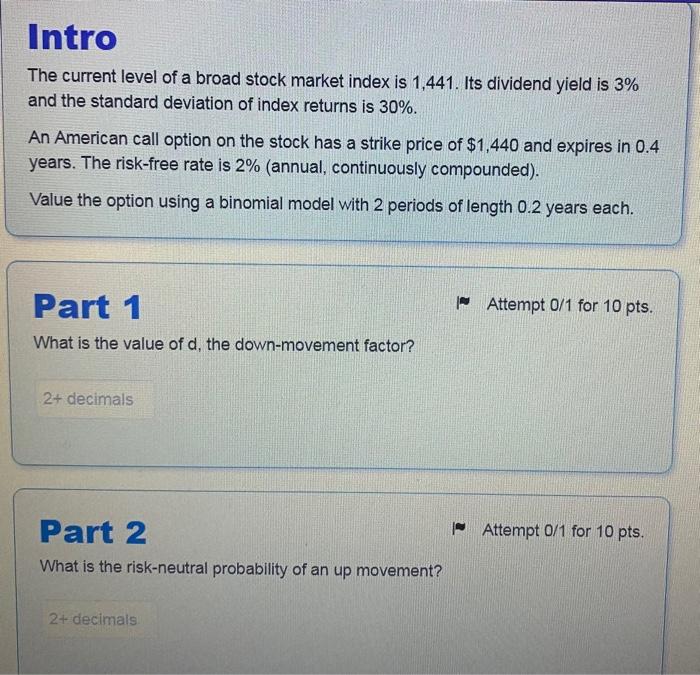

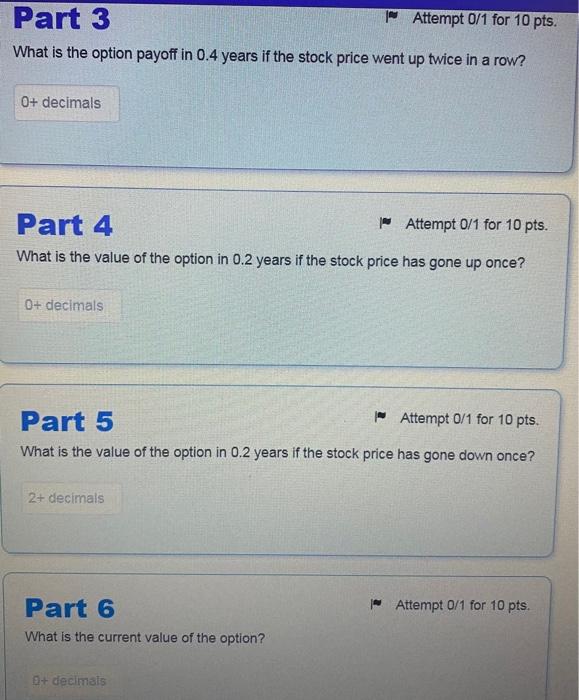

Intro The current level of a broad stock market index is 1,441. Its dividend yield is 3% and the standard deviation of index returns is 30%. An American call option on the stock has a strike price of $1,440 and expires in 0.4 years. The risk-free rate is 2% (annual, continuously compounded). Value the option using a binomial model with 2 periods of length 0.2 years each. - Attempt 0/1 for 10 pts. Part 1 What is the value of d, the down-movement factor? 2+ decimals - Attempt 0/1 for 10 pts. Part 2 What is the risk-neutral probability of an up movement? 2+ decimals Part 3 | Attempt 0/1 for 10 pts. What is the option payoff in 0.4 years if the stock price went up twice in a row? 0+ decimals Part 4 | Attempt 0/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone up once? 0+ decimals Part 5 - Attempt 0/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone down once? 2+ decimals | Attempt 0/1 for 10 pts. Part 6 What is the current value of the option? 0+ decimals Intro The current level of a broad stock market index is 1,441. Its dividend yield is 3% and the standard deviation of index returns is 30%. An American call option on the stock has a strike price of $1,440 and expires in 0.4 years. The risk-free rate is 2% (annual, continuously compounded). Value the option using a binomial model with 2 periods of length 0.2 years each. - Attempt 0/1 for 10 pts. Part 1 What is the value of d, the down-movement factor? 2+ decimals - Attempt 0/1 for 10 pts. Part 2 What is the risk-neutral probability of an up movement? 2+ decimals Part 3 | Attempt 0/1 for 10 pts. What is the option payoff in 0.4 years if the stock price went up twice in a row? 0+ decimals Part 4 | Attempt 0/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone up once? 0+ decimals Part 5 - Attempt 0/1 for 10 pts. What is the value of the option in 0.2 years if the stock price has gone down once? 2+ decimals | Attempt 0/1 for 10 pts. Part 6 What is the current value of the option? 0+ decimals