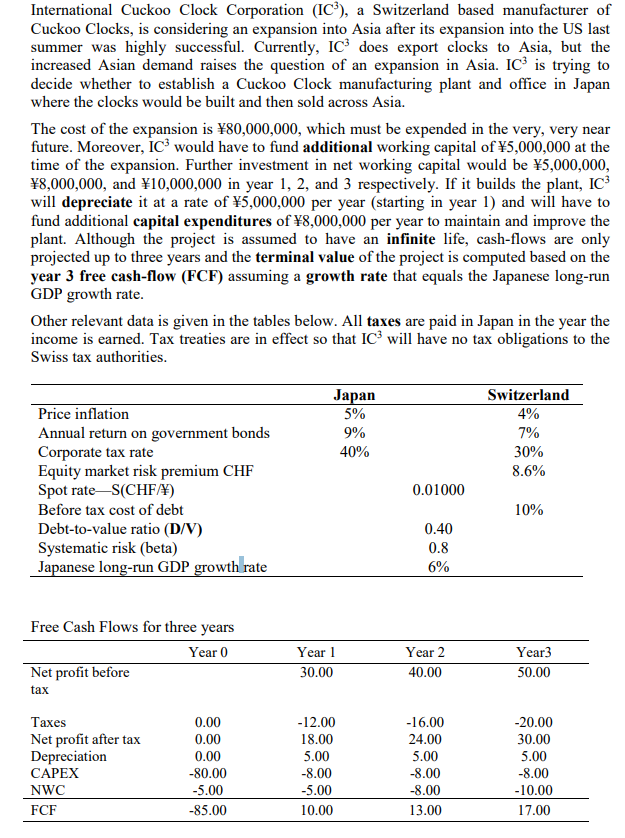

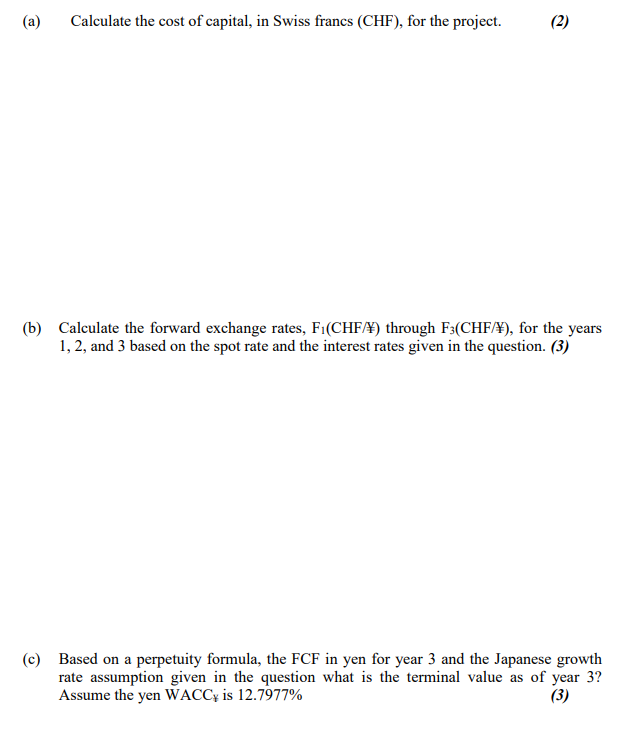

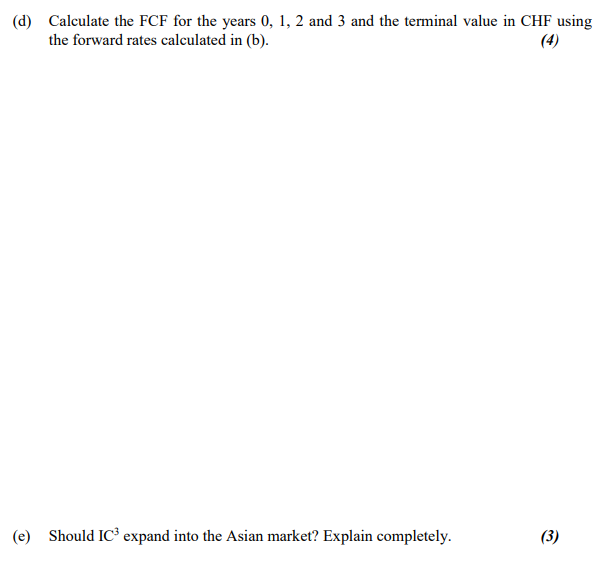

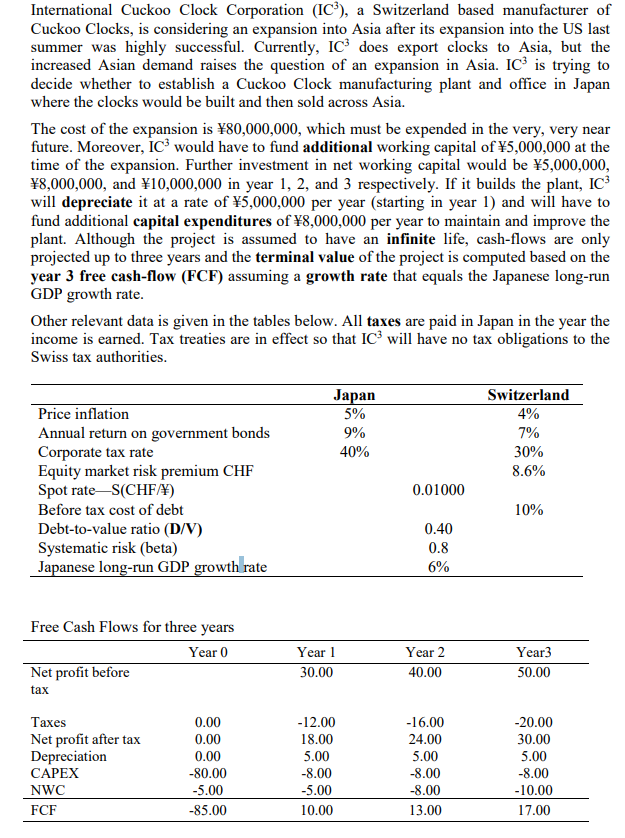

International Cuckoo Clock Corporation (IC), a Switzerland based manufacturer of Cuckoo Clocks, is considering an expansion into Asia after its expansion into the US last summer was highly successful. Currently, IC does export clocks to Asia, but the increased Asian demand raises the question of an expansion in Asia. IC is trying to decide whether to establish a Cuckoo Clock manufacturing plant and office in Japan where the clocks would be built and then sold across Asia. The cost of the expansion is 80,000,000, which must be expended in the very, very near future. Moreover, I would have to fund additional working capital of 5,000,000 at the time of the expansion. Further investment in net working capital would be 5,000,000, 8,000,000, and 10,000,000 in year 1, 2, and 3 respectively. If it builds the plant, IC3 will depreciate it at a rate of 5,000,000 per year (starting in year 1) and will have to fund additional capital expenditures of 8,000,000 per year to maintain and improve the plant. Although the project is assumed to have an infinite life, cash-flows are only projected up to three years and the terminal value of the project is computed based on the year 3 free cash-flow (FCF) assuming a growth rate that equals the Japanese long-run GDP growth rate. Other relevant data is given in the tables below. All taxes are paid in Japan in the year the income is earned. Tax treaties are in effect so that I will have no tax obligations to the Swiss tax authorities. Japan 5% 9% 40% Switzerland 4% 7% 30% 8.6% Price inflation Annual return on government bonds Corporate tax rate Equity market risk premium CHF Spot rateS(CHF/) Before tax cost of debt Debt-to-value ratio (D/V) Systematic