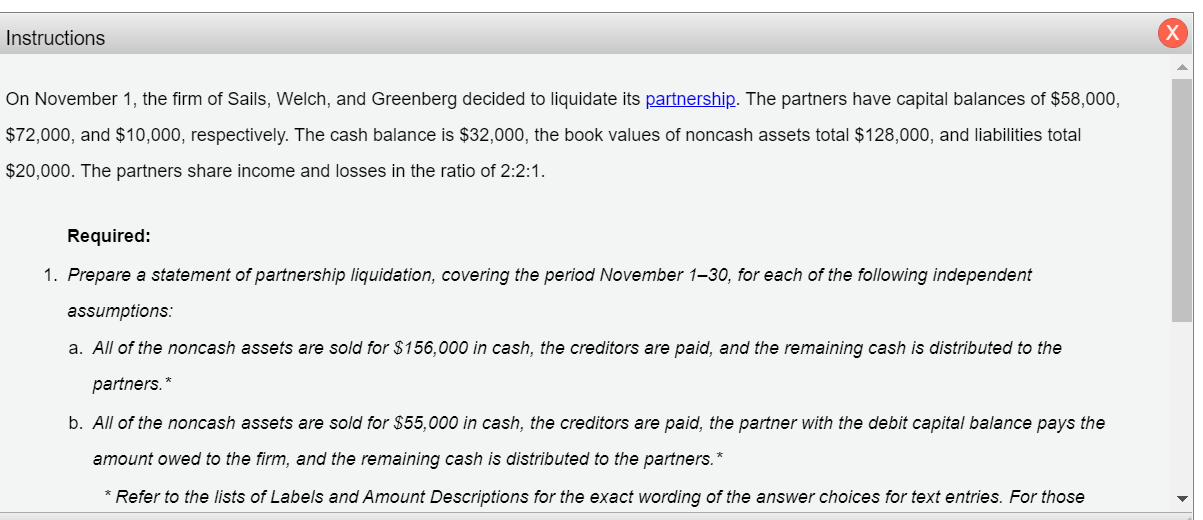

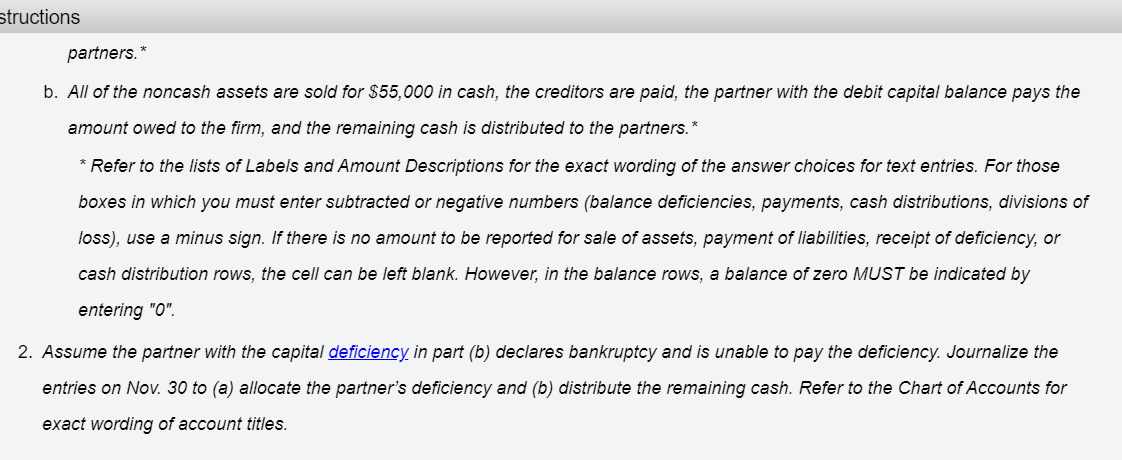

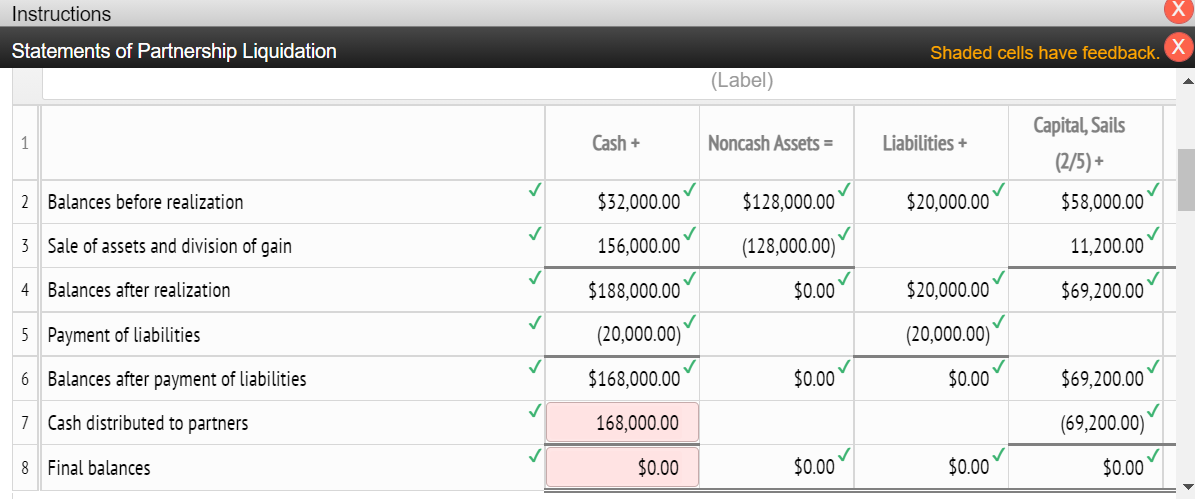

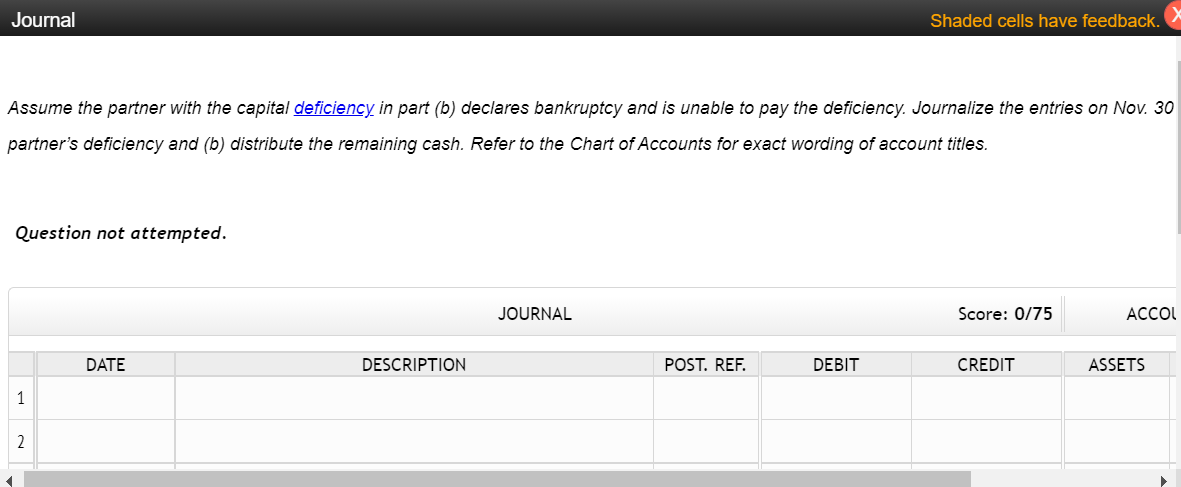

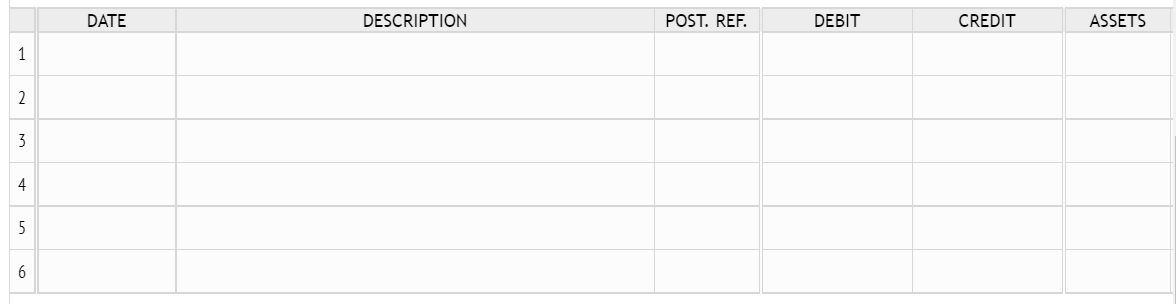

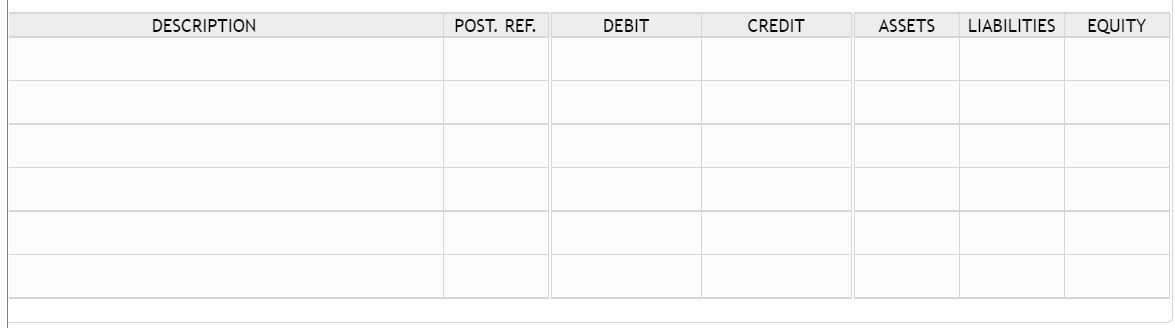

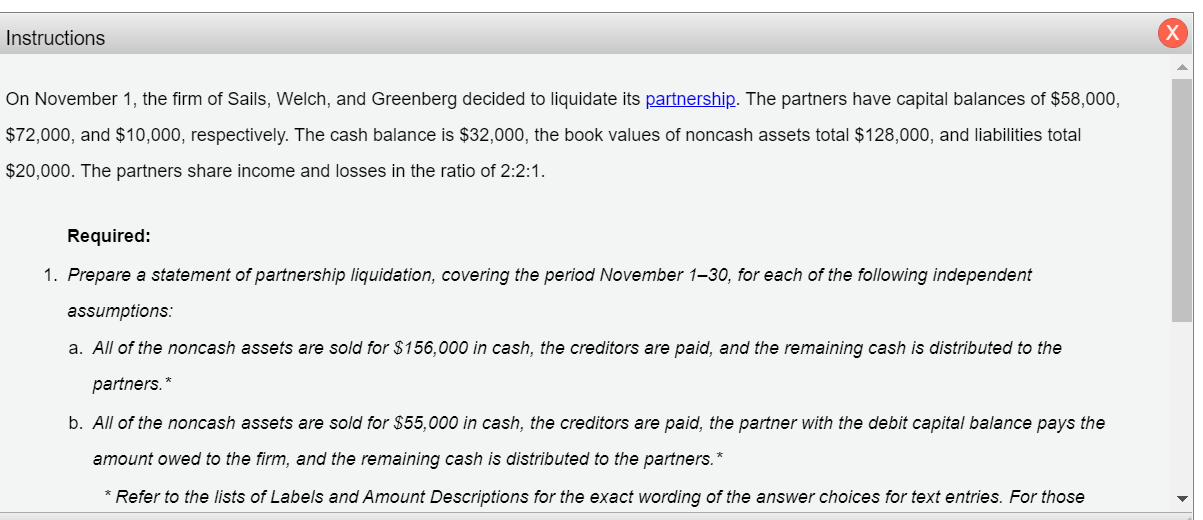

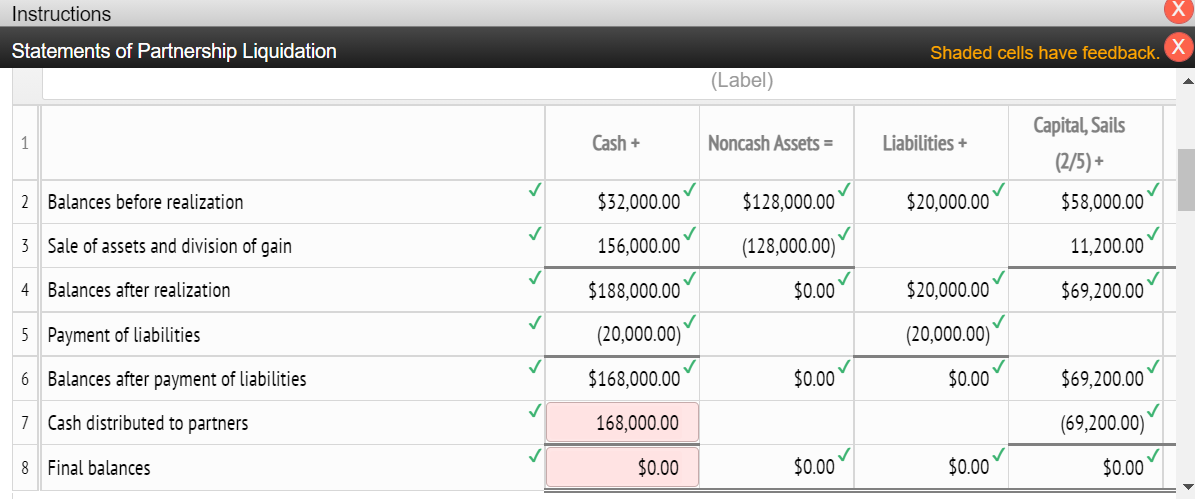

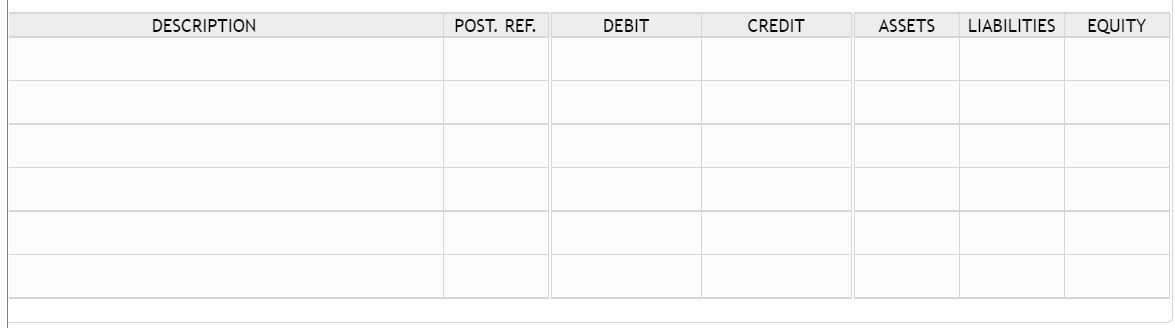

Instructions On November 1, the firm of Sails, Welch, and Greenberg decided to liquidate its partnership. The partners have capital balances of $58,000, $72,000, and $10,000, respectively. The cash balance is $32,000, the book values of noncash assets total $128,000, and liabilities total $20,000. The partners share income and losses in the ratio of 2:2:1. Required: 1. Prepare a statement of partnership liquidation, covering the period November 130, for each