. b. Yes, the monthly payment is $954.83. c. No, the monthly payment is $1,989.22. d. Yes, the monthly payment is $1,687.71. e. None of the above. 12. Sierra owns a bakery. On her way to work on day, the police pull her over, and give her a $500 ticket for speeding. Is the fine deductible under Internal Revenue Code Section (IRC) 162? a. Yes, because she was on her to work when it happened. b. Yes, because it an ordinary and necessary expense of her business. c. No, because such payments are nondeductible under IRC 162(c)(1). d. No, because such payments are nondeductible under IRC 162(f)(1). 13. Richard and Monica have been married for three vears, and have filed joint returns during this time period. Frank is unaware that Monica has been operating an illegal drug business out of their home. Monica has earned between $100,000 and $200,000 a year from this activity but has never reported any income on their joint returns. Richard has noticed that, even though Monica is not employed, she always has tons of money, e.g., she recently purchased a car for $120,000. However, Richard has never asked her about it (even though he has been curious). In 2023, Monica is finally caught, and arrested for operating an illegal business. As soon as she posts bail, Monica flees to another country. The IRS finds Monica's records and determines that she owes the IRS $250,000 of taxes, interest, and penalties related to her ill-gotten gains. Since Richard signed the joint returns and Monica is nowhere to be find, the IRS demands Richard pay the entire amount. Richard is aware of a something called "innocent spouse" relief that would excuse him from being responsible for the payment. Would Richard likely qualify for relief under this provision? a. Yes, because Richard did not have actual knowledge of Monica's activities or income. b. Yes, because if would be inequitable to make Richard pay and that is all he has to prove. c. Yes, as long as Richard was not involved in the operation of the business. d. No, because even if Richard did not have actual knowledge, he had reason to know something was going on because of Monica's extravagant spending and lack of employment. e. No, but only because innocent spouse relief is never allowed for income from drug activities. 19. Rose, one of your clients, was born male but has lived as a woman for several years after being diagnosed with gender identify disorder. Rose has decided to have a sex-change operation this year. She asks you if the related costs will be deductible as medical expenses. What do you tell Rose? a. No, sex reassignment surgery and hormone therapy in connection with the treatment of gender-identify disorder are considered cosmetic in nature and not deductible. b. Yes, sex reassignment surgery and hormone therapy in connection with the treatment of gender-identify disorder are considered to be for treatment of a disease and are deductible. 20. To answer this question, do a keyword search in the Federal Tax Coordinator Client Letters area of Checkpoint. Use the following search: basis /5 gifts. Assume your aunt Lila owns stock worth $400,000. Lila purchased the stock many years ago for $5,000. This year Lila gifts you the stock. You would like to know what your tax consequences will be if you immediately sell the stock for $400,000, e.g., will you have $395,000 of gain because your basis in the stock is only $5,000, or zero gain because your basis in the stock is $400,000 ?. What amount of gain will you have and what is the title of the client letter you found to answer this question? a. $395,000;2230 Gain or loss on sale of property received as a gift. b. Zero; 2230 Gain or loss on sale of property received as a gift. c. \$395,000; 2120 Inherited property; basis rules. d. Zero; 2120 Inherited property; basis rules. 5. Frank and Farrah, who are twins, ask you to research an issue for them. Both are starting new jobs as staff accountants. Farrah decides to start saving $400 per month and intends to keep saving $400 per month for 20 years. Frank, on the other hand, desperately wants a new sports car and thus decides he is going to wait five years before starting his $400 per month savings plan. Frank figures $400 per month for five years is only a difference of $24,000 so it will not make much of a difference if he waits five years before starting to save. What difference will delaying his savings really make? Assuming a 6 percent rate of return, using the Savings tools in Checkpoint, what is the difference in the future value of Farrah's and Frank's savings plans? (Assume the starting amount = zero). a. $187,065. b. $89,574. c. $107,253. d. $66,935. e. None of the above. 