Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions Read the following two-part scenario and answer the questions provided. In each of your responses, please include: - A clear answer that shows your

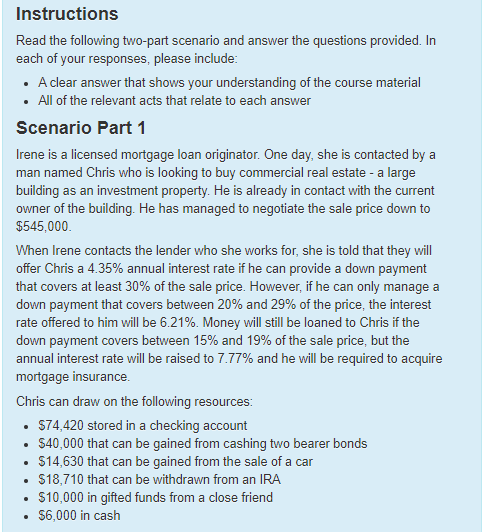

Instructions Read the following two-part scenario and answer the questions provided. In each of your responses, please include: - A clear answer that shows your understanding of the course material - All of the relevant acts that relate to each answer Scenario Part 1 Irene is a licensed mortgage loan originator. One day, she is contacted by a man named Chris who is looking to buy commercial real estate - a large building as an investment property. He is already in contact with the current owner of the building. He has managed to negotiate the sale price down to $545,000. When Irene contacts the lender who she works for, she is told that they will offer Chris a 4.35% annual interest rate if he can provide a down payment that covers at least 30% of the sale price. However, if he can only manage a down payment that covers between 20% and 29% of the price, the interest rate offered to him will be 6.21%. Money will still be loaned to Chris if the down payment covers between 15% and 19% of the sale price, but the annual interest rate will be raised to 7.77% and he will be required to acquire mortgage insurance. Chris can draw on the following resources: - $74,420 stored in a checking account - $40,000 that can be gained from cashing two bearer bonds - $14,630 that can be gained from the sale of a car - $18,710 that can be withdrawn from an IRA - $10,000 in gifted funds from a close friend - $6,000 in cash Given the resources Chris can draw on, what can he expect to receive with regard to the amount of money that will be provided by the lender, the annual interest rate that will be applied to the loan, and whether or not Chris must acquire mortgage insurance

Instructions Read the following two-part scenario and answer the questions provided. In each of your responses, please include: - A clear answer that shows your understanding of the course material - All of the relevant acts that relate to each answer Scenario Part 1 Irene is a licensed mortgage loan originator. One day, she is contacted by a man named Chris who is looking to buy commercial real estate - a large building as an investment property. He is already in contact with the current owner of the building. He has managed to negotiate the sale price down to $545,000. When Irene contacts the lender who she works for, she is told that they will offer Chris a 4.35% annual interest rate if he can provide a down payment that covers at least 30% of the sale price. However, if he can only manage a down payment that covers between 20% and 29% of the price, the interest rate offered to him will be 6.21%. Money will still be loaned to Chris if the down payment covers between 15% and 19% of the sale price, but the annual interest rate will be raised to 7.77% and he will be required to acquire mortgage insurance. Chris can draw on the following resources: - $74,420 stored in a checking account - $40,000 that can be gained from cashing two bearer bonds - $14,630 that can be gained from the sale of a car - $18,710 that can be withdrawn from an IRA - $10,000 in gifted funds from a close friend - $6,000 in cash Given the resources Chris can draw on, what can he expect to receive with regard to the amount of money that will be provided by the lender, the annual interest rate that will be applied to the loan, and whether or not Chris must acquire mortgage insurance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started