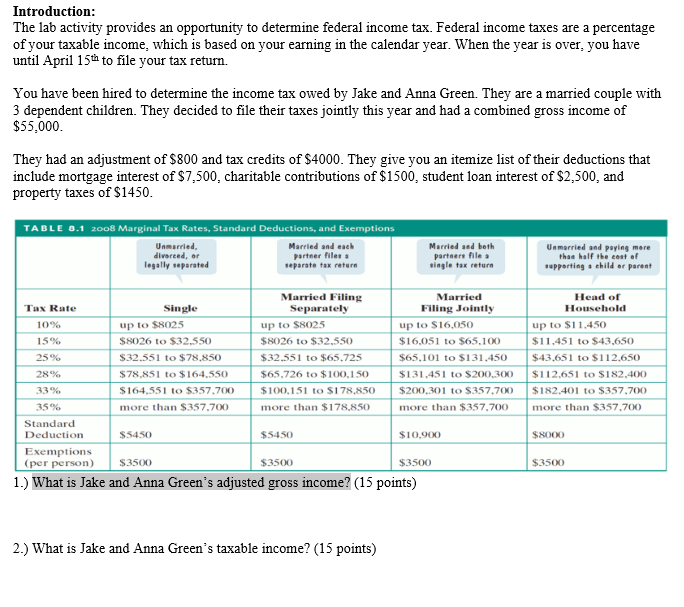

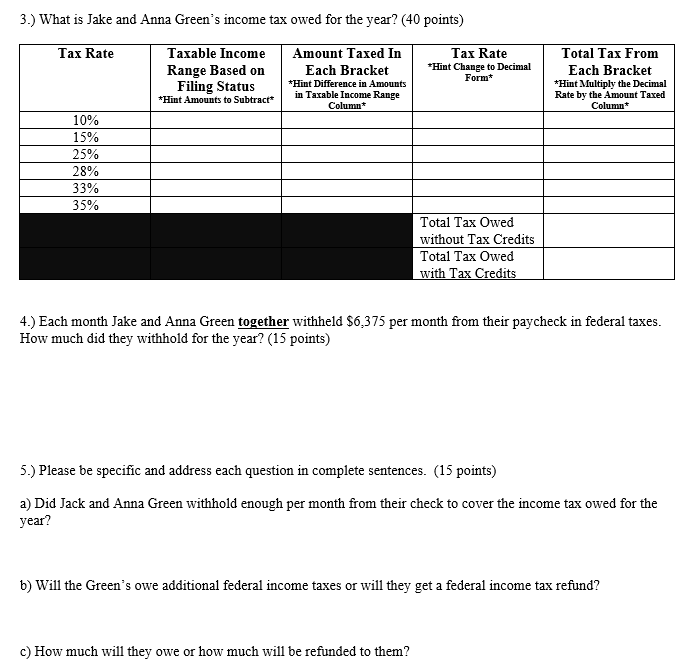

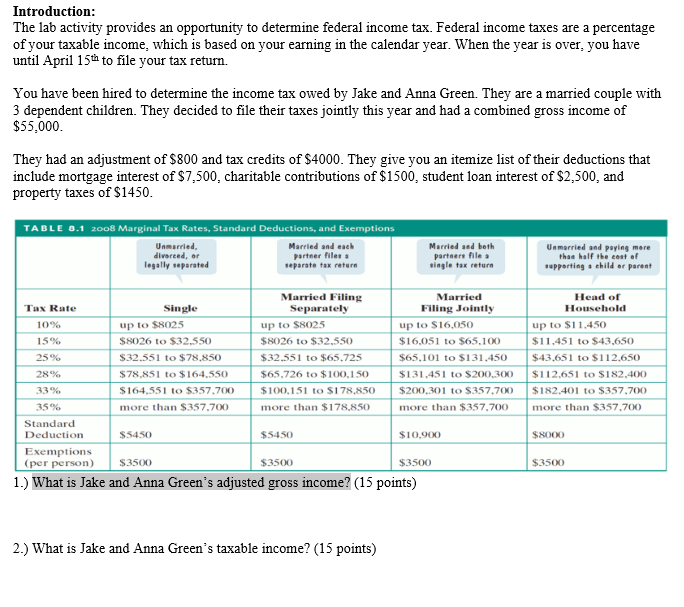

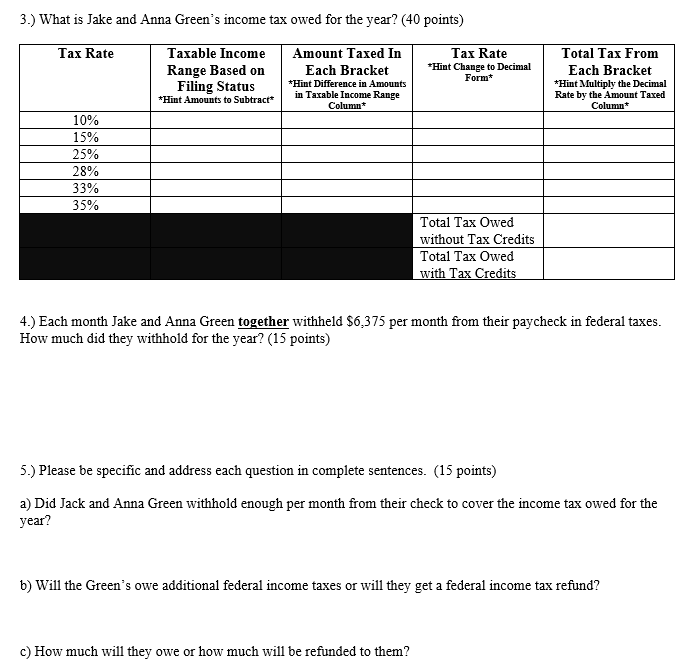

Introduction: The lab activity provides an opportunity to determine federal income tax. Federal income taxes are a percentage of your taxable income, which is based on your earning in the calendar year. When the year is over, you have until April 15th to file your tax return. You have been hired to determine the income tax owed by Jake and Anna Green. They are a married couple with 3 dependent children. They decided to file their taxes jointly this year and had a combined gross income of $55,000 They had an adjustment of $800 and tax credits of $4000. They give you an itemize list of their deductions that include mortgage interest of $7,500, charitable contributions of $1500, student loan interest of $2,500, and property taxes of $1450. TABLE 8.1 2008 Marginal Tax Rates, Standard Deductions, and Exemptions Unmarried Married and each divorced, or partner files a legally separated separate tax retur Married sed both partners file a single tax return Unmarried and paying more than half the cast of supporting child or parent Tax Rate 10% 15% 25% 28% 33% 35% Standard Deduction Exemptions (per person) Single up to $8025 $8026 to $32.550 $32.551 to $78.850 $78,851 to $164.550 $164.551 to $357.700 more than $357.700 Married Filing Separately up to S8025 $8026 to $32.550 $32,551 to $65.725 $65,726 to $100,150 $100.151 to $178,850 more than $178,850 Married Filing Jointly up to $16,050 $16,051 to $65.100 $65,101 to $131,450 $131,451 to $200,300 $200,301 to $357.700 more than $357.700 Head of Household up to $11.450 $11.451 to $43.650 $43,651 to $112,650 $112,651 to $182,400 $182,401 to $357,700 more than $357.700 $5450 $5450 $10.900 $8000 $3500 $3500 $3500 $3500 1.) What is Jake and Anna Green's adjusted gross income? (15 points) 2.) What is Jake and Anna Green's taxable income? (15 points) Total Tax From Each Bracket *Hint Multiply the Decimal Rate by the Amount Taxed Column Column 3.) What is Jake and Anna Green's income tax owed for the year? (40 points) Tax Rate Taxable Income Amount Taxed In Tax Rate Range Based on Each Bracket *Hint Change to Decimal Formt Filing Status *Hint Difference in Amounts *Hint Amounts to Subtract* in Taxable Income Range 10% 15% 25% 28% 33% 35% Total Tax Owed without Tax Credits Total Tax Owed with Tax Credits 4.) Each month Jake and Anna Green together withheld $6,375 per month from their paycheck in federal taxes. How much did they withhold for the year? (15 points) 5.) Please be specific and address each question in complete sentences. (15 points) a) Did Jack and Anna Green withhold enough per month from their check to cover the income tax owed for the year? b) Will the Green's owe additional federal income taxes or will they get a federal