Question

intermediate-term bonds. (2 points) (2) Based on your answer in (1), what will happen to the equilibrium price of Westeros' intermediate-term bonds? What will happen

intermediate-term bonds. (2 points)

(2) Based on your answer in (1), what will happen to the equilibrium price of Westeros' intermediate-term bonds? What will happen to the equilibirum interest rate on Westeros' intermediate-term bonds? What will happen to the equilibrium quantity of Westeros' intermediate-term bonds? (3 points)

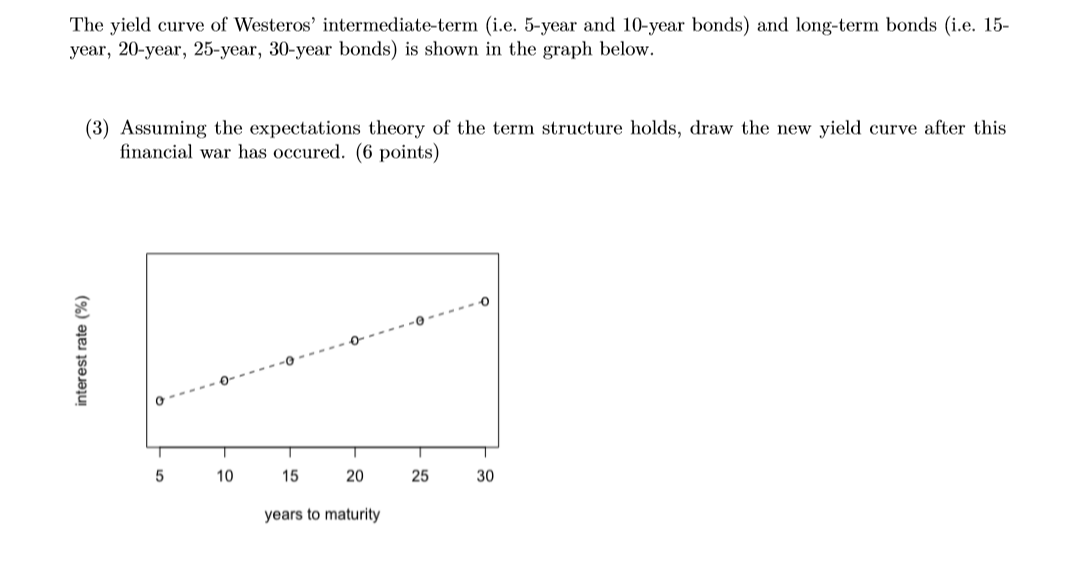

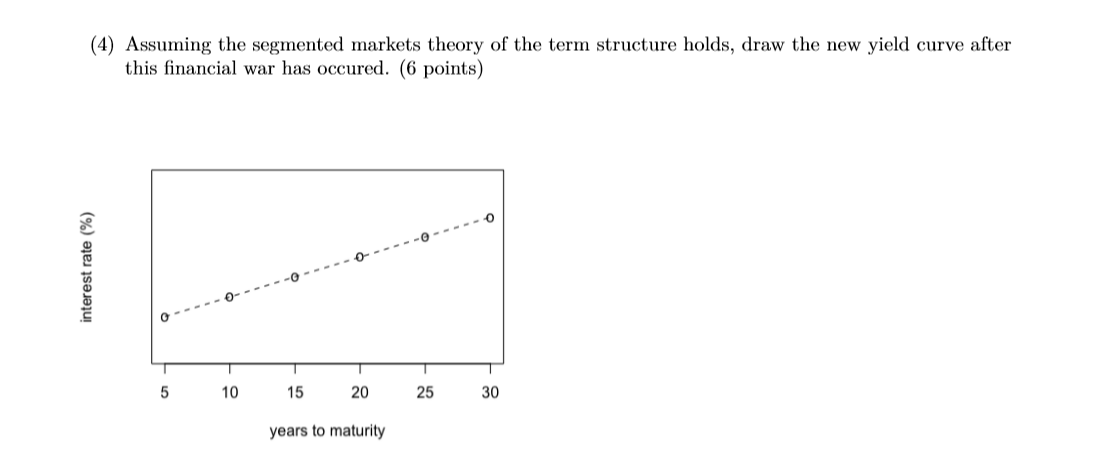

The yield curve of Westeros' intermediate-term (i.e. 5-year and 10-year bonds) and long-term bonds (i.e. 15year, 20-year, 25-year, 30-year bonds) is shown in the graph below.

(3) Assuming the expectations theory of the term structure holds, draw the new yield curve after this ?nancial war has occured. (6 points)

3

(4) Assuming the segmented markets theory of the term structure holds, draw the new yield curve after this ?nancial war has occured. (6 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started