6. Edward received two gifts in 2023. A car valued at $30,000 from his parents and a $20,000 cash gift from his grandparents. According to IRC 102(a) Edward will be required to include in gross income as a result of the gifts. a. $20,000. b. $15,000. c. Zero. d. $35,000. 7. Carl has been hearing a lot about non-fungible tokens in the news lately, but does not fully understand how they work. Find an article (published in the Journal of Taxation) written by Roger W. Dorsey, et al., addressing this topic. What month and year was the article published? a. November, 2022. b. April, 2022. c. September, 2021. d. March. 2023. 8. Jan is hoping to have some of her student debt forgiven in the future, but wonders whether the amount of debt forgiveness would be considered taxable income to her. Using a keyword search, you locate a paragraph in Chapter "J" of the Federal Tax Coordinator Analysis dealing with exclusions for student loans cancelled. What are the last two numbers of the paragraph? For example, the last two number of paragraph J-6412 is 12 . a. 53. b. 06. c. 03 . d. 93. e. None of the above. 9. Corey owns One Stop, a service station. Beginning in 2018, in order to increase business, Corey started to offer a "free beer" to any customer, of legal age, who made a purchase at the service station. After Corey implemented the free beer offer, his business increased significantly over the prior five years. Corey's costs related to the free beer for 2023 was $20,000. Corey wants to know if the $20,000 is deductible as a valid business expense. Are you able to find any cases specifically dealing with the deductibility of free beer promotional expenses for a service station? a. Yes, a U.S. Supreme Court case from 1957. b. Yes, a U.S. Court of Appeals case from 1997. c. Yes, a Tax Court Memo case from 1982. d. Yes, a U.S. District Court case from 2015. 14. Corrine owns property valued at $330,000 with a $420,000 basis. Corrine intends to sell the property to her mother, Mika, for its FMV of $330,000. Can Corrine recognize a loss on the property when she sells it to her mother? a. Yes, because it is being sold at its FMV. b. Yes, mothers are not considered related parties for purposes of loss disallowance. c. No, because mothers are considered related parties for purposes of loss disallowance under IRC 267. d. No, because mothers are considered related parties for purposes of loss disallowance under IRC 318 . e. No, unless Corrine and Mika sign an agreement stating that the sale is bona fide. 15. Find a case with the following citation: 792 F.3d 1146. Assume your client lives in Lexington Kentucky and that this case is relevant to your client's issue. Is this case authoritative for your client? a. Yes, as long as the facts of the case are identical to the facts of your client's case. b. Yes, as long as the facts of the case are similar to the facts of your client's case. c. No. d. No, but only because the case is over five years old, and therefore no longer good law. e. Unable to tell from the fact given in this question. 16. Cindy is a full-time college student and her parents will claim her as a dependent on their 2023 tax return. Cindy's only income for 2023 is $12,000 she won playing slot machines in the Las Vegas airport while waiting for her connecting flight. Assume the he winnings are considered unearned income. Cindy is not concerned about paying taxes on her winnings because she believes she is entitled to a standard deduction of $13,850 for a single taxpayer, which will offset the income and result in a zero tax liability. She asks you to confirm that her reasoning is correct. a. Yes, Cindy is entitled to the full $13,850. b. No, Cindy is only entitled to a standard deduction of $12,000. c. No, Cindy is only entitled to a standard deduction of $1,250. d. No, Cindy is not entitled to a standard deduction at all because she is a dependent. e. None of the above. 17. Olivia, who is 28 years old, wants to purchase a home for herself but does not have any money for a down payment, except for what she has in her Individual Retirement Account (IRA). While Olivia knows she will have to pay income tax on any money she withdraws from the IRA, she wants to know whether she will also have to pay a 10% penalty for withdrawing the money before she turns 5921. Assume that Olivia wishes to withdraw $25,000 from her IRA for the down payment and that Olivia is a "first time home buyer". How much of Olivia's withdrawal will be subject to the 10% penalty? a. $15,000. b. $10,000. c. $25,000. d. zero. 18. Nancy believes her income for 2023 will be just enough to push her into a higher tax bracket. Nancy wants to know if making a contribution to a Roth IRA will help reduce her taxable income for 2023. In other words, Nancy wants to know if "contributions to Roth IRAs" are tax deductible. What do you tell her? a. No, contributions to Roth IRAs are not deductible. b. Yes, contributions to Roth IRAs are deductible. c. Contributions to Roth IRAs are deductible as long as the contribution is considered "regular". d. Contributions to Roth IRAs are deductible as long as the contribution is considered a "qualified rollover

