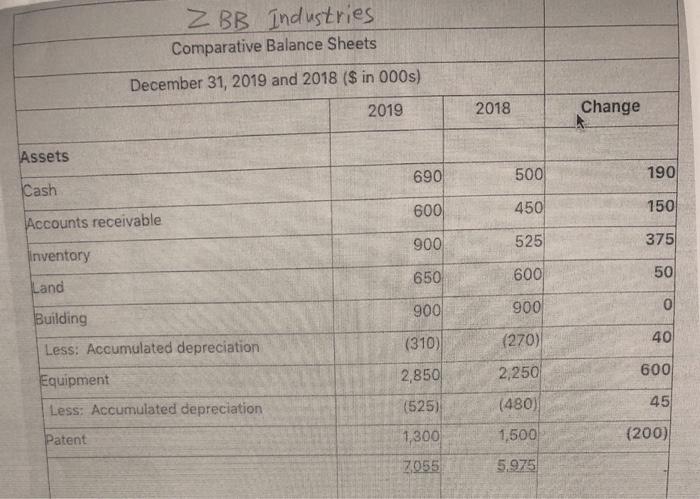

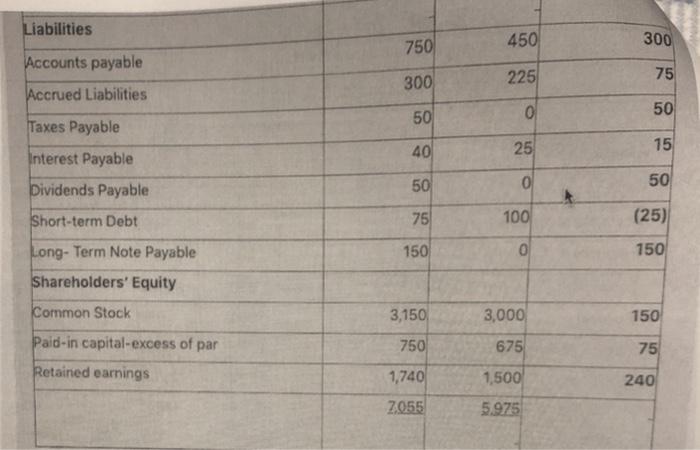

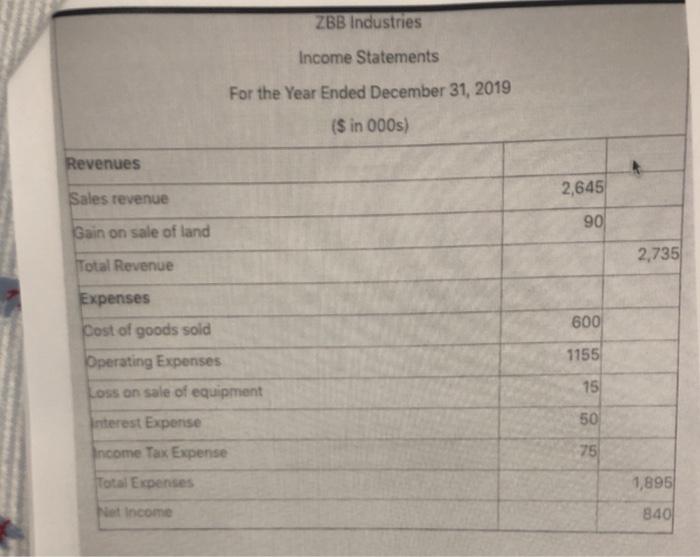

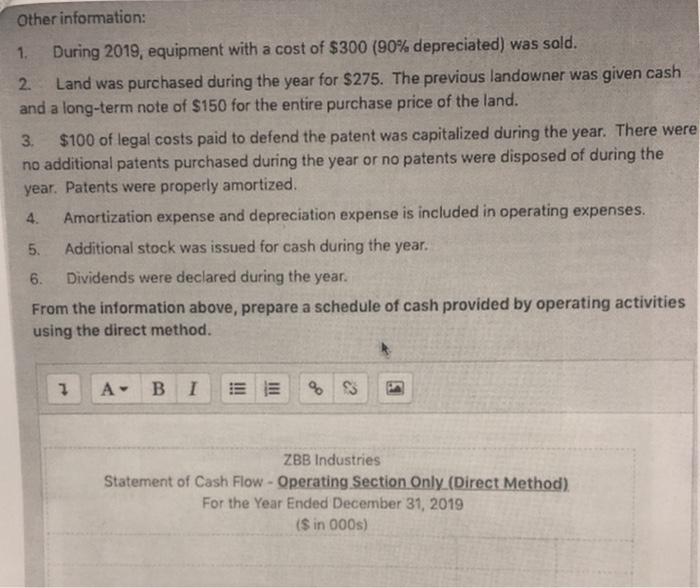

ZBB Industries Comparative Balance Sheets December 31, 2019 and 2018 ($ in 000s) 2019 2018 Change Assets 690 500 190 Cash 600 450 150 Accounts receivable 900 525 375 Inventory 650 600 50 Land 900 900 0 (270) 40 Building Less: Accumulated depreciation Equipment (310) 2,850 2,250 600 (525) Less: Accumulated depreciation (480) 45 Patent 1,300 1,500 (200) 2055 5.975 ZBB Industries Income Statements For the Year Ended December 31, 2019 ($ in 000s) Revenues 2,645 Sales revenue 90 Gain on sale of land 2,735 Total Revenue Expenses 600 1155 Cost of goods sold Operating Expenses Loss on sale of equipment Interest Expense Income Tax Expense SSLC Total Expenses 1,895 Net Income 840 Other information: 1. During 2019, equipment with a cost of $300 (90% depreciated) was sold. 2. Land was purchased during the year for $275. The previous landowner was given cash and a long-term note of $150 for the entire purchase price of the land. 3. $100 of legal costs paid to defend the patent was capitalized during the year. There were no additional patents purchased during the year or no patents were disposed of during the year. Patents were properly amortized. 4. Amortization expense and depreciation expense is included in operating expenses. 5. Additional stock was issued for cash during the year. 6. Dividends were declared during the year. From the information above, prepare a schedule of cash provided by operating activities using the direct method. 