Answered step by step

Verified Expert Solution

Question

1 Approved Answer

investissement appraisal CONSTRUCTION OF FINANCIAL CASH FLOWS CRUNCHY BISCUIT COMPANY 1. The Background Prof. Caramel had completed 20 years of teaching Economics. He needed a

investissement appraisal

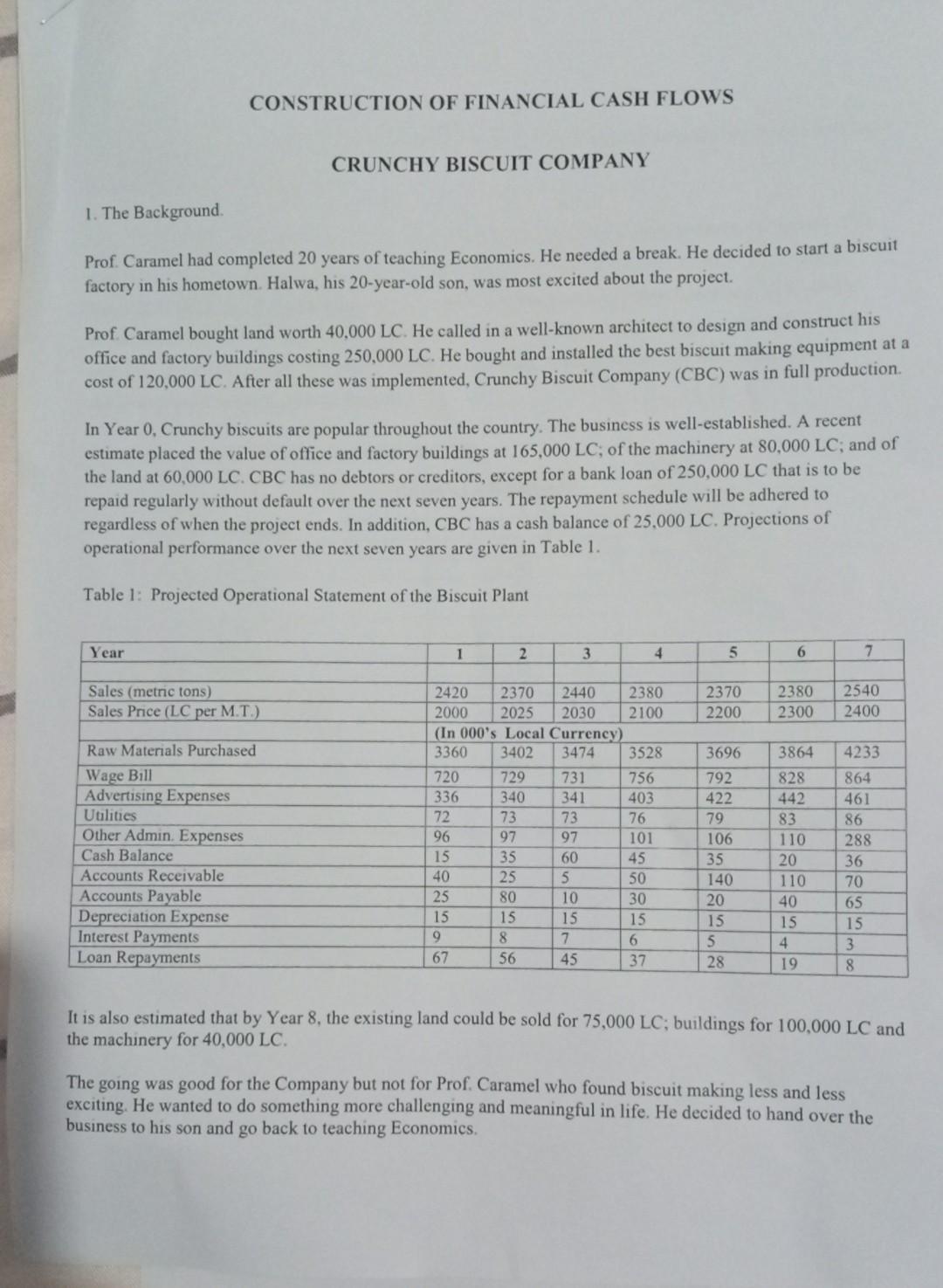

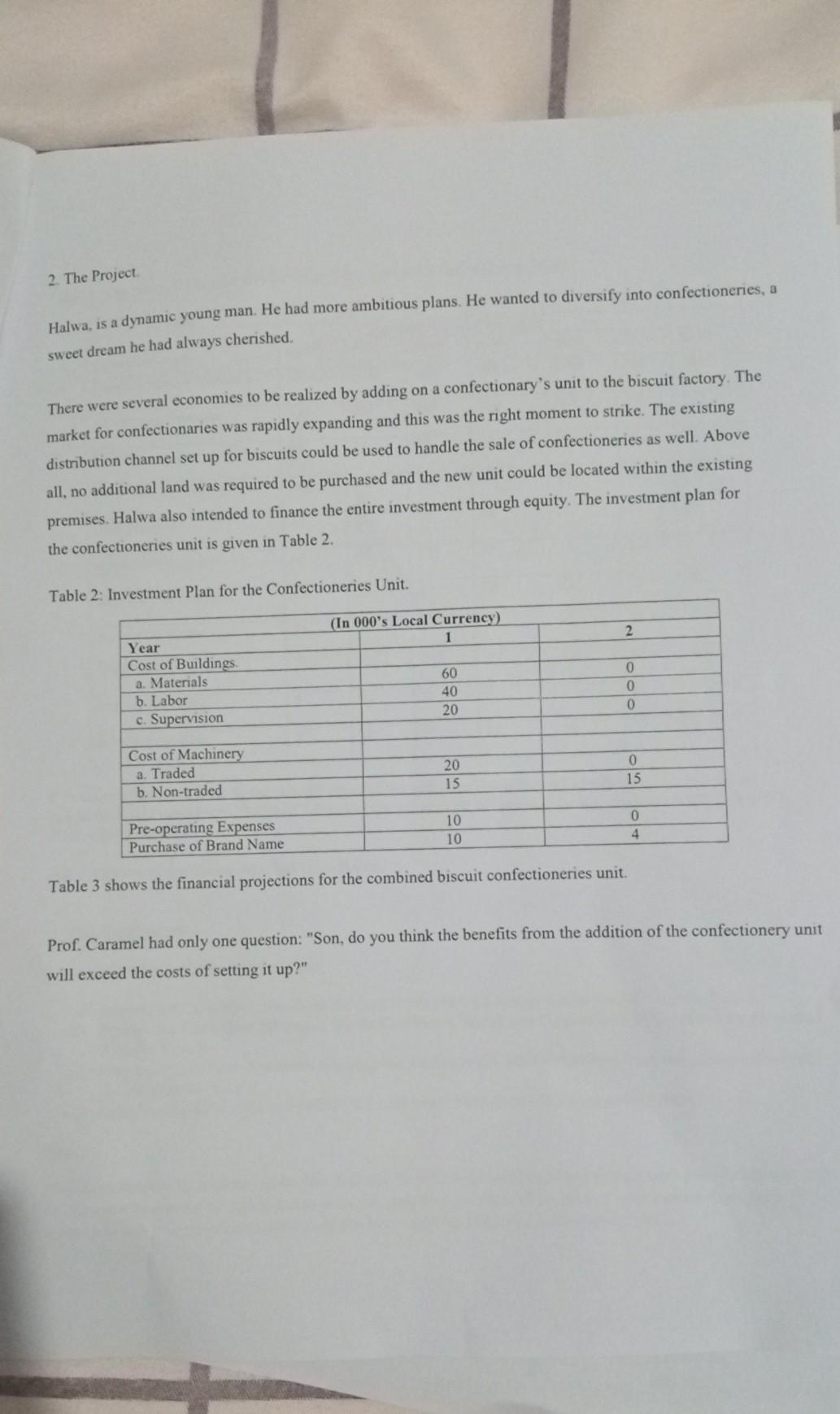

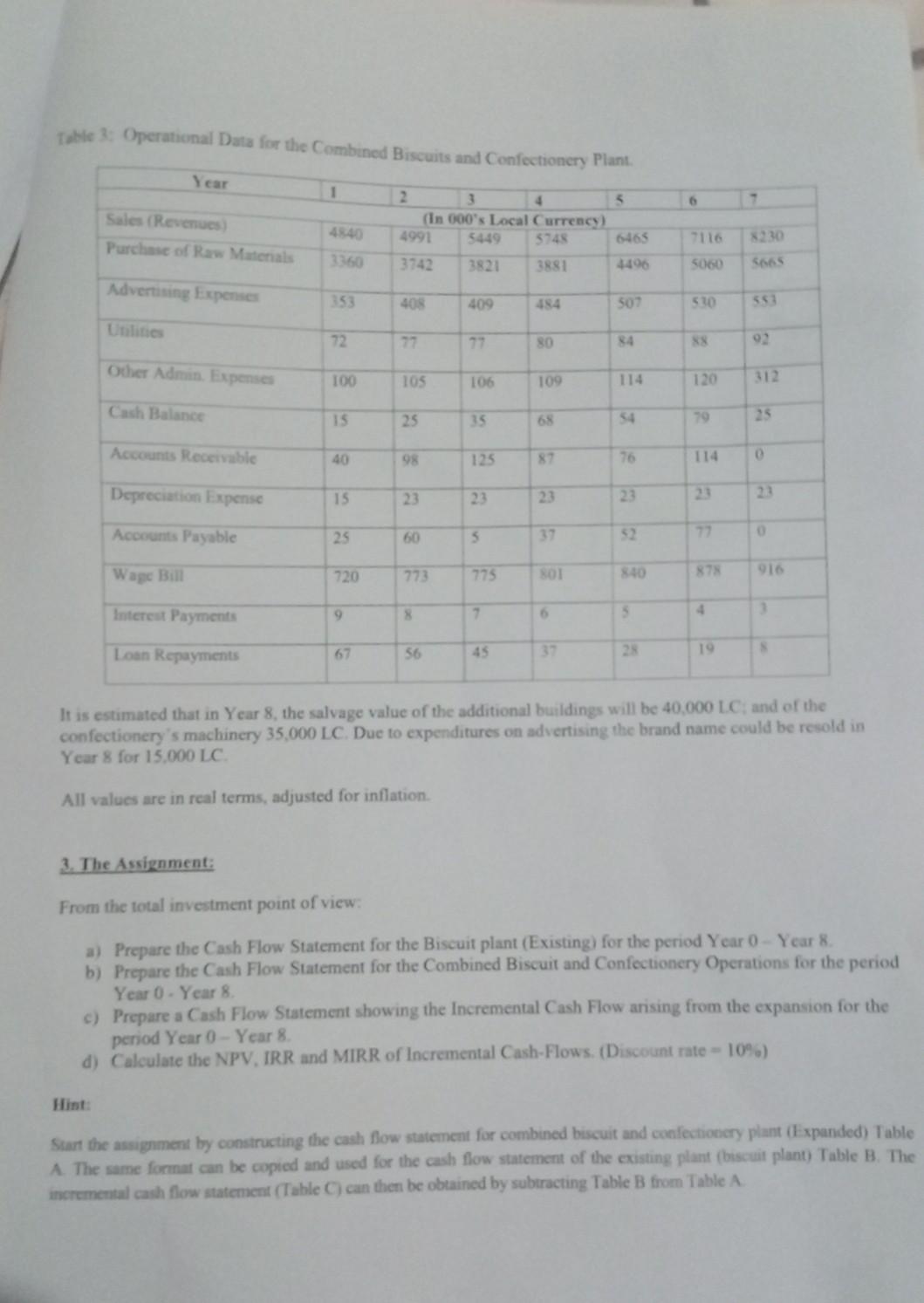

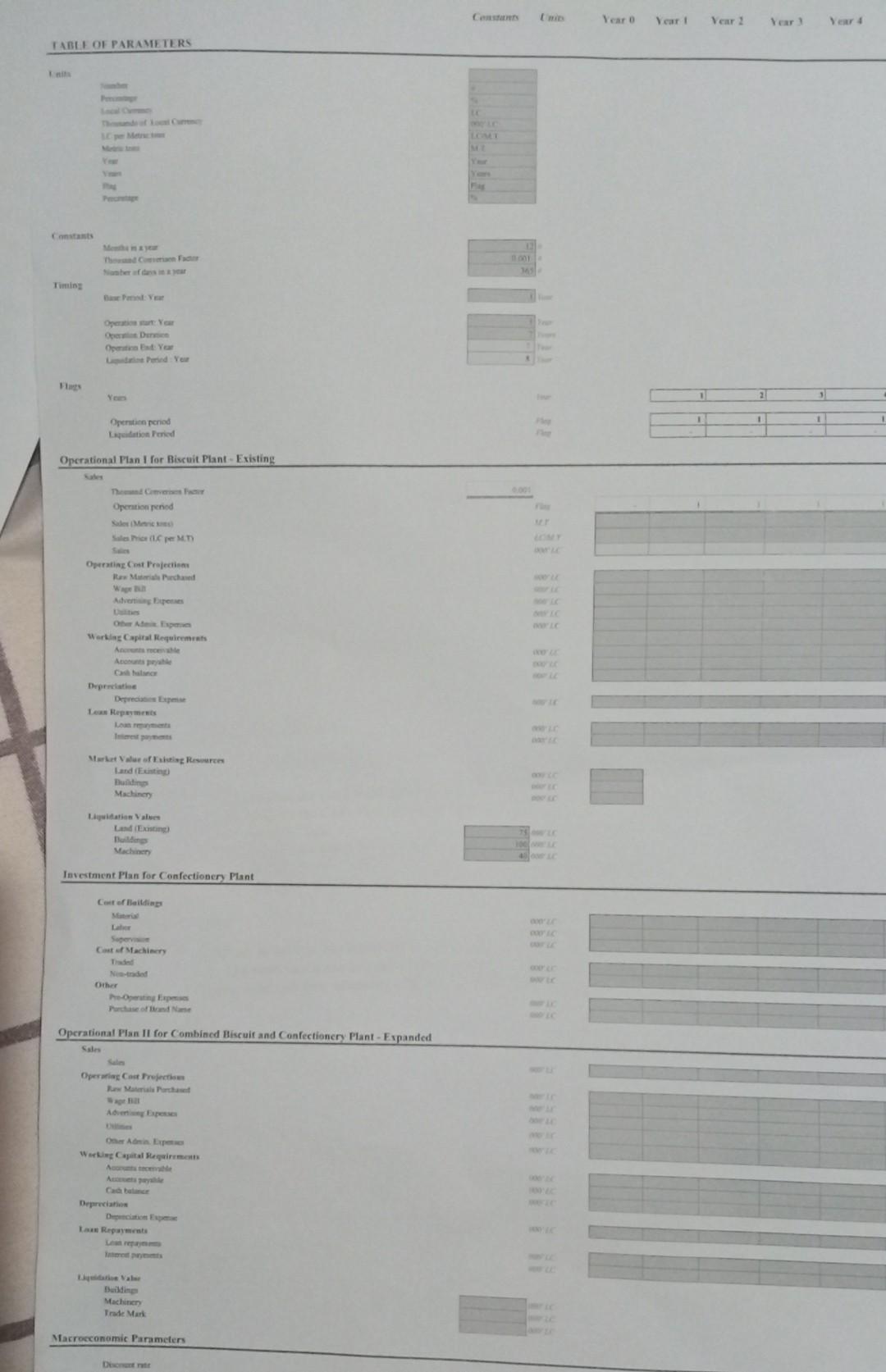

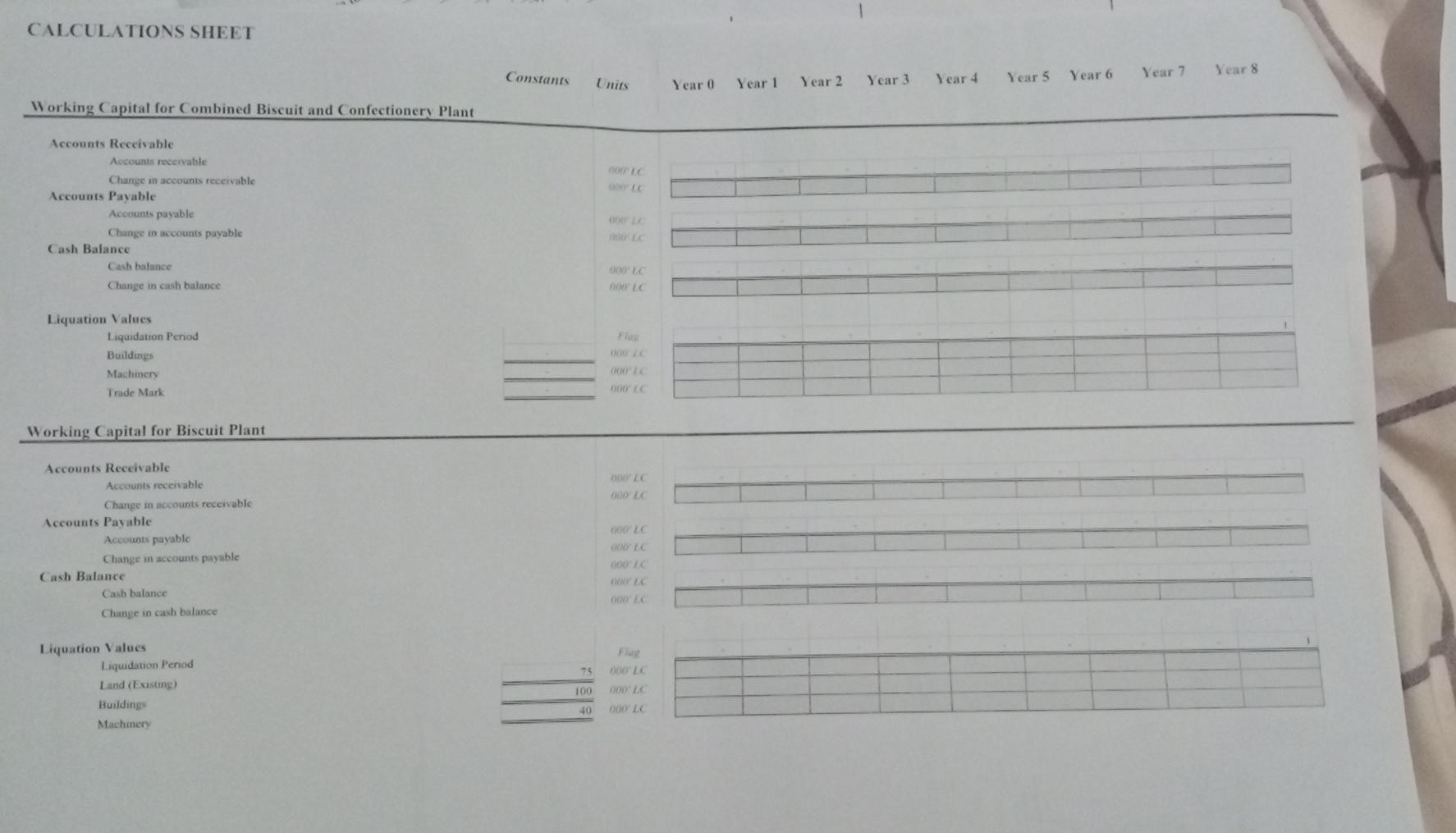

CONSTRUCTION OF FINANCIAL CASH FLOWS CRUNCHY BISCUIT COMPANY 1. The Background Prof. Caramel had completed 20 years of teaching Economics. He needed a break. He decided to start a biscuit factory in his hometown. Halwa, his 20-year-old son, was most excited about the project. Prof. Caramel bought land worth 40,000 LC. He called in a well-known architect to design and construct his office and factory buildings costing 250,000 LC. He bought and installed the best biscuit making equipment at a cost of 120,000 LC. After all these was implemented, Crunchy Biscuit Company (CBC) was in full production In Year 0. Crunchy biscuits are popular throughout the country. The business is well-established. A recent estimate placed the value of office and factory buildings at 165,000 LC, of the machinery at 80,000 LC; and of the land at 60,000 LC. CBC has no debtors or creditors, except for a bank loan of 250,000 LC that is to be repaid regularly without default over the next seven years. The repayment schedule will be adhered to regardless of when the project ends. In addition, CBC has a cash balance of 25.000 LC. Projections of operational performance over the next seven years are given in Table 