Question

Investment and Default Risk: 10 minutes A borrower country faces a risk of bad luck pbl that returns on investment will be low, and a

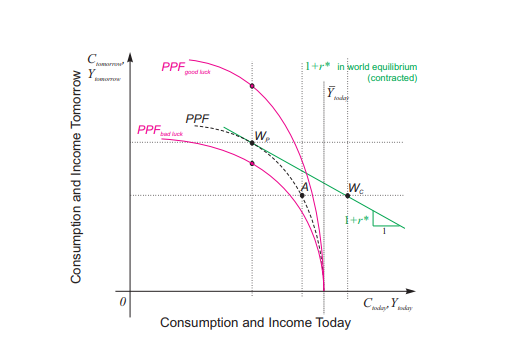

Investment and Default Risk: 10 minutes A borrower country faces a risk of bad luck pbl that returns on investment will be low, and a chance (1pbl) that returns will be high. The diagram below depicts the PPF for bad luck, the PPF for good luck, and the expected return with the dashed PPF between the other two. Foreign lenders are risk neutral. Depict the investment today that the foreign lender expects when offering the contractual interest rate r .

Show the borrowers expected current account balance tomorrow.

Show the borrowers expected debt service D tomorrow. Suppose a borrower pays the full debt service D (principal and interest) tomorrow if output Ytomorrow D + C A tomorrow, where C A tomorrow is autarky consumption tomorrow. Otherwise, the debtor defaults partially and pays V = Ytomorrow C A tomorrow. Output tomorrow is Ytomorrow = Fbl(I) under bad luck or Ytomorrow = Fgl(I) under good luck.

Show the minimal investment level I1 so that the debtor will never default, not even under bad luck.

Show the maximal investment level I0 so that the debtor will always default, even under good luck.

For the range of investments between I0 and I1, derive the expected debt service V as a function of pbl, investment I and autarky consumption.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started