Answered step by step

Verified Expert Solution

Question

1 Approved Answer

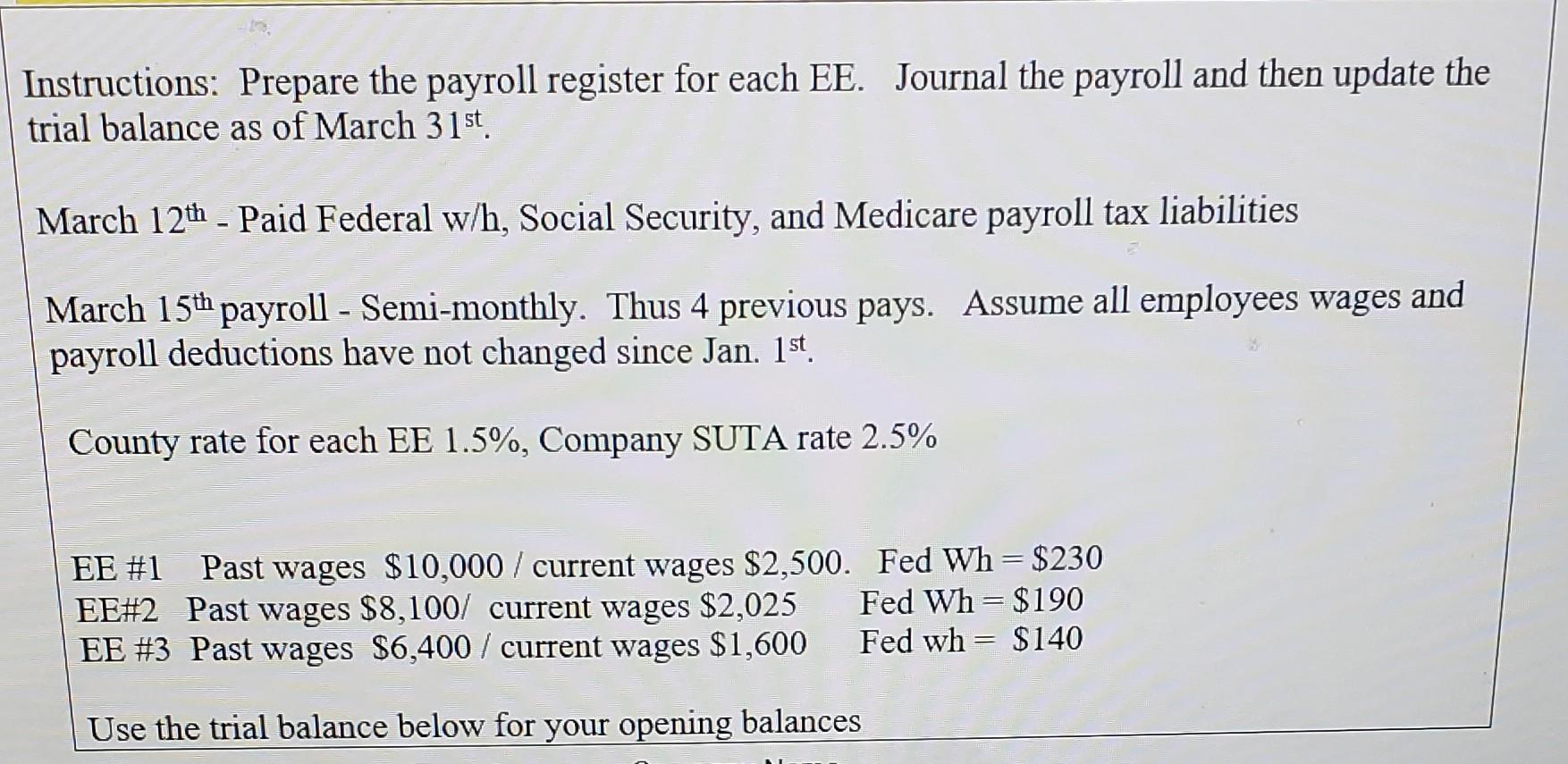

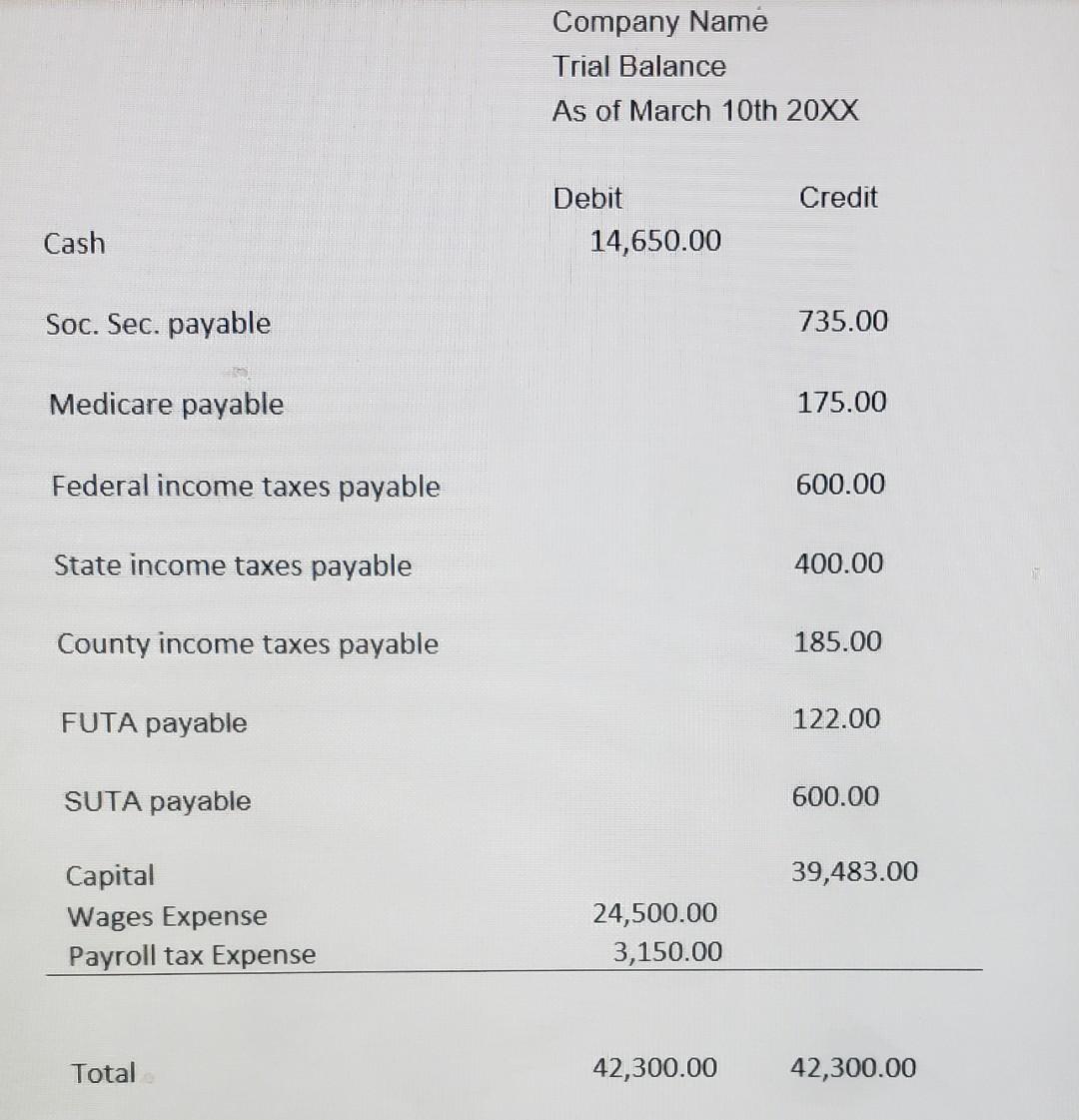

