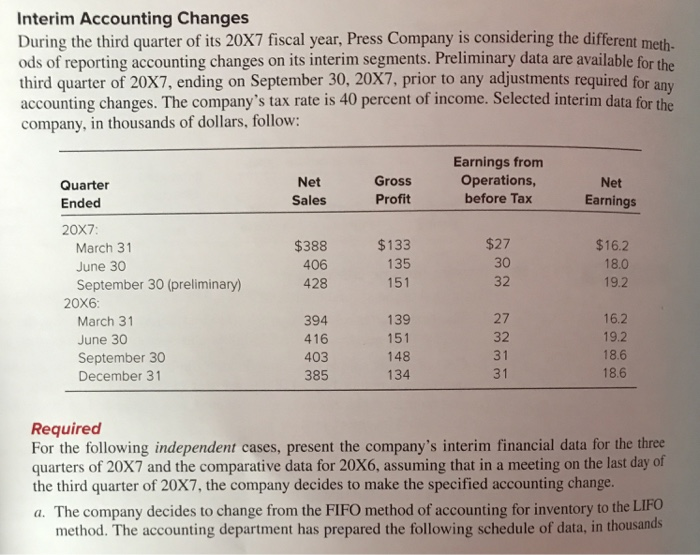

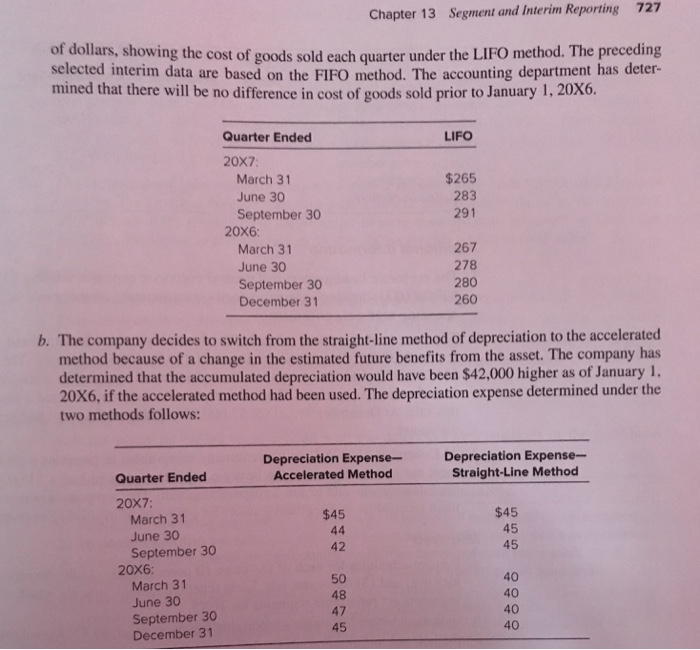

Interim Accounting Changes During the third quarter of its 20X7 fiscal year, Press Company is considering the different meth. ods of reporting accounting changes on its interim segments. Preliminary data are available for the third quarter of 20X7, ending on September 30, 20x7, prior to any adjustments required for any accounting changes. The company's tax rate is 40 percent of income. Selected interim data for the company, in thousands of dollars, follow: Earnings from Net Sales Gross Profit Operations,Earnings before Tax Net Quarter Ended 20X7 March 31 June 30 September 30 (preliminary) $388 406 428 $133 135 151 $27 30 32 $16.2 18.0 19.2 20X6 March 31 June 30 September 30 December 31 394 416 403 385 139 151 148 134 27 32 31 16.2 19.2 18.6 18.6 Required For the following independent cases, present the company's interim financial data for the three quarters of 20X7 and the comparative data for 20X6, assuming that in a meeting on the last day of the third quarter of 20X7, the company decides to make the specified accounting change. a. The company decides to change from the FIFO method of accounting for inventory to the LIFO method. The accounting department has prepared the following schedule of data, in thousands Chapter 13 Segment and Interim Reporting 727 of dollars, showing the cost of goods sold each quarter under the LIFO method. The preceding selected interim data are based on the FIFO method. The accounting department has deter mined that there will be no difference in cost of goods sold prior to January 1, 20X6. Quarter Ended LIFO 20X7 March 31 June 30 September 30 $265 283 291 20x6 March 31 June 30 September 30 December 31 267 278 280 260 b. The company decides to switch from the straight-line method of depreciation to the accelerated method because of a change in the estimated future benefits from the asset. The company has determined that the accumulated depreciation would have been $42,000 higher as of January 1 20x6, if the accelerated method had been used. The depreciation expense determined under the two methods follows: Depreciation Expense- Accelerated Methoc Depreciation Expense- Straight-Line Method Quarter Ended 20x7 $45 March 31 June 30 September 30 $45 45 42 20x6 March 31 June 30 September 30 December 31 50 48 47 45 40 40 40 40