Question

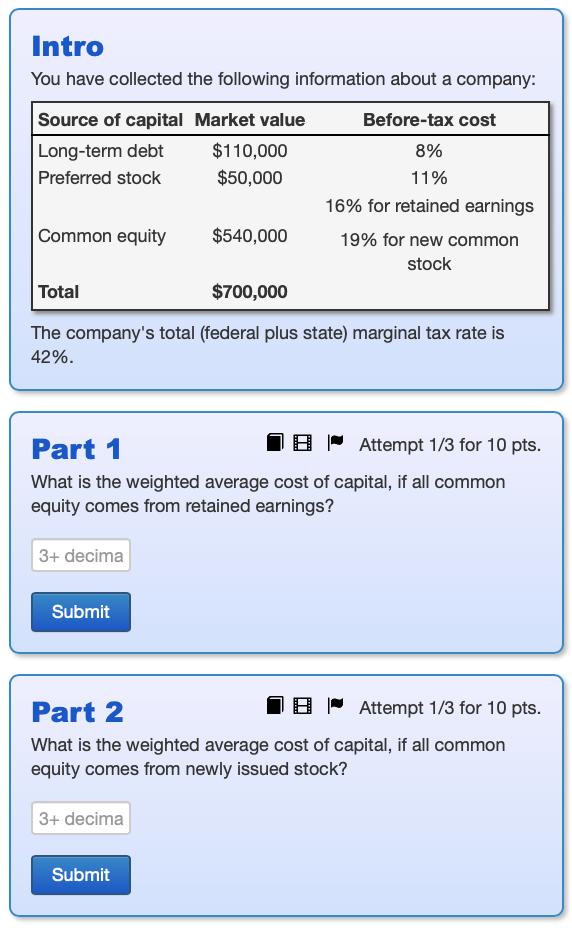

Intro You have collected the following information about a company: Source of capital Market value Before-tax cost Long-term debt $110,000 8% Preferred stock $50,000

Intro You have collected the following information about a company: Source of capital Market value Before-tax cost Long-term debt $110,000 8% Preferred stock $50,000 11% 16% for retained earnings Common equity $540,000 19% for new common stock Total $700,000 The company's total (federal plus state) marginal tax rate is 42%. Part 1 Attempt 1/3 for 10 pts. What is the weighted average cost of capital, if all common equity comes from retained earnings? 3+ decima Submit Part 2 Attempt 1/3 for 10 pts. What is the weighted average cost of capital, if all common equity comes from newly issued stock? 3+ decima Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Corporate Finance

Authors: Aswath Damodaran

4th edition

978-1-118-9185, 9781118918562, 1118808932, 1118918568, 978-1118808931

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App