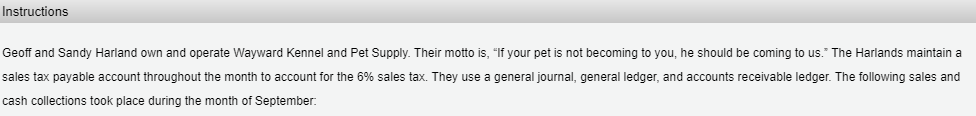

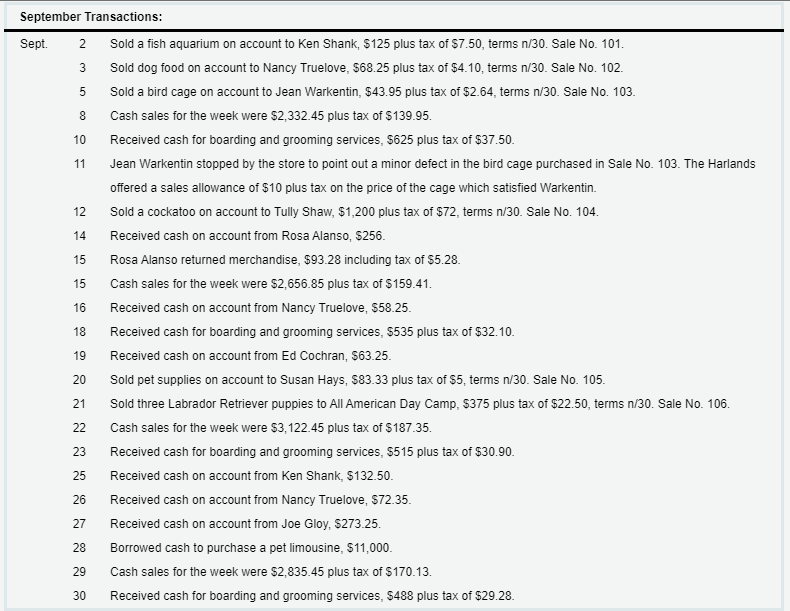

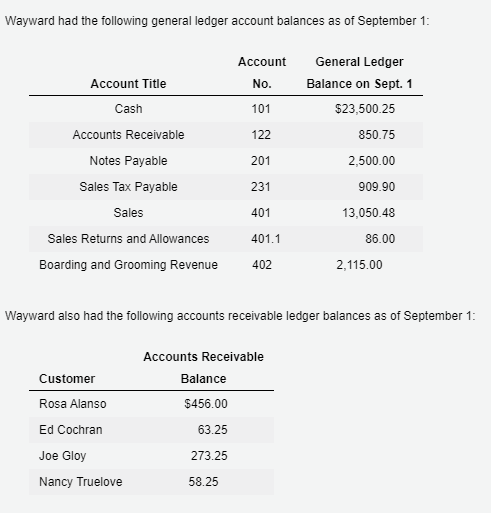

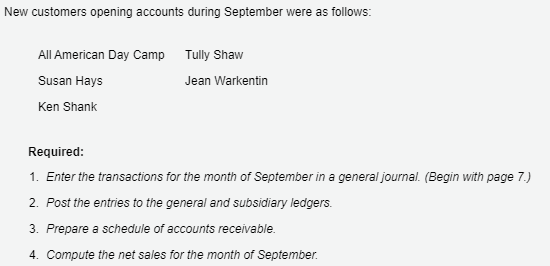

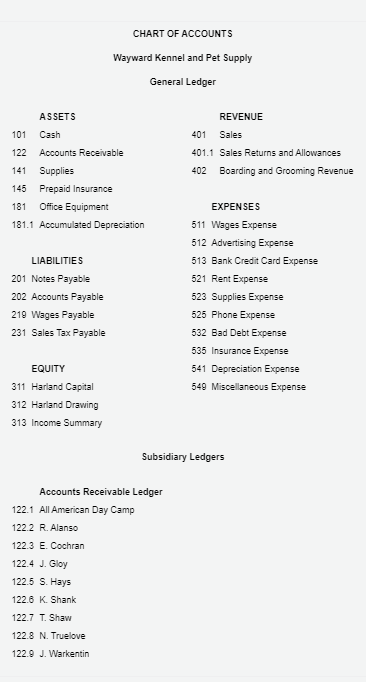

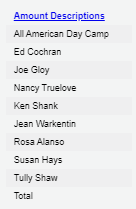

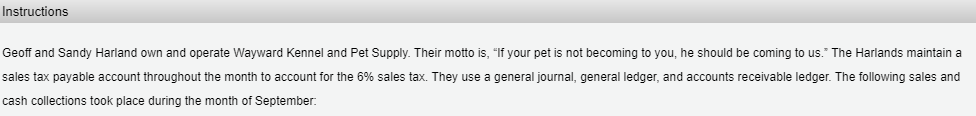

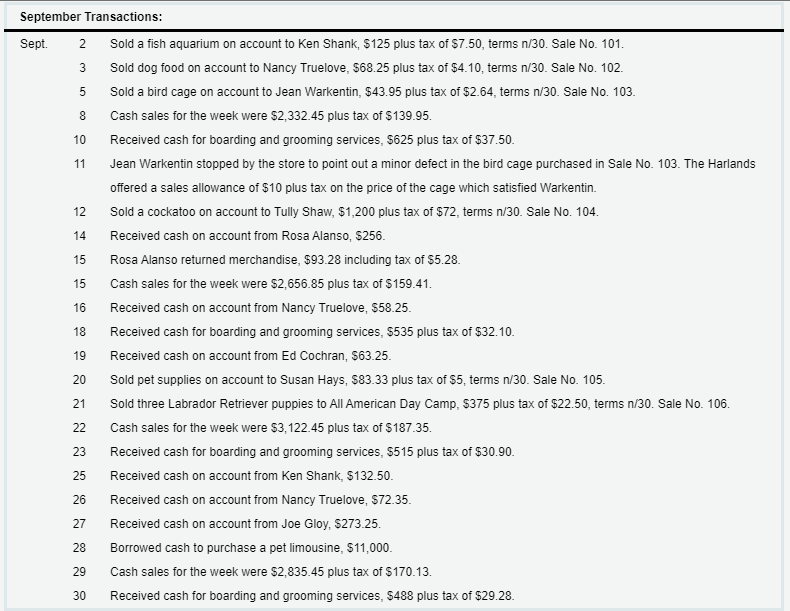

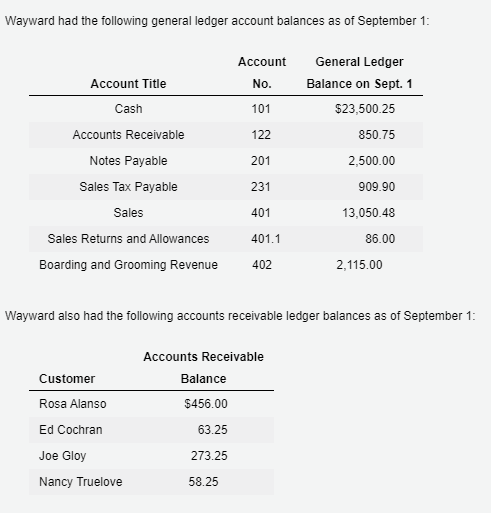

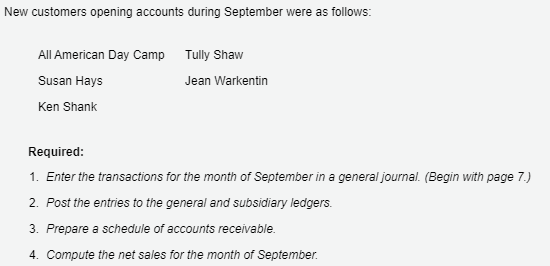

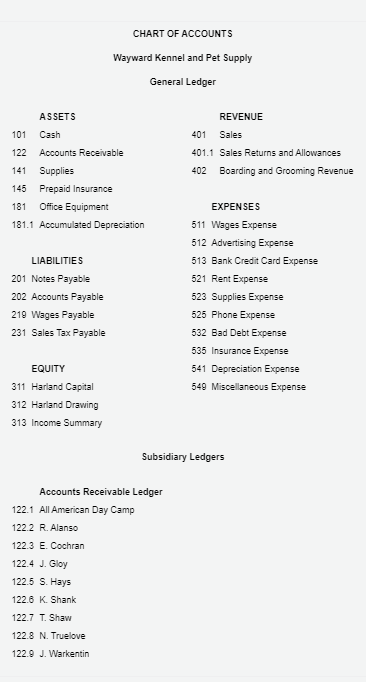

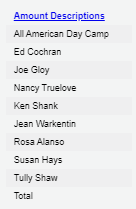

Instructions Geoff and Sandy Harland own and operate Wayward Kennel and Pet Supply. Their motto is, "If your pet is not becoming to you, he should be coming to us." The Harlands maintain a sales tax payable account throughout the month to account for the 6% sales tax. They use a general journal, general ledger, and accounts receivable ledger. The following sales and cash collections took place during the month of September: September Transactions: Sept. 2 3 Sold a fish aquarium on account to Ken Shank, $125 plus tax of $7.50, terms n/30. Sale No. 101. Sold dog food on account to Nancy Truelove, $68.25 plus tax of $4.10, terms n/30. Sale No. 102. Sold a bird cage on account to Jean Warkentin, $43.95 plus tax of $2.64, terms n/30. Sale No. 103. Cash sales for the week were $2,332.45 plus tax of $139.95. Received cash for boarding and grooming services, S625 plus tax of $37.50. Jean Warkentin stopped by the store to point out a minor defect in the bird cage purchased in Sale No. 103. The Harlands offered a sales allowance of $10 plus tax on the price of the cage which satisfied Warkentin. 