1. Table 1: Projected Operational Statement of the Biscuit Plant Year 1 2 3 4 5 6 7 Sales (metric tons) Sales Price (LC per M.T.) 2370 2200 2380 2300 2540 2400 3696 3864 Raw Materials Purchased Wage Bill Advertising Expenses Utilities Other Admin. Expenses Cash Balance Accounts Receivable Accounts Payable Depreciation Expense Interest Payments Loan Repayments 2420 2370 2440 2380 2000 2025 2030 2100 (In 000's Local Currency) 3360 3402 3474 3528 720 729 731 756 336 340 341 403 72 73 73 76 96 97 97 101 15 35 60 45 40 25 5 50 25 80 10 30 15 15 15 15 9 8 7. 6 67 45 37 792 422 79 106 35 140 20 15 5 28 828 442 83 110 20 110 40 15 4 19 4233 864 461 86 288 36 70 65 15 3 8 It is also estimated that by Year 8, the existing land could be sold for 75,000 LC; buildings for 100,000 LC and the machinery for 40,000 LC. The going was good for the Company but not for Prof. Caramel who found biscuit making less and less exciting. He wanted to do something more challenging and meaningful in life. He decided to hand over the business to his son and go back to teaching Economics, 2. The Project Halwa, is a dynamic young man. He had more ambitious plans. He wanted to diversify into confectioneries, a sweet dream he had always cherished, There were several economies to be realized by adding on a confectionary's unit to the biscuit factory. The market for confectionaries was rapidly expanding and this was the right moment to strike. The existing distribution channel set up for biscuits could be used to handle the sale of confectioneries as well. Above all, no additional land was required to be purchased and the new unit could be located within the existing premises. Halwa also intended to