Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Internal Rate of Return Method-Two Projects Munch N' Crunch Snack Company is considering two possible investments: a delivery truck or a bagging machine. The

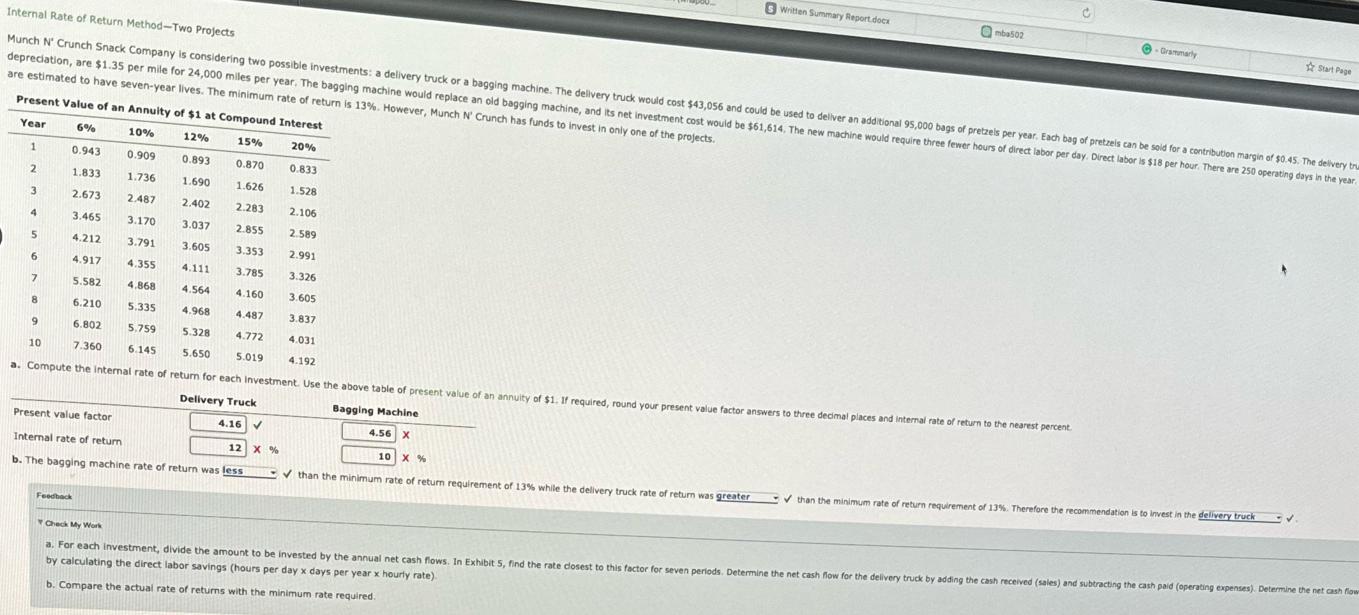

Internal Rate of Return Method-Two Projects Munch N' Crunch Snack Company is considering two possible investments: a delivery truck or a bagging machine. The delivery truck would cost $43,056 and could be used to deliver an additional 95,000 bags of pretzels per year. Each bag of pretzels can be sold for a contribution margin of $0.45. The delivery tru depreciation, are $1.35 per mile for 24,000 miles per year. The bagging machine would replace an old bagging machine, and its net investment cost would be $61,614, The new machine would require three fewer hours of direct labor per day. Direct labor is $18 per hour. There are 250 operating days in the year. are estimated to have seven-year lives. The minimum rate of return is 13%. However, Munch N' Crunch has funds to invest in only one of the projects. Present Value of an Annuity of $1 at Compound Interest Year 15% 20% 6% 10% 12% 0.943 0.909 0.893 0.870 1 2 1.833 1.736 1.690 1.626 2.673 2.487 2.402 2.283 3.465 3.170 3.037 2.855 4.212 3.791 3.605 3.353 4.917 4.355 4.111 3.785 4.160 5.582 4.868 4.564 6.210 5.335 6.802 5.759 4.968 4.487 5.328 4.772 7.360 6.145 5.650 5.019 a. Compute the internal rate of return for each investment. Use the above table of present value of an annuity of $1. If required, round your present value factor answers to three decimal places and internal rate of return to the nearest percent. Delivery Truck Bagging Machine 4.16 3 4 5 6 7 8 9 10 Present value factor Internal rate of return b. The bagging machine rate of return was less Feedback 12 X % 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 S Written Summary Report.docx 4.56 X 10 X % than the minimum rate of return requirement of 13% while the delivery truck rate of return was greater mba502 C -Grammarly than the minimum rate of return requirement of 13%. Therefore the recommendation is to invest in the delivery truck Start Page Check My Work a. For each investment, divide the amount to be invested by the annual net cash flows. In Exhibit 5, find the rate closest to this factor for seven periods. Determine the net cash flow for the delivery truck by adding the cash received (sales) and subtracting the cash paid (operating expenses). Determine the net cash flown by calculating the direct labor savings (hours per day x days per year x hourly rate). b. Compare the actual rate of returns with the minimum rate required.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Compute the internal rate of return for each investment Using the present val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started