Answered step by step

Verified Expert Solution

Question

1 Approved Answer

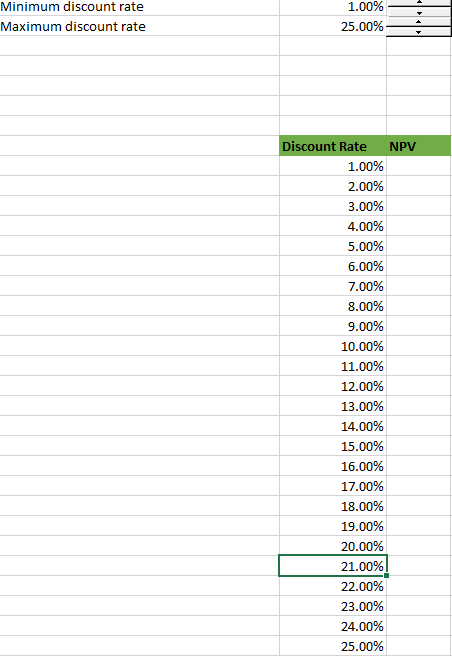

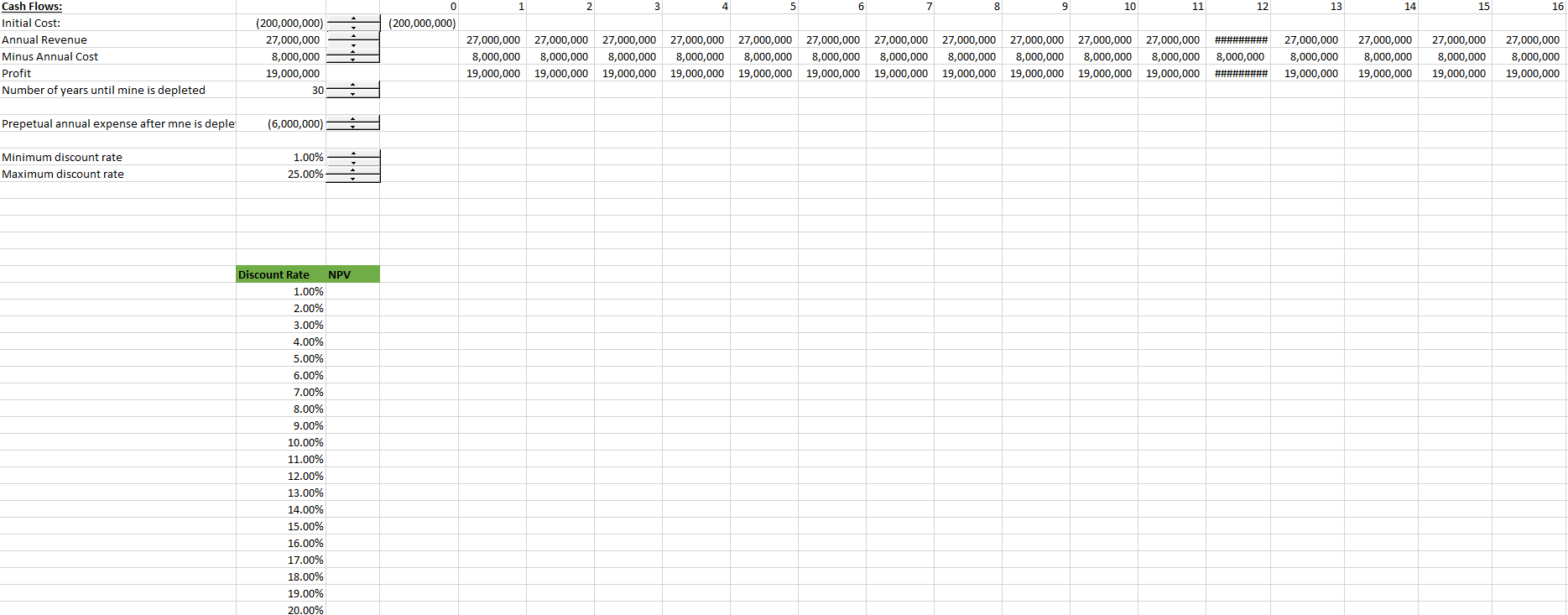

INSTRUCTIONS: You are required to plot the NPV as a function of the two discount rate spin buttons. In other words, calculate NPV for all

INSTRUCTIONS: "You are required to plot the NPV as a function of the two discount rate spin buttons. In other words, calculate NPV for all discount rates between the minimum and maximum rate and plot those values. That's called the NPV profile.

The spin button for the Minimum Discount Rate should go from 1% to 5% (increment by 1) and the Maximum Discount Rate should go from 20% to 25% (increment by 1)."

I'm curious what excel formula I will need to use and how to input it to achieve the NPV for all of the discount rates. Thank you!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started