Question

INTRODUCTION Janet McKinley is employed by the Quality Products Corporation, a publicly traded conglomerate. The corporation manufactures and sells many different kinds of products, including

INTRODUCTION

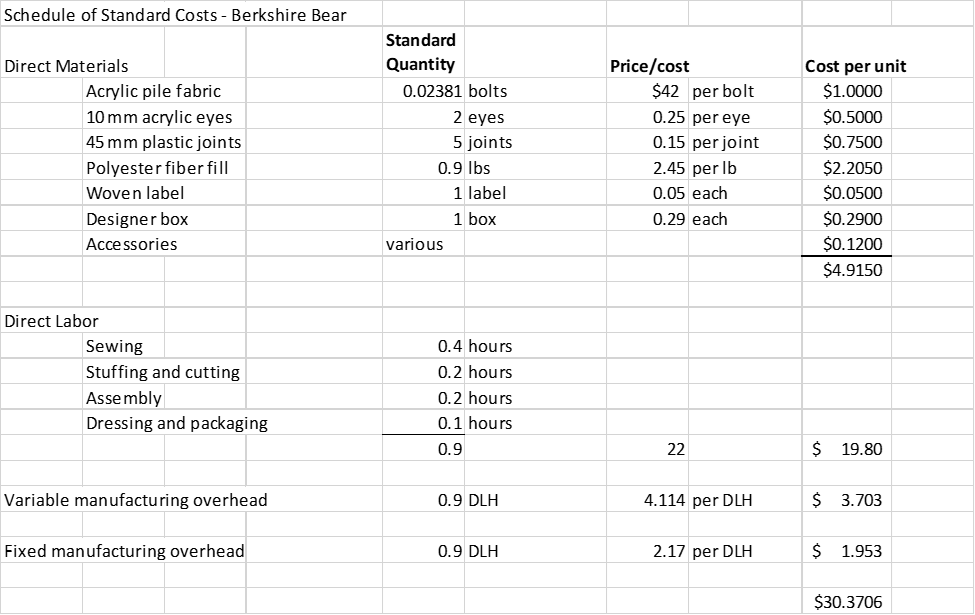

Janet McKinley is employed by the Quality Products Corporation, a publicly traded conglomerate. The corporation manufactures and sells many different kinds of products, including luggage, music synthesizers, breakfast cereals, peanut butter, and children's toys. McKinley is Vice President in charge of the Berkshire Toy Company, a division of Quality Products.

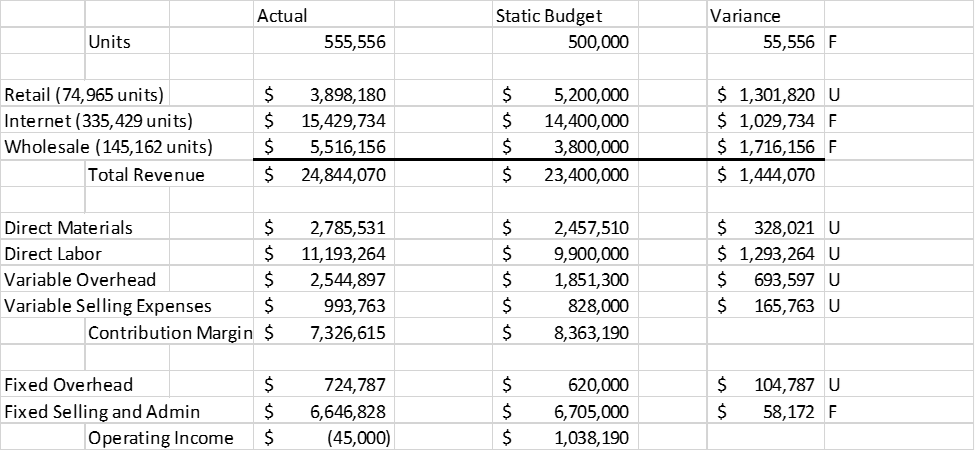

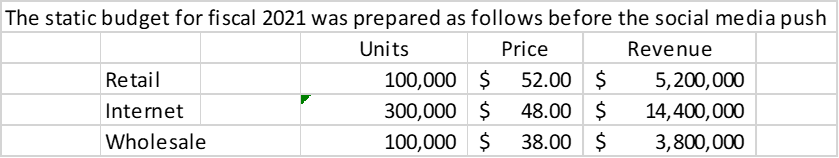

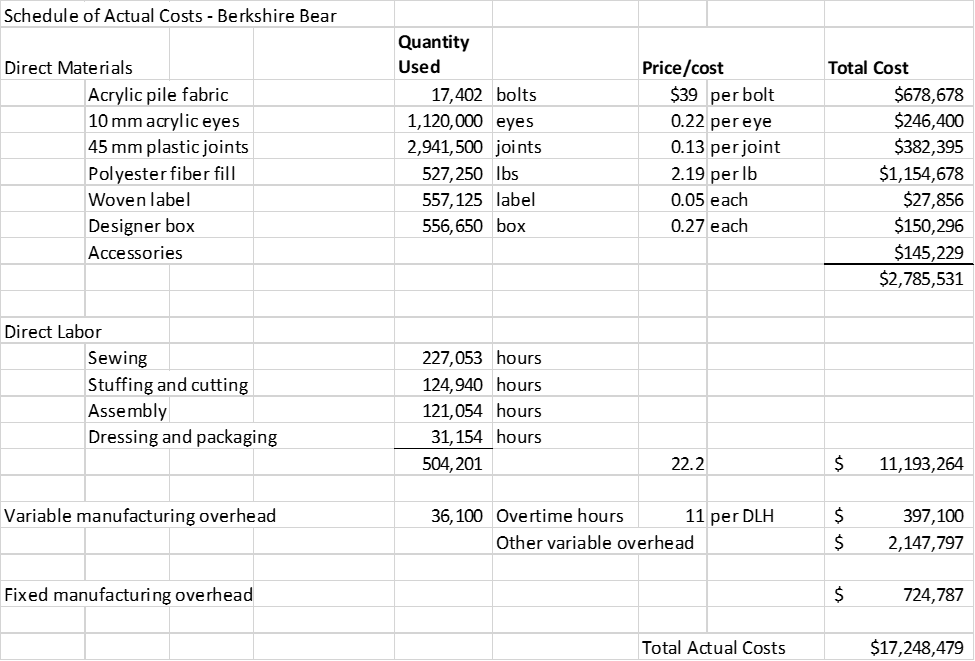

It is late July 2021 and McKinley has just received the preliminary income statement for her division for the year ended June 30, 2021 (see Table 1). The master (static) budget and master budget variances for the same period are included for comparison purposes. McKinley looks at the bottom line, a loss approaching a million dollars, then picks up the phone to call you. You are an accountant in the controller's office at the headquarters of Quality Products Corporation. You worked with McKinley when her company was acquired by Quality Products, and now she has called you for advice.

"I know the bottom line looks pretty bad," she says. "But we made great strides this year. Sales are higher than ever. Customers love our product and respect our quality. There must be a way to make this business work and turn a profit, too. The budget variances should provide some insights. Could you do an analysis of the budget variances?"

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started