Question

Internalities and externalities could interact. One consequence is that it might modify the Pigouvian prescription in that the optimal tax rate is not simply equal

Internalities and externalities could interact. One consequence is that it might modify the Pigouvian prescription in that the optimal tax rate is not simply equal to marginal damages. But, we noted that if the internality is heterogeneous, this will lead to a Diamondlike second-best situation. We explore this graphically here.

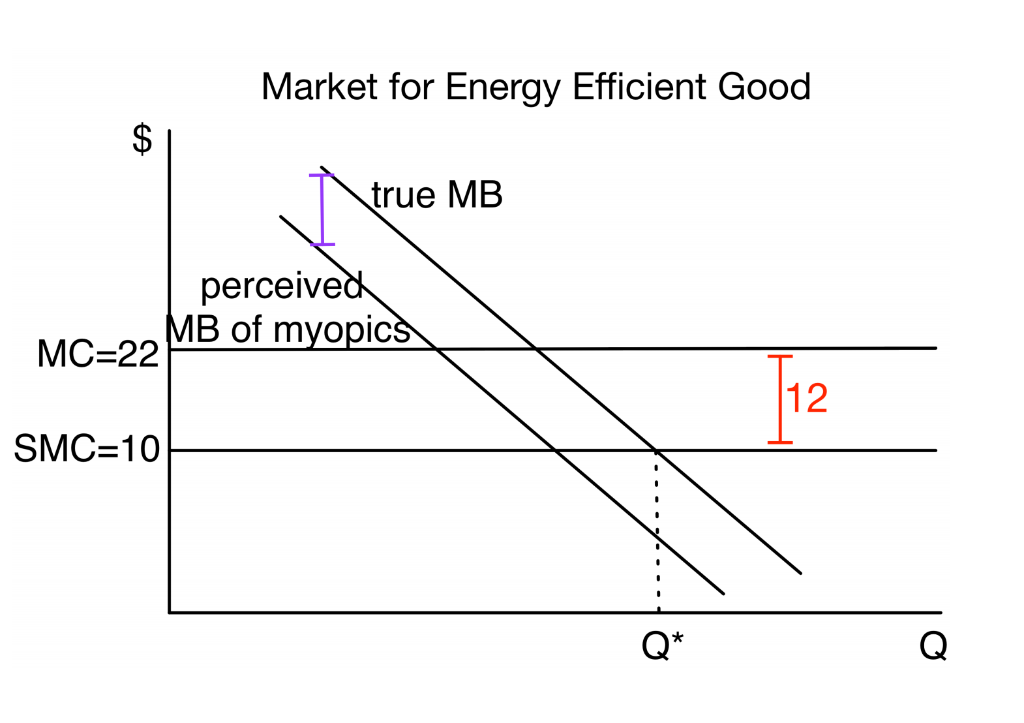

Below is a depiction of a market with an internality with two types of agents, labeled "Market for Energy Efficient Good." In this market, some buyers are fully rational (no internality) and some who are myopic (have an internality that causes them to undervalue the good). Both types of agents have the same true marginal benefits equal to the line labeled true MB. But, the myopic agents misperceive their benefits and demand too little of the good. Their MB curve is shifted down vertically by $9. The good is sold in a competitive market with constant marginal cost of production equal to $22. But, there is also a constant positive externality per unit produced equal to $12. The corresponding social marginal cost curve is drawn. Assume that there are an equal number of myopic and rational agents so that each MB curve represents same 4 amount of agent. Note that the socially optimal quantity to be consumed of both myopic and rational agents is the same, and it is equal to Q* .

17. If you could impose a different subsidy for rational agents and for myopic agents, what would the two subsidy rates be? (2 points)

18. What is the second-best subsidy for this good? (2 points)

19. Suppose that this second-best subsidy is added into the market. Draw on top of this graph (or replicate your own version by hand if you prefer) and label (i) the after-subsidy price that results from imposing the second-best tax, (ii) the quantity that myopic consumers would choose, (iii) the quantity that rational consumers would choose, and shade and label (iv) the deadweight loss associated with myopic consumers (if any), and (v) the deadweight loss associated with rational consumers (if any). (* 5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started