Question

Intermediate accounting 3 Adjusting Entries The financial data as of October 2020 for Whole Pine Inc. is given in the spreadsheet. You are asked to

Intermediate accounting 3

Adjusting Entries

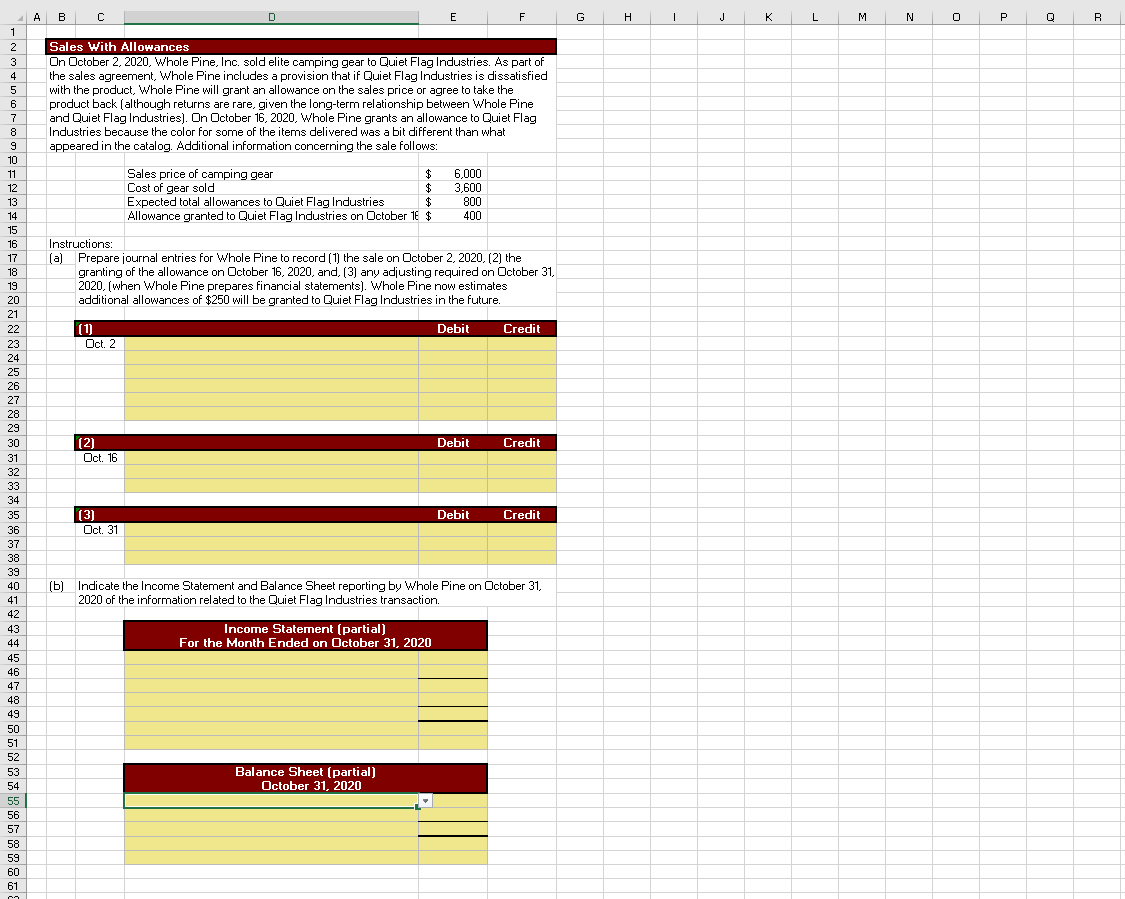

The financial data as of October 2020 for Whole Pine Inc. is given in the spreadsheet. You are asked to record sales, prepare annual adjusting entries, prepare a a balance sheet and income statement. Complete the following tasks.

Prepare the journal entries to record (1) the sale on October 2, 2020.

Prepare the journal entries to record (2) the granting of the allowance on October 16, 2020.

Prepare any other adjusting entries required (3) on October 31, 2020 (when Steele prepares financial statements).

Prepare the Income Statement at October 31, 2020. Use a formula whenever possible to do a calculation of a value.

Prepare the Balance Sheet at October 31, 2020. Use a formula whenever possible to do a calculation of a value.

Drop down menu:

Accounts receivable

Accounts receivable -net

Allowance for sales returns and allowances

Cash

Cost of goods sold

Estimated inventory returns

Gross profit

Inventory

Less: sales returns and allowances

Net sales

Operating income

Prepaid expense

Sales returns and allowances

Sales revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started