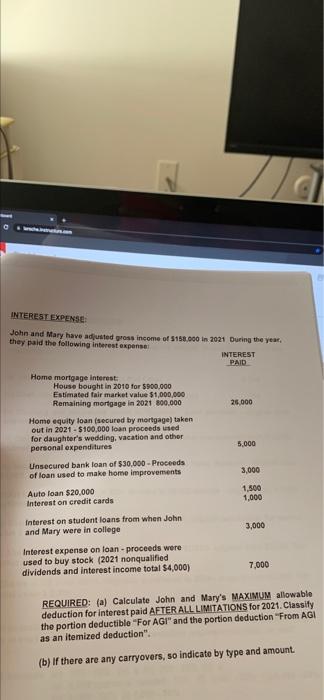

INTEREST EXPENSE John and Mary have adjusted gross income of $15.000 in 2021 During the year. they paid the following interest expenser INTEREST PAID 25.000 5,000 3,000 Home mortgage interest House bought in 2010 for $900.000 Estimated fair market value $1,000,000 Remaining mortgage in 2021 800.000 Homo equity loan (secured by mortgage taken out in 2021 - $100,000 loan proceeds used for daughter's wedding, vacation and other personal expenditures Unsecured bank loan of $30,000 - Proceeds of loan used to make home improvements Auto loan $20.000 Interest on credit cards Interest on student loans from when John and Mary were in college Interest expense on loan - proceeds were used to buy stock (2021 nonqualified dividends and interest income total $4,000) 1,500 1,000 3,000 7,000 REQUIRED: (a) Calculate John and Mary's MAXIMUM allowable deduction for interest paid AFTER ALL LIMITATIONS for 2021. Classify the portion deductible "For AGI" and the portion deduction "From AGI as an itemized deduction" (b) If there are any carryovers, so indicate by type and amount INTEREST EXPENSE John and Mary have adjusted gross income of $15.000 in 2021 During the year. they paid the following interest expenser INTEREST PAID 25.000 5,000 3,000 Home mortgage interest House bought in 2010 for $900.000 Estimated fair market value $1,000,000 Remaining mortgage in 2021 800.000 Homo equity loan (secured by mortgage taken out in 2021 - $100,000 loan proceeds used for daughter's wedding, vacation and other personal expenditures Unsecured bank loan of $30,000 - Proceeds of loan used to make home improvements Auto loan $20.000 Interest on credit cards Interest on student loans from when John and Mary were in college Interest expense on loan - proceeds were used to buy stock (2021 nonqualified dividends and interest income total $4,000) 1,500 1,000 3,000 7,000 REQUIRED: (a) Calculate John and Mary's MAXIMUM allowable deduction for interest paid AFTER ALL LIMITATIONS for 2021. Classify the portion deductible "For AGI" and the portion deduction "From AGI as an itemized deduction" (b) If there are any carryovers, so indicate by type and amount