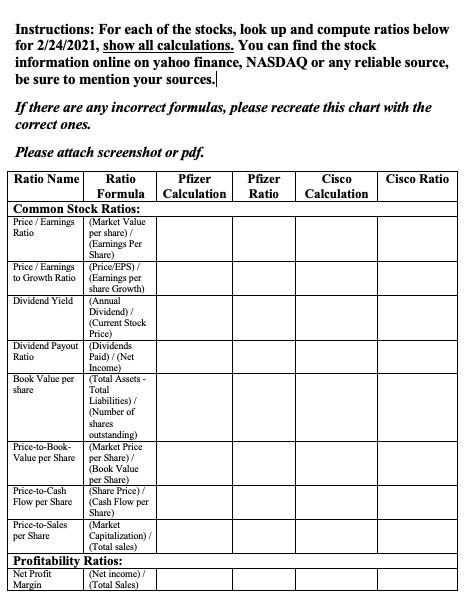

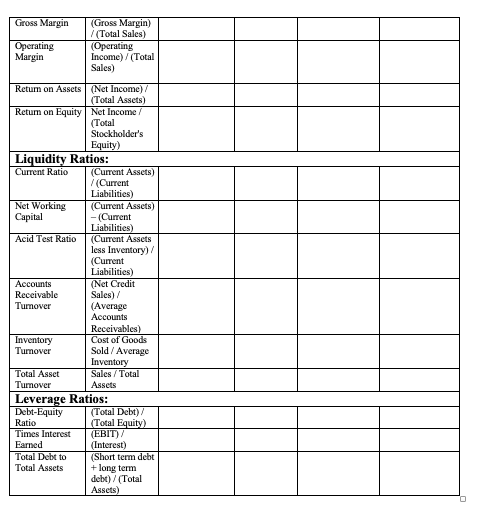

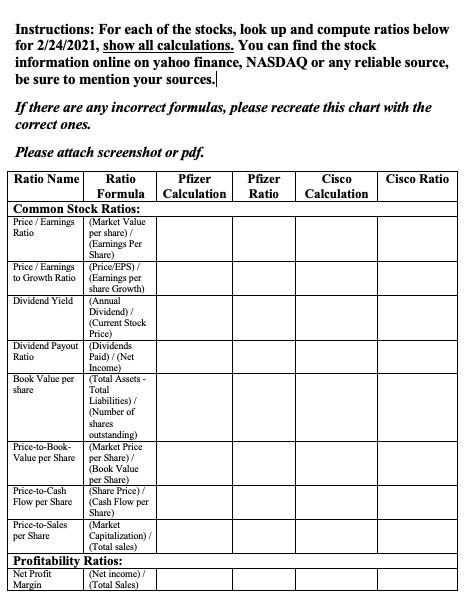

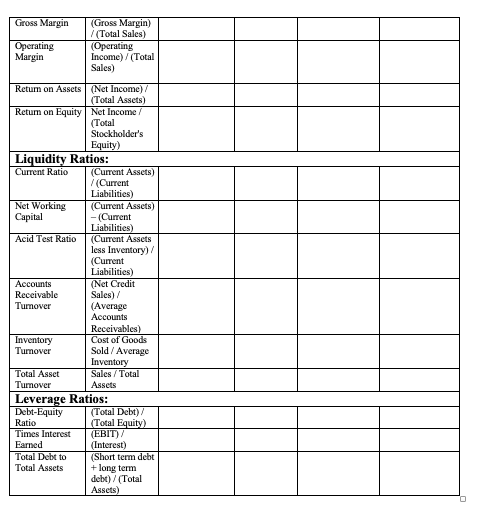

Instructions: For each of the stocks, look up and compute ratios below for 2/24/2021, show all calculations. You can find the stock information online on yahoo finance, NASDAQ or any reliable source, be sure to mention your sources. If there are any incorrect formulas, please recreate this chart with the correct ones. Please attach screenshot or pdf. Ratio Name Pfizer Pfizer Cisco Ratio Formula Calculation Calculation Common Stock Ratios: Ratio Cisco Ratio Price/ Earnings (Market Value Ratio per share) / (Earings Per Share) Price/ Earnings (Price/EPS)/ to Growth Ratio (Earnings per share Growth) Dividend Yield (Annual Dividend) / (Current Stock Price) Dividend Payout (Dividends Ratio Paid)/(Net Income) Book Value per (Total Assets share Total Liabilities) / (Number of shares outstanding) Price-to-Book- (Market Price Value per Share per Share) / (Book Value per Share) Price-to-Cash (Share Price) Flow per Share (Cash Flow per Share) Price-to-Sales (Market per Share Capitalization) (Total sales) Profitability Ratios: Net Profit (Net income) / Margin (Total Sales) Gross Margin Operating Margin (Gross Margin) /(Total Sales) (Operating Income) / (Total Sales) Return on Assets (Net Income) / (Total Assets) Retum on Equity Net Income / (Total Stockholder's Equity) Liquidity Ratios: Current Ratio (Current Assets) /(Current Liabilities) Net Working (Current Assets) Capital - (Current Liabilities) Acid Test Ratio (Current Assets less Inventory) (Current Liabilities) Accounts (Net Credit Receivable Sales) / Tumover (Average Accounts Receivables) Inventory Cost of Goods Tumover Sold / Average Inventory Total Asset Sales/Total Tumover Assets Leverage Ratios: Debt-Equity (Total Debt) / Ratio (Total Equity) Times Interest (EBIT) / Earned (Interest) Total Debt to (Short term debt Total Assets + long term debt) / (Total Assets) Instructions: For each of the stocks, look up and compute ratios below for 2/24/2021, show all calculations. You can find the stock information online on yahoo finance, NASDAQ or any reliable source, be sure to mention your sources. If there are any incorrect formulas, please recreate this chart with the correct ones. Please attach screenshot or pdf. Ratio Name Pfizer Pfizer Cisco Ratio Formula Calculation Calculation Common Stock Ratios: Ratio Cisco Ratio Price/ Earnings (Market Value Ratio per share) / (Earings Per Share) Price/ Earnings (Price/EPS)/ to Growth Ratio (Earnings per share Growth) Dividend Yield (Annual Dividend) / (Current Stock Price) Dividend Payout (Dividends Ratio Paid)/(Net Income) Book Value per (Total Assets share Total Liabilities) / (Number of shares outstanding) Price-to-Book- (Market Price Value per Share per Share) / (Book Value per Share) Price-to-Cash (Share Price) Flow per Share (Cash Flow per Share) Price-to-Sales (Market per Share Capitalization) (Total sales) Profitability Ratios: Net Profit (Net income) / Margin (Total Sales) Gross Margin Operating Margin (Gross Margin) /(Total Sales) (Operating Income) / (Total Sales) Return on Assets (Net Income) / (Total Assets) Retum on Equity Net Income / (Total Stockholder's Equity) Liquidity Ratios: Current Ratio (Current Assets) /(Current Liabilities) Net Working (Current Assets) Capital - (Current Liabilities) Acid Test Ratio (Current Assets less Inventory) (Current Liabilities) Accounts (Net Credit Receivable Sales) / Tumover (Average Accounts Receivables) Inventory Cost of Goods Tumover Sold / Average Inventory Total Asset Sales/Total Tumover Assets Leverage Ratios: Debt-Equity (Total Debt) / Ratio (Total Equity) Times Interest (EBIT) / Earned (Interest) Total Debt to (Short term debt Total Assets + long term debt) / (Total Assets)