Question

Intercompany Goods in Ending Inventory Company P and Subsidiary Company SWorksheet for Consolidated Financial Statements For Year Ended December 31,2015(Credit balance amounts are in parentheses.)Trial

Intercompany Goods in Ending Inventory

Company P and Subsidiary Company

SWorksheet for Consolidated Financial Statements

For Year Ended December 31,2015(Credit balance amounts are in parentheses.)Trial BalanceCompany PCompany S1Accounts Receivable110,000150,0002Inventory, December 31, 2015, 70,00040,0003Investment in Company S196,00045Other Assets314,000155,0006Accounts Payable(80,000)(100,000)7Common Stock ($10 par)Company P(200,000)8Retained Earnings, January 1, 2015Company P(250,000)9Common Stock ($10 par)Company S(100,000)10Retained Earnings, January 1, 2015Company S(70,000)11Sales(700,000)(500,000)12Cost of Goods Sold510,000350,00013Expenses90,00075,00014Subsidiary Income(60,000)150016Consolidated Net Income17To NCI (see distribution schedule)18Balance to Controlling Interest (see distribution schedule)19Total NCI20Retained Earnings, Controlling Interest, December 31, 201521Eliminations and Adjustments:(CY1) Eliminate the entry recording the parents share of subsidiary net income.(EL)Eliminate 80% of the subsidiary equity balances against the investment in Company S account. There is no excess of cost orbook value in this example.(IS)Eliminate the intercompany sale of $100,000.(EI)Eliminate intercompany profit in ending inventory, 20%$40,000.(IA)Eliminate the intercompany trade balances.228Part 1COMBINEDCORPORATEENTITIES ANDCONSOLIDATIONS

I need help understanding this, excel portion as in the pictures must be done.

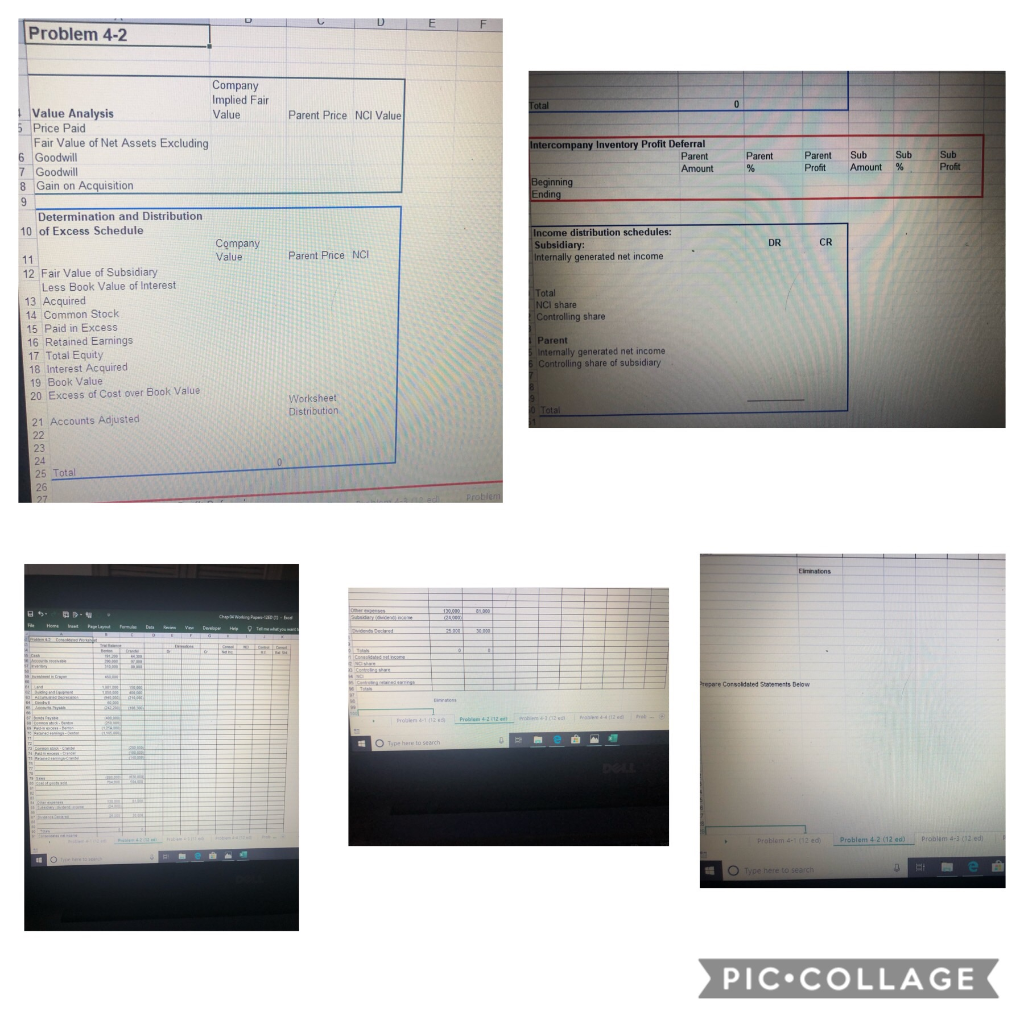

DUE F Problem 4-2 Value Parent Price NCI Value Parent Company Implied Fair 1 Value Analysis 5 Price Paid Fair Value of Net Assets Excluding 6 Goodwill 7 Goodwill 8 Gain on Acquisition 9 Determination and Distribution 10 of Excess Schedule Company Intercompany Inventory Profit Deferral Parent Amount Beginning Ending Parent Profit Sub Amount Sub % Sub Profit Parent Price NCI Income distribution schedules: Subsidiary: Internally generated net income Total NCI share Controlling share 12 Fair Value of Subsidiary Less Book Value of Interest 13 Acquired 14 Common Stock 15 Paid in Excess 16 Retained Earnings 17 Total Equity 18 Interest Acquired 19 Book Value 20 Excess of Cost over Book Value Parent Internally generated net income Controlling share of subsidiary Worksheet Distribution 0 Total 21 Accounts Adjusted Total repare Consolidated Statements Below Problem - (12 ed Problem 4.2 (12 od) Problemas 12odi Type here to search PIC.COLLAGE DUE F Problem 4-2 Value Parent Price NCI Value Parent Company Implied Fair 1 Value Analysis 5 Price Paid Fair Value of Net Assets Excluding 6 Goodwill 7 Goodwill 8 Gain on Acquisition 9 Determination and Distribution 10 of Excess Schedule Company Intercompany Inventory Profit Deferral Parent Amount Beginning Ending Parent Profit Sub Amount Sub % Sub Profit Parent Price NCI Income distribution schedules: Subsidiary: Internally generated net income Total NCI share Controlling share 12 Fair Value of Subsidiary Less Book Value of Interest 13 Acquired 14 Common Stock 15 Paid in Excess 16 Retained Earnings 17 Total Equity 18 Interest Acquired 19 Book Value 20 Excess of Cost over Book Value Parent Internally generated net income Controlling share of subsidiary Worksheet Distribution 0 Total 21 Accounts Adjusted Total repare Consolidated Statements Below Problem - (12 ed Problem 4.2 (12 od) Problemas 12odi Type here to search PIC.COLLAGEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started