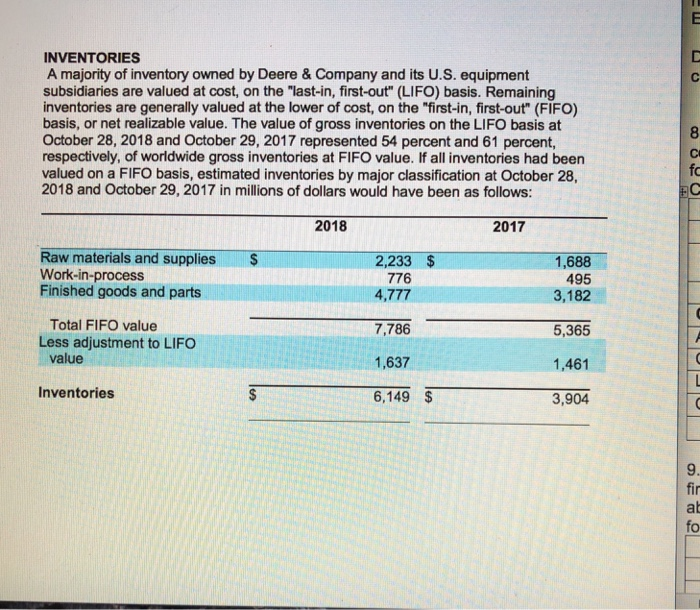

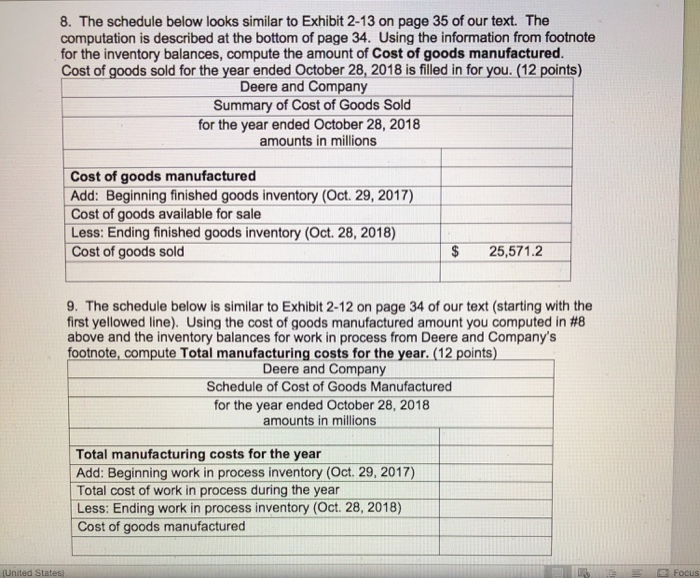

INVENTORIES A majority of inventory owned by Deere & Company and its U.S. equipment subsidiaries are valued at cost, on the "last-in, first-out" (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the "first-in, first-out" (FIFO) basis, or net realizable value. The value of gross inventories on the LIFO basis at October 28, 2018 and October 29, 2017 represented 54 percent and 61 percent, respectively, of worldwide gross inventories at FIFO value. If all inventories had been valued on a FIFO basis, estimated inventories by major classification at October 28, 2018 and October 29, 2017 in millions of dollars would have been as follows fo 2018 2017 Raw materials and supplies $ Work-in-process Finished goods and parts 2,233 $ 1,688 495 3,182 776 4,777 7,786 1,637 Total FIFO value 5,365 Less adjustment to LIFO value 1,461 Inventories 6,149 3.904 fir ab fo 8. The schedule below looks similar to Exhibit 2-13 on page 35 of our text. The computation is described at the bottom of page 34. Using the information from footnote for the inventory balances, compute the amount of Cost of goods manufactured. Cost of goods sold for the year ended October 28, 2018 is filled in for you. (12 points) Deere and Company Summary of Cost of Goods Sold for the year ended October 28, 2018 amounts in millions Cost of goods manufactured Add: Beginning finished goods inventory (Oct.29, 2017) Cost of goods available for sale Less: Ending finished goods inventory (Oct. 28, 2018) Cost of goods sold $ 25,571.2 9. The schedule below is similar to Exhibit 2-12 on page 34 of our text (starting with the first yellowed line). Using the cost of goods manufactured amount you computed in #8 above and the inventory balances for work in process from Deere and Company's footnote, compute Total manufacturing costs for the year. (12 points) Deere and Company Schedule of Cost of Goods Manufactured for the year ended October 28, 2018 amounts in millions Total manufacturing costs for the year Add: Beginning work in process inventory (Oct. 29, 2017) Total cost of work in process during the year Less: Ending work in process inventory (Oct. 28, 2018) Cost of goods manufactured