Answered step by step

Verified Expert Solution

Question

1 Approved Answer

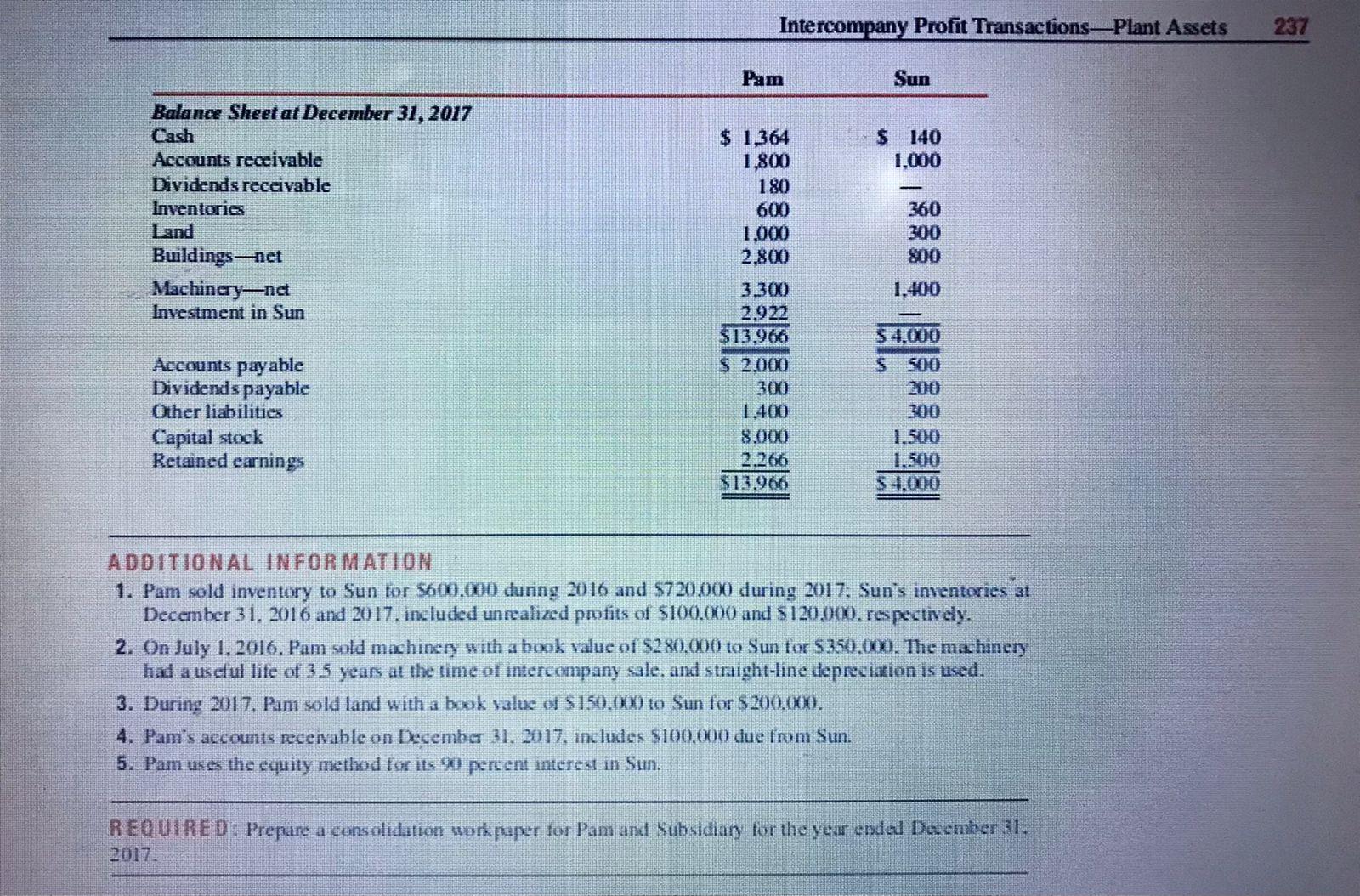

Intercompany Profit Transactions-Plant Assets 237 Pam Sun Balance Sheet at December 31, 2017 $ 1,364 $ 140 Accounts receivable 1,800 1,000 Dividends receivable 180

