Answered step by step

Verified Expert Solution

Question

1 Approved Answer

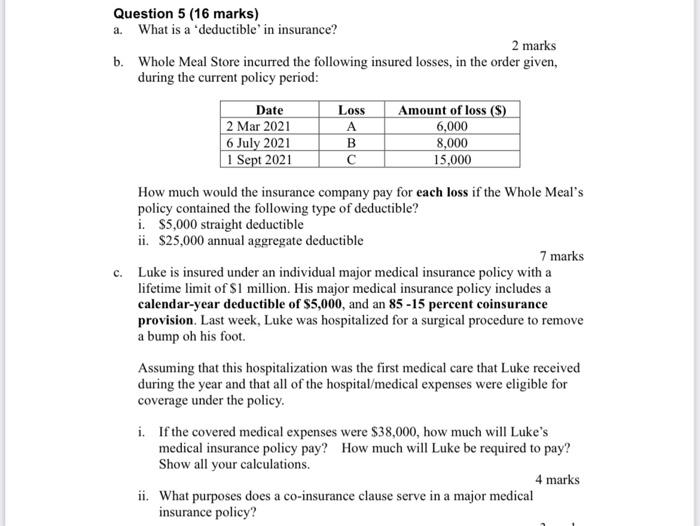

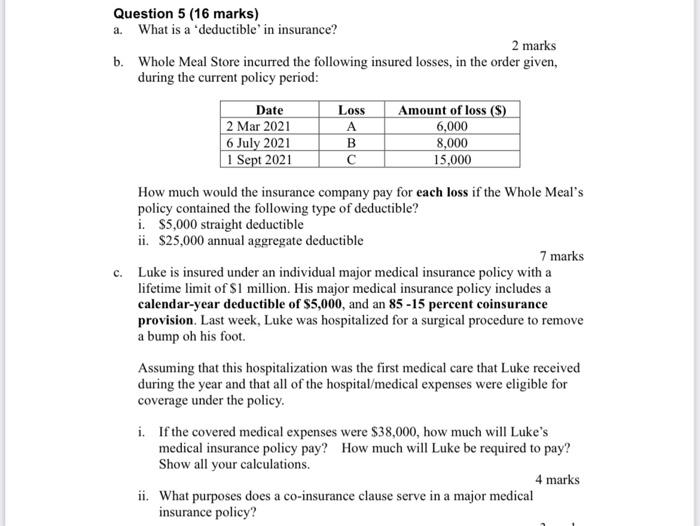

Insurance Question 5 (16 marks) a. What is a 'deductible in insurance? 2 marks b. Whole Meal Store incurred the following insured losses, in the

Insurance

Question 5 (16 marks) a. What is a 'deductible in insurance? 2 marks b. Whole Meal Store incurred the following insured losses, in the order given, during the current policy period: Date 2 Mar 2021 6 July 2021 1 Sept 2021 Loss A B Amount of loss ($) 6,000 8,000 15,000 How much would the insurance company pay for each loss if the Whole Meal's policy contained the following type of deductible? i. $5,000 straight deductible ii. $25,000 annual aggregate deductible 7 marks c. Luke is insured under an individual major medical insurance policy with a lifetime limit of $1 million. His major medical insurance policy includes a calendar-year deductible of $5,000, and an 85 -15 percent coinsurance provision. Last week, Luke was hospitalized for a surgical procedure to remove a bump oh his foot. Assuming that this hospitalization was the first medical care that Luke received during the year and that all of the hospital/medical expenses were eligible for coverage under the policy. i. If the covered medical expenses were $38,000, how much will Luke's medical insurance policy pay? How much will Luke be required to pay? Show all your calculations. 4 marks ii. What purposes does a co-insurance clause serve in a major medical insurance policy? Question 5 (16 marks) a. What is a 'deductible in insurance? 2 marks b. Whole Meal Store incurred the following insured losses, in the order given, during the current policy period: Date 2 Mar 2021 6 July 2021 1 Sept 2021 Loss A B Amount of loss ($) 6,000 8,000 15,000 How much would the insurance company pay for each loss if the Whole Meal's policy contained the following type of deductible? i. $5,000 straight deductible ii. $25,000 annual aggregate deductible 7 marks c. Luke is insured under an individual major medical insurance policy with a lifetime limit of $1 million. His major medical insurance policy includes a calendar-year deductible of $5,000, and an 85 -15 percent coinsurance provision. Last week, Luke was hospitalized for a surgical procedure to remove a bump oh his foot. Assuming that this hospitalization was the first medical care that Luke received during the year and that all of the hospital/medical expenses were eligible for coverage under the policy. i. If the covered medical expenses were $38,000, how much will Luke's medical insurance policy pay? How much will Luke be required to pay? Show all your calculations. 4 marks ii. What purposes does a co-insurance clause serve in a major medical insurance policy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started