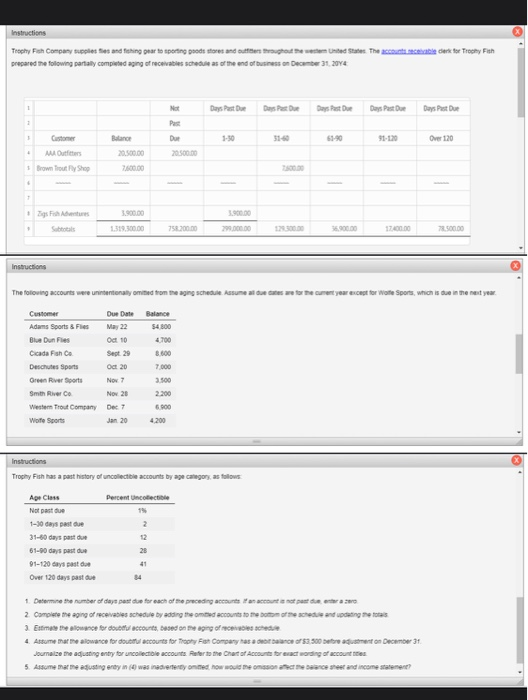

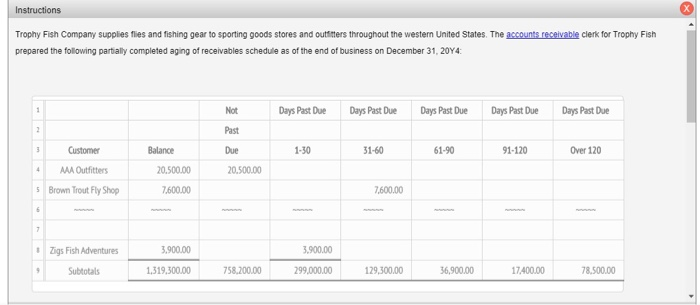

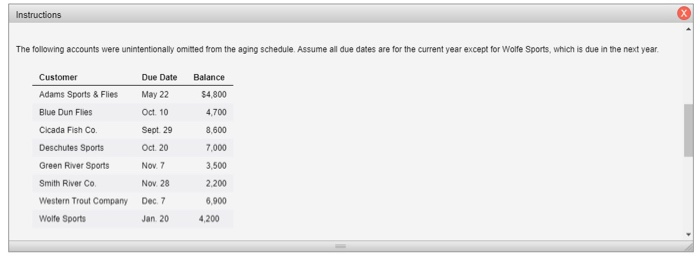

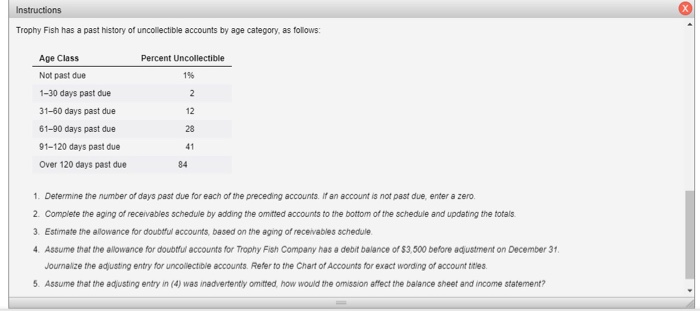

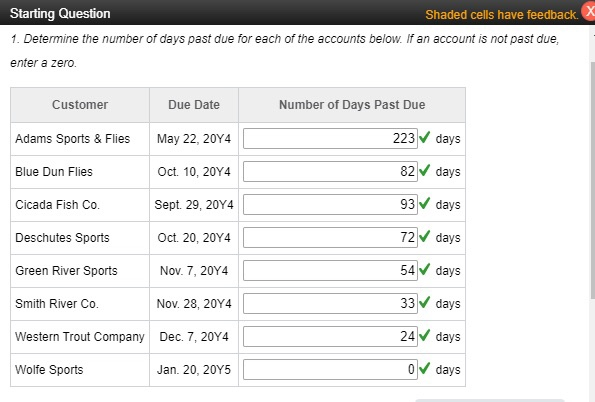

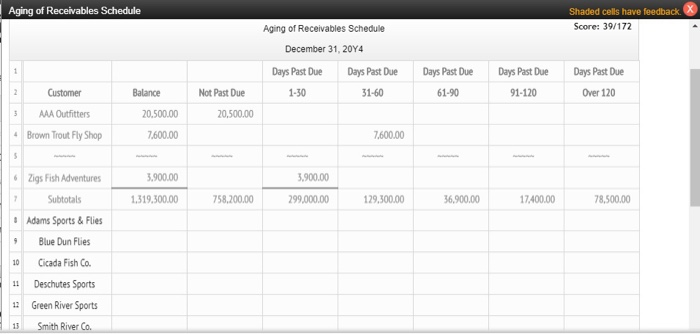

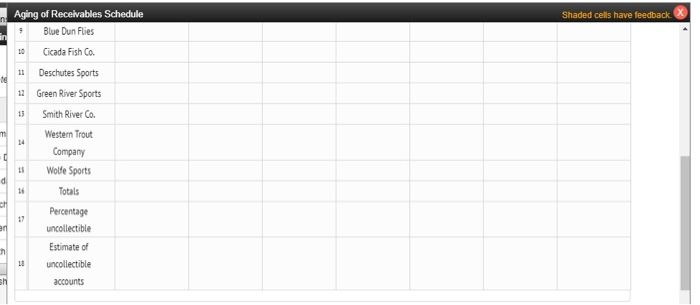

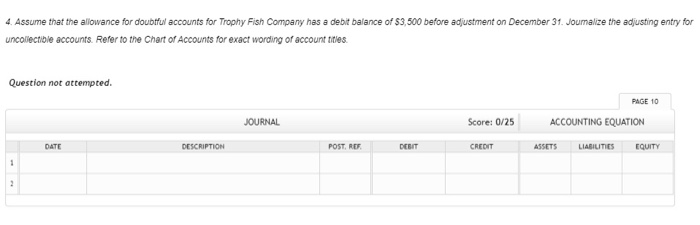

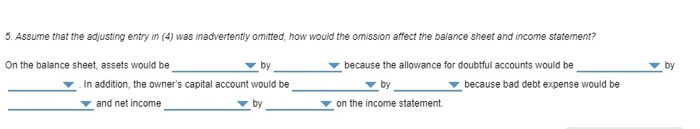

Instructions Trophy Fish Company slees and thing pear to sporting goods stores and out the United States. The conceder for Troy Fish prepared the following prally completed aging of receivables schedule as of the end of business on December 31, 2044 Days Post 1 Balance 91-120 Over 120 20.500.00 Outfitters Brown Tourly Shop . ZsFit 3.800.00 1.319.300.00 750.200.00 298.000.00 72.500.00 Instructions The following accounts were unintentionally omitted from the aging schedule. Assume alue dates for the current year except for Wome Sports, which is due in the next year Customer Due Date Balance Adams Sports & Fles May 22 54.800 Blue Dun Fies Oct 10 Cicada Fish C Sept. 29 8.600 Deschtes Sports Oct 20 Green River Sort Now 3.500 Smith River Co Nov 26 2.200 Western Trout Company Dee 6.900 Wole Sports Jan 20 4200 7.000 Instructions Trophy Fish has a past history of uncollectible accounts by age category, as follows Percent Uncollectible 15 Ape Class Not past 1-10 days past due 31-60 days past de 61-90 days past de 91-120 days pasto Over 120 days paste 12 41 1 Determine the number of days for each of the preceding accounts an account per 2. Complete the aging of receivable schedule by adding the med accounts to the bottom of the schedule and updating the Estimate the allowance for doubtful accounts, based on the aging of is schedule 4. Assume that the lowance for our counts for Toys Compras Dance of 53.500 ore autent on December 31 Joumalize the adjusting entry for collectible accounts Refer to the Chant of Accounts for exact wording of accounts 5. Assume mare acusting eney in