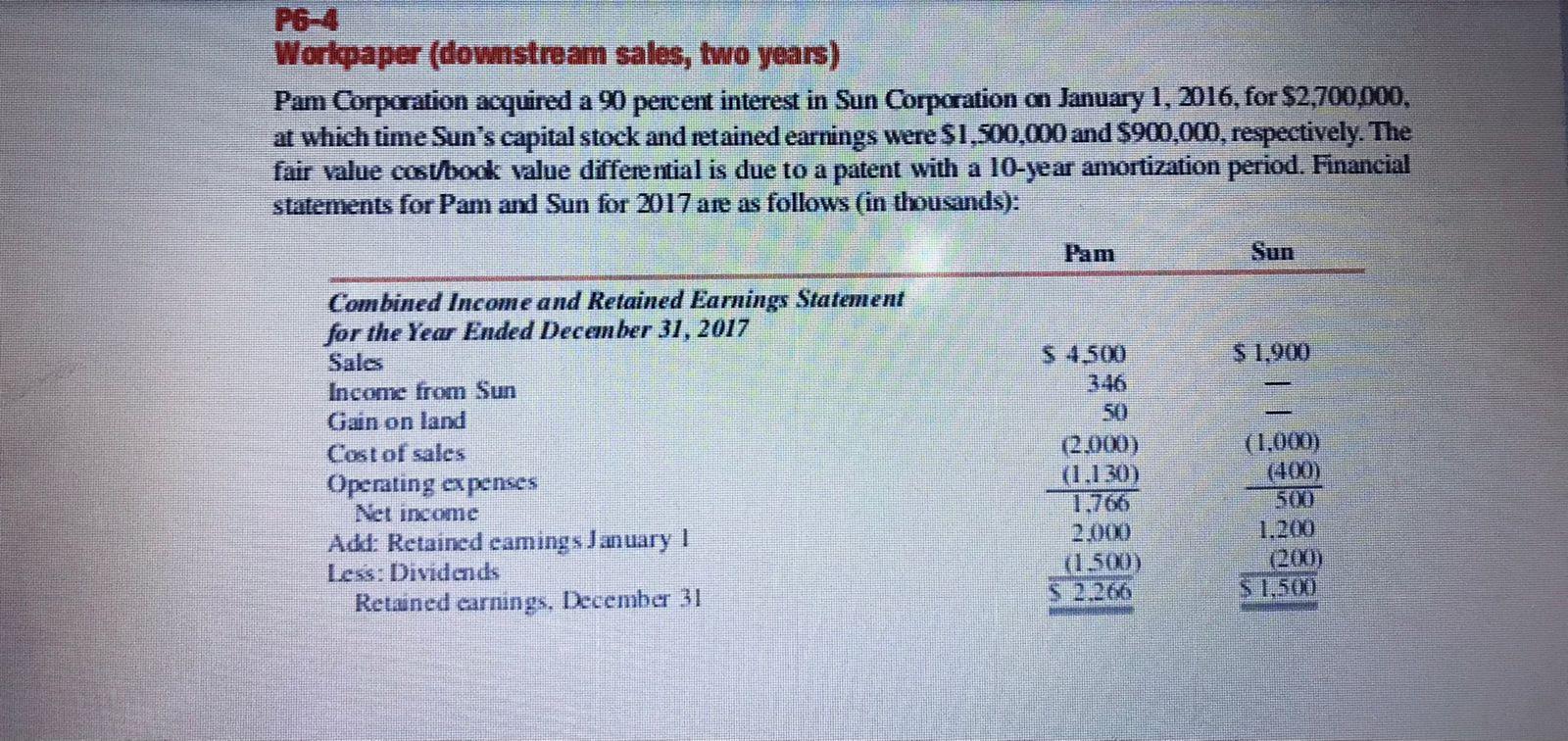

Intercompany Profit Transactions-Plant Assets 237 Pam Sun Balance Sheet at December 31, 2017 $ 1,364 $ 140 Accounts receivable 1,800 1,000 Dividends receivable 180 Inventories 600 360 Land 1,000 300 Buildings-net 2,800 800 3.300 1.400 Machinery-net Investment in Sun 2,922 $13.966 $4,000 $ 2,000 $ 500 300 200 Accounts payable Dividends payable Other liabilities Capital stock Retained earnings 1.400 300 8,000 1.500 2.266 1.500 $13.966 $4.000 ADDITIONAL INFORMATION 1. Pam sold inventory to Sun for $600,000 during 2016 and $720,000 during 2017, Sun's inventories at December 31, 2016 and 2017, included unrealized profits of $100.000 and $120,000, respectively. 2. On July 1, 2016, Pam sold machinery with a book value of $280,000 to Sun for $350,000. The machinery had a useful life of 3.5 years at the time of intercompany sale, and straight-line depreciation is used. 3. During 2017, Pam sold land with a book value of $150,000 to Sun for $200,000. 4. Pam's accounts receivable on December 31, 2017, includes $100,000 due from Sun. 5. Pam uses the equity method for its 90 percent interest in Sun. REQUIRED: Prepare a consolidation work paper for Pam and Subsidiary for the year ended December 31. 2017. Workpaper (downstream sales, two years) Pam Corporation acquired a 90 percent interest in Sun Corporation on January 1, 2016, for $2,700,000, at which time Sun's capital stock and retained earnings were $1,500,000 and $900,000, respectively. The fair value cost/book value differential is due to a patent with a 10-year amortization period. Financial statements for Pam and Sun for 2017 are as follows (in thousands): Pam Sun Combined Income and Retained Earnings Statement for the Year Ended December 31, 2017 Sales $ 4.500 $1,900 Income from Sun Gain on land 50 Cost of sales (2.000) Operating expenses (1,130) Net income 1.766 Add: Retained camings January 1 2,000 Less: Dividends (1.500) Retained earnings, December 31 2.266 (1,000) 500 1.200 (200) $1,500

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer Step 1 Consolidated Balance Sheet Consolidat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started