Instructions: Do not begin this assignment until you have watched all of the instructor tax research videos. Use RIA Checkpoint to answer the following questions. Use this text copy to highlight your answers as you navigate RIA. Do not submit this copy for grading. Instead, once you are sure of all your answers, click on the link under the "Tax Projects" tab of blackboard. You will see an online version of this assignment. Click "begin", fill in your answers, and submit. 1. A client of your firm, Lenny, filed a fraudulent return in 2015 , omitting $200,000 of income. In Mav, 2018, his conscience got the better of him and he filed a correct amended return reporting the $200,000 but did not pay the related tax due. In 2023, the IRS sent Lenny a notice of deficiency demanding Lenny pay taxes, interest, and penalties on the $200,000. Lenny believes the IRS cannot collect anything from him because the statute of limitations on the return filed in 2018 has expired. One of your tax partners asks you to find a pertinent case with the following citation: 464 US 386. Is Lenny correct, and which Justice wrote the opinion? a. No, O'Connor. b. Yes, Powell. c. No, Blackmun. d. Yes, Burger. 2. While researching a tax question for a client you locate a case with the following citation: TC Memo 1992-170. You believe this case will be very helpful to your client's position, however, you want to determine whether any other courts have cited the case "favorably". How many courts have cited the case favorably? a. 21. b. Zero. c. 2. d. None of the above. 3. While researching a tax question for a client you locate a helpful case with the following citation: 428 F.2d 812 . After reading the case, however, you are not sure you fully understand the court's reasoning in reaching its decision. You decide it would be a good idea to use the Federal Tax Coordinator Analysis (FTC) to help clarify things for you. Use the "citator" button to determine how many paragraphs in the FTC link to this case. a. 1 b. 2 . c. 3. d. 4 . e. None of the above. 4. Calculate the following using the "TOOLS", "Savings", "Cool Million" section of Checkpoint. Assume a person (age 25 ) is planning to save $400 each month at an expected rate of return of 5% and expected inflation rate of 2%. At what age would this person become a millionaire? (Use age 65 as your millionaire target age and amount currently invest = zero). a. 30 . b. 46 . c. 50 . d. 74 . e. None of the above. 10. Craig wants to buy a car and his parents would like to give him an interest-free loan of $15,000 to help him out. However, Craig's parent have heard that even though they are not actually receiving any interest on the loan, according to the internal revenue code, they may still have to pay tax because of the "imputed interest" rules on loans with "below-market interest" Craig finds this hard to believe but asks you to check it out for him. You learn that this is true. However, you also notice that loans under a certain amount are not subject to these rules because they are considered "de minimis" in nature. To avoid the rules, Craig's parents should limit the loan amount to: a. $12,000 according to IRC 7872(c)(2). b. $10,000 according to IRC 7872(c)(2). c. $20,000 according to IRC 7872(c)(2). d. $100,000 according to IRC 7872(c)(2). 11. Calculate the following using the "TOOLS", "Loan", Amortizing Loan" section of Checkpoint. You recently graduated and obtained a great job at a large public accounting firm. You would like to buy a house. After assessing your financial situation, you determine your maximum monthly payment of the loan is $1,800. Assume the market rate of interest is 6%, the amount of the loan is $200,000, and the term of the loan is 15 years. Based on these facts, will you be able to stay within your $1,800 budget? a. No, the monthly payment is $2,024.90. b. Yes, the monthly payment is $954.83. c. No, the monthly payment is $1,989.22. d. Yes, the monthly payment is $1,687.71. e. None of the above. 12. Sierra owns a bakery. On her way to work on day, the police pull her over, and give her a $500 ticket for speeding. Is the fine deductible under Internal Revenue Code Section (IRC) 162? a. Yes, because she was on her to work when it happened. b. Yes, because it an ordinary and necessary expense of her business. c. No, because such payments are nondeductible under IRC 162(c)(1). d. No, because such payments are nondeductible under IRC 162(f)(1). 