income tax refund? c) How much will they owe or how much will be refunded to them? Introduction: The lab activity provides an opportunity to determine federal income tax. Federal income taxes are a percentage of your taxable income, which is based on your earning in the calendar year. When the year is over, you have until April 15th to file your tax return. You have been hired to determine the income tax owed by Jake and Anna Green. They are a married couple with 3 dependent children. They decided to file their taxes jointly this year and had a combined gross income of $55,000 They had an adjustment of $800 and tax credits of $4000. They give you an itemize list of their deductions that include mortgage interest of $7,500, charitable contributions of $1500, student loan interest of $2,500, and property taxes of $1450. TABLE 8.1 2008 Marginal Tax Rates, Standard Deductions, and Exemptions Unmarried Married and each divorced, or partner files a legally separated separate tax retur Married sed both partners file a single tax return Unmarried and paying more than half the cast of supporting child or parent Tax Rate 10% 15% 25% 28% 33% 35% Standard Deduction Exemptions (per person) Single up to $8025 $8026 to $32.550 $32.551 to $78.850 $78,851 to $164.550 $164.551 to $357.700 more than $357.700 Married Filing Separately up to S8025 $8026 to $32.550 $32,551 to $65.725 $65,726 to $100,150 $100.151 to $178,850 more than $178,850 Married Filing Jointly up to $16,050 $16,051 to $65.100 $65,101 to $131,450 $131,451 to $200,300 $200,301 to $357.700 more than $357.700 Head of Household up to $11.450 $11.451 to $43.650 $43,651 to $112,650 $112,651 to $182,400 $182,401 to $357,700 more than $357.700 $5450 $5450 $10.900 $8000 $3500 $3500 $3500 $3500 1.) What is Jake and Anna Green's adjusted gross income? (15 points) 2.) What is Jake and Anna Green's taxable income? (15 points) Total Tax From Each Bracket *Hint Multiply the Decimal Rate by the Amount Taxed Column Column 3.) What is Jake and Anna Green's income tax owed for the year? (40 points) Tax Rate Taxable Income Amount Taxed In Tax Rate Range Based on Each Bracket *Hint Change to Decimal Formt Filing Status *Hint Difference in Amounts *Hint Amounts to Subtract* in Taxable Income Range 10% 15% 25% 28% 33% 35% Total Tax Owed without Tax Credits Total Tax Owed with Tax Credits 4.) Each month Jake and Anna Green together withheld $6,375 per month from their paycheck in federal taxes. How much did they withhold for the year? (15 points) 5.) Please be specific and address each question in complete sentences. (15 points) a) Did Jack and Anna Green withhold enough per month from their check to cover the income tax owed for the year? b) Will the Green's owe additional federal income taxes or will they get a federal income tax refund? c) How much will they owe or how much will be refunded to them