Question

INSTRUCTIONS: Part 1 Use formulas, cell referencing, rounding function and the information on the Given Info worksheet to complete the Schedule of Expected Collections from

INSTRUCTIONS: Part 1

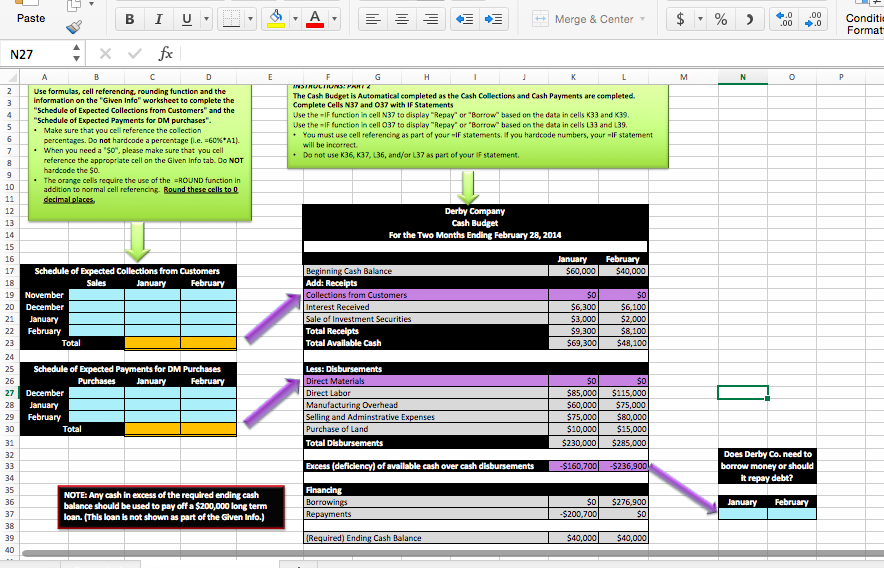

Use formulas, cell referencing, rounding function and the information on the "Given Info" worksheet to complete the "Schedule of Expected Collections from Customers" and the "Schedule of Expected Payments for DM purchases".

Make sure that you cell reference the collection percentages. Do not hardcode a percentage (i.e. =60%*A1).

When you need a "$0", please make sure that you cell reference the appropriate cell on the Given Info tab. Do NOT hardcode the $0.

The orange cells require the use of the =ROUND function in addition to normal cell referencing. Round these cells to 0 decimal places.

INSTRUCTIONS: PART 2

The Cash Budget is Automatical completed as the Cash Collections and Cash Payments are completed.

Complete Cells N37 and O37 with IF Statements

Use the =IF function in cell N37 to display "Repay" or "Borrow" based on the data in cells K33 and K39.

Use the =IF function in cell O37 to display "Repay" or "Borrow" based on the data in cells L33 and L39.

You must use cell referencing as part of your =IF statements. If you hardcode numbers, your =IF statement will be incorrect.

Do not use K36, K37, L36, and/or L37 as part of your IF statement.

SHOW WORK IN EACH CELL!

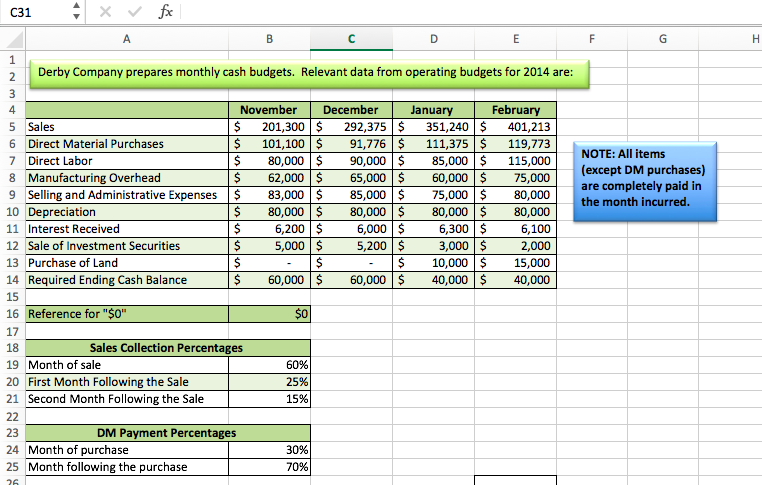

Given info:

Given info continued:

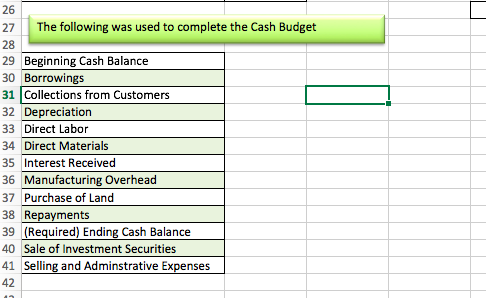

Fill in blue and orange cells:

SHOW FORMULAS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started