13. Richard and Monica have been married for three vears, and have filed joint returns during this time period. Frank is unaware that Monica has been operating an illegal drug business out of their home. Monica has earned between $100,000 and $200,000 a year from this activity but has never reported any income on their joint returns. Richard has noticed that, even though Monica is not employed, she always has tons of money, e.g., she recently purchased a car for $120,000. However, Richard has never asked her about it (even though he has been curious). In 2023, Monica is finally caught, and arrested for operating an illegal business. As soon as she posts bail, Monica flees to another country. The IRS finds Monica's records and determines that she owes the IRS $250,000 of taxes, interest, and penalties related to her ill-gotten gains. Since Richard signed the joint returns and Monica is nowhere to be find, the IRS demands Richard pay the entire amount. Richard is aware of a something called "innocent spouse" relief that would excuse him from being responsible for the payment. Would Richard likely qualify for relief under this provision? a. Yes, because Richard did not have actual knowledge of Monica's activities or income. b. Yes, because if would be inequitable to make Richard pay and that is all he has to prove. c. Yes, as long as Richard was not involved in the operation of the business. d. No, because even if Richard did not have actual knowledge, he had reason to know something was going on because of Monica's extravagant spending and lack of employment. e. No, but only because innocent spouse relief is never allowed for income from drug activities. 19. Rose, one of your clients, was born male but has lived as a woman for several years after being diagnosed with gender identify disorder. Rose has decided to have a sex-change operation this year. She asks you if the related costs will be deductible as medical expenses. What do you tell Rose? a. No, sex reassignment surgery and hormone therapy in connection with the treatment of gender-identify disorder are considered cosmetic in nature and not deductible. b. Yes, sex reassignment surgery and hormone therapy in connection with the treatment of gender-identify disorder are considered to be for treatment of a disease and are deductible. 20. To answer this question, do a keyword search in the Federal Tax Coordinator Client Letters area of Checkpoint. Use the following search: basis /5 gifts. Assume your aunt Lila owns stock worth $400,000. Lila purchased the stock many years ago for $5,000. This year Lila gifts you the stock. You would like to know what your tax consequences will be if you immediately sell the stock for $400,000, e.g., will you have $395,000 of gain because your basis in the stock is only $5,000, or zero gain because your basis in the stock is $400,000 ?. What amount of gain will you have and what is the title of the client letter you found to answer this question? a. $395,000;2230 Gain or loss on sale of property received as a gift. b. Zero; 2230 Gain or loss on sale of property received as a gift. c. \$395,000; 2120 Inherited property; basis rules. d. Zero; 2120 Inherited property; basis rules. 5. Frank and Farrah, who are twins, ask you to research an issue for them. Both are starting new jobs as staff accountants. Farrah decides to start saving $400 per month and intends to keep saving $400 per month for 20 years. Frank, on the other hand, desperately wants a new sports car and thus decides he is going to wait five years before starting his $400 per month savings plan. Frank figures $400 per month for five years is only a difference of $24,000 so it will not make much of a difference if he waits five years before starting to save. What difference will delaying his savings really make? Assuming a 6 percent rate of return, using the Savings tools in Checkpoint, what is the difference in the future value of Farrah's and Frank's savings plans? (Assume the starting amount = zero). a. $187,065. b. $89,574. c. $107,253. d. $66,935. e. None of the above. 6. Edward received two gifts in 2023. A car valued at $30,000 from his parents and a $20,000 cash gift from his grandparents. According to IRC 102(a) Edward will be required to include in gross income as a result of the gifts. a. $20,000. b. $15,000. c. Zero. d. $35,000. 7. Carl has been hearing a lot about non-fungible tokens in the news lately, but does not fully understand how they work. Find an article (published in the Journal of Taxation) written by Roger W. Dorsey, et al., addressing this topic. What month and year was the article published? a. November, 2022. b. April, 2022. c. September, 2021. d. March. 