finance the entire investment through equity. The investment plan for the confectioneries unit is given in Table 2. Table 2: Investment Plan for the Confectioneries Unit. (In 000's Local Currency) 1 2 Year Cost of Buildings a. Materials b. Labor c. Supervision 60 40 20 0 0 0 Cost of Machinery a. Traded b. Non-traded 20 15 0 15 Pre-operating Expenses Purchase of Brand Name 10 10 0 4 Table 3 shows the financial projections for the combined biscuit confectioneries unit. Prof. Caramel had only one question: "Son, do you think the benefits from the addition of the confectionery unit will exceed the costs of setting it up?" Table 3: Operational Data for the Combined Biscuits and Confectionery Plant. Year 1 5 6 Sales (Revenues Purchase of Raw Materials 2 3 4 (in 000's Local Currency) 4991 5449 5245 6465 7116 3742 3821 3881 4406 Advertising Expenses 353 408 409 484 507 530 563 Utilities 72 77 77 80 84 8 Other Admin Expenses 100 105 106 109 114 120 312 Cash Balance 15 25 35 70 Accounts Receivable 40 98 125 8 76 114 Depreciation Expense 15 23 23 Accounts Payable 25 60 5 Wage Bill 720 773 775 SOL 916 Interest Payment 7 4 Loon Repayments 67 56 45 33 It is estimated that in Year 8, the salvage value of the additional buildings will be 40.000 LC and of the confectionery's machinery 35,000 LC. Due to expenditures on advertising the brand name could be resold in Year 8 for 15.000 LC All values are in real terms, adjusted for inflation 3. The Assignment: From the total investment point of view: a) Prepare the Cash Flow Statement for the Biscuit plant (Existing) for the period Year 0-Year 8 b) Prepare the Cash Flow Statement for the Combined Biscuit and Confectionery Operations for