15 18 19 20 21 Sold a cockatoo on account to Tully Shaw, $1,200 plus tax of $72, terms n/30. Sale No. 104. Received cash on account from Rosa Alanso, $256. Rosa Alanso returned merchandise, $93.28 including tax of $5.28. Cash sales for the week were $2,656.85 plus tax of $159.41. Received cash on account from Nancy Truelove, $58.25. Received cash for boarding and grooming services, $535 plus tax of $32.10. Received cash on account from Ed Cochran, $63.25. Sold pet supplies on account to Susan Hays, $83.33 plus tax of $5, terms n/30. Sale No. 105. Sold three Labrador Retriever puppies to All American Day Camp, $375 plus tax of $22.50, terms n/30. Sale No. 106. Cash sales for the week were $3,122.45 plus tax of $187.35. Received cash for boarding and grooming services, $515 plus tax of $30.90. Received cash on account from Ken Shank, $132.50. Received cash on account from Nancy Truelove, $72.35. Received cash on account from Joe Gloy, $273.25. Borrowed cash to purchase a pet limousine, $11,000. Cash sales for the week were $2,835.45 plus tax of $170.13. Received cash for boarding and grooming services, $488 plus tax of $29.28. 22 25 27 28 29 30 Wayward had the following general ledger account balances as of September 1: Account No. Account Title General Ledger Balance on Sept. 1 $23,500.25 850.75 Cash Accounts Receivable Notes Payable Sales Tax Payable Sales 2,500.00 909.90 13,050.48 86.00 2,115.00 Sales Returns and Allowances 401.1 402 Boarding and Grooming Revenue Wayward also had the following