2023. 8. Jan is hoping to have some of her student debt forgiven in the future, but wonders whether the amount of debt forgiveness would be considered taxable income to her. Using a keyword search, you locate a paragraph in Chapter "J" of the Federal Tax Coordinator Analysis dealing with exclusions for student loans cancelled. What are the last two numbers of the paragraph? For example, the last two number of paragraph J-6412 is 12 . a. 53. b. 06. c. 03 . d. 93. e. None of the above. 9. Corey owns One Stop, a service station. Beginning in 2018, in order to increase business, Corey started to offer a "free beer" to any customer, of legal age, who made a purchase at the service station. After Corey implemented the free beer offer, his business increased significantly over the prior five years. Corey's costs related to the free beer for 2023 was $20,000. Corey wants to know if the $20,000 is deductible as a valid business expense. Are you able to find any cases specifically dealing with the deductibility of free beer promotional expenses for a service station? a. Yes, a U.S. Supreme Court case from 1957. b. Yes, a U.S. Court of Appeals case from 1997. c. Yes, a Tax Court Memo case from 1982. d. Yes, a U.S. District Court case from 2015. 14. Corrine owns property valued at $330,000 with a $420,000 basis. Corrine intends to sell the property to her mother, Mika, for its FMV of $330,000. Can Corrine recognize a loss on the property when she sells it to her mother? a. Yes, because it is being sold at its FMV. b. Yes, mothers are not considered related parties for purposes of loss disallowance. c. No, because mothers are considered related parties for purposes of loss disallowance under IRC 267. d. No, because mothers are considered related parties for purposes of loss disallowance under IRC 318 . e. No, unless Corrine and Mika sign an agreement stating that the sale is bona fide. 15. Find a case with the following citation: 792 F.3d 1146. Assume your client lives in Lexington Kentucky and that this case is relevant to your client's issue. Is this case authoritative for your client? a. Yes, as long as the facts of the case are identical to the facts of your client's case. b. Yes, as long as the facts of the case are similar to the facts of your client's case. c. No. d. No, but only because the case is over five years old, and therefore no longer good law. e. Unable to tell from the fact given in this question. 16. Cindy is a full-time college student and her parents will claim her as a dependent on their 2023 tax return. Cindy's only income for 2023 is $12,000 she won playing slot machines in the Las Vegas airport while waiting for her connecting flight. Assume the he winnings are considered unearned income. Cindy is not concerned about paying taxes on her winnings because she believes she is entitled to a standard deduction of $13,850 for a single taxpayer, which will offset the income and result in a zero tax liability. She asks you to confirm that her reasoning is correct. a. Yes, Cindy is entitled to the full $13,850. b. No, Cindy is only entitled to a standard deduction of $12,000. c. No, Cindy is only entitled to a standard deduction of $1,250. d. No, Cindy is not entitled to a standard deduction at all because she is a dependent. e. None of the above. 17. Olivia, who is 28 years old, wants to purchase a home for herself but does not have any money for a down payment, except for what she has in her Individual Retirement Account (IRA). While Olivia knows she will have to pay income tax on any money she withdraws from the IRA, she wants to know whether she will also have to pay a 10% penalty for withdrawing the money before she turns 5921. Assume that Olivia wishes to withdraw $25,000 from her IRA for the down payment and that Olivia is a "first time home buyer". How much of Olivia's withdrawal will be subject to the 10% penalty? a. $15,000. b. $10,000. c. $25,000. d. zero. 18. Nancy believes her income for 2023 will be just enough to push her into a higher tax bracket. Nancy wants to know if making a contribution to a Roth IRA will help reduce her taxable income for 2023. In other words, Nancy wants to know if "contributions to Roth IRAs" are tax deductible. What do you tell her? a. No, contributions to Roth IRAs are not deductible. b. Yes, contributions to Roth IRAs are deductible. c. Contributions to Roth IRAs are deductible as long as the contribution is considered "regular". d. Contributions to Roth IRAs are deductible as long as the contribution is considered a "qualified rollover Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started