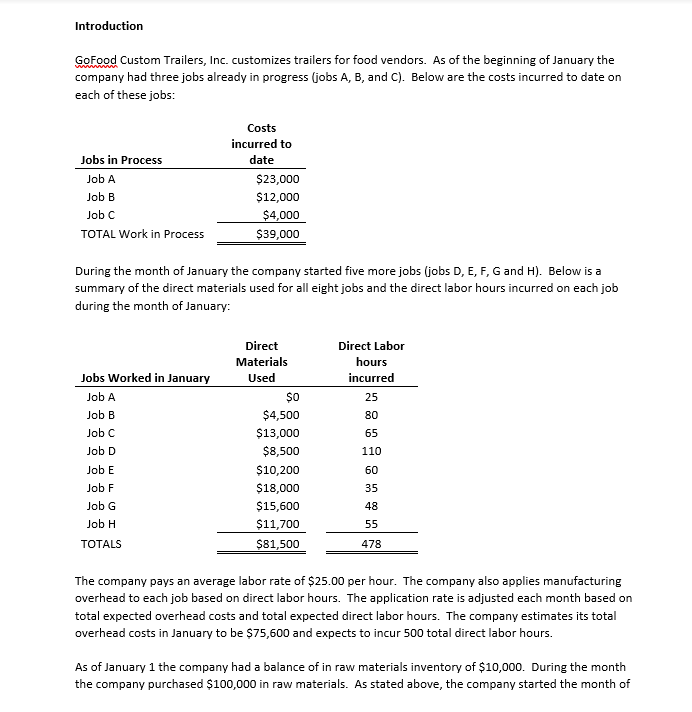

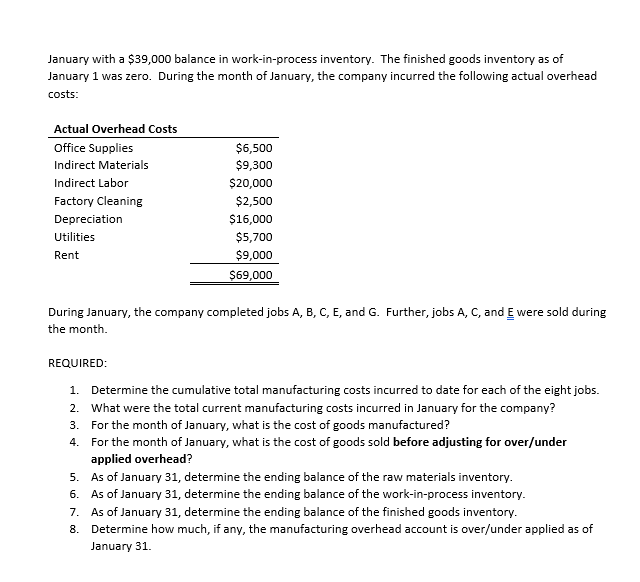

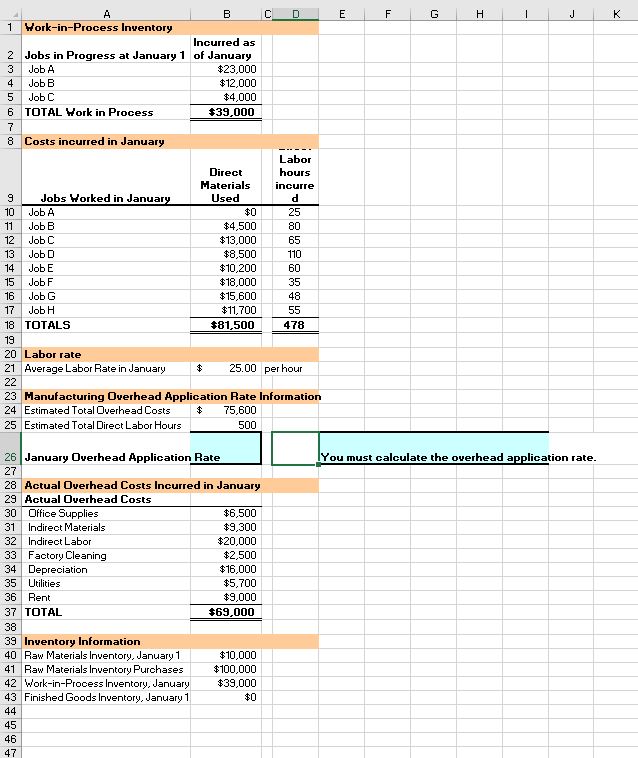

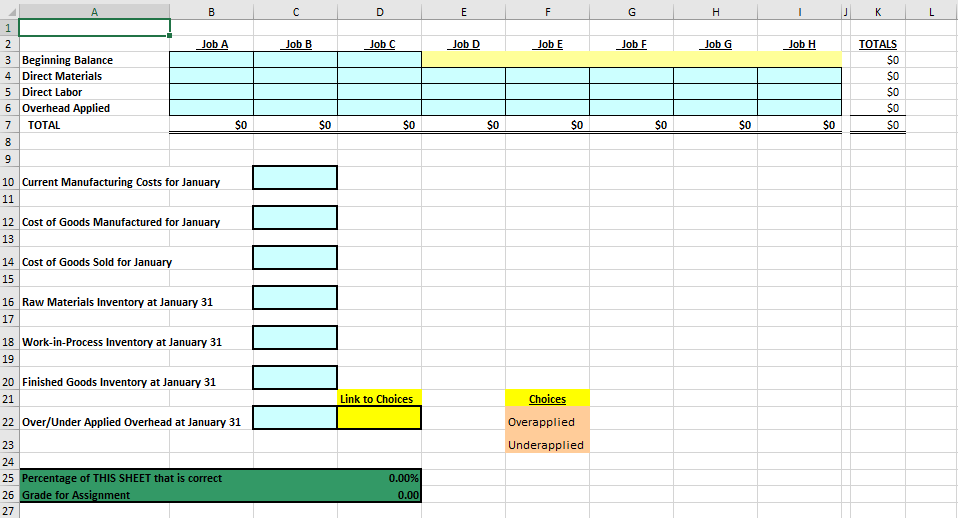

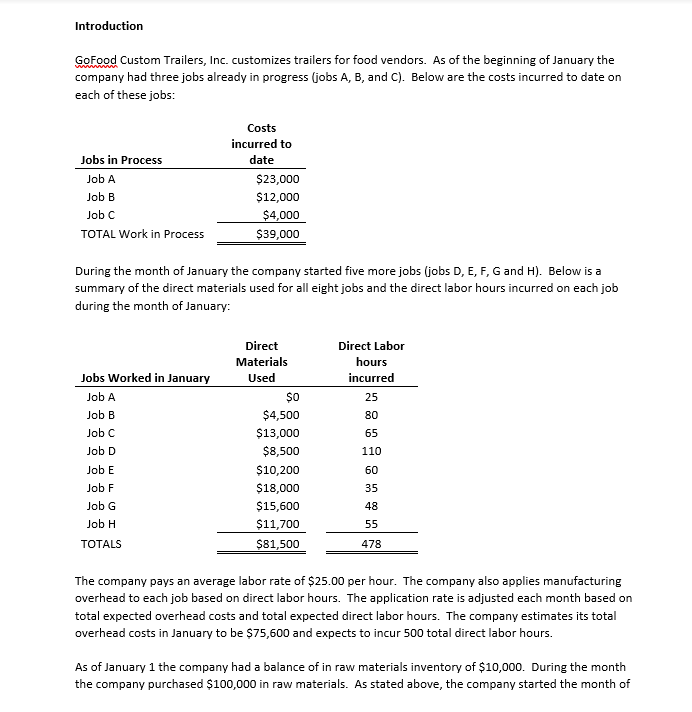

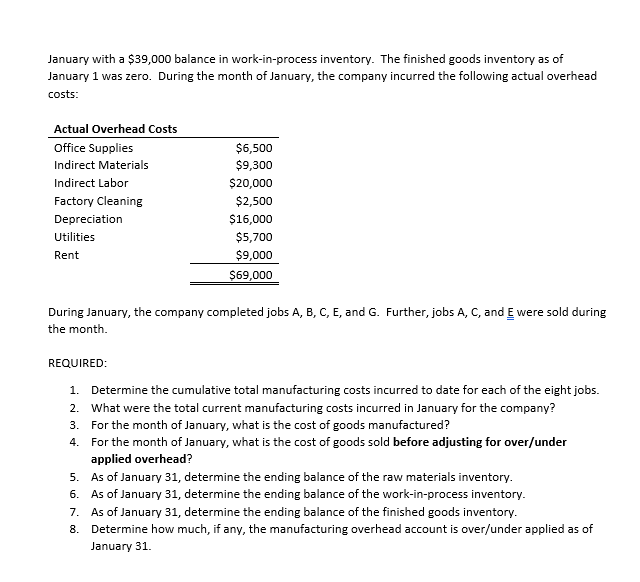

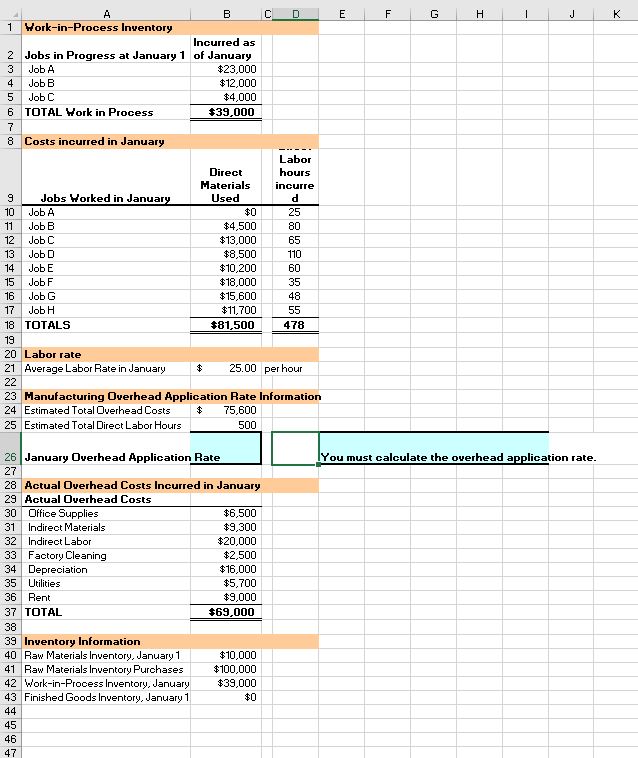

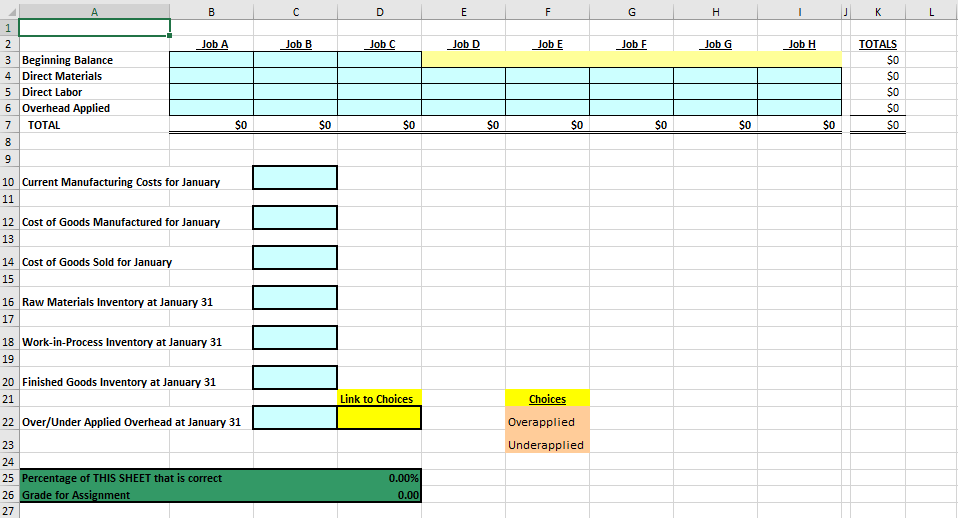

Introduction GoFood Custom Trailers, Inc. customizes trailers for food vendors. As of the beginning of January the company had three jobs already in progress (jobs A, B, and C). Below are the costs incurred to date on each of these jobs: Jobs in Process JobA Job B Job C TOTAL Work in Process Costs incurred to date $23,000 $12,000 $4,000 $39,000 During the month of January the company started five more jobs (jobs D, E, F, G and H). Below is a summary of the direct materials used for all eight jobs and the direct labor hours incurred on each job during the month of January: Direct Labor hours incurred 25 Direct Materials Used $0 $4,500 $13,000 $8,500 $10,200 $18,000 $15,600 $11,700 $81,500 Jobs Worked in January JobA Job B Job C Job D Job E Job F Job G Job H TOTALS 80 65 110 60 35 48 55 478 The company pays an average labor rate of $25.00 per hour. The company also