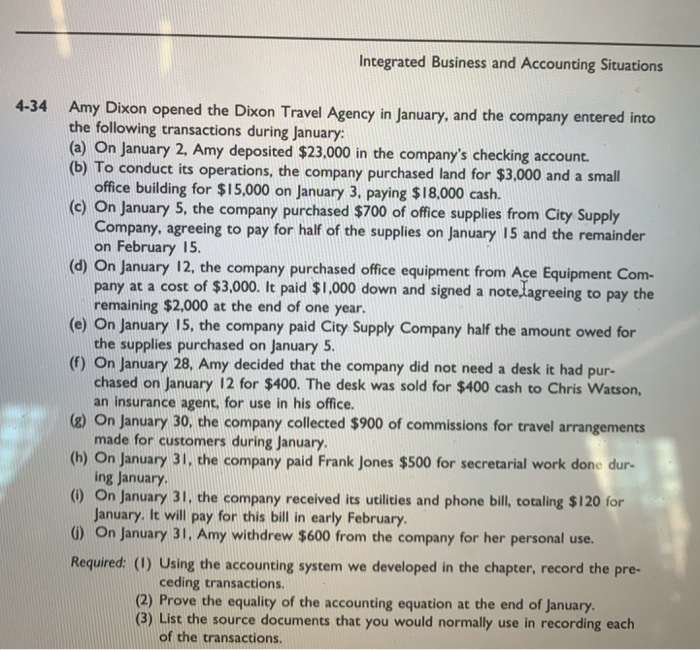

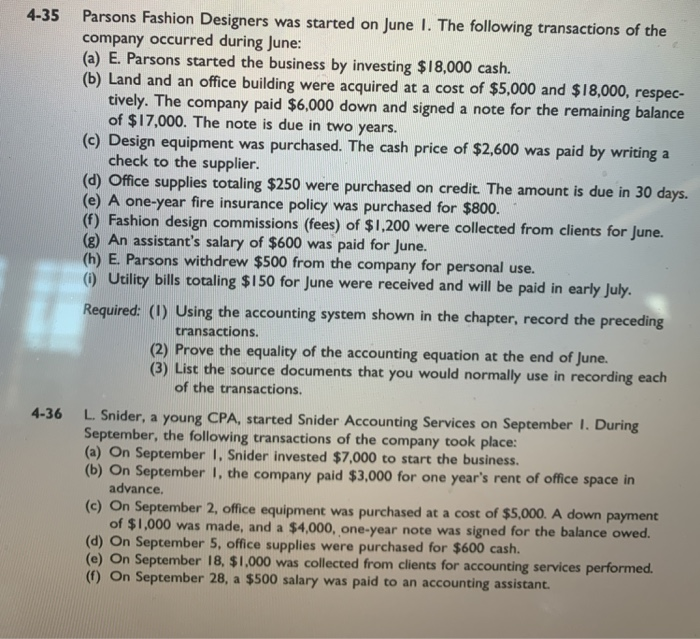

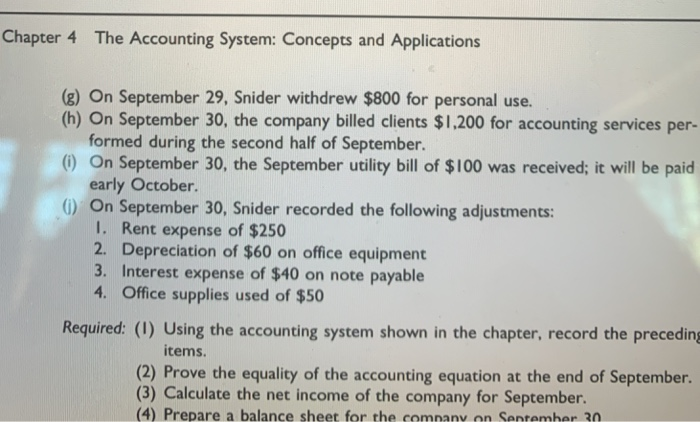

Integrated Business and Accounting Situations 4-34 Amy Dixon opened the Dixon Travel Agency in January, and the company entered into the following transactions during January (a) On January 2. Amy deposited $23.000 in the company's checking acount. (b) To conduct its operations, the company purchased land for $3,000 and a small office building for $15,000 on January 3. paying $18.000 cash (c) On January 5, the company purchased $700 of office supplies from City Supply (d) On January 12, the company purchased office equipment from Ace Equipment Com- (e) On January 15, the company paid City Supply Company half the amount owed for (6) On January 28, Amy decided that the company did not need a desk it had pur- Company, agreeing to pay for half of the supplies on January 15 and the remainder on February 15 pany at a cost of $3,000. It paid $1.000 down and signed a note.lagreeing to pay the remaining $2.000 at the end of one year. the supplies purchased on January 5. chased on January 12 for $400. The desk was sold for $400 cash to Chris Watson, (2) On January 30, the company collected $900 of commissions for travel arrangements (b) On January 31, the company paid Frank Jones $500 for secretarial work done dur- (0 On January 31. the company received its utilicies and phone bill, totaling $120 for 0) On January 31. Amy withdrew $600 from the company for her personal use. Required: (1) Using the accounting system we developed in the chapter, record the pre- an insurance agent, for use in his office. made for customers during Januany ing January January. It will pay for this bill in early February ceding transactions (2) Prove the equality of the accounting equation at the end of January. (3) List the source documents that you would normally use in recording each of the transactions. 4-35 Parsons Fashion Designers was started on June I. The following transactions of the company occurred during June: (a) E. Parsons started the business by investing $18,000 cash. (b) Land and an office building were acquired at a cost of $5,000 and $18,000, respec- ti vely. The company paid $6,000 down and signed a note for the remaining balance of $17,000. The note is due in two years. (c) Design