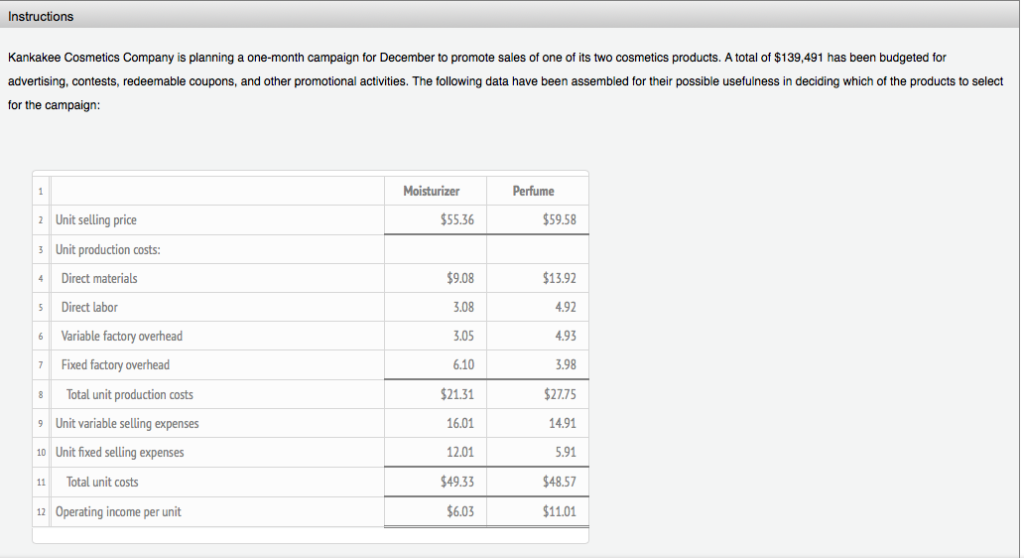

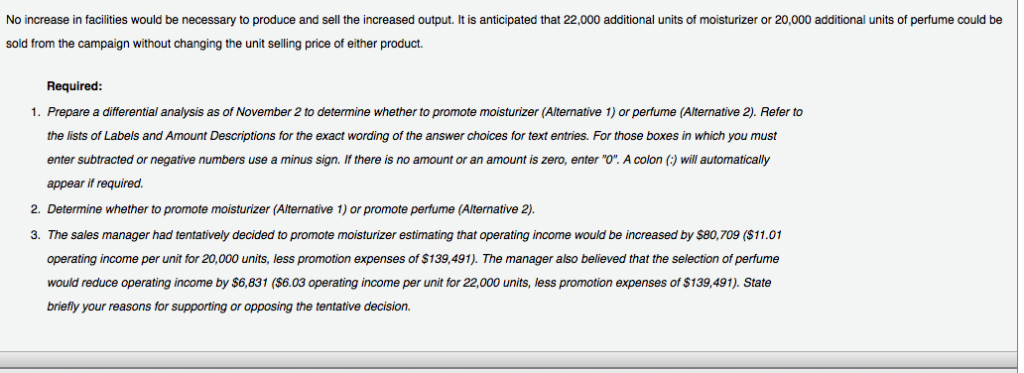

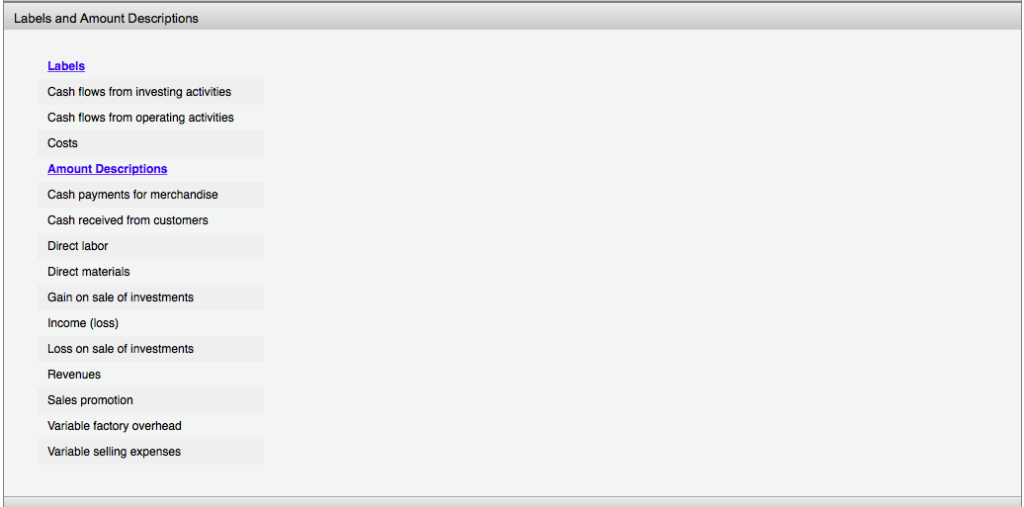

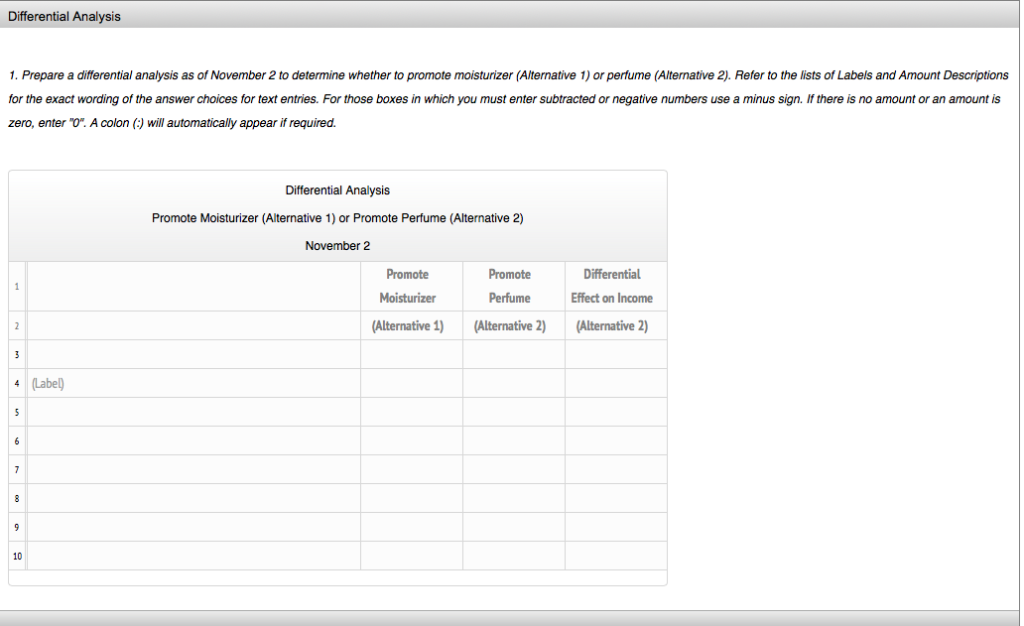

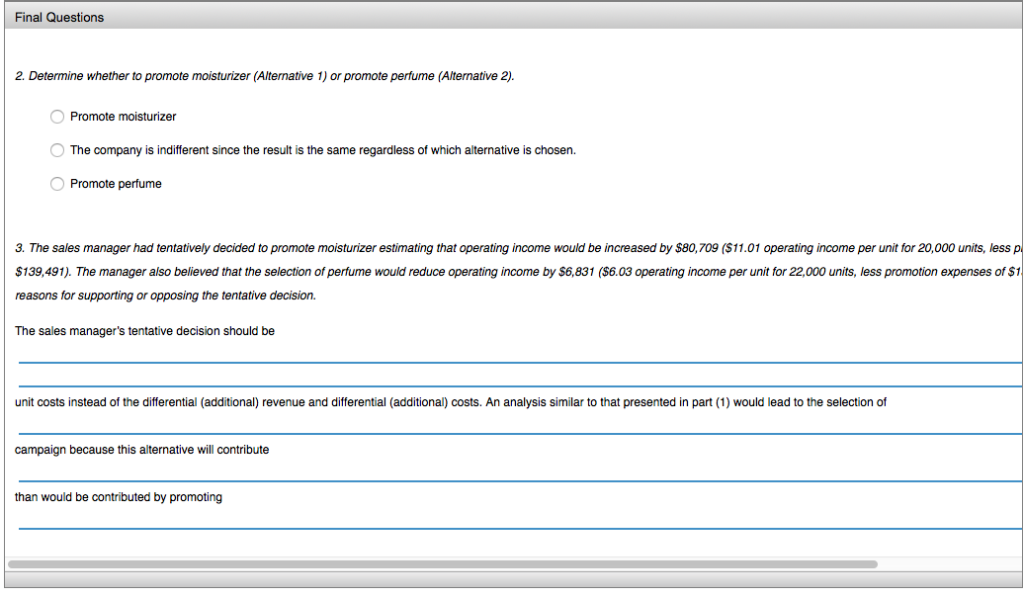

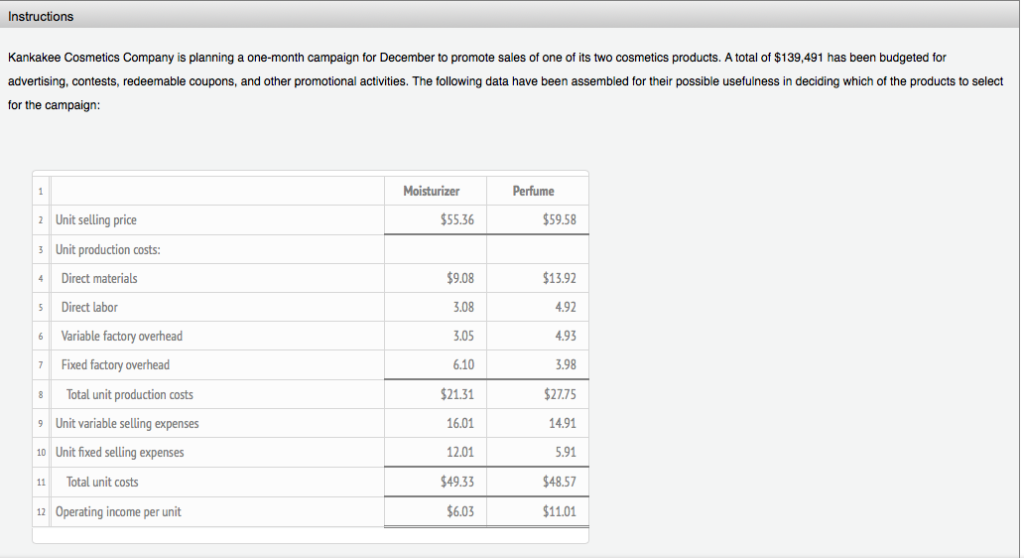

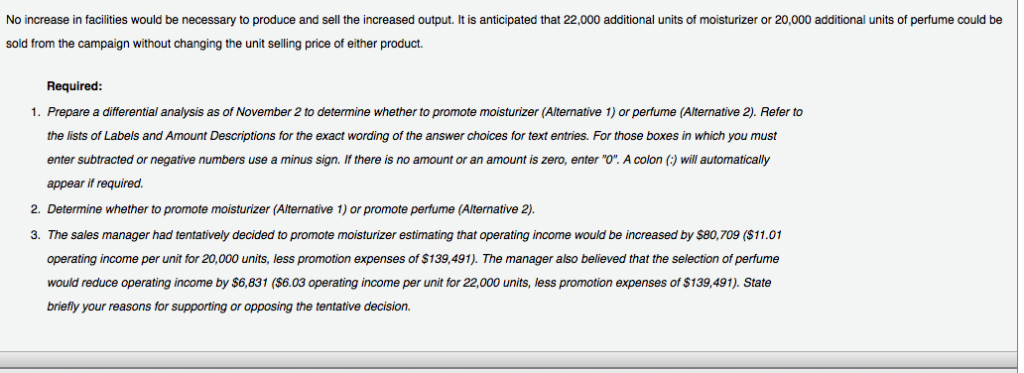

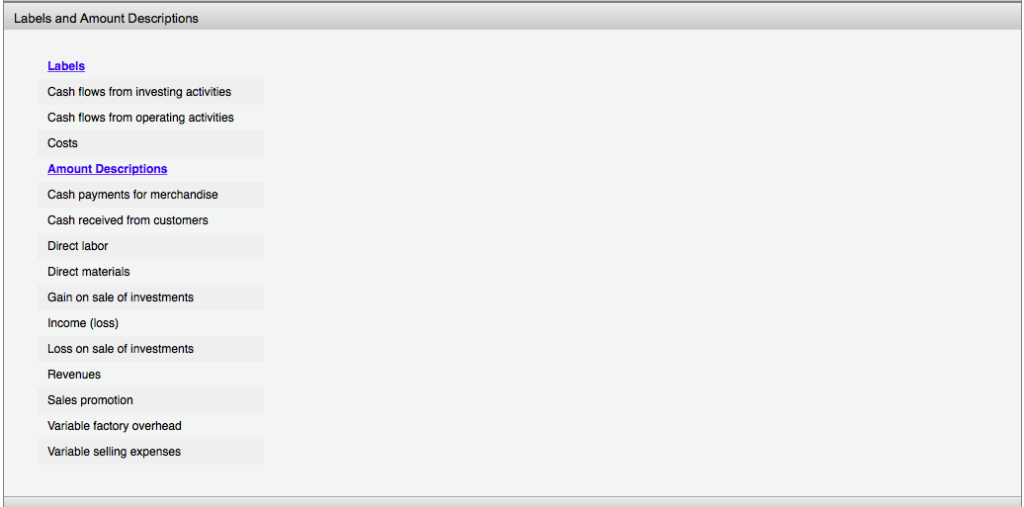

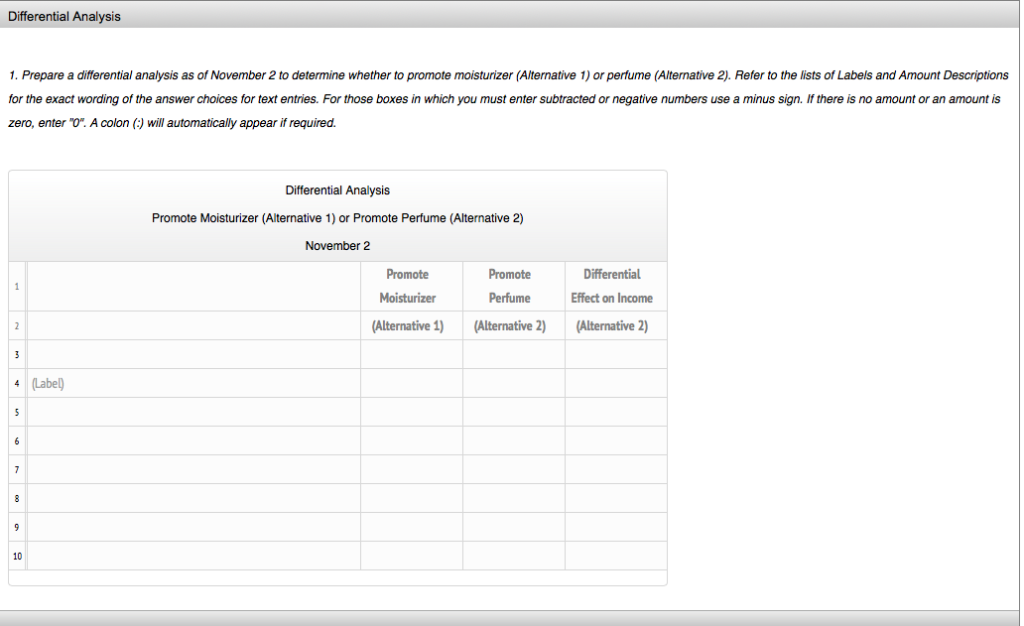

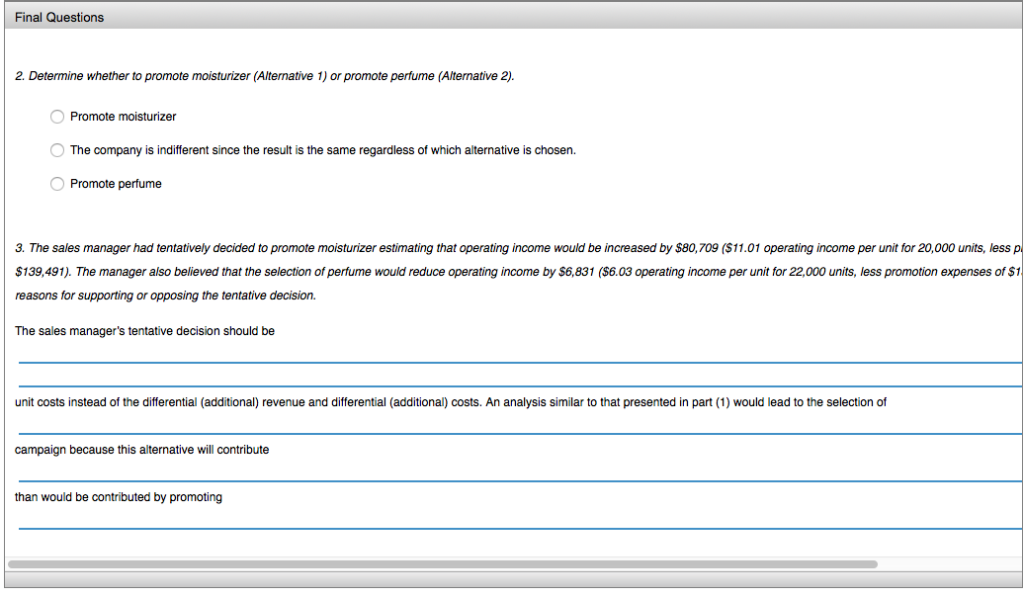

Instructions Kankakee Cosmetics Company is planning a one-month campaign for December to promote sales of one of its two cosmetics products. A total of $139,491 has been budgeted for advertising. contests,redeemable coupons, and other promotional activities. The following data have been assembled for their possible usefulness in deciding which of the products to select for the campaign: Moisturizer Perfume 55.36 $59.58 2Unit