Answered step by step

Verified Expert Solution

Question

1 Approved Answer

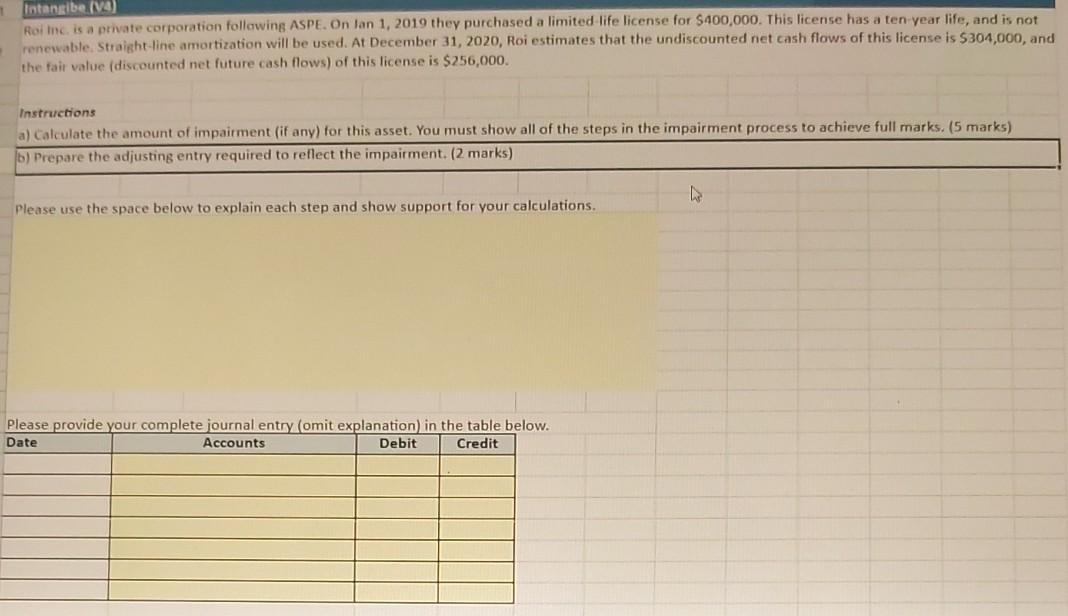

Intangibe (VA) Roi inc. is a private corporation following ASPE. On Jan 1, 2019 they purchased a limited life license for $400,000. This license has

Intangibe (VA) Roi inc. is a private corporation following ASPE. On Jan 1, 2019 they purchased a limited life license for $400,000. This license has a ten year life, and is not renewable Straight line amortization will be used. At December 31, 2020, Roi estimates that the undiscounted net cash flows of this license is $304,000, and the fair value (discounted net future cash flows) of this license is $256,000. Instructions a) Calculate the amount of impairment (if any) for this asset. You must show all of the steps in the impairment process to achieve full marks. (5 marks) b) Prepare the adjusting entry required to reflect the impairment. (2 marks) Please use the space below to explain each step and show support for your calculations. Please provide your complete journal entry (omit explanation in the table below. Date Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started