accounts receivable ledger balances as of September 1: Customer Rosa Alanso Accounts Receivable Balance $456.00 63.25 273.25 58.25 Ed Cochran Joe Gloy Nancy Truelove New customers opening accounts during September were as follows: Tully Shaw All American Day Camp Susan Hays Jean Warkentin Ken Shank Required: 1. Enter the transactions for the month of September in a general journal. (Begin with page 7.) 2. Post the entries to the general and subsidiary ledgers. 3. Prepare a schedule of accounts receivable. 4. Compute the net sales for the month of September. CHART OF ACCOUNTS Wayward Kennel and Pet Supply General Ledger ASSETS REVENUE 401 Sales 401.1 Sales Returns and Allowances 402 Boarding and Grooming Revenue 101 Cash 122 Accounts Receivable 141 Supplies 145 Prepaid Insurance 181 Office Equipment 181.1 Accumulated Depreciation LIABILITIES 201 Notes Payable 202 Accounts Payable 219 Wages Payable 231 Sales Tax Payable EXPENSES 511 Wages Expense 512 Advertising Expense 513 Bank Credit Card Expense 521 Rent Expense 523 Supplies Expense 525 Phone Expense 532 Bad Debt Expense 535 Insurance Expense 541 Depreciation Expense 549 Miscellaneous Expense EQUITY 311 Harland Capital 312 Harland Drawing 313 Income Summary Subsidiary Ledgers Accounts Receivable Ledger 122.1 All American Day Camp 122.2 R. Alanso 122.3 E. Cochran 122.4 J. Gloy 122.5 S. Hays 122.6 K. Shank 122.7 T. Shaw 122.8 N. Truelove 122.9 J. Warkentin Amount Descriptions All American Day Camp Ed Cochran Joe Gloy Nancy Truelove Ken Shank Jean Warkentin Rosa Alanso Susan Hays Tully Shaw Total