Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Interest During Construction Matrix Inc. borrowed $1,100,000 at 8% to finance the construction of a new building for its own use. Construction began on

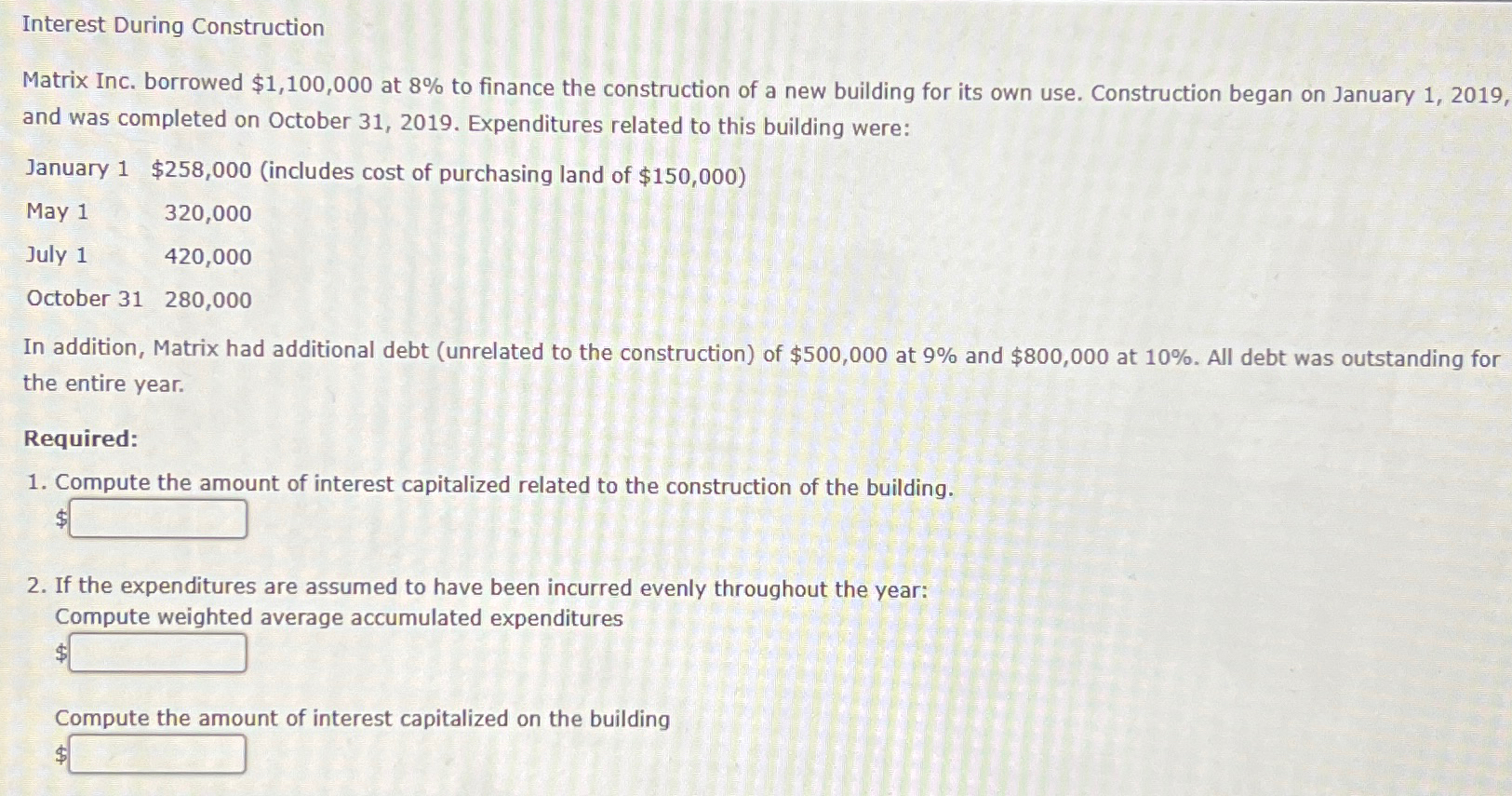

Interest During Construction Matrix Inc. borrowed $1,100,000 at 8% to finance the construction of a new building for its own use. Construction began on January 1, 2019, and was completed on October 31, 2019. Expenditures related to this building were: January 1 $258,000 (includes cost of purchasing land of $150,000) May 1 July 1 320,000 420,000 October 31 280,000 In addition, Matrix had additional debt (unrelated to the construction) of $500,000 at 9% and $800,000 at 10%. All debt was outstanding for the entire year. Required: 1. Compute the amount of interest capitalized related to the construction of the building. $ 2. If the expenditures are assumed to have been incurred evenly throughout the year: Compute weighted average accumulated expenditures Compute the amount of interest capitalized on the building $

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To compute the amount of interest capitalized related to the construction of the building we need to follow these steps 1 Determine the specific interest expense on the new debt 2 Calculate the averag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started