Question

Instructions The textbook (in its Chapter 17) explains capital expenditure budgets concepts. One of the methods used is the payback period method. After reading chapter

Instructions

The textbook (in its Chapter 17) explains capital expenditure budgets concepts. One of the methods used is the payback period method. After reading chapter 17, go to its Appendix 17-A in page 205 and try to replicate the example provided in Table 17-A-1 Payback Method. Do you understand what it means to have a project with a 3.5 years as payback period? Explain. If you were investing in this project, would you prefer a lower payback period (let's say 2.5 years for example) or a higher payback period (let's say 4.5 years for example)? Explain.

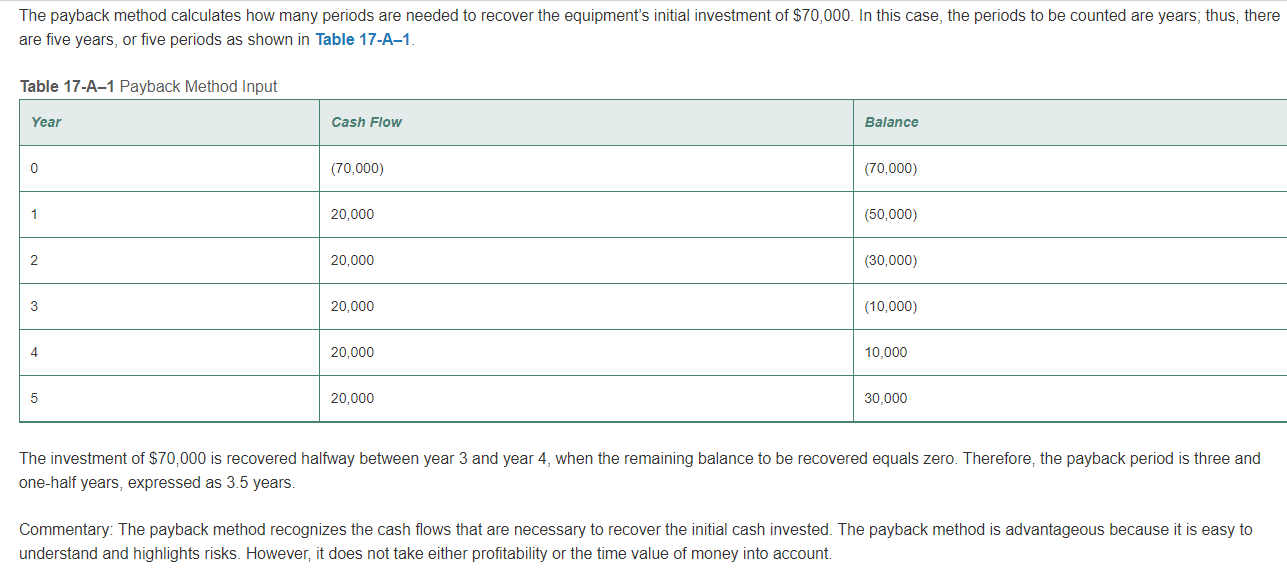

APPENDIX 17-A: A Further Discussion of Capital Budgeting Methods LFor/Shutterstock This appendix presents a further discussion of the four methods of capital budgeting computations presented in this chapter. ASSUMPTIONS Item: Assume the purchase of a new piece of laboratory equipment is proposed. Cost: The laboratory equipment will cost $70,000. Useful life: It will last five years. Remaining value (salvage value): The lab equipment will be sold for $10,000 (its salvage value) at the end of the five years. Cost of capital: The estimated cost of capital for the hospital is 10%. Cash flow. The addition of this new piece of equipment is expected to generate additional revenue. In fact, the increase of revenue over expenses is expected to amount to $20,000 per year for the five years. The cash flow is therefore expected to be as follows: Year 0 = ($70,000); year 1 = $20,000; year 2 = $20,000; year 3 = $20,000; year 4 = $20,000; year 5 = $20,000. Note that year 0 is a negative figure and years 1 through 5 are positive figures

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started