1 A- % ZBB Industries Statement of Cash Flow - Operating Section Only (Direct Method), For the Year Ended December 31, 2019 ($ in 000s) ZBB Industries Comparative Balance Sheets December 31, 2019 and 2018 ($ in 000s) 2019 2018 Change Assets 690 500 190 Cash 600 450 150 Accounts receivable 900 525 375 Inventory 650 600 50 Land 900 900 0 (270) 40 Building Less: Accumulated depreciation Equipment (310) 2,850 2,250 600 (525) Less: Accumulated depreciation (480) 45 Patent 1,300 1,500 (200) 2055 5.975 ZBB Industries Income Statements For the Year Ended December 31, 2019 ($ in 000s) Revenues 2,645 Sales revenue 90 Gain on sale of land 2,735 Total Revenue Expenses 600 1155 Cost of goods sold Operating Expenses Loss on sale of equipment Interest Expense Income Tax Expense SSLC Total Expenses 1,895 Net Income 840 Other information: 1. During 2019, equipment with a cost of $300 (90% depreciated) was sold. 2. Land was purchased during the year for $275. The previous landowner was given cash and a long-term note of $150 for the entire purchase price of the land. 3. $100 of legal costs paid to defend the patent was capitalized during the year. There were no additional patents purchased during the year or no patents were disposed of during the year. Patents were properly amortized. 4. Amortization expense and depreciation expense is included in operating expenses. 5. Additional stock was issued for cash during the year. 6. Dividends were declared during the year. From the information above, prepare a schedule of cash provided by operating activities using the direct method. 1 A- % ZBB Industries Statement of Cash Flow - Operating Section Only (Direct Method), For the Year Ended December 31, 2019 ($ in 000s)