selling price 3 Unit production costs: 4 Direct materials $9.08 3.08 .05 6.10 $2131 16.01 12.01 49.33 6.03 $13.92 4.92 4.93 3.98 $27.75 14.91 5.91 48.57 11.01 Direct labor Variable factory overhead Fixed factory overheacd Ttal unit production costs Unit variable selling expenses Unit fixed selling expenses Total unit costs Operating income per unit 8 9 10 No increase in facilities would be necessary to produce and sell the increased output. It is anticipated that 22,000 additional units of moisturizer or 20,000 additional units of perfume could be sold from the campaign without changing the unit selling price of either product. Required 1. Prepare a differential analysis as of November 2 to determine whether to promote moisturizer (Alternative 1) or perfume (Alternative 2). Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter "O". A colon (:) will automatically appear if required. 2. Determine whether to promote moisturizer (Alternative 1) or promote perfume (Alternative 2) 3. The sales manager had tentatively decided to promote moisturizer estimating that operating income would be increased by $80,709 ($11.01 operating income per unit for 20,000 units, less promotion expenses of $139,491). The manager also believed that the selection of perfume would reduce operating income by $6,831 ($6.03 operating income per unit for 22,000 units, less promotion expenses of $139,491). State briefly your reasons for supporting or opposing the tentative decision. Labels and Amount Descriptions Labels Cash flows from investing activities Cash flows from operating activities Costs Amount Descriptions Cash payments for merchandise Cash received from customers Direct labor Direct materials Gain on sale of investments Income (loss) Loss on sale of investments Revenues Sales promotion Variable factory overhead Variable selling expenses Differential Analysis 1. Prepare a differential analysis as of November 2 to determine whether to promote moisturizer (Alternative 1) or perfume (Alternative 2). Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign.If there is no amount or an amount is zero, enter 'o". A colon (:) will automatically appear if required. Differential Analysis Promote Moisturizer (Alternative 1) or Promote Perfume (Alternative 2) November 2 Differential Promote Perfume Alternative 1) Alternative 2) (Alternative 2) Promote Moisturizer Effect on Income 4 Label) 10 Final Questions 2. Determine whether to promote moisturizer (Alternative 1) or promote perfume (Alternative 2 O Promote moisturizer The company is indifferent since the result is the same regardless of which alternative is chosen. O Promote perfume 3. The sales manager had tentatively decided to promote moisturizer estimating that operating income would be increased by $80,709 ($11.01 operating income per unit for 20,000 units, less p $139,491). The manager also believed that the selection of perfume would reduce operating income by $6,831 ($6.03 operating income per unit for 22,000 units, less promotion expenses of $1 reasons for supporting or opposing the tentative decision. The sales manager's tentative decision should be unit costs instead of the differential (additional) revenue and differential (additional) costs. An analysis similar to that presented in part (1) would lead to the selection of campaign because this alternative will contribute than would be contributed by promoting