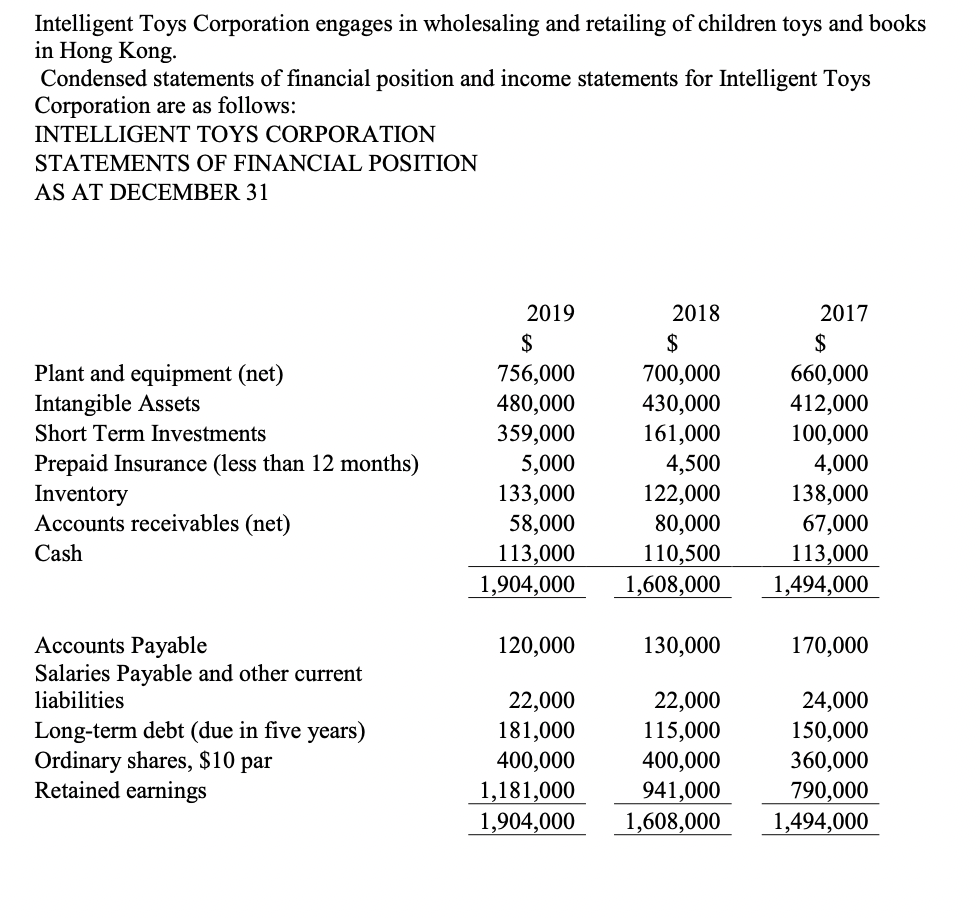

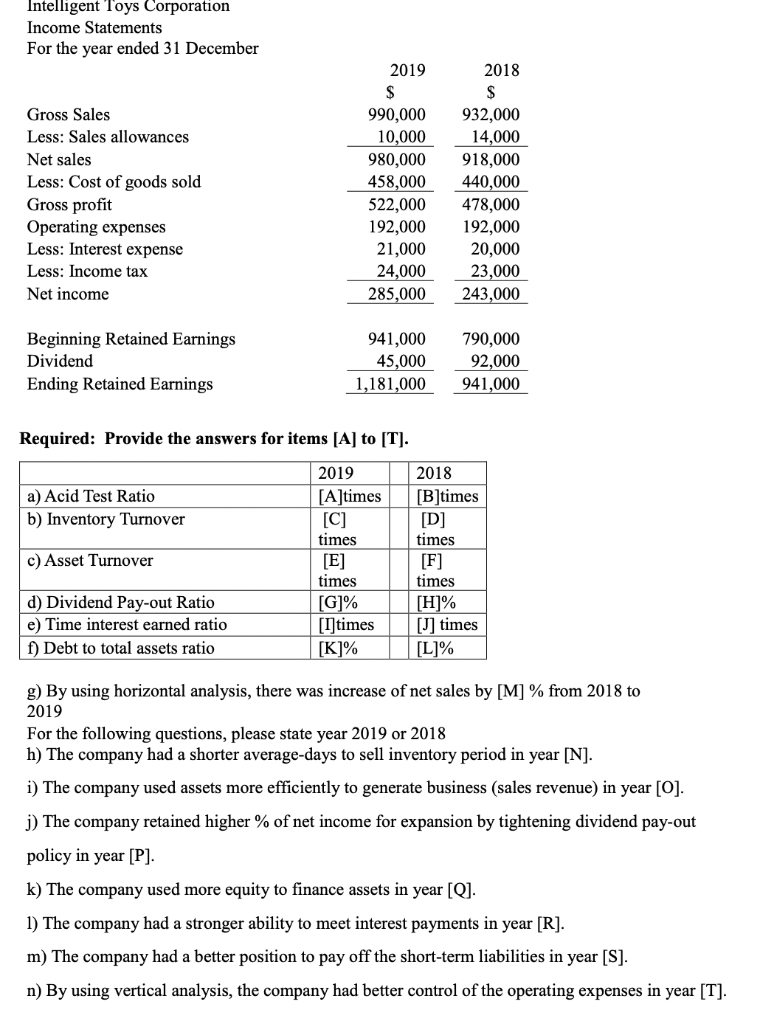

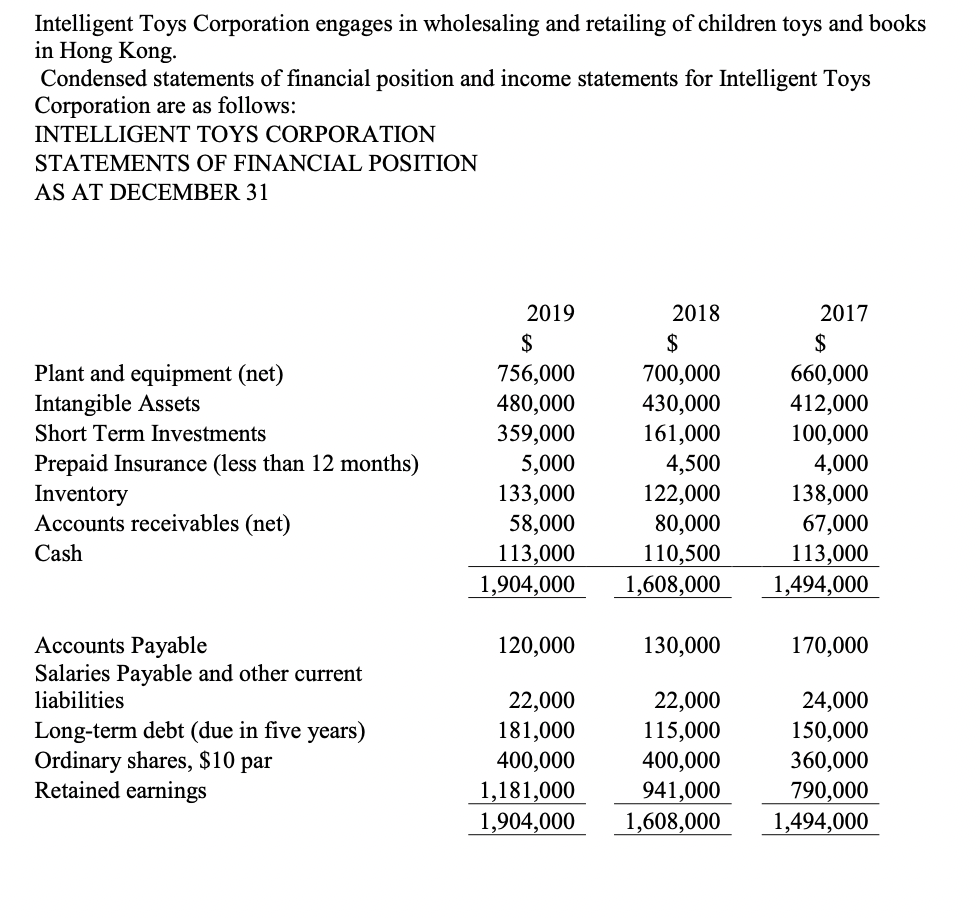

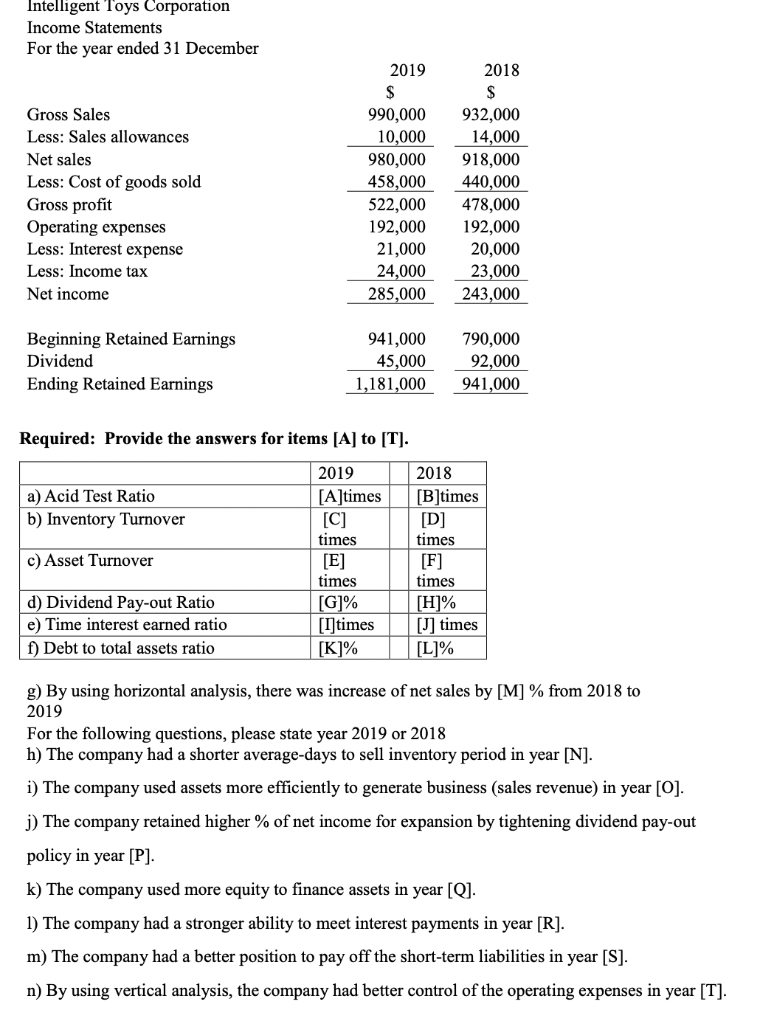

Intelligent Toys Corporation engages in wholesaling and retailing of children toys and books in Hong Kong. Condensed statements of financial position and income statements for Intelligent Toys Corporation are as follows: INTELLIGENT TOYS CORPORATION STATEMENTS OF FINANCIAL POSITION AS AT DECEMBER 31 2019 2018 $ 756,000 $ 700,000 2017 $ 660,000 Plant and equipment (net) Intangible Assets 480,000 430,000 412,000 Short Term Investments 359,000 161,000 100,000 Prepaid Insurance (less than 12 months) 5,000 4,500 4,000 Inventory 133,000 122,000 138,000 Accounts receivables (net) 58,000 80,000 67,000 Cash 113,000 110,500 113,000 1,904,000 1,608,000 1,494,000 Accounts Payable 120,000 130,000 170,000 Salaries Payable and other current liabilities 22,000 22,000 24,000 Long-term debt (due in five years) 181,000 115,000 150,000 Ordinary shares, $10 par 400,000 400,000 360,000 Retained earnings 1,181,000 941,000 790,000 1,904,000 1,608,000 1,494,000 Intelligent Toys Corporation Income Statements For the year ended 31 December 2019 2018 $ $ Gross Sales 990,000 932,000 Less: Sales allowances 10,000 14,000 Net sales 980,000 918,000 