equipment was purchased. The cash price of $2,600 was paid by writing a check to the supplier (d) Office supplies totaling $250 were purchased on credit. The amount is due in 30 days. (e) A one-year fire insurance policy was purchased for $800 (F) Fashion design commissions (fees) of $1.200 were collected from clients for June. (8) An assistant's salary of $600 was paid for June. (h) E. Parsons withdrew $500 from the company for personal use. o Udility bills totaling $i50 for June were received and will be paid in early July Require d: (1) Using the accounting system shown in the chapter, record the preceding transactions. (2) Prove the equality of the accounting equation at the end of june. (3) List the source documents that you would normally use in recording each of the transactions. L. Snider, a young CPA, started Snider Accounting Services on September I. During September, the following transactions of the company took place: (a) On September 1, Snider invested $7,000 to start the business (b) On September I, the company paid $3,000 for one year's rent of office space in 4-36 advance. (c) On September 2, office equipment was purchased at a cost of $5,000. A down payment of $1,000 was made, and a $4,000, one-year note was signed for the balance o (d) On September 5, office supplies were purchased for $600 cash (e) On September 18, $1,000 was collected from clients for accounting services performed. (1) On September 28, a $500 salary was paid to an accounting assistant Chapter 4 The Accounting System: Concepts and Applications (g) On September 29, Snider withdrew $800 for personal use. (h) On September 30, the company billed clients $1,200 for accounting services per- (0 On September 30, the September utility bill of $100 was received; it will be paid 0) On September 30, Snider recorded the following adjustments: formed during the second half of September. early October. I. Rent expense of $250 2. Depreciation of $60 on office equipment 3. Interest expense of $40 on note payable 4. Office supplies used of $50 Required: (1) Using the accounting system shown in the chapter, record the preceding items. (2) Prove the equality of the accounting equation at the end of September. (3) Calculate the net income of the company for September. (4) Prepare a balance sheet for the company on Senremher 30