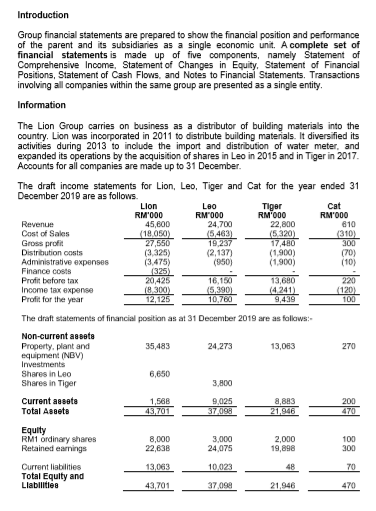

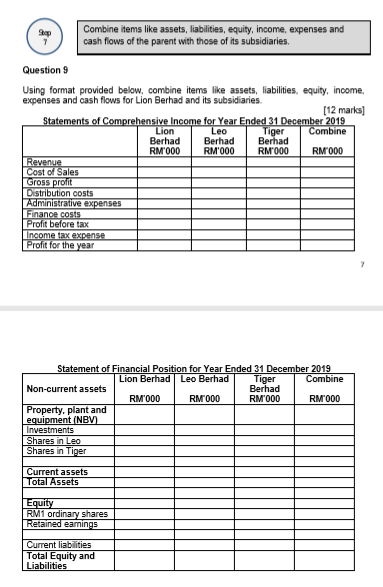

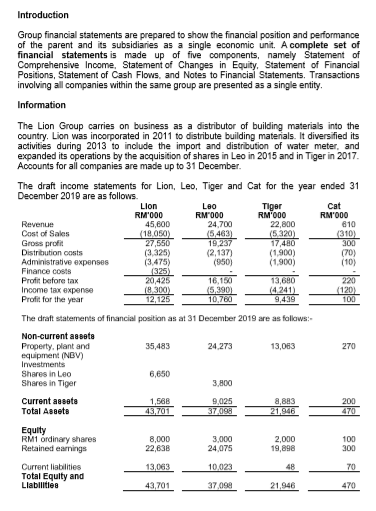

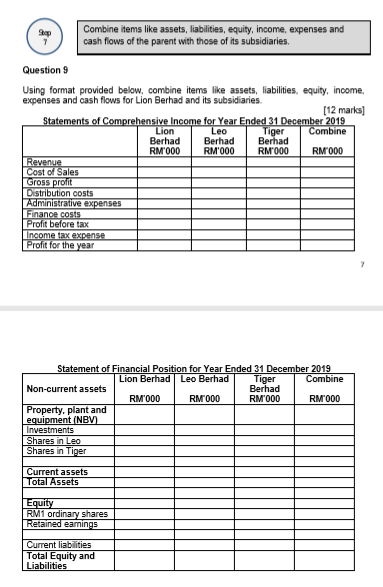

Introduction Group financial statements are prepared to show the financial position and performance of the parent and its subsidiaries as a single economic unit A complete set of financial statements is made up of five components, namely Statement of Comprehensive Income Statement of Changes in Equity Statement of Financial Positions, Statement of Cash Flows, and Notes to Financial Statements. Transactions involving all companies within the same group are presented as a single entity Information The Lion Group carries on business as a distributor of building materials into the country. Lion was incorporated in 2011 to distribute building materials. It diversified its activities during 2013 to include the import and distribution of water meter, and expanded its operations by the acquisition of shares in Leo in 2015 and in Tiger in 2017 Accounts for all companies are made up to 31 December Cat 810 The draft income statements for Lion, Leo, Tiger and Cat for the year ended 31 December 2010 are as follows Lion Leo Tloer RM 000 RM000 RM"000 RM000 Revenue 45.600 24.700 22,800 Cost of Sales (18 050) (5.463) (5320) (310) Gr pro 27.550 19237 17,480 Distribution costs (3.325) (2,137 (1.900) Administrative expenses (3 475) (950) (1.900) Finance cost Profit before tax 20,425 Income tax expense 18300) (5.390) 14.241) Profit for the year 2125 10.700 9.459 1375 16.150 13 100 The draft statements of financial position as at 31 December 2019 are as follows: 35,483 24.273 13,063 Non-current asseta Property, plant and equipment (NBV) Investments Shares in Leo Shares in Tiger 6,650 3.800 Current assets Total Assets 9.025 377098 R Equity ondary shares Retained earnings 8.000 22.638 3.000 24.075 2.000 19 ROR 100 500 13.063 10.023 Current liabilities Total Equity and Liabilities 43701 37 099 21946 470 Combine items like assets, liabilities, equity, income, expenses and cash flows of the parent with those of its subsidiaries. PO Questions Using format provided below, combine items like assets. liabilities, equity, income expenses and cash flows for Lion Berhad and its subsidiaries [12 marks] Statements of Comprehensive Income for Year Ended 31 December 2019 Lion Tiger Combine Berhad Berhad 1 Berhad RM000 RM000 RM000 RM000 Revenue cost sales Gross pro Distribution costs Administrative expenses Finance cost Profit before tax Income tax expense Profit for the year Statement of Financial Position for Year Ended 31 December 2019 Lion Berhad Leo Berhad Tiger Combine Non-current assets Berhad RM000 RM8000 RM8000 RM000 Property, plant and equipment (NBV) Investments Shares in Leo Shares in Tiger Current assets Total Assets Equity RM ordinary shares Retained earnings Current liabilities Total Equity and Liabilities