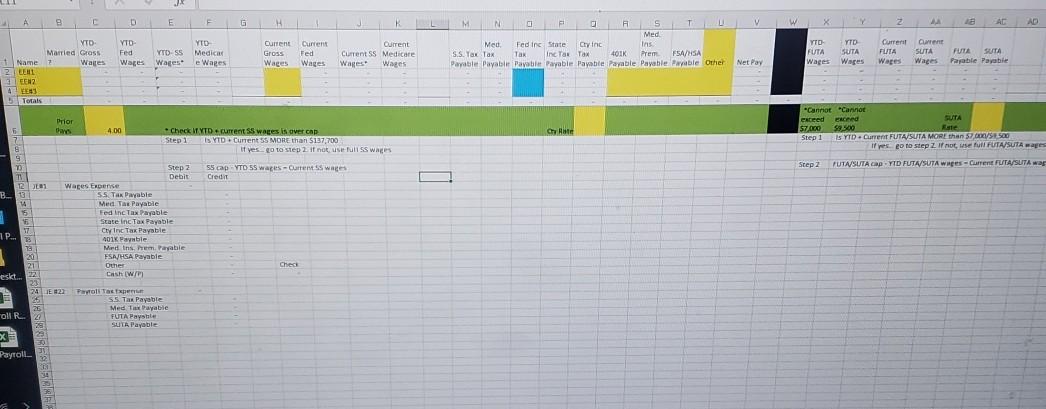

Instructions: Prepare the payroll register for each EE. Journal the payroll and then update the trial balance as of March 31st. March 12th - Paid

