Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions Prepare the quarterly adjusting entries required at March 31, 2021. E3.12 (LO 3) AP During 2021, Aubergine Co. borrowed cash from Chartreuse Company

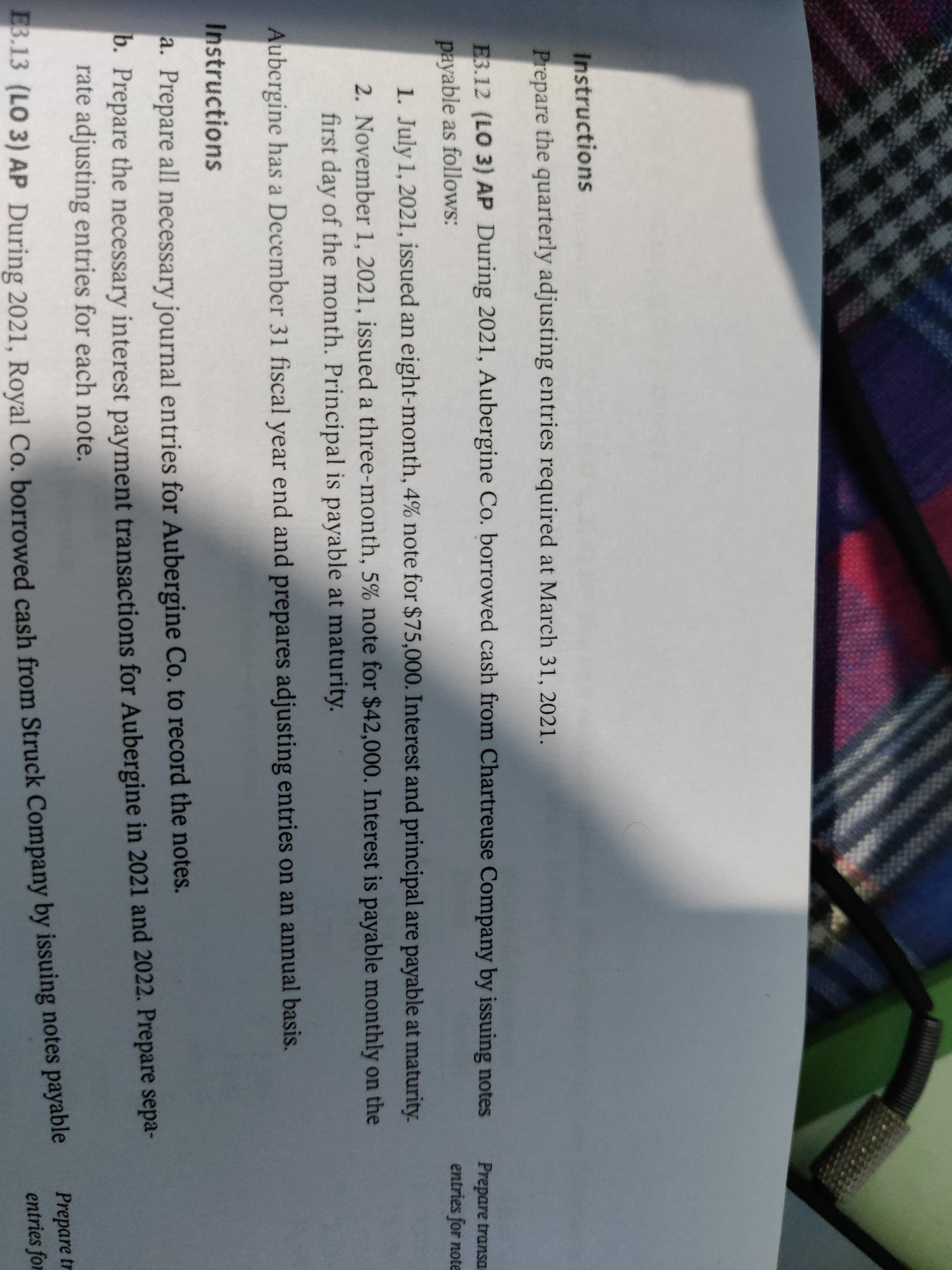

Instructions Prepare the quarterly adjusting entries required at March 31, 2021. E3.12 (LO 3) AP During 2021, Aubergine Co. borrowed cash from Chartreuse Company by issuing notes payable as follows: Prepare transa entries for note 1. July 1, 2021, issued an eight-month, 4% note for $75,000. Interest and principal are payable at maturity. 2. November 1, 2021, issued a three-month, 5% note for $42,000. Interest is payable monthly on the first day of the month. Principal is payable at maturity. Aubergine has a December 31 fiscal year end and prepares adjusting entries on an annual basis. Instructions a. Prepare all necessary journal entries for Aubergine Co. to record the notes. D. Prepare the necessary interest payment transactions for Aubergine in 2021 and 2022. Prepare sepa- rate adjusting entries for each note. Prepare tr entries for E3.13 (LO 3) AP During 2021, Royal Co, borrowed cash from Struck Company by issuing notes payable

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer a July 121 Cash 75000 Notes Payable 75000 Borrowed cash and signed a not...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started