Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Introduction: Risk is an important concept in financial analysis, especially in terms of how it affects security prices and rates of return. The risk

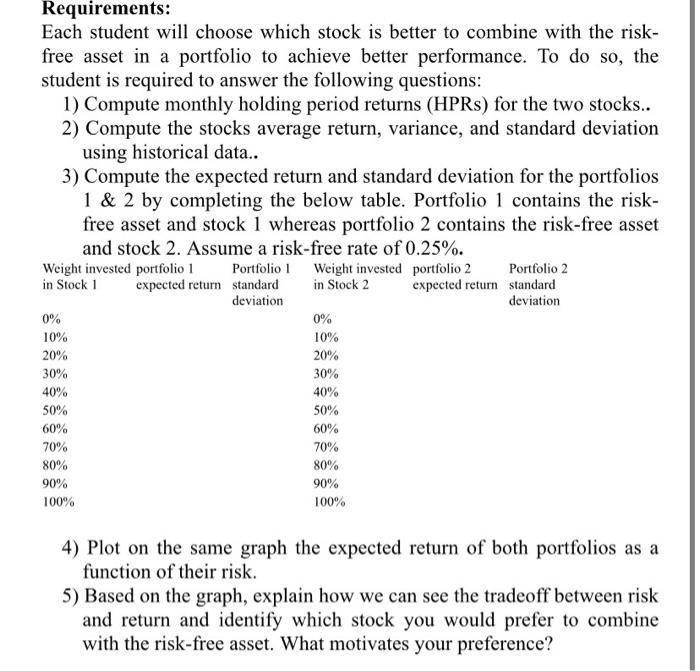

Introduction: Risk is an important concept in financial analysis, especially in terms of how it affects security prices and rates of return. The risk and return tradeoff is defined as the principle that potential return rises with an increase in risk. Low levels of uncertainty (low-risk) are associated with low potential returns, whereas high levels of uncertainty (high-risk) are associated with high potential returns. In today's information technology world, real time financial data are readily available via the Internet. Students and investors now have easy access to on-line databases. Student will be able to demonstrate how to measure a risk and return for a stock and for a portfolio over time. Risk and returns are key ingredients in portfolio theory. THE RISK AND RETURN CALCULATION Students will download the relevant stock prices for two companies from the Internet and perform risk and return calculations for the selected companies. The purpose of this assignment is to provide students with the opportunity to: 1. Retrieve real time financial data via the Web; 2. Calculate the risk and return of selected stocks; 3. Construct a portfolio; 4. Calculate the portfolio's expected risk and return; Students are instructed to follow the path shown below to retrieve the risk and return for the selected companies via Qatar Stock Exchange. Go to Qatar stock exchange website: www.qe.com.qa From the menu, click on Publications then Market reports and them Trading reports Choose the 2020 and 2019 monthly trading reports and hit submit, and then download the closing prices. (you need the data for 2 years: 2019-2020) Requirements: Each student will choose which stock is better to combine with the risk- free asset in a portfolio to achieve better performance. To do so, the student is required to answer the following questions: 1) Compute monthly holding period returns (HPRs) for the two stocks.. 2) Compute the stocks average return, variance, and standard deviation using historical data.. 3) Compute the expected return and standard deviation for the portfolios 1 & 2 by completing the below table. Portfolio 1 contains the risk- free asset and stock 1 whereas portfolio 2 contains the risk-free asset and stock 2. Assume a risk-free rate of 0.25%. Portfolio 1 Weight invested in Stock 2 Weight invested portfolio 1 in Stock 1 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% expected return standard deviation 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% portfolio 2 expected return Portfolio 2 standard deviation 4) Plot on the same graph the expected return of both portfolios as a function of their risk. 5) Based on the graph, explain how we can see the tradeoff between risk and return and identify which stock you would prefer to combine with the risk-free asset. What motivates your preference?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It seems you have a detailed assignment related to calculating risk and return for stocks and constructing portfolios using historical financial data ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started