Question

INVESTMENT APPRAISAL On 1 January 2019, Della Ltd is considering investing in a new equipment that would cost $539,000, payable immediately. The equipment will be

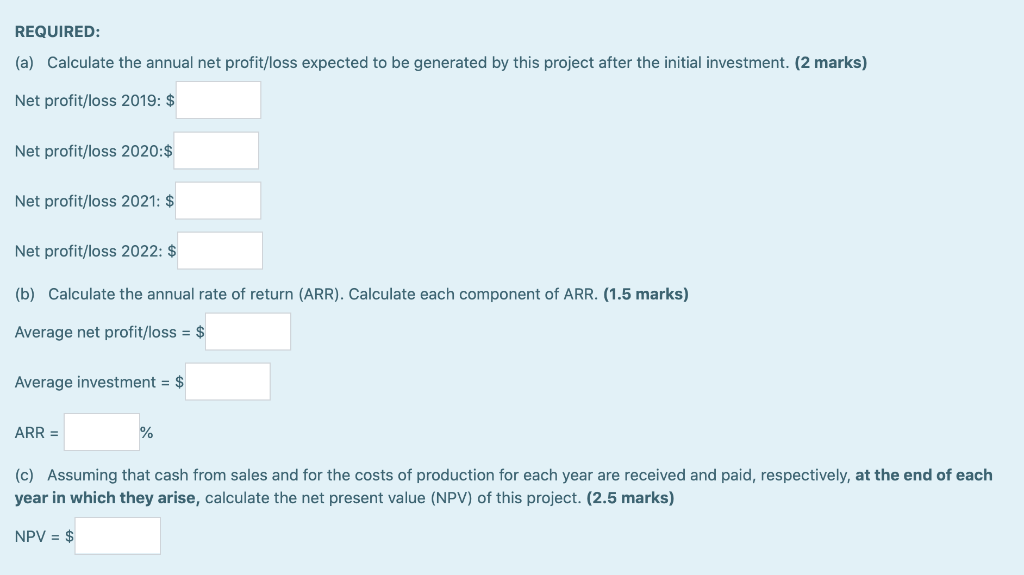

INVESTMENT APPRAISAL

On 1 January 2019, Della Ltd is considering investing in a new equipment that would cost $539,000, payable immediately. The equipment will be used to produce a new product, and Della Ltd expects to use the equipment for the next 4 years. At the end of the 4 years, the equipment will have a residual value of $110,000.

The expected net cash flows from the new product produced using this equipment are as follows:

|

| 2019 | 2020 | 2021 | 2022 |

| Expected net cash flows | $150,000 | $190,000 | $120,000 | $100,000 |

Della Ltd calculates depreciation on a straight-line basis. The companys cost of capital (i.e. required rate of return) is 3%.

The present values of $1 (i.e. discount factors) are:

| Interest (discount) rate | Periods | |||

| 1 | 2 | 3 | 4 | |

| 3% | 0.9709 | 0.9426 | 0.9151 | 0.8885 |

IMPORTANT:

- In answering the questions below, please dont include the dollar sign ($) or any thousands separator - i.e. $12,000 should be written as 12000.

- For ARR, make sure you express it as a percentage with 2 decimal places (e.g. 14.55) - please don't include the % (percentage) sign.

- When calculating the NPV, please use the discount factors provided in the question.

- If any of the net profits/losses or the NPV is negative, please include the (minus) sign in front of the amount and dont put it in parentheses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started