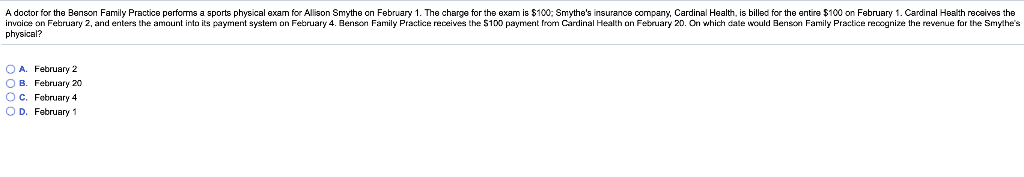

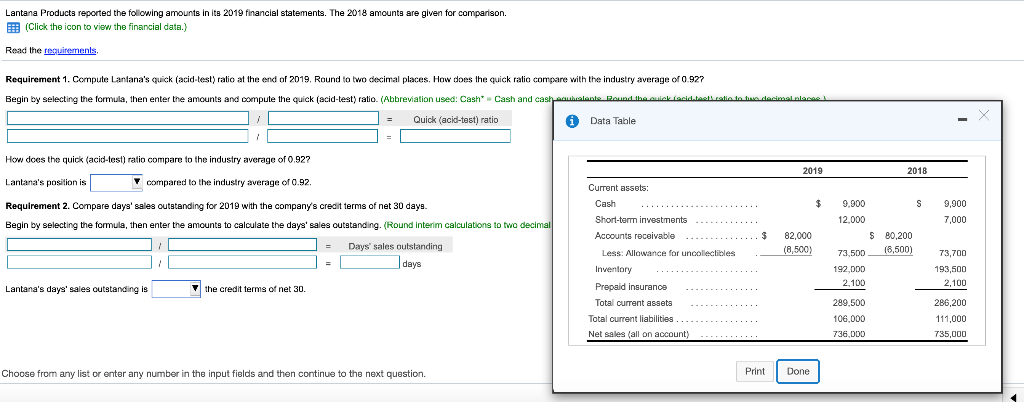

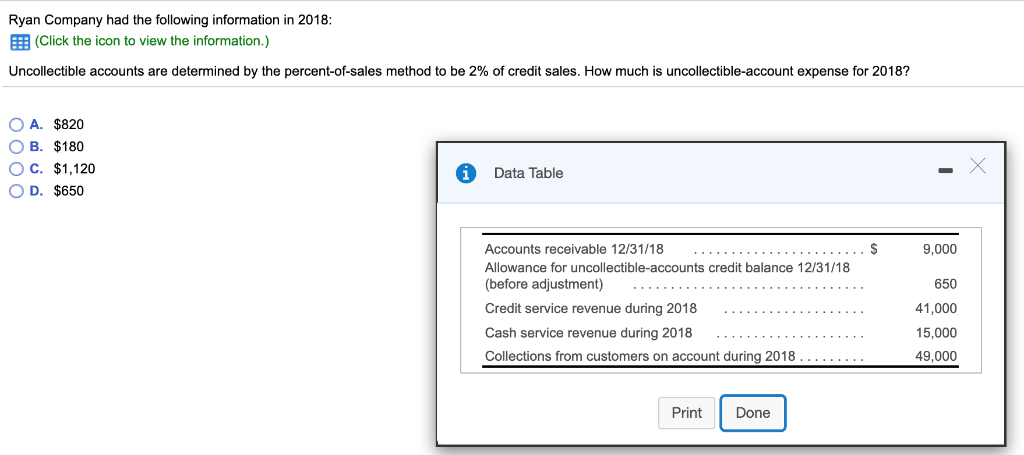

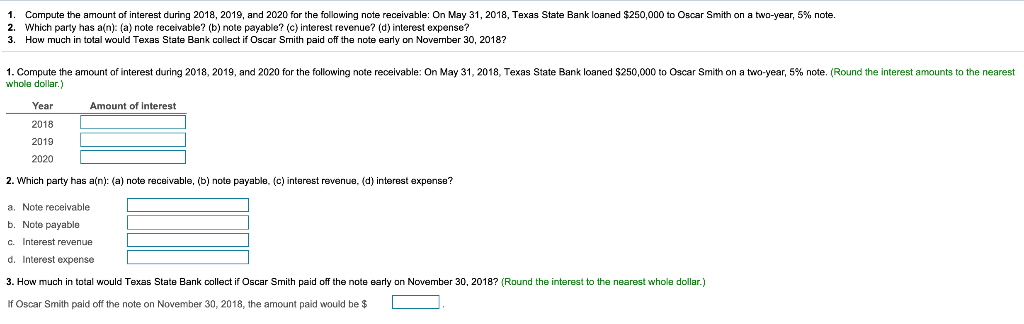

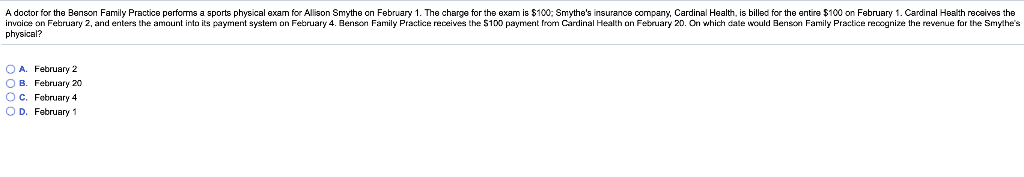

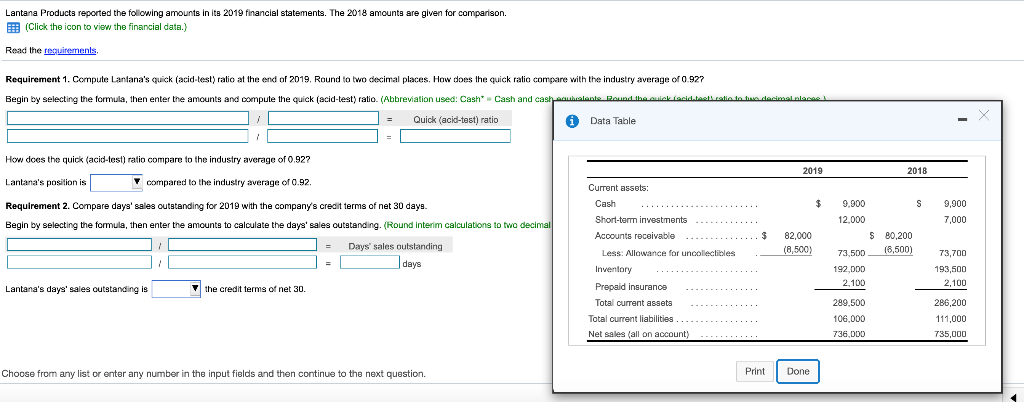

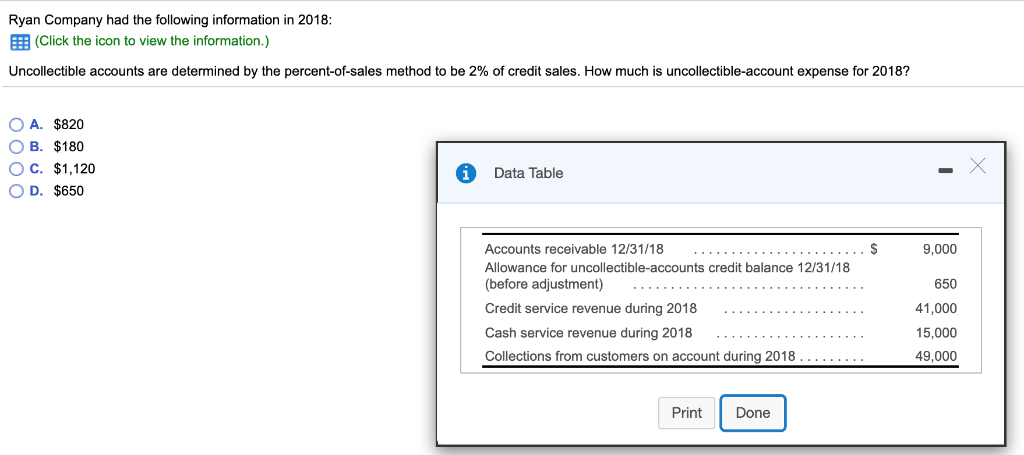

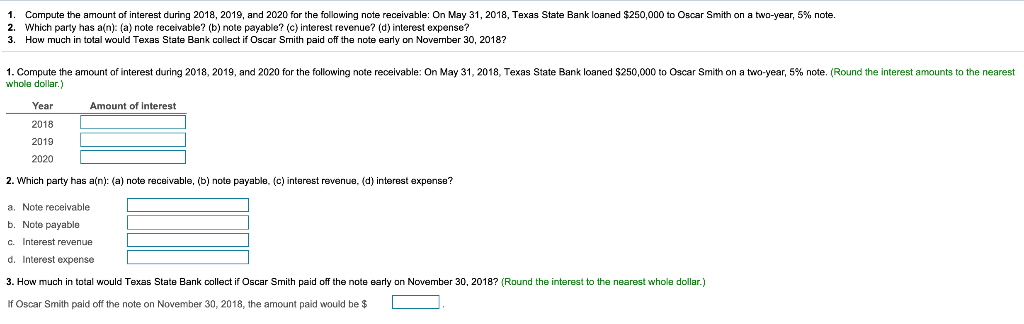

invaice on February 2, and enters the amgunt into its aayment system on February 4, Benson Family Prectice receives the S100 pament from Cardinal Health gn February 20, On which date would Benson Family Practice receanize the revenue for the Smythe's physical? Q A. February 2 February 20 c. February 4 D. February 1 Lantana Products reported the following amounts in its 2019 financial statements. The 2018 amounts are given for comparison EB(Click the icon to view the financial data.) Read the reguirements. Requirement 1. Compute Lantana's quick (acid-test) ralio at the end 2019. Round to two decimal places. How does the quick ratio compare with the industry average of 0.927 Cash and cashecubalante Rund the auick iacidtesti rotio to to decinmel places Begin by selecting the formula, then enter the amounts and compute e quick (acid-test) ratio. (Abbreviation used: Cash Quick (acid-tast) ratio Data Table How does the quick (acid-test) ratio compare to the industry average of 0.92? 