the period Year 0 - Year 8 c) Prepare a Cash Flow Statement showing the Incremental Cash Flow arising from the expansion for the period Year 0-Year 8. d) Calculate the NPV, IRR and MIRR of Incremental Cash-Flows. (Discount rate -10%) Start the assignment by constructing the cash flow statement for combined biscuit and confectionery plant (Expanded) Table A The same format can be copied and used for the cash flow statement of the existing plant (biscuit plant) Table B. The incremental cash flow statement (Table C) can then be obtained by subtracting Table B from Table A Constanta Year o Year o Year! Vear 2 Vear ! Years TABLE OF PARAMETERS Timing de Y 1 2 31 Operation period dation Pored Operational Plan I for Biscuit Plant Existing Operation period | | | Operating traject Marched Advertiser AE Working Capital Requirements Acous Deprecies Lease Repermes www of Rur Landsting Machinery Latin Valves Machine Investment Plan for Confectionery Plant CatMachinery Other Operational Plan Il for Combined Biscuit and Confectionery Plant - Expanded Sales Operg Cost Projectes Weita Reinet Cada Depreciation Le Reparate Building Machine Trade Mark Macroeconomic Parameters CALCULATIONS SHEET Constants Year 6 Year 7 Year 8 Year 0 Year 1 Year 5 Year 2 Year 3 Year 4 Working Capital for Combined Biscuit and Confectionery Plant Accounts Receivable Accounts receivable Change in accounts receivable Accounts Payable Accounts payable Change in accounts payable Cash Balance Cash balance Change in cash balance DOLC DOLC Flo Liquation Values Liquidation Period Buildings Machinery Trude Mark WO DI Working Capital for Biscuit Plant 000 Accounts Receivable Accounts receivable Change in accounts receivable Accounts Payable Accounts payable Change in accounts payable Cash Balance Cash balance Change in cash balance LC LC DIC 75 000 Liquation Values Liquidation Period Land (Existing) Buildings Machinery 100 40 CONSTRUCTION OF FINANCIAL CASH FLOWS CRUNCHY BISCUIT COMPANY 1. The Background Prof. Caramel had completed 20 years of teaching Economics. He needed a break. He decided to start a biscuit factory in his hometown. Halwa, his 20-year-old son, was most excited about the project. Prof. Caramel bought land worth 40,000 LC. He called in a well-known architect to design and construct his office and factory buildings costing 250,000 LC. He bought and installed the best biscuit making equipment at a cost of 120,000 LC. After all these was implemented, Crunchy Biscuit Company (CBC) was in full production In Year 0. Crunchy biscuits are popular throughout the country. The business is well-established. A recent estimate placed the value of office and factory buildings at 165,000 LC, of the machinery at 80,000 LC; and of the land at 60,000 LC. CBC has no debtors or creditors, except for a bank loan of 250,000 LC that is to be repaid regularly without default over the next seven years. The repayment schedule will be adhered to regardless of when the project ends. In addition, CBC has a cash balance of 25.000 LC. Projections of operational performance over the next seven years are given in Table 1. Table 1: Projected Operational Statement of the Biscuit Plant Year 1 2 3 4 5 6 7 Sales (metric tons) Sales Price (LC per M.T.) 2370 2200 2380 2300 2540 2400 3696 3864 Raw Materials Purchased Wage Bill Advertising Expenses Utilities Other Admin. Expenses Cash Balance Accounts Receivable Accounts Payable Depreciation Expense Interest Payments Loan Repayments 2420 2370 2440 2380 2000 2025 2030 2100 (In 000's Local Currency) 3360 3402 3474 3528 720 729 731 756 336 340 341 403 72 73 73 76 96 97 97 101 15 35 60 45 40 25 5 50 25 80 10 30 15 15 15 15 9 8 7. 6 67 45 37 792 422 79 106 35 140 20 15 5 28 828 442 83 110 20 110 40 15 4 19 4233 864 461 86 288 36 70 65 15 3 8 It is also estimated that by Year 8, the existing land could be sold for 75,000 LC; buildings for 100,000 LC and the machinery for 40,000 LC. The going was good for the Company but not for Prof. Caramel who found biscuit making less and less exciting. He wanted to do something more challenging and meaningful in life. He decided to hand over the business to his son and go back to teaching Economics, 2. The Project Halwa, is a dynamic young man. He had more ambitious plans. He wanted to diversify into confectioneries, a sweet dream he had always cherished, There were several economies to be realized by adding on a confectionary's unit to the biscuit factory. The market for confectionaries was rapidly expanding and this was the right moment to strike. The existing distribution channel set up for biscuits could be used to handle the sale of confectioneries as well. Above all, no additional land was required to be purchased and the new unit could be located within the existing premises. Halwa also intended to finance the entire investment through equity. The investment plan for the confectioneries unit is given in Table 2. Table 2: Investment Plan for the Confectioneries Unit. (In 000's Local Currency) 1 2 Year Cost of Buildings a. Materials b. Labor c. Supervision 60 40 20 0 0 0 