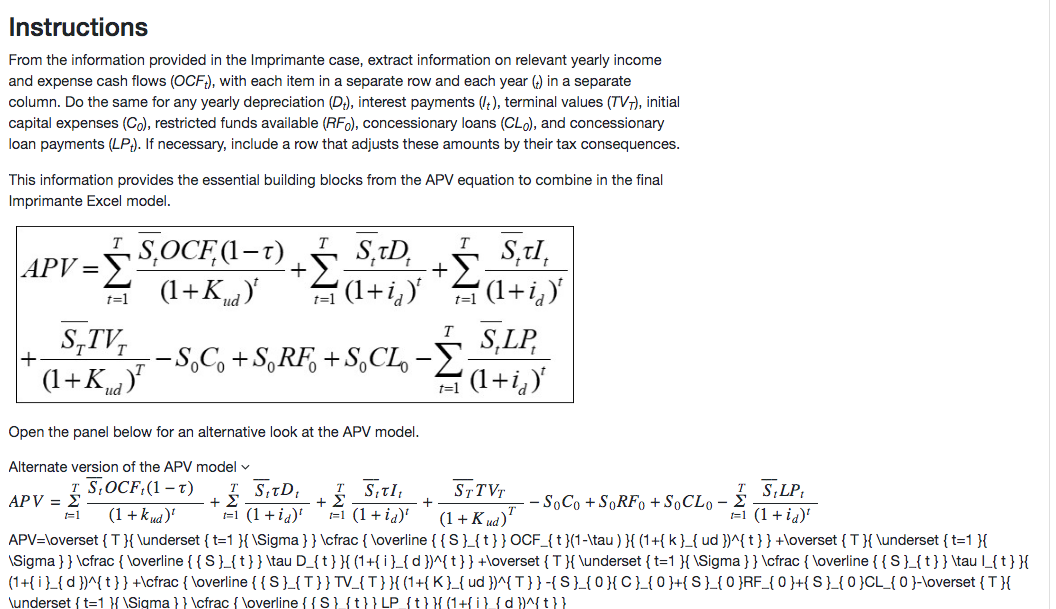

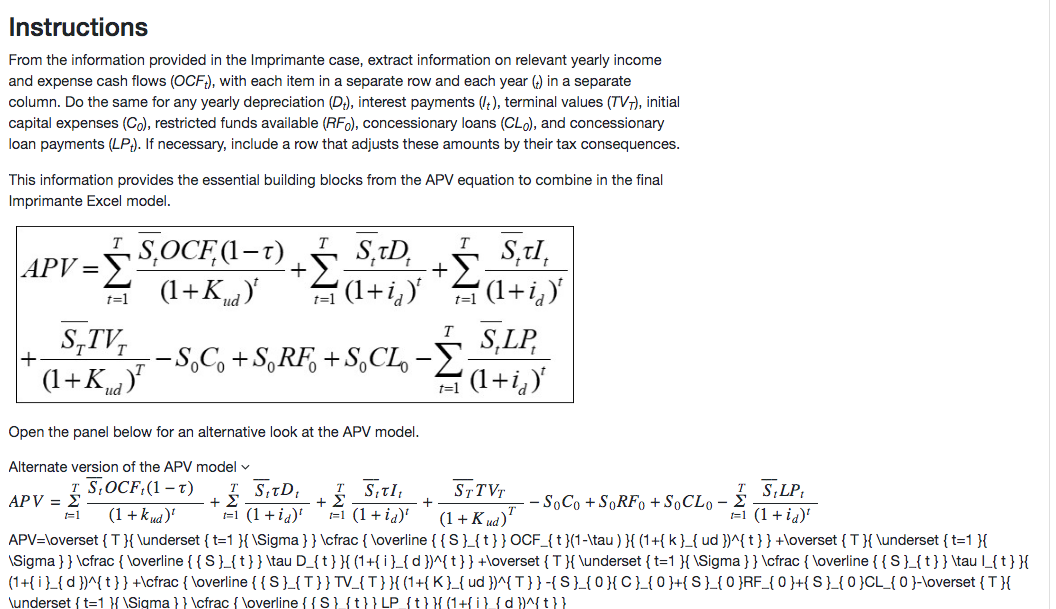

Instructions From the information provided in the Imprimante case, extract information on relevant yearly income and expense cash flows (OCFt), with each item in a separate row and each year 1) in a separate column. Do the same for any yearly depreciation (D), interest payments (+), terminal values (TV1), initial capital expenses (Co), restricted funds available (RF), concessionary loans (CLO), and concessionary loan payments (LPd). If necessary, include a row that adjusts these amounts by their tax consequences. This information provides the essential building blocks from the APV equation to combine in the final Imprimante Excel model. T = SOCF(1-1) + + t=1 t=1 S,TD, SATI, APV = (1+Kud)' = (1+in)' 1 (1+i)' S,LP, -S,Co + S, RF, +S,CL-E (1+Kud)? S TV T + + = (1+iz)' Open the panel below for an alternative look at the APV model. + + Alternate version of the APV model I SOCF,(1 - 1) T SED, I Sith, SLP + STTV APV = -S.CoSoRFO +S.CLO- =1 (1 + kud) =1 (1+id)' 21 (1 + id)' (1 +Kud)' 1=1 (1 + id) APV=\overset {T}{\underset {t=1 }{\Sigma }} \cfrac {\overline {{S}_{t}} OCF_{ t }(1-\tau) }{ (1+{k}_{ud })^{t}} +loverset {T}{ \underset {t=1 }{ Sigma } } \cfrac {\overline {{S}_{t}} \tau D_{t}} (1+{i}_{d})^{t}}+\overset {T}{\underset {t=1}{ \Sigma }} \cfrac {\overline {{S}_{t}} \tau l{t}}{ (1+{i}_{d})^{t}}+\cfrac {\overline {{S}_{T}}TV_{T}} (1+{K}_{ ud })^{T}}-{S}_{0}{C}_{0}+{S}_{0}RF_{0}+{S}_{0}CL_{0}-\overset {T}{ \underset {t=1 / \Sigma } } \cfrac {\overline {S} {t}} LP {t}(1+{i{ dt}} Instructions From the information provided in the Imprimante case, extract information on relevant yearly income and expense cash flows (OCFt), with each item in a separate row and each year 1) in a separate column. Do the same for any yearly depreciation (D), interest payments (+), terminal values (TV1), initial capital expenses (Co), restricted funds available (RF), concessionary loans (CLO), and concessionary loan payments (LPd). If necessary, include a row that adjusts these amounts by their tax consequences. This information provides the essential building blocks from the APV equation to combine in the final Imprimante Excel model. T = SOCF(1-1) + + t=1 t=1 S,TD, SATI, APV = (1+Kud)' = (1+in)' 1 (1+i)' S,LP, -S,Co + S, RF, +S,CL-E (1+Kud)? S TV T + + = (1+iz)' Open the panel below for an alternative look at the APV model. + + Alternate version of the APV model I SOCF,(1 - 1) T SED, I Sith, SLP + STTV APV = -S.CoSoRFO +S.CLO- =1 (1 + kud) =1 (1+id)' 21 (1 + id)' (1 +Kud)' 1=1 (1 + id) APV=\overset {T}{\underset {t=1 }{\Sigma }} \cfrac {\overline {{S}_{t}} OCF_{ t }(1-\tau) }{ (1+{k}_{ud })^{t}} +loverset {T}{ \underset {t=1 }{ Sigma } } \cfrac {\overline {{S}_{t}} \tau D_{t}} (1+{i}_{d})^{t}}+\overset {T}{\underset {t=1}{ \Sigma }} \cfrac {\overline {{S}_{t}} \tau l{t}}{ (1+{i}_{d})^{t}}+\cfrac {\overline {{S}_{T}}TV_{T}} (1+{K}_{ ud })^{T}}-{S}_{0}{C}_{0}+{S}_{0}RF_{0}+{S}_{0}CL_{0}-\overset {T}{ \underset {t=1 / \Sigma } } \cfrac {\overline {S} {t}} LP {t}(1+{i{ dt}}