Answered step by step

Verified Expert Solution

Question

1 Approved Answer

investment bank in which you work as compliance officer has recently recruited a new stockbroker whose client base comprises many high net worth (HNW) and

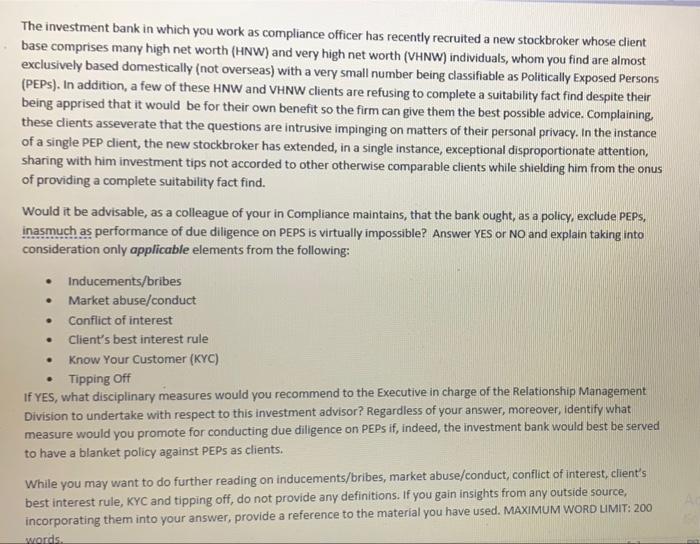

investment bank in which you work as compliance officer has recently recruited a new stockbroker whose client base comprises many high net worth (HNW) and very high net worth (VHNW) individuals, whom you find are almost exclusively based domestically (not overseas) with a very small number being classifiable as Politically Exposed Persons (PEPS). In addition, a few of these HNW and VHNW clients are refusing to complete a suitability fact find despite their being apprised that it would be for their own benefit so the firm can give them the best possible advice. Complaining, these clients asseverate that the questions are intrusive impinging on matters of their personal privacy. In the instance of a single PEP client, the new stockbroker has extended, in a single instance, exceptional disproportionate attention, sharing with him investment tips not accorded to other otherwise comparable clients while shielding him from the onus of providing a complete suitability fact find.

Would it be advisable, as a colleague of your in Compliance maintains, that the bank ought, as a policy, exclude PEPS, inasmuch as performance of due diligence on PEPS is virtually impossible? Answer YES or NO and explain taking into consideration only applicable elements from the following:

Inducements/bribes

Market abuse/conduct

Conflict of interest

Client's best interest rule

Know Your Customer (KYC)

Tipping Off

If YES, what disciplinary measures would you recommend to the Executive in charge of the Relationship Management Division to undertake with respect to this investment advisor? Regardless of your answer, moreover, identify what measure would you promote for conducting due diligence on PEPS if, indeed, the investment bank would best be served to have a blanket policy against PEPs as clients.

While you may want to do further reading on inducements/bribes, market abuse/conduct, conflict of interest, client's best interest rule, KYC and tipping off, do not provide any definitions. If you gain insights from any outside source, incorporating them into your answer, provide a reference to the material you have used. MAXIMUM WORD LIMIT: 200 words

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started