Cost of Machinery a. Traded b. Non-traded 20 15 0 15 Pre-operating Expenses Purchase of Brand Name 10 10 0 4 Table 3 shows the financial projections for the combined biscuit confectioneries unit. Prof. Caramel had only one question: "Son, do you think the benefits from the addition of the confectionery unit will exceed the costs of setting it up?" Table 3: Operational Data for the Combined Biscuits and Confectionery Plant. Year 1 5 6 Sales (Revenues Purchase of Raw Materials 2 3 4 (in 000's Local Currency) 4991 5449 5245 6465 7116 3742 3821 3881 4406 Advertising Expenses 353 408 409 484 507 530 563 Utilities 72 77 77 80 84 8 Other Admin Expenses 100 105 106 109 114 120 312 Cash Balance 15 25 35 70 Accounts Receivable 40 98 125 8 76 114 Depreciation Expense 15 23 23 Accounts Payable 25 60 5 Wage Bill 720 773 775 SOL 916 Interest Payment 7 4 Loon Repayments 67 56 45 33 It is estimated that in Year 8, the salvage value of the additional buildings will be 40.000 LC and of the confectionery's machinery 35,000 LC. Due to expenditures on advertising the brand name could be resold in Year 8 for 15.000 LC All values are in real terms, adjusted for inflation 3. The Assignment: From the total investment point of view: a) Prepare the Cash Flow Statement for the Biscuit plant (Existing) for the period Year 0-Year 8 b) Prepare the Cash Flow Statement for the Combined Biscuit and Confectionery Operations for the period Year 0 - Year 8 c) Prepare a Cash Flow Statement showing the Incremental Cash Flow arising from the expansion for the period Year 0-Year 8. d) Calculate the NPV, IRR and MIRR of Incremental Cash-Flows. (Discount rate -10%) Start the assignment by constructing the