applies manufacturing overhead to each job based on direct labor hours. The application rate is adjusted each month based on total expected overhead costs and total expected direct labor hours. The company estimates its total overhead costs in January to be $75,600 and expects to incur 500 total direct labor hours. As of January 1 the company had a balance of in raw materials inventory of $10,000. During the month the company purchased $100,000 in raw materials. As stated above, the company started the month of January with a $39,000 balance in work-in-process inventory. The finished goods inventory as of January 1 was zero. During the month of January, the company incurred the following actual overhead costs: Actual Overhead Costs Office Supplies Indirect Materials Indirect Labor Factory Cleaning Depreciation Utilities Rent $6,500 $9,300 $20,000 $2,500 $16,000 $5,700 $9,000 $69,000 During January, the company completed jobs A, B, C, E, and G. Further, jobs A, C, and E were sold during the month. REQUIRED: 1. Determine the cumulative total manufacturing costs incurred to date for each of the eight jobs. 2. What were the total current manufacturing costs incurred in January for the company? 3. For the month of January, what is the cost of goods manufactured? 4. For the month of January, what is the cost of goods sold before adjusting for over/under applied overhead? 5. As of January 31, determine the ending balance of the raw materials inventory. 6. As of January 31, determine the ending balance of the work-in-process inventory. 7. As of January 31, determine the ending balance of the finished goods inventory. Determine how much, if any, the manufacturing overhead account is over/under applied as of January 31. 8. E F G H 1 J K A B C D 1 Work-in-Process Inventory Incurred as 2 Jobs in Progress at January 1 of January 3 Job A $23,000 4 Job B $12,000 5 Job C $4,000 6 TOTAL Work in Process $39,000 7 8 Costs incurred in January Labor Direct hours Materials incurre 9 Jobs Worked in January Used d 10 JobA 25 11 Job B $4,500 80 12 Job C $13,000 65 13 Job D $8,500 110 14 Job E $10,200 60 15 Job F $18,000 35 16 JobG $15,600 48 17 JobH $11,700 55 18 TOTALS $81,500 478 19 20 Labor rate 21 Average Labor Rate in January $ 25.00 per hour 22 23 Manufacturing Overhead Application Rate Information 24 Estimated Total Overhead Costs 75,600 25 Estimated Total Direct Labor Hours 500 You must calculate