risk (beta) Japanese long-run GDP growth rate 0.01000 10% 0.40 0.8 6% Free Cash Flows for three years Year 0 Net profit before tax Year 1 30.00 Year 2 40.00 Year3 50.00 Taxes Net profit after tax Depreciation CAPEX NWC FCF 0.00 0.00 0.00 -80.00 -5.00 -85.00 -12.00 18.00 5.00 -8.00 -5.00 10.00 -16.00 24.00 5.00 -8.00 -8.00 13.00 -20.00 30.00 5.00 -8.00 -10.00 17.00 (a) Calculate the cost of capital, in Swiss francs (CHF), for the project. (2) (b) Calculate the forward exchange rates, F (CHF/) through F3(CHF/), for the years 1, 2, and 3 based on the spot rate and the interest rates given in the question. (3) (c) Based on a perpetuity formula, the FCF in yen for year 3 and the Japanese growth rate assumption given in the question what is the terminal value as of year 3? Assume the yen WACCy is 12.7977% (3) (d) Calculate the FCF for the years 0, 1, 2 and 3 and the terminal value in CHF using the forward rates calculated in (b). (4) (e) Should IC expand into the Asian market? Explain completely. (3) International Cuckoo Clock Corporation (IC), a Switzerland based manufacturer of Cuckoo Clocks, is considering an expansion into Asia after its expansion into the US last summer was highly successful. Currently, IC does export clocks to Asia, but the increased Asian demand raises the question of an expansion in Asia. IC is trying to decide whether to establish a Cuckoo Clock manufacturing plant and office in Japan where the clocks would be built and then sold across Asia. The cost of the expansion is 80,000,000, which must be expended in the very, very near future. Moreover, I would have to fund additional working capital of 5,000,000 at the time of the expansion. Further investment in net working capital would be 5,000,000, 8,000,000, and 10,000,000 in year 1, 2, and 3 respectively. If it builds the plant, IC3 will depreciate it at a rate of 5,000,000 per year (starting in year 1) and will have to fund additional capital expenditures of 8,000,000 per year to maintain and improve the plant. Although the project is assumed to have an infinite life, cash-flows are only projected up to three years and the terminal value of the project is computed based on the year 3 free cash-flow (FCF) assuming a growth rate that equals the Japanese long-run GDP growth rate. Other relevant data is given in the tables below. All taxes are paid in Japan in the year the income is earned. Tax treaties are in effect so that I will have no tax obligations to the Swiss tax authorities. Japan 5% 9% 40% Switzerland 4% 7% 30% 8.6% Price inflation Annual return on government bonds Corporate tax rate Equity market risk premium CHF Spot rateS(CHF/) Before tax cost of debt Debt-to-value ratio (D/V) Systematic risk (beta) Japanese long-run GDP growth rate 0.01000 10% 0.40 0.8 6% Free Cash Flows for three years Year 0 Net profit before tax Year 1 30.00 Year 2 40.00 Year3 50.00 Taxes Net profit after tax Depreciation CAPEX NWC FCF 0.00 0.00 0.00 -80.00 -5.00 -85.00 -12.00 18.00 5.00 -8.00 -5.00 10.00 -16.00 24.00 5.00 -8.00 -8.00 13.00 -20.00 30.00 5.00 -8.00 -10.00 17.00 (a) Calculate the cost of capital, in Swiss francs (CHF), for the project. (2) (b) Calculate the forward exchange rates, F (CHF/) through F3(CHF/), for the years 1, 2, and 3 based on the spot rate and the interest rates given in the question. (3) (c) Based on a perpetuity formula, the FCF in yen for year 3 and the Japanese growth rate assumption given in the question what is the terminal value as of year 3? Assume the yen WACCy is 12.7977% (3) (d) Calculate the FCF for the years 0, 1, 2 and 3 and the terminal value in CHF using the forward rates calculated in (b). (4) (e) Should IC expand into the Asian market? Explain completely. (3)