was indeertyd how would he is the sheet and income statement? Instructions Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United States. The accounts receivable clerk for Trophy Fish prepared the following partially completed aging of receivables schedule as of the end of business on December 31, 2074 1 Not Days Past Due Days Past Due Days Past Due Days Past Due Days Past Due 2 Past 3 Customer Balance Due 1-30 31-60 61.90 91-120 Over 120 MAA Outfitters 20.500,00 20.500.00 5 Brown Trout Fly Shop 7.600.00 7.600.00 6 7 Zigs Fish Adventures 3,900.00 3.900.00 9 Subtotals 1,319,300.00 758,200.00 299,000.00 129,300.00 36,900.00 17.400,00 78,500.00 Instructions The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Wolfe Sports, which is due in the next year. Balance $4,800 4.700 8,600 Customer Adams Sports & Flies Blue Dun Flies Cicada Fish Co. Deschutes Sports Green River Sports Smith River Co Western Trout Company Wolfe Sports Due Date May 22 Oct. 10 Sept 29 Oct 20 Nov 7 Nov 28 Dec 7 Jan 20 7.000 3,500 2.200 6,900 4,200 Instructions Trophy Fish has a past history of uncollectible accounts by age category, as follows: Percent Uncollectible 1% 2 Age Class Not past due 1-30 days past due 31-60 days past due 61-90 days past due 91-120 days past due Over 120 days past due 12 28 84 1. Determine the number of days past due for each of the preceding accounts. If an account is not past due, enter a zero. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals. 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule 4. Assume that the allowance for doubtfur accounts for Trophy Fish Company has a debit balance of 53,500 before adjustment on December 31 Journalize the adjusting entry for uncollectible accounts. Refer to the Chart of Accounts for exact wording of account titles. 5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? Starting Question Shaded cells have feedback. 