Instructions: Prepare the payroll register for each EE. Journal the payroll and then update the trial balance as of March 31st. March 12th - Paid Federal w/h, Social Security, and Medicare payroll tax liabilities March 15th payroll - Semi-monthly. Thus 4 previous pays. Assume all employees wages and payroll deductions have not changed since Jan. 1st County rate for each EE 1.5%, Company SUTA rate 2.5% EE #1 Past wages $10,000/ current wages $2,500. Fed Wh=$230 EE#2 Past wages $8,100/ current wages $2,025 Fed Wh=$190 EE #3 Past wages $6,400 / current wages $1,600Fed wh = $140 Use the trial balance below for your opening balances Company Name Trial Balance As of March 10th 20XX Credit Debit 14,650.00 Cash Soc. Sec. payable 735.00 Medicare payable 175.00 Federal income taxes payable 600.00 State income taxes payable 400.00 County income taxes payable 185.00 FUTA payable 122.00 SUTA payable 600.00 39,483.00 Capital Wages Expense Payroll tax Expense 24,500.00 3,150.00 Total 42,300.00 42,300.00 . A D E F G V w X 2 AC AD Med YTD- Fed YTOSS Wages Wages YTD Medica e Wages Current Gross Wages Current Fed Wages LM N 0 S T U Med Fed in State th lc ins S.S. Yax Tax Tax Inc Tata 401K Prem FSA/HSA Payablet Payabi Payabile Payable Payable Payable Payable Payable Other Current Current SS Medicare Wages Wages YTD FUTA Wages YTD SUTA Wages Current FUTA wares Current SUTA Wages FUTA SUTA Payable Payable Net Pay YTD Married Gross 1 Name 7 Wales 2 | ERR 3 IEEN 4 TER 5 Totals Che Cannot "Cannot exceeded SUTA 57.000 9.500 Ele Step 1 YTD.Current FUTA/SUTA MORE than 57 / SOO if yes go to step 2. If not useful FUTA/SUTA was Step 2 PUTASUTA GOD TID FUTA/SUTA wages - Current RUTASUTA W Prior 6 Das 4.00 - Check YTD current ss wages is over cap 7 Step 1 YTD Current SS MORE than $137,700 If yes... go to step 2. If not use NIISS WATCH 9 Step 55.capYTO SS Wages - Currents was 1 Debit Credit 121 Wages Experise Bu 55 Tax Payable 44 Med. Tae Payable 5 Fed Inc Tax Payable State Inc Tax Payable 17 Cty Inc Tax Payable P... 18 401 able 3 Med ins Prem Payable 20 FSAHSA Payable 21 Ones Checi eskt. 22 Cash [WI 23 24 E82 Pavoli Tas The SST Payable 25 Med Tit Payable Toll R. FUTA Paysle 20 SUTA Payable Payroll Instructions: Prepare the payroll register for each EE. Journal the payroll and then update the trial balance as of March 31st. March 12th - Paid Federal w/h, Social Security, and Medicare payroll tax liabilities March 15th payroll - Semi-monthly. Thus 4 previous pays. Assume all employees wages and payroll deductions have not changed since Jan. 1st County rate for each EE 1.5%, Company SUTA rate 2.5% EE #1 Past wages $10,000/ current wages $2,500. Fed Wh=$230 EE#2 Past wages $8,100/ current wages $2,025 Fed Wh=$190 EE #3 Past wages $6,400 / current wages $1,600Fed wh = $140 Use the trial balance below for your opening balances Company Name Trial Balance As of March 10th 20XX Credit Debit 14,650.00 Cash Soc. Sec. payable 735.00 Medicare payable 175.00 Federal income taxes payable 600.00 State income taxes payable 400.00 County income taxes payable 185.00 FUTA payable 122.00 SUTA payable 600.00 39,483.00 Capital Wages Expense Payroll tax Expense 24,500.00 3,150.00 Total 42,300.00 42,300.00 . A D E F G V w X 2 AC AD Med YTD- Fed YTOSS Wages Wages YTD Medica e Wages Current Gross Wages Current Fed Wages LM N 0 S T U Med Fed in State th lc ins S.S. Yax Tax Tax Inc Tata 401K Prem FSA/HSA Payablet Payabi Payabile Payable Payable Payable Payable Payable Other Current Current SS Medicare Wages Wages YTD FUTA Wages YTD SUTA Wages Current FUTA wares Current SUTA Wages FUTA SUTA Payable Payable Net Pay YTD Married Gross 1 Name 7 Wales 2 | ERR 3 IEEN 4 TER 5 Totals Che Cannot "Cannot exceeded SUTA 57.000 9.500 Ele Step 1 YTD.Current FUTA/SUTA MORE than 57 / SOO if yes go to step 2. If not useful FUTA/SUTA was Step 2 PUTASUTA GOD TID FUTA/SUTA wages - Current RUTASUTA W Prior 6 Das 4.00 - Check YTD current ss wages is over cap 7 Step 1 YTD Current SS MORE than $137,700 If yes... go to step 2. If not use NIISS WATCH 9 Step 55.capYTO SS Wages - Currents was 1 Debit Credit 121 Wages Experise Bu 55 Tax Payable 44 Med. Tae Payable 5 Fed Inc Tax Payable State Inc Tax Payable 17 Cty Inc Tax Payable P... 18 401 able 3 Med ins Prem Payable 20 FSAHSA Payable 21 Ones Checi eskt. 22 Cash [WI 23 24 E82 Pavoli Tas The SST Payable 25 Med Tit Payable Toll R. FUTA Paysle 20 SUTA Payable Payroll

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started