of the following independent assumptions: a. All of the noncash assets are sold for $156,000 in cash, the creditors are paid, and the remaining cash is distributed to the partners. * b. All of the noncash assets are sold for $55,000 in cash, the creditors are paid, the partner with the debit capital balance pays the amount owed to the firm, and the remaining cash is distributed to the partners.* * Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those structions partners. * b. All of the noncash assets are sold for $55,000 in cash, the creditors are paid, the partner with the debit capital balance pays the * amount owed to the firm, and the remaining cash is distributed to the partners. * Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers (balance deficiencies, payments, cash distributions, divisions of loss), use a minus sign. If there is no amount to be reported for sale of assets, payment of liabilities, receipt of deficiency, or cash distribution rows, the cell can be left blank. However, in the balance rows, a balance of zero MUST be indicated by entering "O". 2. Assume the partner with the capital deficiency in part (b) declares bankruptcy and is unable to pay the deficiency. Journalize the entries on Nov. 30 to (a) allocate the partner's deficiency and (b) distribute the remaining cash. Refer to the Chart of Accounts for exact wording of account titles. Instructions Statements of Partnership Liquidation Shaded cells have feedback. (Label) Cash + Noncash Assets = Liabilities + Capital, Sails (2/5) + $58,000.00 2 Balances before realization $32,000.00 $128,000.00 $20,000.00 3 Sale of assets and division of gain 156,000.00 (128,000.00) 11,200.00 4 Balances after realization $188,000.00 $0.00 $20,000.00 $69,200.00 5 Payment of liabilities (20,000.00) (20,000.00 6 Balances after payment of liabilities $168,000.00 $0.00 $0.00 $69,200.00 7 Cash distributed to partners 168,000.00 (69,200.00) 8 Final balances $0.00 $0.00 $0.00 $0.00 Journal Shaded cells have feedback. Assume the partner with the capital deficiency in part (b) declares bankruptcy and is unable to pay the deficiency. Journalize the entries on Nov. 30 partner's deficiency and (b) distribute the remaining cash. Refer to the Chart of Accounts for exact wording of account titles. Question not attempted. JOURNAL Score: 0/75 ACCOL DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS 1 2 DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS 1 2 3 4 5 6 DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY