Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions Frito Lay is determining whether to purchase a new piece of equipment, which has a base price of $ 4 5 0 , 0

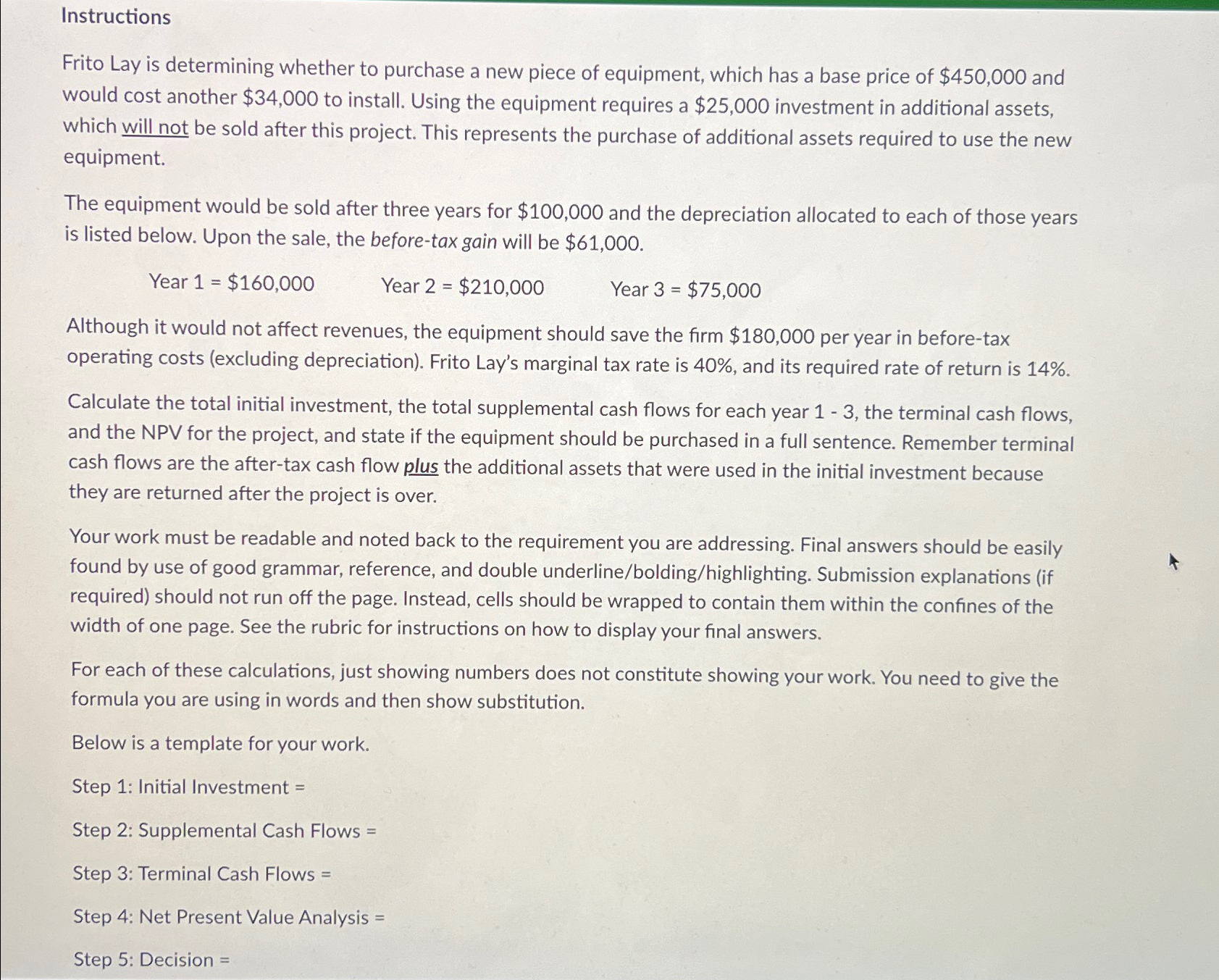

Instructions

Frito Lay is determining whether to purchase a new piece of equipment, which has a base price of $ and would cost another $ to install. Using the equipment requires a $ investment in additional assets, which will not be sold after this project. This represents the purchase of additional assets required to use the new equipment.

The equipment would be sold after three years for $ and the depreciation allocated to each of those years is listed below. Upon the sale, the beforetax gain will be $

Year $

Year $

Year $

Although it would not affect revenues, the equipment should save the firm $ per year in beforetax operating costs excluding depreciation Frito Lay's marginal tax rate is and its required rate of return is

Calculate the total initial investment, the total supplemental cash flows for each year the terminal cash flows, and the NPV for the project, and state if the equipment should be purchased in a full sentence. Remember terminal cash flows are the aftertax cash flow plus the additional assets that were used in the initial investment because they are returned after the project is over.

Your work must be readable and noted back to the requirement you are addressing. Final answers should be easily found by use of good grammar, reference, and double underlineboldinghighlighting Submission explanations if required should not run off the page. Instead, cells should be wrapped to contain them within the confines of the width of one page. See the rubric for instructions on how to display your final answers.

For each of these calculations, just showing numbers does not constitute showing your work. You need to give the formula you are using in words and then show substitution.

Below is a template for your work.

Step : Initial Investment

Step : Supplemental Cash Flows

Step : Terminal Cash Flows

Step : Net Present Value Analysis

Step : Decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started