Less: Cost of goods sold 458,000 440,000 Gross profit 522,000 478,000 Operating expenses 192,000 192,000 Less: Interest expense 21,000 20,000 Less: Income tax 24,000 23,000 Net income 285,000 243,000 Beginning Retained Earnings 941,000 790,000 Dividend 45,000 92,000 Ending Retained Earnings 1,181,000 941,000 Required: Provide the answers for items [A] to [T]. 2019 2018 a) Acid Test Ratio [A]times [B]times b) Inventory Turnover [C] [D] times times c) Asset Turnover [E] [F] times times d) Dividend Pay-out Ratio [G]% [H]% e) Time interest earned ratio [I]times [J] times f) Debt to total assets ratio [K]% [L]% g) By using horizontal analysis, there was increase of net sales by [M] % from 2018 to 2019 For the following questions, please state year 2019 or 2018 h) The company had a shorter average-days to sell inventory period in year [N]. i) The company used assets more efficiently to generate business (sales revenue) in year [O]. j) The company retained higher % of net income for expansion by tightening dividend pay-out policy in year [P]. k) The company used more equity to finance assets in year [Q]. 1) The company had a stronger ability to meet interest payments in year [R]. m) The company had a better position to pay off the short-term liabilities in year [S]. n) By using vertical analysis, the company had better control of the operating expenses in year [T]. Intelligent Toys Corporation engages in wholesaling and retailing of children toys and books in Hong Kong. Condensed statements of financial position and income statements for Intelligent Toys Corporation are as follows: INTELLIGENT TOYS CORPORATION STATEMENTS OF FINANCIAL POSITION AS AT DECEMBER 31 2019 2018 $ 756,000 $ 700,000 2017 $ 660,000 Plant and equipment (net) Intangible Assets 480,000 430,000 412,000 Short Term Investments 359,000 161,000 100,000 Prepaid Insurance (less than 12 months) 5,000 4,500 4,000 Inventory 133,000 122,000 138,000 Accounts receivables (net) 58,000 80,000 67,000 Cash 113,000 110,500 113,000 1,904,000 1,608,000 1,494,000 Accounts Payable 120,000 130,000 170,000 Salaries Payable and other current liabilities 22,000 22,000 24,000 Long-term debt (due in five years) 181,000 115,000 150,000 Ordinary shares, $10 par 400,000 400,000 360,000 Retained earnings 1,181,000 941,000 790,000 1,904,000 1,608,000 1,494,000 Intelligent Toys Corporation Income Statements For the year ended 31 December 2019 2018 $ $ Gross Sales 990,000 932,000 Less: Sales allowances 10,000 14,000 Net sales 980,000 918,000 Less: Cost of goods sold 458,000 440,000 Gross profit 522,000 478,000 Operating expenses 192,000 192,000 Less: Interest expense 21,000 20,000 Less: Income tax 24,000 23,000 Net income 285,000 243,000 Beginning Retained Earnings 941,000 790,000 Dividend 45,000 92,000 Ending Retained Earnings 1,181,000 941,000 Required: Provide the answers for items [A] to [T]. 2019 2018 a) Acid Test Ratio [A]times [B]times b) Inventory Turnover [C] [D] times times c) Asset Turnover [E] [F] times times d) Dividend Pay-out Ratio [G]% [H]% e) Time interest earned ratio [I]times [J] times f) Debt to total assets ratio [K]% [L]% g) By using horizontal analysis, there was increase of net sales by [M] % from 2018 to 2019 For the following questions, please state year 2019 or 2018 h) The company had a shorter average-days to sell inventory period in year [N]. i) The company used assets more efficiently to generate business (sales revenue) in year [O]. j) The company retained higher % of net income for expansion by tightening dividend pay-out policy in year [P]. k) The company used more equity to finance assets in year [Q]. 1) The company had a stronger ability to meet interest payments in year [R]. m) The company had a better position to pay off the short-term liabilities in year [S]. n) By using vertical analysis, the company had better control of the operating expenses in year [T]