2019 2018 Tcompared to the industry average of 0.92 Lantana's position is Current assets: 9.900 Requirement 2. Compare days' sales outstanding for 2019 with the company's credit terms of net 30 days. as 9,900 7,000 Short-term investments 12,000 Begin by selecting the formula, then enter the amounts to calculate the days' sales outstanding. (Round interim calculations to two decimal S 80,200 Accounts receivable 82,000 Days' sales outstanding (8,500) (6,500) Less: Allowance for uncollectibles 73,500 73,700 days 192.DDD 193,500 Inventory 2.100 2100 Prapaid insurance the credt terms of net 30. Lantana's days' sales outstanding is 286.200 Total current assets 289,500 Total current liabilities 106.000 111,000 736 Net sales (all 735.000 account) Print Done Choose from any list or enter any number the input fields and then continue to the next question. Ryan Company had the following information in 2018: E(Click the icon to view the information.) Uncollectible accounts are determined by the percent-of-sales method to be 2% of credit sales. How much is uncollectible-account expense for 2018? A. $820 O B. $180 C. $1,120 i Data Table D. $650 Accounts receivable 12/31/18 .. . . S 9,000 Allowance for uncollectible-accounts credit balance 12/31/18 (before adjustment) 650 Credit service revenue during 2018 41,000 Cash service revenue during 2018 15,000 Collections from customers on account during 2018... .. . ... 49,000 Print Done Which of the following statements is true? O A. Write-offs of accounts decrease receivables. O B. Credit sales increase receivables. C. Collections on account decrease receivables. D. All of these statements are true. 1. Compute the amount of interest during 2018, 2019, and 2020 for the following note receivable: On May 31, 2018, Texas State Bank loaned $250,000 to Oscar Smith on a two-year, 5 % note. 2. Which party has a(n): (a) note receivable? (b) note payable? (c) interest revenue? (d) interest expense? 3. How much in total would Texas State Bank collect if Oscar Smith paid if the note early on November 30, 2018? .Compute the amount of interest during 2018, 2019, and 2020 for the following note receivable: On May 31, 2018, Texas State Bank loaned S250,000 whole dollar) Oscar Smith on a two-year, 5% note. (Round the interest amounts to the nearest Year Amount of interest 2018 2019 2020 2. Which party has a(n): (a) note receivable, ) note payable, (c) interest revenue, (d) interest expense? a. Note receivable b. Note payable c. Interest revenue d. Interest expense 3. How much in total would Texas State Bank collect if Oscar Smith paid off the note early on November 30, 2018? (Round the interest to the nearest whole dollar.) If Oscar Smith paid off the note on November 30, 2018, the amount paid would be $