cash flow statement for combined biscuit and confectionery plant (Expanded) Table A The same format can be copied and used for the cash flow statement of the existing plant (biscuit plant) Table B. The incremental cash flow statement (Table C) can then be obtained by subtracting Table B from Table A Constanta Year o Year o Year! Vear 2 Vear ! Years TABLE OF PARAMETERS Timing de Y 1 2 31 Operation period dation Pored Operational Plan I for Biscuit Plant Existing Operation period | | | Operating traject Marched Advertiser AE Working Capital Requirements Acous Deprecies Lease Repermes www of Rur Landsting Machinery Latin Valves Machine Investment Plan for Confectionery Plant CatMachinery Other Operational Plan Il for Combined Biscuit and Confectionery Plant - Expanded Sales Operg Cost Projectes Weita Reinet Cada Depreciation Le Reparate Building Machine Trade Mark Macroeconomic Parameters CALCULATIONS SHEET Constants Year 6 Year 7 Year 8 Year 0 Year 1 Year 5 Year 2 Year 3 Year 4 Working Capital for Combined Biscuit and Confectionery Plant Accounts Receivable Accounts receivable Change in accounts receivable Accounts Payable Accounts payable Change in accounts payable Cash Balance Cash balance Change in cash balance DOLC DOLC Flo Liquation Values Liquidation Period Buildings Machinery Trude Mark WO DI Working Capital for Biscuit Plant 000 Accounts Receivable Accounts receivable Change in accounts receivable Accounts Payable Accounts payable Change in accounts payable Cash Balance Cash balance Change in cash balance LC LC DIC 75 000 Liquation Values Liquidation Period Land (Existing) Buildings Machinery 100 40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started