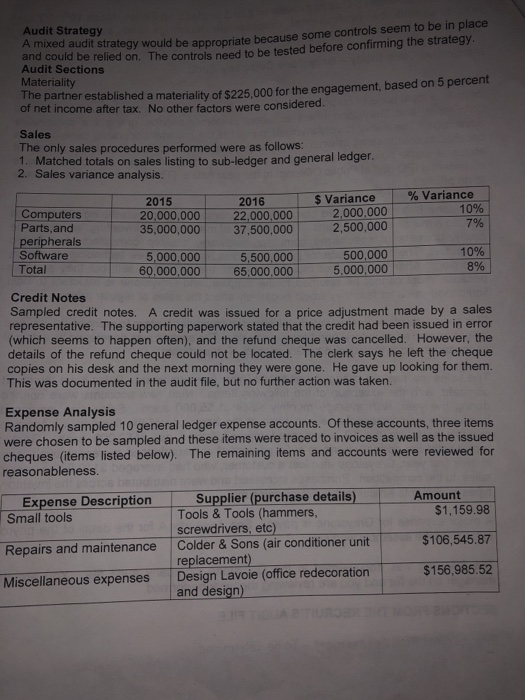

Integrative Case Study - Greystone Company Audit Greystone Company manufactures computers, parts and related equipmen them to a loyal base of corporate customers. Competition is growing favourable, and Greystone offers excellent customer service, advantage. The owner is very involved in most of the important operating decisions capable assistant steps in when necessary. The owner plans to implement a ethics at some point and also wishes to improve certain controls. The owner also considering IPO (Initial Public Offering) in the near future. (Thi to go public.) t and sells ket is giving it a competitive code of but the man , is would allow the company Greystone is a medium-sized company that operates four manufacturing plants, ea making a mix of inventory items. The first type costly, consists of specialized computers. The turnover emerging. After three or four months, products are difficult to sell, but they are kept because most cannot be returned to the supplier, and Greystone is reluctant to hold liquidation sales for fear they would negatively affect the sales at regular prices. of manufactured inventory, which can be computer hardware, desktop computers, and laptop since new technology is always is high This year, Greystone implemented an integrated computer system to manage the genera ledger as well as inventory, purchases, and sales. The system was developed by external consultants and is maintained by Greystone's IT department. The sales mix has not changed significantly from previous years. Sales have remained constant, w during the year, with average monthly sales of $5,000 each. Sales also increas ith the exception of the following items. Nine new accounts were opened ed w representative was hired at the beginning of the fiscal year. Average monthly sales for the 10 experienced representatives are $550,000 each. Rookie representatives normally perform at 60 percent of an experienced representative's level in their first year, Greystone also lost a customer, who had averaged $110,000 a year in sales, to the competition. Purchases increased and were distributed across the inventory types in amounts similar to the overall sales mix. A major expense for Greystone is payroll, See Appendix A for the detail of the payroll system for the assembly workers. The following was documented in the Greystone Company audit file. You are the manager on the file and you are reviewing the work performed SECTIONS FROM THE RECRUIT'S AUDIT FILE Engagement Risk Assessment- To be determined Audit Strategy A mixed audit strategy would be appropriate because some controls seem to be in place arid could be relied on. The controls need to be tested before confirming the strategy Audit Sections Materiality The e partner established a materiality of $225,000 for the engagement, based on 5 percent idered of net income after tax. No other factors were cons Sales The only sales procedures performed were as follows: 2. Sales variance analysis. 1. Matched totals on sales listing to sub-ledger and general ledger % Variance Variance 2015 20,000,000 35,000,000 2016 22,000,000 37,500,000 2,000,000 2,500,000 10% 7% Computers Parts,and peripherals 500,000 5,000,000 10% 8% Software 5,000,000 60,000,000 5,500,000 65,000,000 Total Credit Notes Sampled credit notes. A credit was issued for a price adjustment made by a sales representative. The supporting paperwork stated that the credit had been issued in error (which seems to happen often), and the refund cheque was cancelled. However, the details of the refund cheque could not be located. The clerk says he left the cheque copies on his desk and the next morning they were gone. He gave up looking for them. This was documented in the audit file, but no further action was taken. Expense Analysis Randomly sampled 10 general ledger expense accounts. Of these accounts, three items were chosen to be sampled and these items were traced to invoices as well as the issued cheques (items listed below). The remaining items and accounts were reviewed for reasonableness Expense Desiption Supplier (purchase details) Amount Repairs and maintenance Colder &Sons (air conditioner unit Miscellaneous expenses Design Lavoie (office redecoration $1,159.98 $106,545.87 $156,985.52 Small tools Tools & Tools (hammers, screwdrivers, etc) replacement) and design) APPENDIX A Payroll System Assembly-line workers normally work a standard eight-hour day although this is supplemented by overtime on a regular. There is one shift per day Wages system-shift workers Shift workers arrive for work at about 7:00 a.m. and "clock in" using an electronic identification card. The card is scanned by the time-recording system and each production shift worker's identification number is read from their card by the scanner The worker is then logged in as being at work. Shift workers are paid from the time of logging in. The logging-in process is not monitored because it is assumed that shift workers would not work without first logging in on the time-recording system. Shift workers are split into groups of about 25 employees, with each group under the supervision of a shift foreman. The shift foreman is not required to monitor the extent of any overtime working although the foreman does ensure workers are not taking unnecessary or prolonged breaks that would automatically increase the amount of overtime worked. Shift workers log off at the end of each shift by re-scanning their identification card Payment of wages Details of hours worked each week are sent electronically to the payroll department, where hours worked are allocated by the computerized wages system to each employee's wages records. Staff in the payroll department compare hours worked from the time-recording system with the computerized wages system and enter a code word to confirm the accuracy of transfer. The code word also acts as authorization to calculate net wages. The code word is the name of a cat belonging to the department head and is therefore generally known around the department. Each week the computerized wages system calculates: . gross wages, using the standard rate and overtime rates per hour for each employee statutory deductions from wages, and net pay The list of net pay for each employee is sent over the internal network to the accounting department. In the accounting department, an accounting clerk ensures that employee bank details are on file. The clerk then authorizes and makes payment to those employees using Greystone's online banking systems. Every few weeks, the financial accountant reviews the total amount of wages paid to ensure that the management accounts are accurate