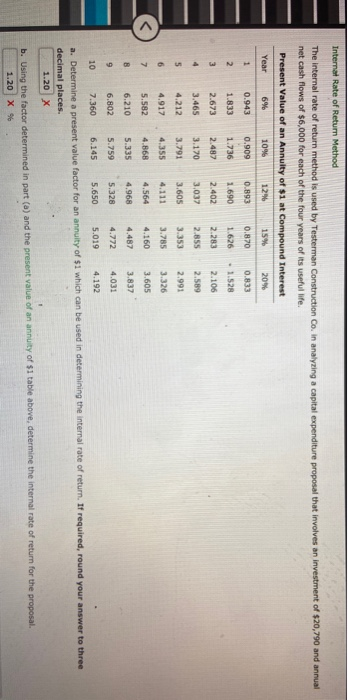

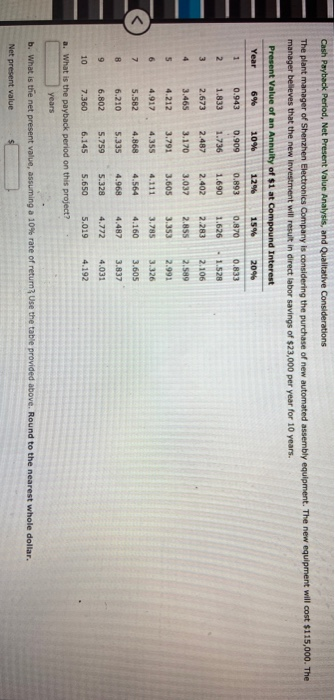

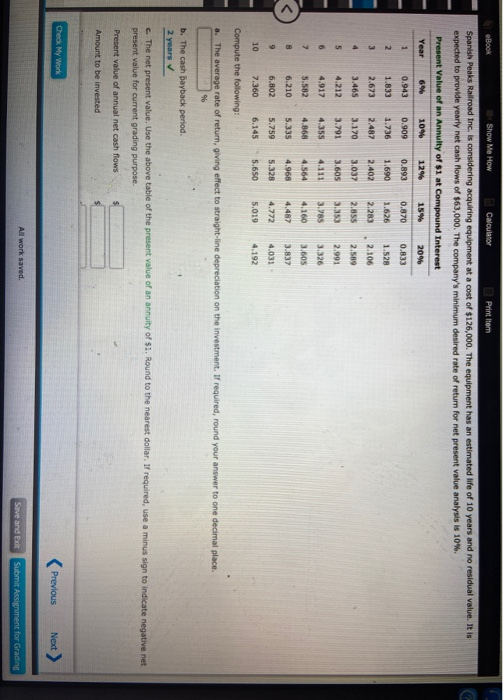

Internal Rate of Return Method The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure proposal that involves an investment of $20,790 and annual net cash flows of $6,000 for each of the four years of its useful life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 - 1.528 3 2.673 2.487 2.402 2.283 2.106 3.465 3.170 3,037 2.85 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 B 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your answer to three decimal places. 1.20 X b. Using the factor determined in part (a) and the present value of an annuity of $1 table above, determine the internal rate of return for the proposal. 1.20 X % Cash Payback Period, Net Present Value Analysis, and Qualitative considerations The plant manager of Shenzhen Electronics Company is considering the purchase of new automated assembly equipment. The new equipment will cost $115,000. The manager believes that the new investment will result in direct labor savings of $23,000 per year for 10 years. Present Value of an Annuity of $1 at Compound Interest Year 10% 12% 15% 20% 6% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 - 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 2.85 3.037 3.605 2.589 2.991 5 4.212 3.353 3.785 6 3.791 4.355 4.868 4.917 4.111 3.326 7 5.582 4.564 4.160 3.605 8 6.210 5.335 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. What is the payback period on this project? years b. What is the net present value, assuming a 10% rate of return? Use the table provided above. Round to the nearest whole dollar. Net present value Book Show Me How Calculator Print Item Spanish Peaks Railroad Inc. is considering acquiring equipment at a cost of $126,000. The equipment has an estimated life of 10 years and no residual value. It is expected to provide yearly net cash flows of $63,000. The company's minimum desired rate of return for net present value analysis is 10%. Present Value of an Annulty of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.909 0.893 0.870 0.833 2 0.943 1.833 2.623 1.736 1.690 1.626 1.528 3 2.487 2.402 2.283 2.106 2.589 4 2.85 3.465 4.212 3.170 3.791 3.037 3.605 5 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4,160 3.605 3.837 6.210 5.335 4.968 4.487 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 Compute the following: The average rate of return, giving effect to straight-line depreciation on the investment. If required, round your answer to one decimal place. % b. The cash bayback period. 2 years c. The net present value. Use the above table of the present value of an annuity of $1. Round to the nearest dollar. If required, use a minus sign to indicate negative net present value for current grading purpose. Present value of annual net cash flows Amount to be invested Check My Work Previous Next > All work saved Save and Edit Submit Assignment for Grading