the overhead application rate. 26 January Overhead Application Rate 27 28 Actual Overhead Costs Incurred in January 29 Actual Overhead Costs 30 Office Supplies $6,500 31 Indirect Materials $9,300 32 Indirect Labor $20,000 33 Factory Cleaning $2,500 34 Depreciation $16,000 35 Utilities $5,700 36 Rent $9,000 37 TOTAL $69,000 38 39 Inventory Information 40 Raw Materials Inventory, January 1 $10,000 41 Raw Materials Inventory Purchases $100,000 42 Work-in-Process Inventory, January $39,000 43 Finished Goods Inventory, January 1 44 45 46 47 A B D E F G . 1 K 1 Job A Job B Job C Job D Job E Job F Job G Job H 2 3 Beginning Balance 4 Direct Materials 5 Direct Labor 6 Overhead Applied 7 TOTAL 8 TOTALS $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 000 10 Current Manufacturing Costs for January 11 12 Cost of Goods Manufactured for January 13 14 Cost of Goods Sold for January 15 16 Raw Materials Inventory at January 31 000000 17 18 Work-in-Process Inventory at January 31 19 20 Finished Goods Inventory at January 31 21 Link to Choices Choices Overapplied Underapplied 22 Over/Under Applied Overhead at January 31 23 24 25 Percentage of THIS SHEET that is correct 26 Grade for Assignment 27 0.00% 0.00