Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions: Use a separate sheet for your answer to each question. You MUST show ALL calculations to receive full credit. Do NOT abbreviate account titles.

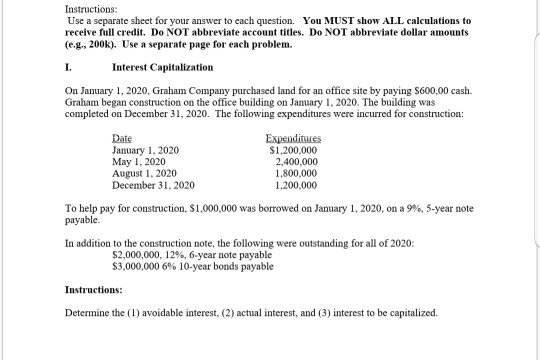

Instructions: Use a separate sheet for your answer to each question. You MUST show ALL calculations to receive full credit. Do NOT abbreviate account titles. Do NOT abbreviate dollar amounts (e.g., 200k). Use a separate page for each problem. 1. Interest Capitalization On January 1, 2020, Graham Company purchased land for an office site by paying $600,00 cash. Graham began construction on the office building on January 1, 2020. The building was completed on December 31, 2020. The following expenditures were incurred for construction: Date Expenditures January 1, 2020 $1,200,000 May 1, 2020 2,400,000 August 1, 2020 1.800.000 December 31, 2020 1.200,000 To help pay for construction, $1,000,000 was borrowed on January 1, 2020, on a 9%, 5-year note payable In addition to the construction note, the following were outstanding for all of 2020: $2,000,000, 12%, 6-year note payable $3,000,000 6% 10-year bonds payable Instructions: Determine the (1) avoidable interest, (2) actual interest, and (3) interest to be capitalized

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started