1. Determine the number of days past due for each of the accounts below. If an account is not past due, enter a zero Customer Due Date Number of Days Past Due Adams Sports & Flies May 22, 2014 223 days Blue Dun Flies Oct 10, 2044 82 days Cicada Fish Co. Sept. 29, 2014 93 days Deschutes Sports Oct. 20, 2074 72 days Green River Sports Nov. 7, 2014 54 days Smith River Co. Nov. 28, 2044 33 days Western Trout Company Dec. 7. 2014 24 days Wolfe Sports Jan. 20, 2015 0 days Aging of Receivables Schedule Shaded cells have feedback Score: 39/172 Aging of Receivables Schedule December 31, 2074 Days Past Due Days Past Due 31-60 1 Days Past Due 61-90 Days Past Due 91-120 Days Past Due Over 120 2 Customer Balance 1-30 Not Past Due 20,500.00 3 AAA Outfitters 20.500.00 - Brown Trout Fly Shop 7.600.00 7.600.00 3,900.00 3,900.00 1.319,300.00 758.200.00 299,000.00 129,300.00 36,900.00 17.400.00 78,500.00 9 Zigs Fish Adventures Subtotals Adams Sports & Flies Blue Dun Flies Cicada Fish Co. Deschutes Sports Green River Sports 10 11 13 Smith River Co. Shaded cells have feedback Aging of Receivables Schedule Blue Dun Flies in 16 m . 10 Cicada Fish Co. 11 Deschutes Sports 12 Green River Sports Smith River Co. Western Trout 14 Company Wolte Sports 11 Totals Percentage uncollectible Estimate of 18 uncollectible d CH 11 en sh accounts 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule. 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of 53,500 before adjustment on December 31. Journalize the adjusting entry for uncollectible accounts. Refer to the Chart of Accounts for exact wording of account titles Question not attempted. PAGE 10 JOURNAL Score: 0/25 ACCOUNTING EQUATION DATE DESCRIPTION POST. REF DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 by by 5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? On the balance sheet assets would be because the allowance for doubtful accounts would be In addition, the owner's capital account would be by because bad debt expense would be and net income by on the income statement