Answered step by step

Verified Expert Solution

Question

1 Approved Answer

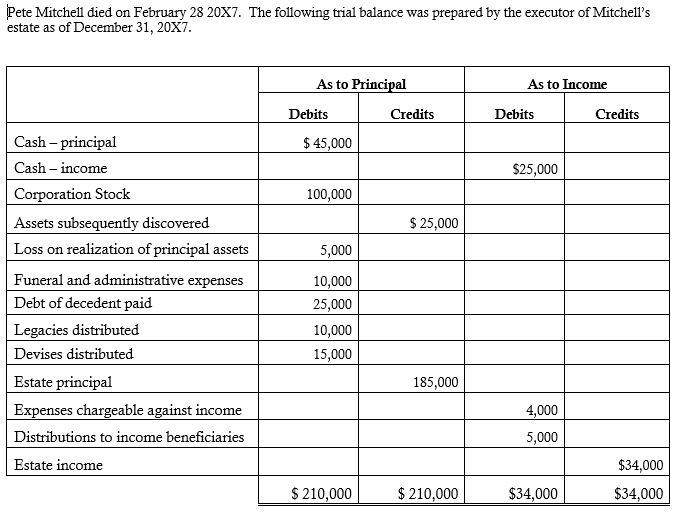

Instructions: Prepare a charge and discharge statement. Estate of Pete Mitchell Charge and Discharge Statement For the Period February 28, 20X7, to December 31, 20X7

Instructions: Prepare a charge and discharge statement.

Estate of Pete Mitchell

Charge and Discharge Statement

For the Period February 28, 20X7, to December 31, 20X7

Pete Mitchell died on February 28 20X7. The following trial balance was prepared by the executor of Mitchell's estate as of December 31, 20X7 As to Principal As to Income Debits Credits Debits Credits Cash - principal Cash - income Corporation Stock Assets subsequently discovered Loss on realization of principal assets Funeral and administrative expenses Debt of decedent paid Legacies distributed Devises distributed Estate principal Ex Distributions to income beneficiaries Estate income 45,000 $25,000 100,000 $25,000 5,000 10,000 25,000 10,000 15,000 185,000 s chargeable a 4,000 ncome 5,000 $34,000 S34,000 $ 210,000 $34,000 S 210,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started