Answered step by step

Verified Expert Solution

Question

1 Approved Answer

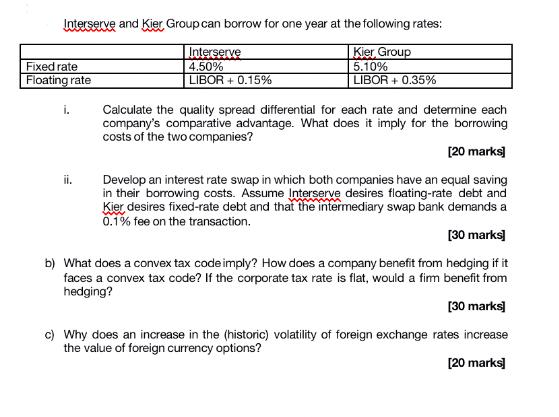

Interserve and Kier Group can borrow for one year at the following rates: Interserve 4.50% Kier Group 5.10% LIBOR + 0.15% LIBOR +0.35% Fixed

Interserve and Kier Group can borrow for one year at the following rates: Interserve 4.50% Kier Group 5.10% LIBOR + 0.15% LIBOR +0.35% Fixed rate Floating rate Calculate the quality spread differential for each rate and determine each company's comparative advantage. What does it imply for the borrowing costs of the two companies? [20 marks] Develop an interest rate swap in which both companies have an equal saving in their borrowing costs. Assume Interserve desires floating-rate debt and Kier desires fixed-rate debt and that the intermediary swap bank demands a 0.1% fee on the transaction. [30 marks] b) What does a convex tax code imply? How does a company benefit from hedging if it faces a convex tax code? If the corporate tax rate is flat, would a firm benefit from hedging? i. ii. [30 marks] c) Why does an increase in the (historic) volatility of foreign exchange rates increase the value of foreign currency options? [20 marks]

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a Quality spread differential refers to the difference between the borrowing rate of two companies with similar credit ratings In this case the qualit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started